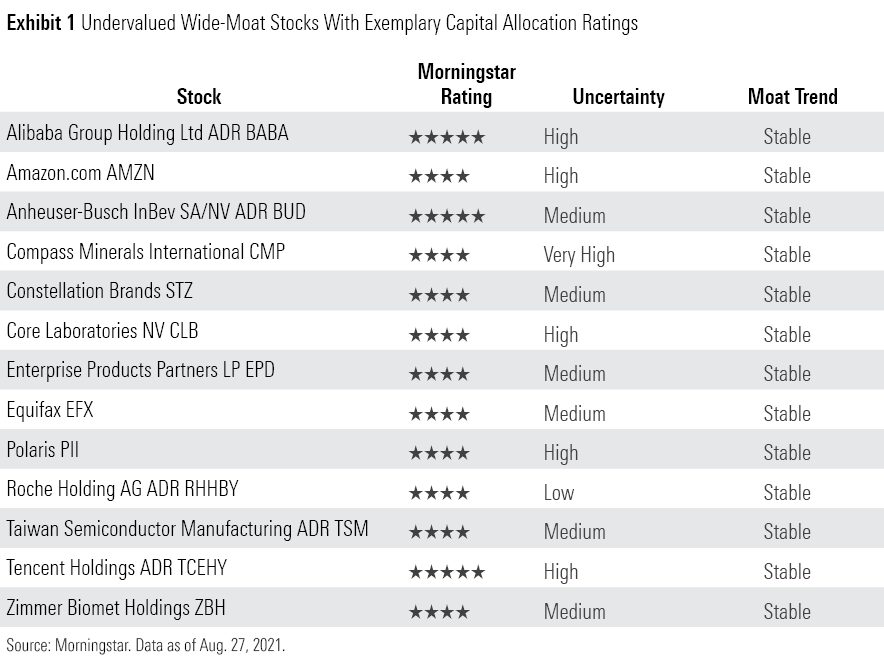

13 Undervalued Wide-Moat Companies With Exceptional Leadership

These wide-moat firms all earn Exemplary capital allocation ratings and trade in the 4- and 5-star range.

Presidential historian Doris Kearns Goodwin spoke at the Morningstar Investment Conference a couple of years ago. Her topic--which is also the focus of one of her books--was leadership in turbulent times. Specifically, the Pulitzer Prize winner examined leadership as it related to four U.S. presidents: Abraham Lincoln, Theodore Roosevelt, Franklin D. Roosevelt, and Lyndon B. Johnson.

These legends took different paths to reach the pinnacle of political leadership, says Goodwin. Further, their unique approaches fit the historical moment during which they led, just as a key fits a lock. She writes: "While there is neither a master key to leadership nor a common lock of historical circumstance, we can detect a certain family resemblance of leadership traits as we trace the alignment of leadership capacity within its historical context."

Similarly, at Morningstar we'd argue that great corporate leaders can take many different paths to get where they are. But there are a few things that, for us at Morningstar, define great corporate leadership.

We think great corporate managers are those who master their roles as stewards of investor capital. Such leaders make investments and acquisitions supporting the competitive advantages and core businesses of their companies--and they won't pay an arm and a leg to do so. They'll divest underperforming or noncore businesses. They'll find the right balance of investing in the business and returning cash to shareholders via dividends and share repurchases. And they'll assemble a portfolio of attractive operating assets and skilled human capital and then execute well.

We wrap up this thinking in our Morningstar Capital Allocation ratings. Morningstar equity analysts assess companies on items such as: financial leverage, investment strategy, investment timing and valuation, dividend and share buyback policies, execution, compensation, related-party transactions, and accounting practices.

Analysts assign one of three capital allocation ratings: Exemplary, Standard, and Poor.

So, for today's screen, we wanted to find high-quality, undervalued companies with exceptional management. Specifically, we screened for wide-moat stocks with Exemplary capital allocation ratings that were trading in the 4- or 5-star range. Thirteen stocks made the cut.

Here's a peek at our capital allocation commentary on three of the names from the list.

Amazon AMZN

"We assign Amazon an Exemplary Capital Allocation rating. The rating reflects our assessments of a sound balance sheet, exceptional investments, and appropriate shareholder distributions. We think investments back into the business are most likely to be the key driver of total shareholder returns and are therefore appropriately prioritized over other capital returns such as dividends and buybacks, which Amazon does not offer.

"The balance sheet is sound with a net cash position and only modest gross debt. We expect the balance sheet to remain sound as the company has typically maintained a conservative balance sheet and generates more than enough free cash flow from AWS and advertising to fund growth throughout the business.

"Management’s track record of investing in areas that investors were initially skeptical of but were ultimately vindicated has been remarkable. Chairman and CEO Jeff Bezos founded the company in 1994 and has led it since its inception. He has done this by focusing on the customer, investing in his vision, and exploring areas that were ignored or not yet defined. The results have been breathtaking. From humble beginnings, Bezos has built Amazon into one of the largest companies in the world. On the e-commerce side, the company has evolved from selling books to selling everything, including groceries, delivering purchases the same day they are ordered, and moving into retail categories that were long thought to be beyond the reach of online shopping. The stickiness of Prime members, the financial stability of subscriptions, the tech world shakeup via AWS, the Kindle--the innovation has been dramatic, and shareholders have been rewarded along the way. Ultimately, we assess investment as exceptional.

