8 Financial Do's and Don'ts for the Seven-Figure Retirement

Spending your nest egg carefully is just as important as building it.

Making the transition from working life to retirement brings with it a set of new challenges, ranging from lifestyle questions about staying active to engaging with a whole different dynamic around day-to-day finances and long-term tax and financial planning.

With this column, I'll continue my look at the financial decisions facing a "Good Saver Couple." As I outlined in part one of this series, I'm defining this as a couple that has worked a full career, is somewhere between ages 62 and 66, and is considering retirement. They have a 401(k) in the low seven figures, own a home that is partially paid for, have consumer debt consisting only of car loans or leases, and no longer have kids who are financially dependent.

In the first column, I looked primarily at investment decisions. With this piece, I'll outline a range of do's and don'ts, including Roth IRAs, tax planning, and when to start taking Social Security.

Don't Retire Too Early

The thought of retirement can be tempting. But there are emotional and financial reasons to not jump the gun. Make sure you have a life outside of work, or retirement will be nonstop boredom. Sleeping in and watching TV are not the keys to a happy retirement.

But it's more than that. Financially, retiring too early can be devastating. Quite simply, each year of early retirement represents one less year of savings and one more year of spending.

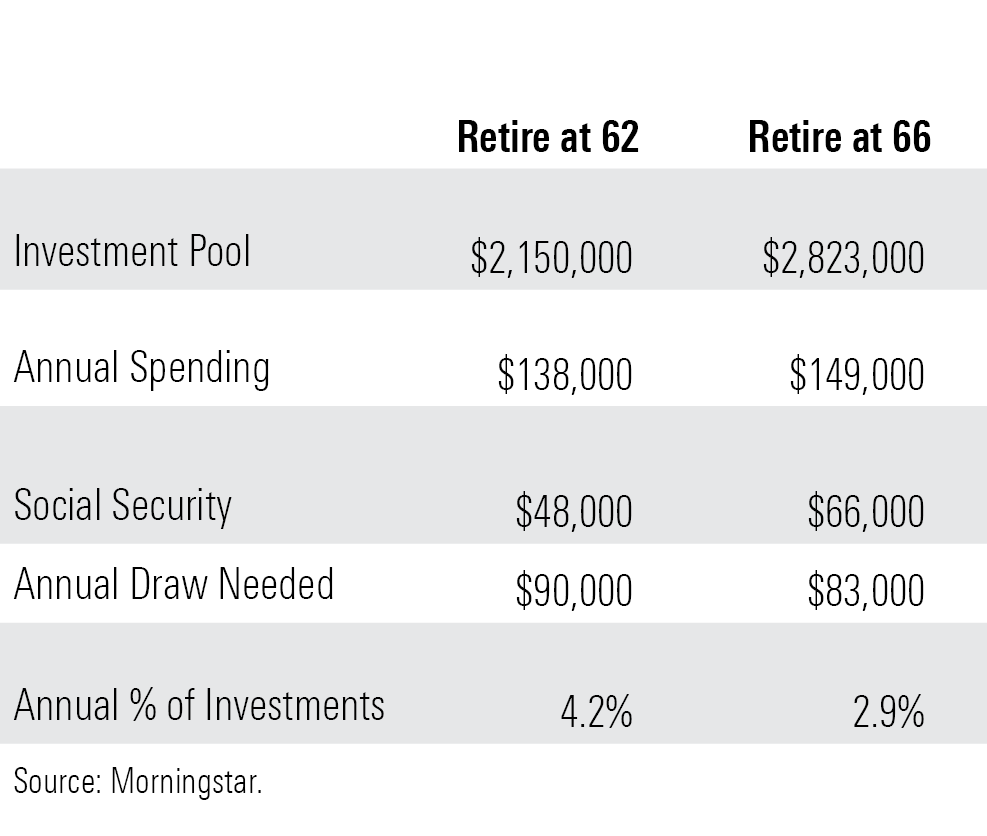

Take our Good Saver Couple's case. Let's say they are both 62. Retiring now means they have to count on the sustainability of a 4.1% withdrawal rate--not considering taxes. Although that's not impossible (especially if they have flexibility to cut down on travel, gifts, and so on if necessary down the road), delaying retirement by four years would have a huge impact. Let's say they add $25,000 per year each to their 401(k)s, and their portfolio grows by 6% per year. Instead of needing $7,500 a month, with higher Social Security benefits, they only need $6,000 a month. Their portfolio grows to $2,823,000. So, by retiring four years later, their required withdrawal rate drops to 2.6%. Even considering that tax will be due on some or all of the draws, this should easily provide for Good Saver Couple's retirement cash flow.

Even adding inflation of 2% per year makes a compelling case for delaying retirement. In this case, the required annual draw drop to 2.9% from 4.2%.

Do Watch Your Taxable Income Level

I've found that many retirees don't understand how much their tax status--and therefore their tax bills--can vary during retirement depending on how they manage their sources of cash. Depending on how skillful the planning, this variability can either be an advantage or disadvantage.

For example, if you delay required minimum distributions until age 72, you might be in a very low tax bracket until 72 and then a high tax bracket when retirement distributions kick in. Rather than put yourself in a high bracket later on, it might be worthwhile to spread withdrawals out by starting earlier.

