Consider Your Active Risk With Strategic-Beta Funds

These funds bet against the broad market with varying degrees of conviction.

A version of this article previously appeared in the August 2021 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

No matter how different their portfolios may look, all strategic-beta funds systematically depart from the traditional broad, market-cap-weighted index portfolio. Investors considering a strategic-beta offering must make two decisions: 1) which factor(s) they believe will beat the market and 2) how much conviction they have in that belief.

Finding a palette of funds to accommodate the first decision shouldn't cause headaches. An investor with a hunch that the quality factor is primed to outperform, for example, can locate several quality-oriented funds with relative ease. However, strategic-beta funds often fail to clearly communicate how they fit into the second decision. Different strategic-beta funds pursue their targeted factors with varying--and often unclear--degrees of intensity. Nuances in index construction separate the funds that cautiously inch away from the market from those that leave it in the rearview, illustrated here by three funds that channel the value factor with very different approaches.

Three Shades of Value

Value funds favor statistically cheaper stocks to faster-growing, more richly valued firms. Tilting toward cheaper companies has historically been tied to market-beating returns, and numerous strategic-beta funds aim to systematically capture this effect.

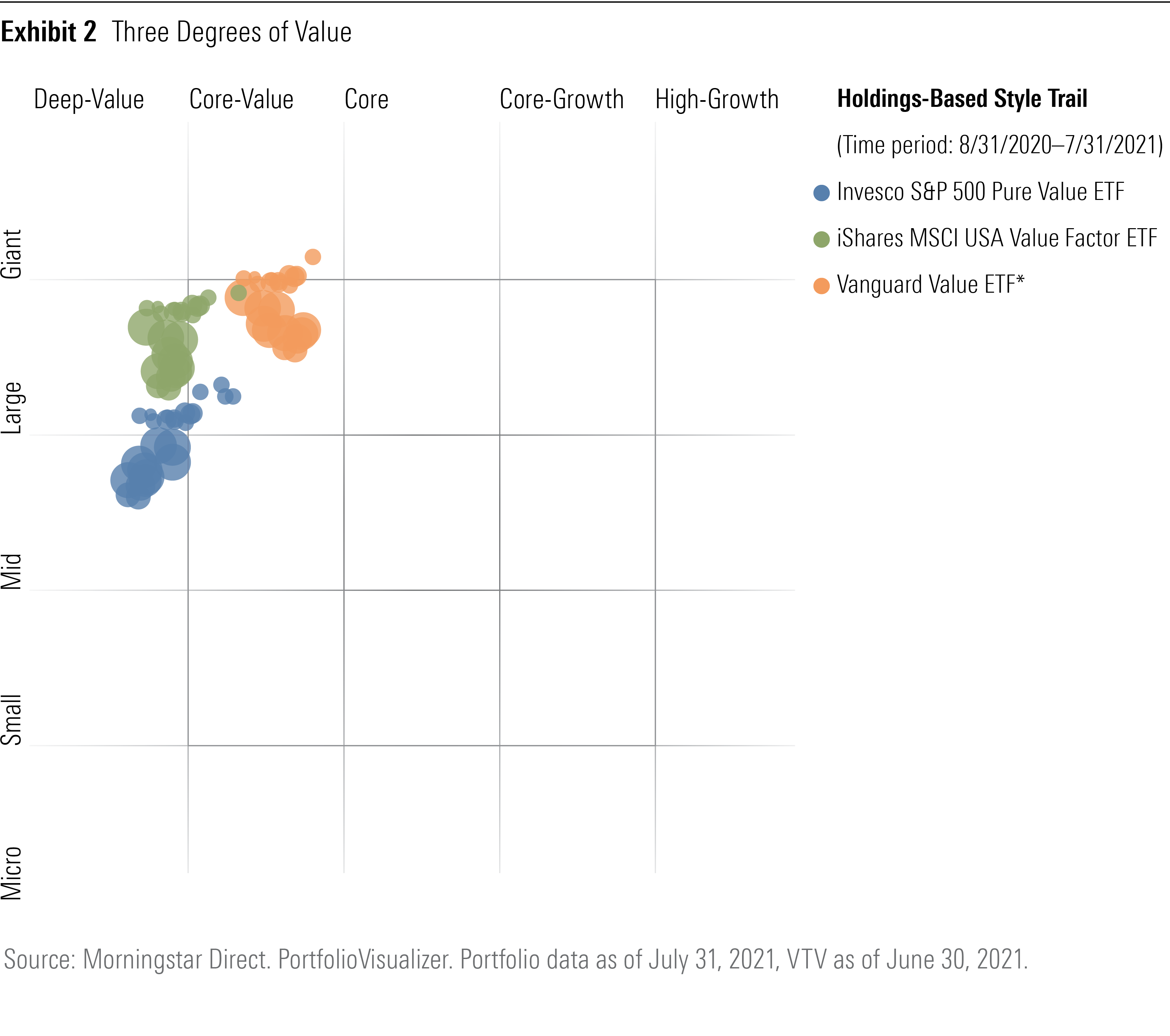

Vanguard Value ETF VTV, iShares MSCI USA Value ETF VLUE, and Invesco S&P 500 Pure Value ETF RPV are three such strategies. They are united by their value focus but distinguished by their methods of pursuit. As a result of their differentiated approaches, the three funds vary in how far they stray from the broad market.

