6 Retail Stocks on Sale

Retailers posted solid numbers this earnings season, but we think their stocks are, in general, overbought--with some exceptions.

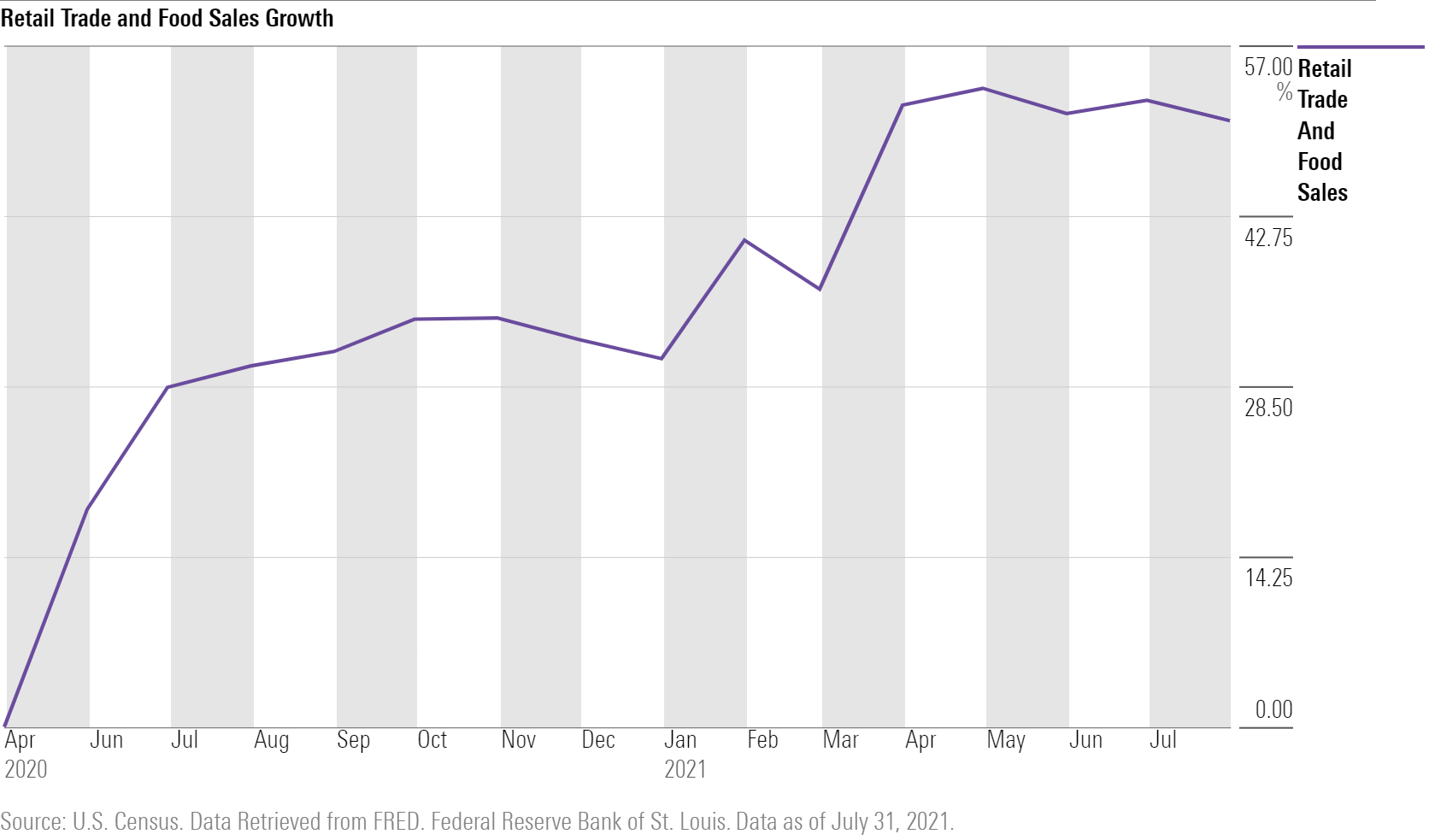

U.S. retail sales have bounced back 50.7% from their low point in 2020: Consumers have been flushing the economy with stimulus and savings this year.

