Berkshire Hathaway Valuation Gets a Boost

Strong investment performance and operating results leave the conglomerate well positioned.

Although 2020 was an extremely difficult year for Berkshire Hathaway BRK.A/BRK.B, with a nearly 10% decline in operating earnings and a 40%-plus decline in reported net earnings, the company’s overall positioning improved as the back half of the year progressed. Since the start of 2021, Berkshire has seen an even more marked improvement in its insurance investment portfolio as well as the operating results of its various subsidiaries. That said, we expect 2021 and 2022 to be relatively abnormal years, with strong results in the current year offset by weaker results next year as the company laps the exceptional levels of performance put up in 2021.

We continue to view Berkshire’s decentralized business model, broad business diversification, high cash-generation capabilities, and unmatched balance sheet strength as true differentiators. While these advantages have been overshadowed by an ever-expanding cash balance--which is earning next to nothing in a near-zero interest-rate environment--we believe the company has finally hit a nexus where it is far more focused on reducing its cash hoard through stock and bond investments and share repurchases.

We’ve increased our fair value estimate for the wide-moat company to $480,000 per Class A share from $440,000 and to $320 per Class B share from $293 after updating our near- to medium-term forecasts for the conglomerate’s various operations. We use a 9.0% cost of equity in our valuation, which assumes an increase in the U.S. federal statutory tax rate to 26% from the current 21%.

Our fair value estimate is equivalent to 1.42, 1.31, and 1.35 times our estimated book value per share for Berkshire at the end of 2021, 2022, and 2023, respectively. For some perspective, during the past five and 10 years, the shares have traded at an average of 1.43 and 1.41 times trailing calendar year-end book value. We expect book value to grow at a 15%-20% rate this year (it expanded 26.6% year over year during the first half) and increase at a mid- to high-single-digit rate in 2022. Having forecast a year with an equity market correction, which will affect the contribution from Berkshire’s insurance investment portfolio, as well as larger-than-normal catastrophe losses, which will require an increase in loss reserves, we see book value per share declining by the midsingle digits in 2023.

Our valuation of Berkshire is derived using a sum-of-the-parts methodology. We value each major part of the company’s operations separately and then add them back together for the total estimate. After updating the different models that we use to value the company, we made the following changes.

- For Berkshire's insurance operations, we increased our fair value estimate to $211,600 per Class A share from $188,100 and to $141 per Class B share from $125. This increase was driven primarily by the strong market gains in the segment's equity portfolio during 2021 and our expectations for stable results in 2022. We also raised our forecasts for earned premium growth of 9.0% on average annually during 2021-25 (compared with 8.3% previously) and underwriting profitability of 98.1% on average annually over the next five years (compared with 99.6% previously).

- For Burlington Northern Santa Fe, we increased our fair value estimate to $81,100 per Class A share from $77,400 and to $54 per Class B share from $51. Much as we've done with the other Class I railroads, we project a more normalized volume and pricing outlook for BNSF following a strong year of recovery during 2021, with profitability improving as a result.

- For Berkshire's utilities and energy division, we increased our fair value estimate to $43,100 per Class A share from $38,600 and to $29 per Class B share from $26. This segment will see less of an impact from a higher statutory tax rate, as any added costs will eventually get passed on to customers

- For Berkshire's manufacturing, service, and retail operations, we raised our fair value estimate to $144,200 per Class A share from $135,900 and to $96 per Class B share from $91 to reflect upwardly revised forecasts for revenue and profitability over 2021-25.

Where’s Berkshire Going to Put Its Capital?

After ongoing capital expenditures, we expect the bulk of Berkshire Hathaway’s excess capital to be focused on stocks and bonds for the insurance investment portfolio--with an eye toward boosting the yield on the portfolio, which has fallen closer to 1.6% in the past year from an average of 2.0% in the past five years and 2.3% in the past 10 years--and a continued return of capital to shareholders via share repurchases.

While Berkshire started the third quarter with an estimated $109 billion in dry powder that could be used to fund acquisitions, stock and bond investments, and share repurchases, we still view its own common stock as its most viable investment opportunity. Over the past eight calendar quarters, the company has repurchased $40 billion worth of its common stock at a price of around 1.3 (1.3) times the prior year’s (prior quarter’s) book value per share and closer to 1.5 (1.4) times during the June quarter of 2021. This eliminated around 7.5% of the total Class A equivalent shares outstanding.

The quarterly run rate of just over $5 billion in share repurchases per quarter the past two years is similar to our expectations for $5.5 billion in quarterly share repurchases on average during 2021-25. The company is already running ahead of our forecast by repurchasing $12.6 billion of stock during the first half of 2021. This raises the following questions in our mind:

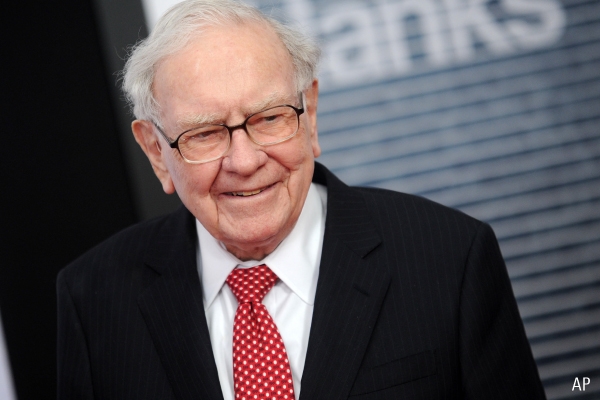

- Is Berkshire buying back shares more recently at prices at or above chair and CEO Warren Buffett's and vice chair Charlie Munger's calculation of intrinsic value?

- If so, is this because the shares remain the best option available to put money to work in order to keep the company's cash balances from pushing out beyond the $150 billion threshold that Buffett described as being untenable to shareholders during Berkshire's May 2017 annual meeting?

We think that the answers to these questions will give us a better sense of how much more stock Berkshire might repurchase over the next five years if valuation relative to historical multiples is less of an issue.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)