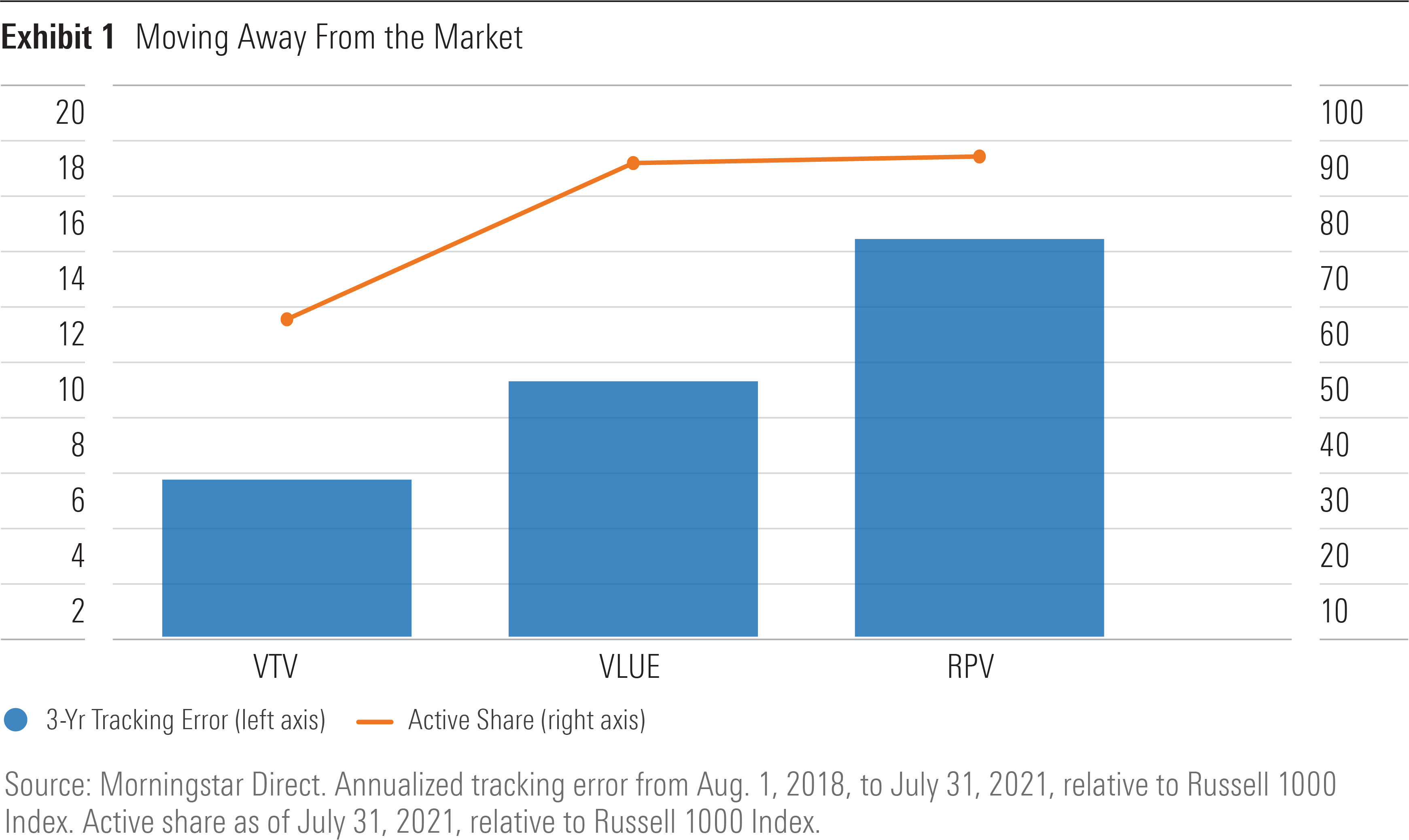

Active risk indicates how different a portfolio is from a benchmark. High-active-risk funds may out- or underperform the benchmark by a wide margin; low-active-risk funds mostly hew close. Investors who are adamant that their chosen factors will outperform would likely opt to shoulder more active risk. Exhibit 1 outlines the three value funds' active risk using two key measures: tracking error, which is a backward-looking, performance-based data point, and active share, a forward-looking, portfolio-based metric. These portfolios' active risk goes hand in hand with the potency of their value exposure. VTV dips its toes into value waters, RPV dives headfirst, and VLUE falls near the middle--though closer to the deep-value end. Unpacking the construction of these portfolios illuminates how they arrived at different levels of active risk.

Narrow the Field

The rules that dictate how an index annexes stocks directly affect the portfolio's active risk. First, indexes must define the pool of stocks from which they can choose. Most strategic-beta indexes pull constituents from a broad universe, such as the MSCI USA or Russell 1000 indexes. Should a fund instead select from a narrower pool, the stocks that best capture its intended factor may not be eligible for inclusion.