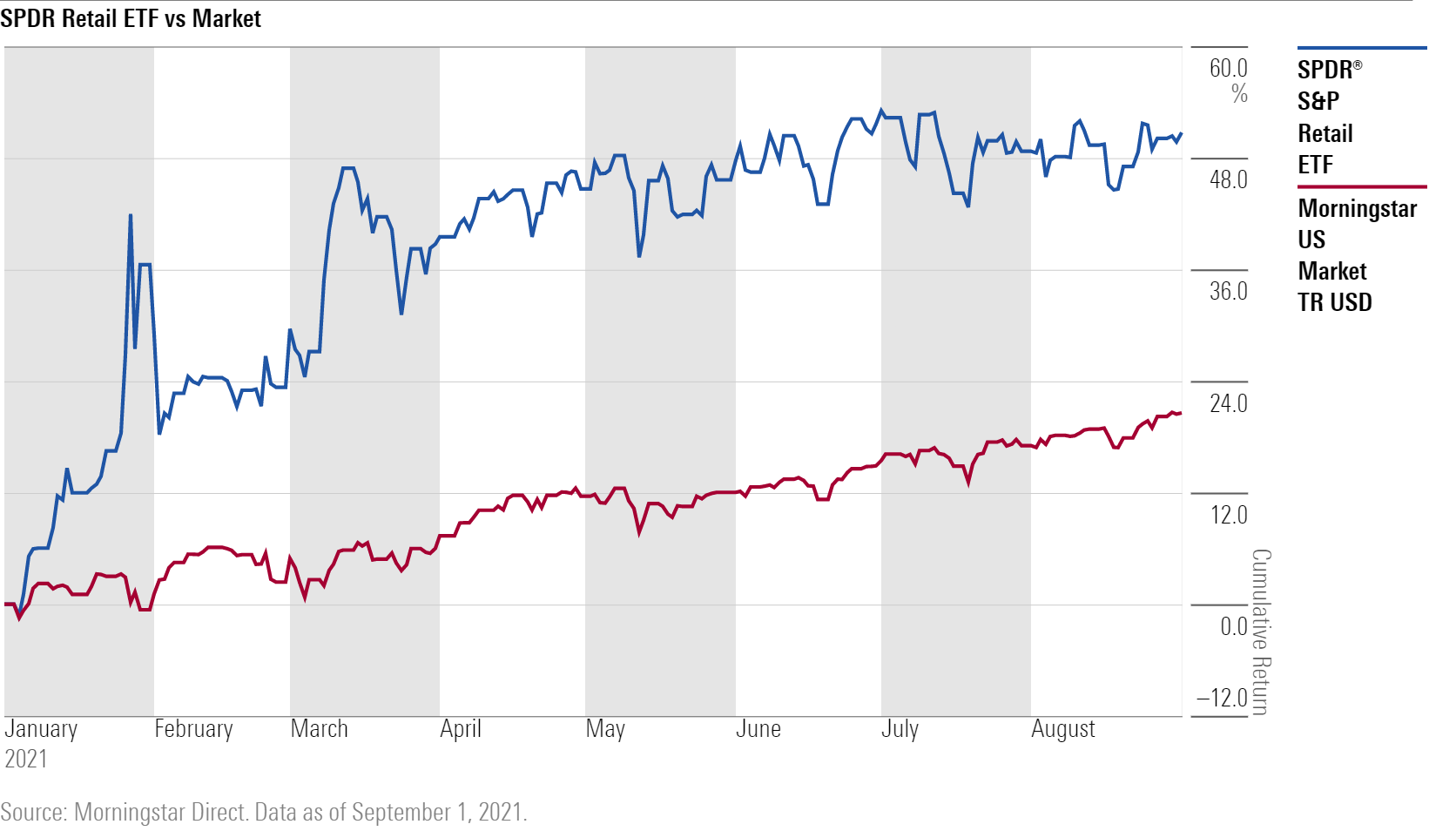

As sales numbers picked up, investors began piling into retail stocks. The S&P Retail ETF XRT has outperformed the Morningstar US Market Index by 30.2% so far this year.