"Amazon’s capital deployment strategy centers around reinvesting in the business and making generally small tuck-in acquisitions. The company does not pay a dividend or repurchase shares, nor do we expect them to over the next several years."

Dan Romanoff, analyst

Compass Minerals CMP

"We award an Exemplary capital allocation rating to Compass Minerals based on our framework that assesses the balance sheet, investment decisions, and shareholder distributions.

"We rate the balance sheet as sound. Compass had elevated leverage from the Produquimica acquisition, but the company has since closed two divestitures, with a third nearing completion. The proceeds have been used to repay debt, which has restored Compass' financial health on a pro forma basis. Compass' revenue is subject to moderate cyclicality. However, with few near-term debt maturities over the next few years and the salt business being restored, Compass is not in danger of being unable to meet its financial obligations.

"We view management's investments as exceptional. Since CEO Kevin Crutchfield took over in May 2019, the company has undergone a swift turnaround. We are in favor of the decision to prioritize the Goderich salt mine and invest in the long-term growth of the salt business, as this segment underpins our wide moat rating. Further, we think the divestiture of the South American businesses makes strategic sense as it allows the company to restore its balance sheet health. Given the company's relatively weak financial position that the current management team inherited, we think Compass was nearly in a forced seller position, which likely reduced the amount the company could receive. As such, management's deal to sell the business to ICL was below both our valuation of the business and what Compass paid when it acquired Produquimica in 2016. However, restoring the balance sheet to allow more financial flexibility makes strategic sense to us.

"Further, we are in favor of Compass' plans to enter lithium production from the lithium in the byproduct of its SOP production. Given that Compass already operates brine ponds and has much of the infrastructure set up, we see a relatively low capital investment to establish lithium production versus new entrants into the industry. We also agree with management's plan to continue development work on lithium production, while exploring multiple strategic paths, including a potential joint venture with an existing lithium producer.

"We see shareholder distributions as mixed, given that the dividend payout ratio is high relative to our forecast earnings over the next several years. However, we think the company will generate enough free cash flow to maintain the current dividend of $2.88 per share.

"Crutchfield is also on the board of directors. Crutchfield brings over 30 years of mining experience, having most recently served as CEO of Contura Energy, a U.S. coal miner, since its inception in 2016. Before that, Crutchfield was CEO of Alpha Natural Resources from 2009 to 2016. His appointment makes sense from an operational standpoint as the coal industry has long used continuous miners and had to focus on controlling costs. Given that Compass was experiencing operational issues at the low-cost Goderich mine that weighed on profitability, we appreciate that management immediately focused on the full restoration of the Goderich mine, which we view as Compass' crown jewel.

"Management’s short-term compensation is based on adjusted EBITDA, while long-term compensation is based on return on invested capital and total shareholder return (including dividends and buybacks) over a three-year period. We like the return on invested capital metric as it encourages management to pursue value-accretive earnings growth."

Seth Goldstein, senior analyst

Roche Holding ADR RHHBY

"We assign Roche an Exemplary Capital Allocation rating. The rating reflects our belief that Roche possesses a sound balance sheet, exceptional investments outlook, and appropriate shareholder distributions. Roche's balance sheet was transformed in 2009 with the $47 billion acquisition of Genentech, a U.S.-based biotech that was already majority-owned by Roche. Roche has steadily paid down the debt from this transaction and had only CHF 1.9 billion in net debt by the end of 2020, which is easily manageable given the firm's roughly CHF 20 billion in annual cash flow from operations. Roche has avoided large acquisitions since the Genentech deal but has supplemented in-house innovation with bolt-on acquisitions and collaborations in both pharmaceuticals and diagnostics over the past several years, allocating capital between the steadily growing dividend and these deals. Roche holds a net debt/EBITDA ratio of close to zero, a ratio that only surpassed 1 shortly after the Genentech deal.

"We have a positive view on Roche's history of investments and our outlook for future investment. While we see Roche's history of acquisitions and collaborative deals as relatively neutral to the firm's ROIC, meaning that they don't appear to create or destroy significant economic value, we think they improve the firm's competitive positioning and moat sources. The largest recent acquisition was the roughly $5 billion deal in 2019 for gene therapy firm Spark, with development programs in hemophilia, ophthalmology, and rare diseases. We think it's too early to judge the success of the deal, although we note that gene therapy has been a competitive field and several recent ophthalmology gene therapy failures at other firms add uncertainty. Beyond Spark, we think Roche has smartly added to its companion diagnostics and real-world data with the acquisitions of Foundation Medicine (two-part deal adding up to more than $3 billion) and Flatiron ($1.8 billion) in 2018, as we believe these deals further entrench Roche in personalized medicine in oncology and have the potential to accelerate further drug development. While Roche is advancing several novel types of antibodies internally, it is also acquiring rights to a wide range of newer modalities with recent deals, from Spark (gene therapy) to BioNTech and Vaccibody (personalized neoantigen vaccines) to Adaptive (cell therapy).

"We see Roche's current level of dividend payment (roughly CHF 8 billion annually) is appropriate, as it maximizes returns to shareholders but still leaves some free cash flow remaining to repay debt as it comes due or support smaller collaborations or acquisitions."

Karen Andersen, strategist

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)