Nearly all strategic-beta funds draw from a wide array of stocks, so indexes' selection criteria are the more variable determinant of active risk. Stricter selection criteria translate to higher active risk. Funds that admit only the few firms that exhibit their desired traits should stray further from the broad market than those that allow hundreds through the turnstiles.

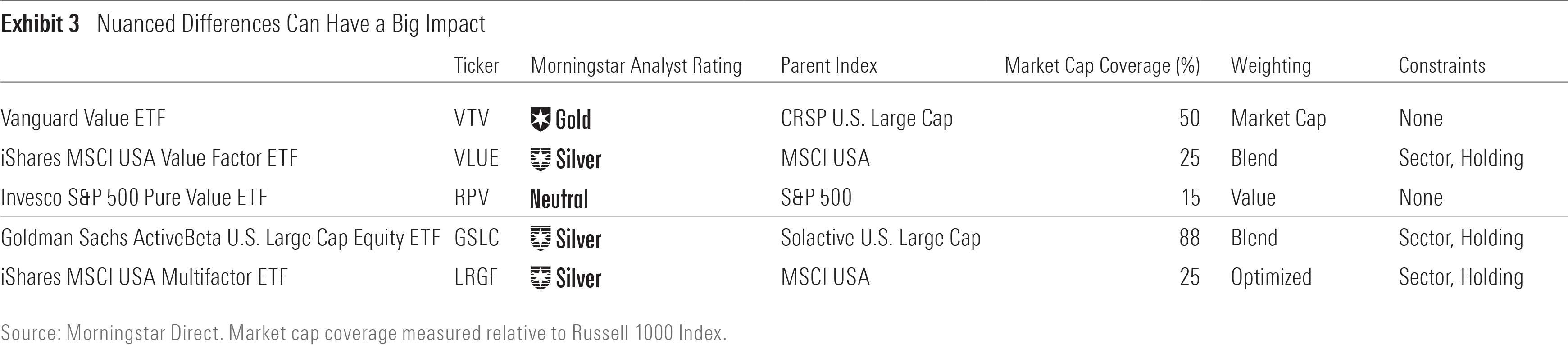

Our three value funds illustrate this relationship. VTV--the least active of the bunch--sources the CRSP U.S. Large Cap Index and adds stocks representing the cheaper half. While this method undoubtedly favors value, it casts a wide net that can snare blend stocks that dull its value tilt. VLUE is more selective. It scans the MSCI USA Index for opportunities and adds the cheapest 150 firms, which usually represent about 25% of the selection universe's total market cap. RPV takes a step further; it only admits stocks that rank in the S&P 500's cheapest third and whose value scores exceed the average constituent of the S&P 500 Value Index (a broader value benchmark). At the end of July 2021, RPV's portfolio covered just 15% of the S&P 500's market cap. How much these funds shrink the overlap between their portfolios and their selection universes' is a key input in how pronounced their value tilt--and active risk--will be.