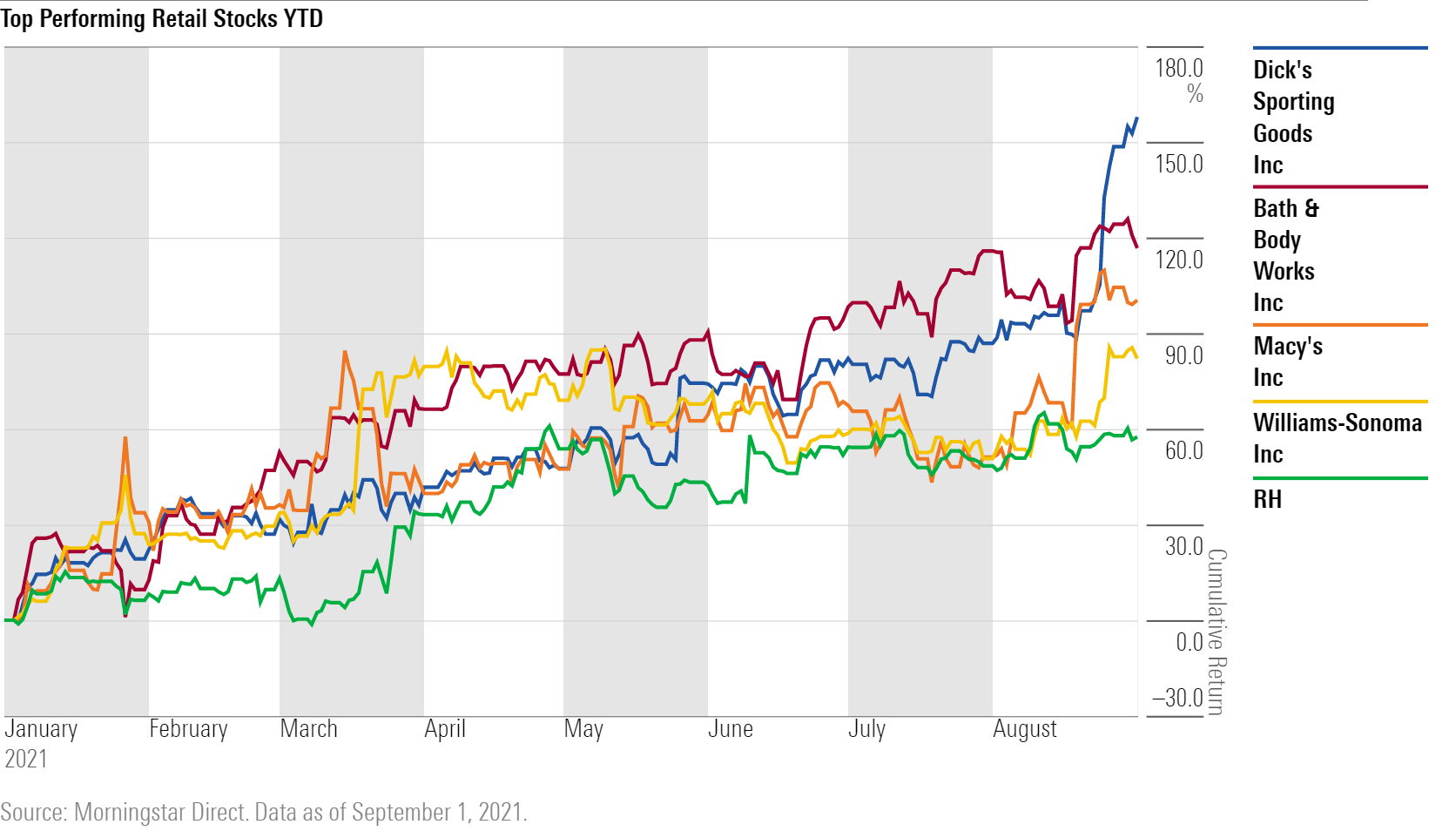

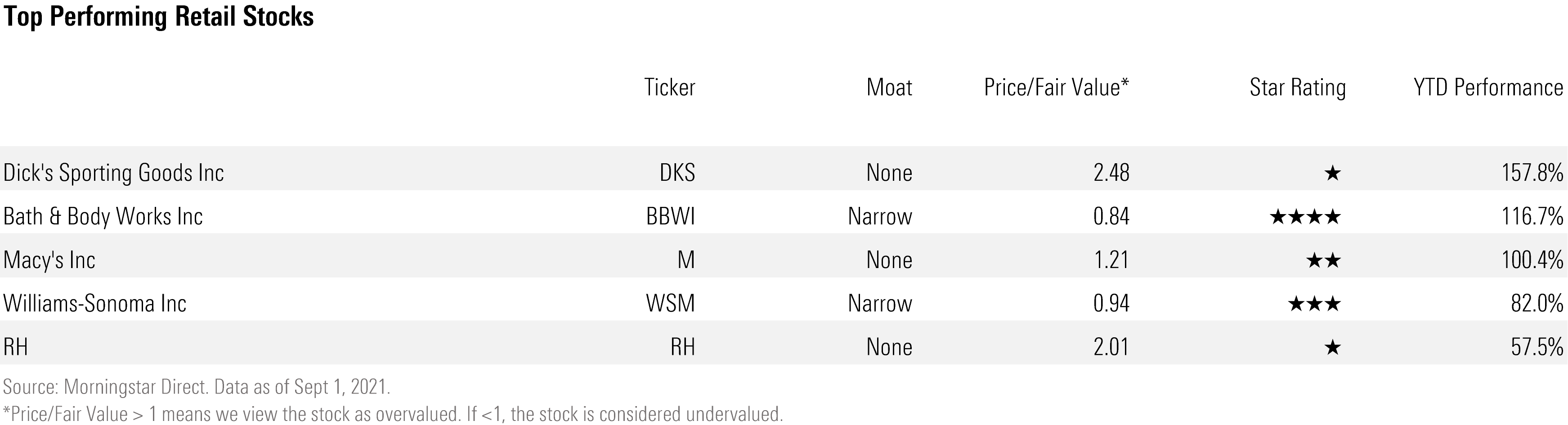

Some retail stocks have returned more than 50% in 2021. Dick’s Sporting Goods DKS leads our retail coverage list with a 157.8% return for the year to date, followed by Bath and Body Works BBWI at 116.7%, and Macy's M at 100.4%.

“The current apparel retail industry conditions are the best in decades with minimal markdowns and soaring demand providing sky-high operating margins,” says equity analyst David Swartz. Certain retail firms found themselves crushing earning expectations. For example, Dick’s Sporting Goods’ recent quarter adjusted earnings per share of $5.08 exceeded the firm’s 2019 full-year EPS by 38%.

But investors might be overvaluing those results. Of the top-five-performing retail stocks on our coverage list, three of them are overvalued.

Dick’s Sporting Goods currently trades at a 148% premium to its fair value, RH RH at a 101% premium, and Macy's hovers 21% over its fair value estimate. “The fact that we view them as overvalued is mostly because many have stock prices that have been going straight up,” says Swartz. “The intense competition that existed in retail before the coronavirus crisis has not gone away.”

Indeed, the pandemic-induced lockdowns in 2020 only expedited the consumer shift to e-commerce channels. In an industry rife with competition, this thrust behind those retailers that primarily relied on brick-and-mortar store business models. While recent earnings events greatly benefited a lot of brick-and-mortar retailers such as Dick's and Macy's, our analysts argued in a recent report that omnichannel will star in the U.S. retail industry post-COVID-19. More surprisingly, our analysts expect that omnichannel retailers are expected to outperform online retailers over the next decade. Brick-and-mortar retailers without a plan to shift toward adopting e-commerce channels may find themselves struggling in the long term. (Morningstar Office and Direct clients can view the full report on research portal.)