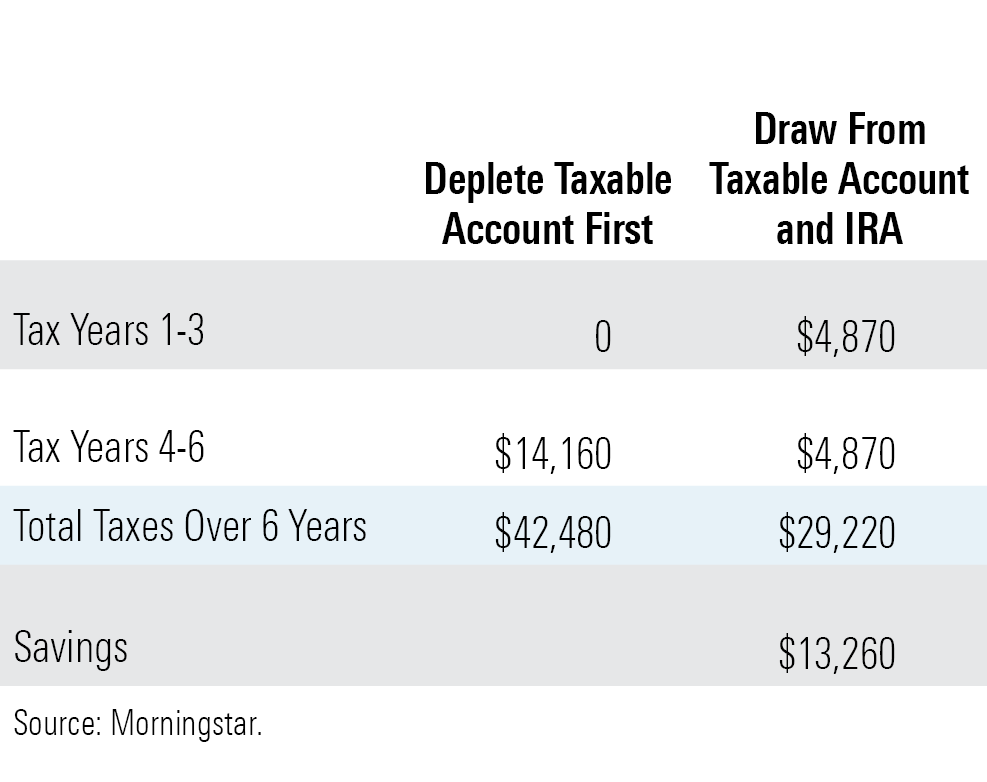

To see how this works, let's say that both members of the Good Saver Couple (who are the same age) retire at age 66 when their 401(k) balance is $2,634,000 and their mutual funds have grown to $190,000. Using Social Security and drawing $6,000 a month from their mutual funds will likely mean zero to minimum tax. Based on their mutual fund balance and continued growth, the couple can utilize this strategy to minimize taxes to zero for about three years. Then, they would be required to use IRA funds to support their living expenses. With $72,000 of IRA income, 85% of Social Security benefits would be taxable, creating total adjusted gross income of $128,100. This would put them in the 22% tax bracket, or tax of about $14,160 per year. Total tax over the six years prior to RMDs would be about $42,480.

On the other hand, let's say that the Good Saver Couple decides to spread IRA distributions over the six years prior to RMDs. They would take $3,000 a month from mutual funds and $3,000 a month from IRAs. This would result in adjusted gross income of $69,000 and put them in the 12% tax bracket, or tax of about $4,870 per year. Total tax over the six years prior to RMDs would be about $29,220--a savings of over $13,000 in six years!

Thus, it is important to do tax planning prior to utilizing funds during retirement. Paying some tax earlier could mean greater tax savings down the road.

Don't Take Social Security Too Early or Too Late

There's a natural instinct--often built around fear--to start taking Social Security as soon as possible.

But taking Social Security benefits before full retirement age can reduce your monthly benefit by up to 30%. Delaying benefits past your full retirement age increases your benefit by 8% a year through age 70. Yet, there can also be valid reason for taking those payments sooner rather than later.