Worth the Weight

After indexes establish their constituents, they are faced with another active risk inflection point: how to weight them. The broad market weights stocks by market cap, so funds can increase their active risk with alternative weighting schemes or dial back their bets by following a cap-weighted approach.

VTV opts for the latter. It weights stocks that make the cut by market cap, which emphasizes the largest firms instead of the cheapest. This approach muffles the fund's active risk and value exposure, but it has proved difficult to beat. VLUE weights stocks by both their market cap and the strength of their value characteristics. So, this fund favors stocks with the most attractive blend of size and value rather than the largest or cheapest stocks. Still, value's role in portfolio construction pushes this fund further into value territory.

RPV weights stocks solely based on the strength of their value traits; the cheapest stocks receive the most investment. Insurance firm Unum Group UNM, whose $5.5 billion market cap rendered it too small for both VTV and VLUE, represented the fund's second-largest position at July's end. This unabashed pursuit of value nets RPV the cheapest portfolio valuation of the trio, but it invites risk and volatility that the others avoid by baking market cap into their weighting approach.

Knowing Their Limits

Index constraints are another tool that helps control risk. These rules--which are often layered over the weighting step of index construction--are designed to reduce risk, either by tethering portfolios to the broad market, mitigating concentration, or reducing volatility. In the multifactor sphere, for example, funds like Hartford Multifactor U.S. Equity ETF ROUS target a specified volatility reduction relative to the broad market.

Neither VTV nor RPV uses constraints. VTV's already-conservative approach reduces the need for them, and adding speed bumps is not embedded in RPV's DNA. VLUE, on the other hand, uses sector-level constraints that anchor its sector allocation to the MSCI USA Index. This softens the fund's value bent a bit but enhances its overall appeal. Value signals are useful stock-picking indicators but weak sector selectors, so sacrificing some value exposure to control this risk is a worthy trade-off. Plus, VLUE's narrow selection criteria and weighting approach drive pronounced value exposure on their own.

Mismatched Multifactors

Genres of value strategic beta funds illustrate the impact of the nuances of index construction on active risk, but they aren't the only arena where this unfolds. Consider two U.S. multifactor portfolios that vary in how far they break from the broad market's mold.

Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF GSLC spins a portfolio of four separate factor sleeves: value, quality, momentum, and low volatility. Companies that rank well in one sleeve often look weak in another, limiting overall factor exposure and sweeping most eligible stocks into the portfolio. Each sleeve weights stocks by a blend of their market cap and respective factor traits. The fund uses sector-level constraints in the value sleeve of the portfolio and caps overall sector- and holding-level weights to limit concentration. At the end of July, the fund sported only a 28% active share relative to the Russell 1000 Index and posted a 1.64% annual tracking error over the past three years.

In the other corner is iShares MSCI USA Multifactor ETF LRGF, which plucks stocks with the most potent combination value, quality, momentum, and small-size characteristics and weights them based on these traits. It uses an optimizer that operates with strict selection criteria; the portfolio only covers about one fourth of the Russell 1000 Index. The portfolio applies constraints at the holding and sector levels that tie its composition to that of the MSCI USA Index. These measures do little to dial down active risk, though. The fund's annualized tracking error versus the Russell 1000 Index was 3.76% over the three years through July, with an active share over 80%.

Despite the wide disparity in active risk, GSLC and LRGF earn Morningstar Analyst Ratings of Silver. Both are solid options because they sensibly combine their factors, control turnover, and charge low fees. But they are suited for different investors: GSLC for the cautious market skeptic, LRGF for the multifactor diehard. To some degree or another, all strategic-beta funds are bets against the broad market. It's crucial for investors to peel back the curtain and understand how much they're putting on the table.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)