Should Insurance Be a Part of Your Financial Plan?

While you shouldn't pay for insurance you don't need, long-term-care and umbrella policies may make sense for some.

In my 40 years of tax and financial planning, I don't think I ever had a client sit down in my office and say, "We really need to talk about my insurance."

While the focus is usually on portfolios, Social Security, and withdrawal strategies, questions around insurance are worth careful attention as well.

With this column, I finish my look at the key decisions that are faced by what I'm calling the "Good Saver Couple."

As I outlined in part one of this series, I'm defining a Good Saver Couple as a couple that has worked a full career, is somewhere between ages 62 and 66, and is considering retirement. They have a 401(k) in the low seven figures, own a home that is partially paid for, have consumer debt consisting only of car loans or leases, and no longer have kids who are financially dependent.

In the first column, I looked primarily at investment decisions. In part two, we looked at a broader range do's and don'ts, including Roth IRAs, tax planning, and when to start taking Social Security.

Here we look at insurance.

The safety nets of insurance and an updated estate plan are critical. However, two types of insurance are typically overlooked: excess liability (umbrella) insurance and long-term-care insurance. Finally, fixed annuities can be a safety net in the event of unexpected longevity and/or increased spending.

Umbrella Insurance

When I ask clients if they have umbrella insurance, there are only two possible answers: "yes" or "what's that?" I explain umbrella insurance to my clients like this: If someone trips and falls at your house and sues you, they can generally go after your entire net worth. Most insurance, including homeowners and auto, covers to a maximum of about $500,000. Umbrella insurance can cover from $500,001 to the limit you specify--recommended to be your net worth. So, umbrella insurance is essential to protecting your assets--and what's surprising about this coverage is it doesn't cost a lot. A few hundred dollars a year can add a significant layer of financial security.

Long-Term-Care Insurance

Another important safety net is long-term-care insurance. Many people erroneously assume that long-term care can be covered by medical insurance or Medicare. This is not the case. Medical insurance and Medicare cover medical expenses, not long-term custodial expenses. For example, a person suffering from dementia might need custodial care for years. This would be covered by long-term-care insurance, not Medicare. At some point, should that person have a broken bone and require surgery, Medicare would cover those expenses.

Over 50% of adults older than 65 will require long-term care. And the biggest problem with long-term-care needs is that the care could be required for many years at a cost of easily $10,000 per month or more. Considering that medical science has prolonged life spans without necessarily prolonging "quality" life, long-term care can often be needed for much longer than the average long-term-care statistic of 2.5 years for women and 1.5 years for men. In fact, 13% of people will need long-term care for over five years.

Statistically, a pool of $250,000 (or accessible home equity) could cover long-term-care costs. But, what if both spouses need long-term care? What if care is required for more than five years? Here, we see the true need for insurance: to protect your assets in the event of the unexpected.

Even for those who believe they can self-insure, I recommend long-term-care insurance. Why? Because if you are the person in need of care, you might be reluctant to spend the money needed for fear of leaving your spouse without enough resources for the future. If you are the caregiver spouse, you might be reluctant to enlist paid help for fear of draining future resources. Yet, for some reason, I've never had a client who was reluctant to spend insurance money.