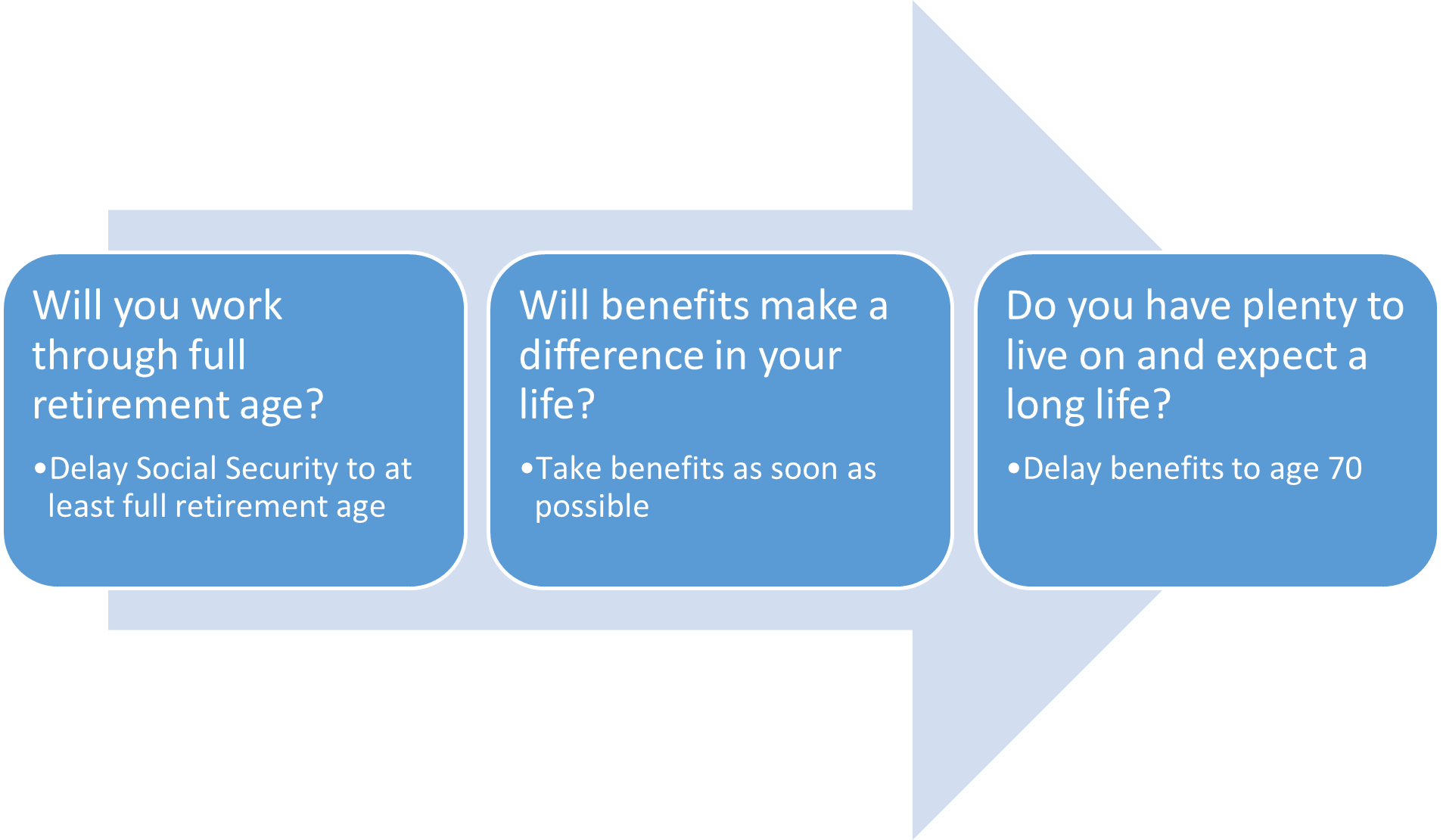

So, when should you take Social Security? This is a complex question that can involve detailed calculations. However, I believe there are some general observations that can help the decision-making process.

It is generally best to wait until your full retirement age to begin taking benefits. Full retirement age is currently 66 for those born between 1943 and 1954, and it increases to 67 years old for those born later.

Taking Social Security benefits earlier than full retirement age often is the wrong move if you plan to continue working. That's because earning income above $18,960 per year lowers the amount you receive from Social Security. If you're not planning to work, taking Social Security could be a good decision, especially if it will positively impact your lifestyle. After all, there's no guarantee that Social Security, as we know it, will be around in the long haul. Finally, although the numbers say that delaying Social Security is beneficial should you live beyond your mid-80s, nobody has guaranteed longevity.

Delaying Social Security until full retirement age makes sense if you are planning to work. Delaying benefits until age 70 can also work to your advantage if you don't need the cash flow and/or you are trying to minimize taxable income in order to execute Roth conversions prior to that time. There is no "one size fits all" recommendation. However, for a quick rule of thumb, see below:

Source: Morningstar.

Do Consider Roth Conversions

If you have more than a few thousand dollars in 401(k)s or IRAs, the period between retirement and RMDs can present a great opportunity for Roth conversions. Without wage income or RMDs, it is possible to minimize taxable income--if you have sources of cash for living expenses other than retirement accounts.

The Roth IRA is the Holy Grail of tax planning. Although funded with aftertax dollars, it grows tax-free and withdrawals are tax-free--meaning that income is never taxed. Additionally, there are no required distributions from a Roth IRA. So, if you have IRAs, the opportunity to do Roth conversions should not be overlooked, even though you have to pay tax on the amount converted.

Let's use the first example above, let's say that Good Saver Couple uses the three years of low taxable income to convert some IRA funds to Roth. Assuming this would result in taxes on 85% of their Social Security payouts, they could add conversion income of up to $141,750 per year and still stay in the 22% tax bracket. At the end of three years, at a 6% growth rate, the Roth IRA would be worth over $475,000! This account can continue to grow tax-free and reduces future IRA RMDs. Note that this is a simplified example that does not consider the source of taxes due on the conversion amounts. Thus, as always, the expertise of a qualified professional is essential.

