The State of Low-Yielding Bond Funds

Fixed-income investors are between a rock and a hard place: accept low returns or add incremental return at the risk of significant losses.

A version of this article was published in the August 2021 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Yields are low. Rates are more likely to go up than down. Real returns are negative. By now, the plight of bond funds is well known, and for good reason. The lower that starting yields are, the lower the return that investors can expect from their bonds going forward. This is a mathematical certainty.

This article will review the current state of four bond Morningstar Categories: short-term bond, intermediate core bond, intermediate core-plus bond, and multisector bond. These four represent the primary bond categories, with other categories such as ultrashort bond and high-yield bond acting in supporting roles. Because funds from one or more of the "big four" are likely to make up the core of an investor's fixed-income allocation, it is important to understand that allocation and build proper expectations for it before layering on supporting products.

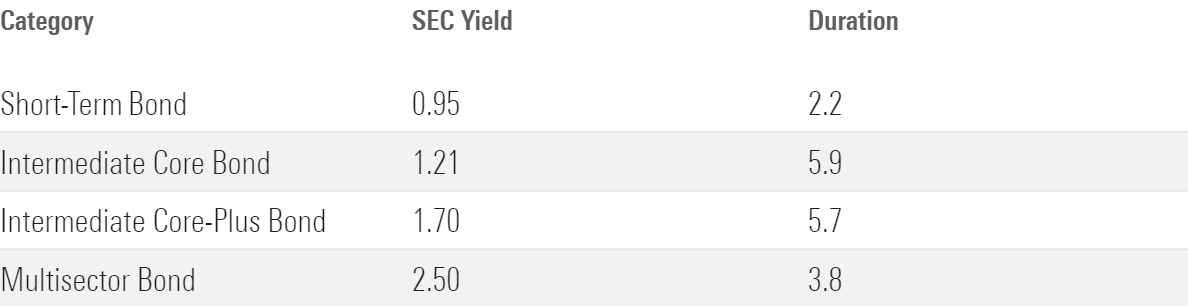

Let's start by looking at the average SEC yield and average duration for each category. The SEC yield is a number that approximates the average current yield of all bonds within a given fund's portfolio, which means it's a reasonable starting point to judge expected returns. Duration is an estimate of the fund's sensitivity to changes in interest rates.

As of August 2021, the average short-term bond fund had an SEC yield of 0.95% and a duration of 2.2 years. Meanwhile, the average core bond fund had a yield of 1.21% and a duration of 5.9 years. This means that investors pick up only 26 basis points of expected yield while almost tripling the risk associated with rising interest rates. Investors already experienced a taste of that risk in the first quarter of 2021, when the yield on the 10-year U.S. Treasury note rose 81 basis points. The average core bond fund lost almost 3% on the quarter, while the average short-term fund was down only 12 basis points.

What happens when we move from core to core plus? The average core-plus bond fund had an SEC yield of 1.70% and a duration of 5.7 years. So, the average yield pickup was 49 basis points over core bond funds, while interest-rate sensitivity was just marginally lower. The differences here are driven by the categories' different exposures to junk-rated debt, with core bond funds limited to 5% max while core-plus bond funds can range from 5% to 25%. The extra credit risk bumps up yields and slightly insulates core-plus funds from rate shocks--the average fund lost 2.6% in 2021's first quarter--but also exposes investors to drawdowns during credit-driven sell-offs such as early 2020. In the depths of the coronavirus panic from Feb. 20, 2020 to March 23, 2020, the average core-plus bond fund lost 6.2%, while the average core bond fund lost only 3.2%--a massive difference when you consider that current yields and durations are not too dissimilar.

Finally, multisector bond funds take on the highest level of credit risk among the big four categories, which insulates them from most rate spikes; the average multisector fund lost only 22 basis points in 2021's first quarter, nearly as good as the average short-term offering. But this comes with a downside, as multisector funds will certainly lag the other three categories during credit crises. During the COVID-19 panic in early 2020, the average multisector fund lost 14.1%, more than double the average loss of core-plus funds. While the average SEC yield on multisector funds is about 100 basis points higher than the yield on core-plus funds, investors need to decide if that compensates for potential double-digit losses.

Source: Morningstar.

There is no magic bullet for fixed-income investors. Low yields force a decision: accept low returns or add incremental return at the risk of significant losses when the tide turns. And gaining protection from one kind of risk, such as rising rates, typically means exposure to losses of a different kind, such as credit risk. The solution to this conundrum is going to be different based on each investor's requirements, expectations, and risk tolerance.

/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d70ff945-8520-4b27-9d10-eb509531f5aa.jpg)