Short-term risks are heightened for retailers, too, according to analyst Zain Akbari. “The cost side has been a focus as a tight labor market pushes wages higher, and product cost inflation and availability remain concerns. Whether retailers can push prices higher to compensate should be a meaningful story over the quarters ahead,” says Akbari. Additionally, a resurgence of coronavirus cases in Asia further heighten concerns regarding retailers’ supply chains.

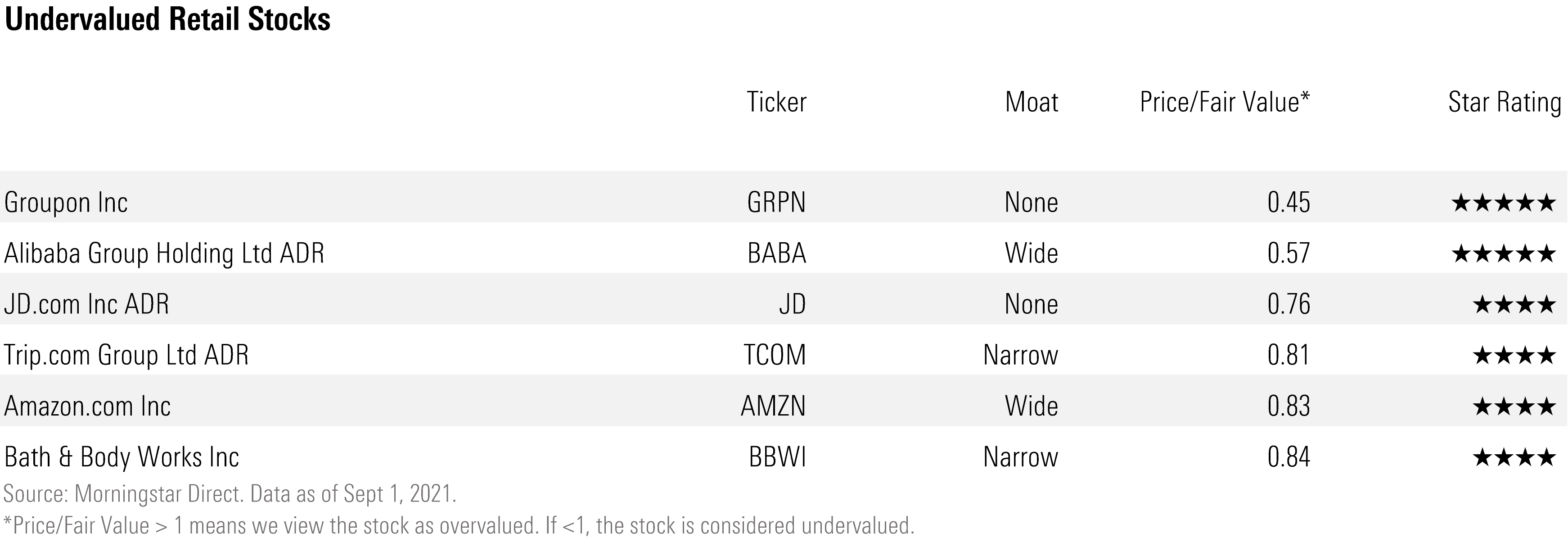

We therefore encourage investors who’d like to dip a toe in retail to focus on maintaining a margin of safety. Below are a list of retail stocks that Morningstar analysts cover that are considered undervalued as of this writing.

It is notable that Amazon.com AMZN makes this list--the stock has been undervalued according to our metrics since August 2020. The company recently announced plans to build physical department-type stores to further grow its omnichannel strategy. “Given its history of tinkering with storefronts and the secular shift toward e-commerce, I think Amazon will open several stores to experiment with and make adjustments on the fly,” says equity analyst Dan Romanoff.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T3GL43HDAFE4XKUGIENW4D5DDI.jpg)