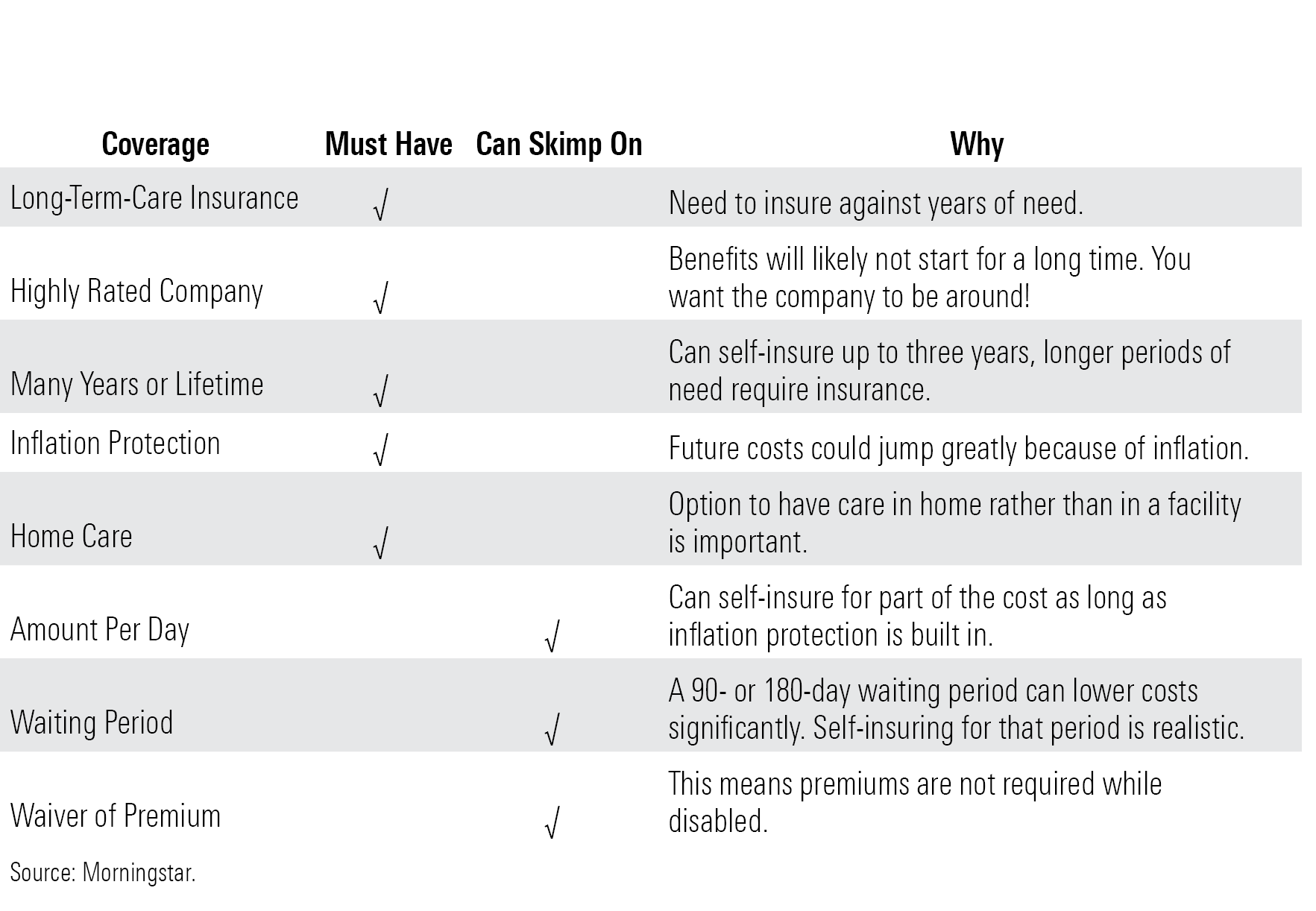

Long-term-care insurance can be pricey. In fact, that's one of the main reasons people opt not to get this coverage. While there are elements of this insurance that are crucial, there are ways to lower costs while preserving the important protection. So, what should you be sure to include in long-term-care insurance and what's ok to skimp on? Below is a simple chart. It's not meant to be all-inclusive and be sure to check with your own qualified advisor(s) before making any decisions.

According to Christine Benz, there are two main options for long-term-care insurance: stand-alone long-term-care insurance policies and "hybrid" life/long-term-care or annuity/long-term-care products.

While purchasing long-term-care insurance when you're younger can mean lower annual premiums, you will pay these premiums over a longer period of time than if you wait until you're older. Mathematically, the age to buy long-term-care insurance is somewhere in the mid- to late 50s, although the risk of not qualifying is an important consideration. According to Benz, about 20% of applicants between the ages of 50 and 59 are denied coverage, largely owing to disqualifying health conditions, whereas a third of people between the ages of 65 and 69 are denied coverage.

If you don't want to pay premiums for long-term-care coverage that you might never use or health issues disqualify you, consider hybrid life/long-term-care or hybrid annuity/long-term-care policies. These policies are increasing in popularity because health screening is often less stringent than with stand-alone policies and there is some "payback" even if long-term care is not needed.

Do I hate spending money on insurance? Yes, I do. But, in many circumstances, it is a necessary evil.

Annuities

I am famous for hating annuities. I say that 90% of the people who have annuities don't understand what they bought and/or should never have bought one in the first place. But there is one big exception: fixed or single-premium immediate annuities. I consider these annuities (in addition to home equity) to be a great safety net for retirees who are concerned about running out of money.

Unlike other investments, assuming a financially secure insurer, an immediate annuity can provide guaranteed income for life, in amounts higher than typical "safe" withdrawal rates. For example, a single 75-year-old woman might be able to receive $1,240 per month for life from an investment of $200,000. This equates to a drawdown rate of approximately 7.5%--much more than an investment advisor like me can promise for a long period of years. Think of this type of annuity as another "Social Security" stream. It's monthly income that will be there even if you live longer than your estimated life span.

As with any insurance policy or investment, it's important to work with a qualified professional, or two--a licensed insurance broker and a fiduciary financial advisor.

Don't Pay for Unnecessary Insurance

Once in or near retirement, life insurance is generally no longer needed (unless intended for burial expenses or estate tax). Life insurance is generally purchased to replace the ongoing earnings of the covered individual. By definition, a retired person is no longer working and, hopefully, has accumulated sufficient assets to cover their living expenses going forward. Unless the beneficiaries are looking for a windfall in the event of death, life insurance premiums are no longer required.

Note that some policies might have accumulated cash surrender value. If this is the case, there are four options:

- Continue the coverage as an investment decision, either by continuing to pay premiums or by using the cash surrender value to pay premiums for a while.

- Cash in the policy. To the extent you receive cash in excess of your basis in the policy, you will pay ordinary tax on the gain.

- Borrow against the policy. As long as there's enough cash value (or continued premium payments) to pay interest and avoid lapsing, there is no tax due on amounts borrowed. When the insured person passes away, the insurance benefit will pay off the loan and any remaining amount will be paid to beneficiaries tax-free.

- Sell the policy to a third party. This strategy might work even if there is little to no cash surrender value. To the extent proceeds received are greater than the tax basis, tax will be owed on the gain.

Similar to life insurance, disability insurance is not necessary while in or approaching retirement. These premiums can be quite expensive, so don't waste your money!

Conclusion

Embarking on retirement is one of the biggest decisions of your life. Although you've worked and saved for it most of your life, pulling the trigger is a big move. Please take note of the suggestions here and, above all, hire a qualified financial advisor. For commission-free unbiased advice, I recommend a member of the National Association of Personal Financial Advisors. You can find someone near you on the NAPFA website.

Sheryl Rowling, CPA, is head of rebalancing solutions for Morningstar and founder of Rowling & Associates, an investment advisory firm. She is a part-time columnist and consultant on advisor-focused products for Morningstar, and she continues to actively work in the advisory business. Morningstar acquired her Total Rebalance Expert software platform in 2015. The opinions expressed in her work are her own and do not necessarily reflect the views of Morningstar or of Rowling & Associates LLC.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)