Do Consider Retirement Stages and Safe Withdrawal Rates in Determining Spending Budgets

An exact number for a safe withdrawal rate is debatable. According to recent articles, it could be as low as 3% to as high as 5%. In a 1994 article, William Bengen advised a 4% safe withdrawal for those retiring at ages 60 to 65 with a portfolio of 50% equity/50% fixed income. Bengen further warns that "an initial 5% withdrawal rate is risky; 6% or more is gambling." However, note two important points: Bengen's 4% was actually 4.5% when small cap stocks were added to the portfolio, and he also noted that increasing equity holdings (not greater than 75%) could increase initial safe withdrawal rates to as much as 5% to 6%. In 2013, because of declining interest rates, publications reported that the 4% rule was dead, suggesting a more conservative number, possibly as low as 3%. Yet, others argued that these low numbers were based on an extremely low failure rate and there could be some flexibility if the retiree would be able to adjust spending down the road if needed. One example is John Rekenthaler's 2013 article. In Rekenthaler's October 2020 article, he was not so certain that retirement portfolios could sustain a withdrawal rate higher than 3%, even in the earlier years.

In a February 2021 article in The Motley Fool, Bengen actually argued in favor of a 5% withdrawal rate, noting that a wide range of withdrawal rates can be applicable, even some topping 10%, depending on factors such as inflation and stock market circumstances, and noted that his famous 4.5% recommendation is meant to make a retiree's money last through a worst-case scenario. In fact, Bengen stated, "I think somewhere in a 4.75%, 5% [range] is probably going to be OK. We won't know for 30 years, so I can safely say that in an interview." The article noted that Bengen himself is using a 5% rate.

So, how should retirees set their retirement withdrawal rates? In my opinion, spending slightly on the high side (5%) in earlier years is fine. This considers several factors:

- You don't have to plan for the worst case.

- You likely have safety nets, such as home equity.

- You will likely spend less over time.

According to David Blanchett, former head of retirement research at Morningstar, "On average, as people age, they tend to slow down. So they transition from the go-go years to the slow-go years and the no-go years. They tend to spend less, they tend to be less mobile, so that obviously affects their overall consumption." In fact, Blanchett found that expenses did not increase by inflation over time, stating, "What I found was that the actual change tends to be negative. A negative change means that if inflation goes up say 3% in the year, they'll only spend maybe 2% more the following year."

Assuming your medical and long-term-care expenses are covered by Medicare and insurance, it is a safe assumption that your retirement cash flow needs will decline as you enter into each new phase. So, to ensure you don't short change your activities during the go-go years, you should build declining expenses over time into your financial plan. However, to protect against a "poison pill" plan (take the pill when you run out of money), you should also consider annuity-type investments, which will provide guaranteed income for life. These types of investments include Social Security, defined-benefit pensions, reverse mortgages, and deferred or immediate annuities.

Finally, you must be willing to be flexible. For example, when talking about withdrawal rates, we must also consider the impact of large market drops--especially in the initial years of retirement. In this case, the general consensus of the experts is to decrease spending during downturns.

Don't Lock in Expensive Payments or Financial Commitments

Being overly generous or committing to a long-term expensive car lease (that won't allow you to turn the car in early should you decide to cut back) can pose a threat to funding retirement throughout your lifetime. For example, if you start playing the "Bank of Mom and Dad" role, your kids will continue to expect bailouts, thus eating away at your nest egg.

As you start retirement, your savings reflect what you accumulated throughout your working years. Although the bucket seems huge, it isn't when you consider its purpose: It is your means of survival for the rest of your life. So, adding extra commitments or frequently helping out organizations/friends/family members in excess of your budget can lead to a poison-pill plan.

Don't Write Checks to Charity

If you itemize, you might get a tax benefit from writing checks to charities. If you don't itemize or you're on the edge of itemizing, you get no tax benefit from charitable contributions (except for up to a $300 single above-the-line deduction this year). Better than writing a check to charity is contributing appreciated stock or mutual fund shares. Assuming the shares were held at least one year, the deduction is the full fair market value and there is no tax on the accumulated gain! It's a way to contribute using partially pretax funds. Obviously, this strategy can only work with material contributions to charities that can handle stock transfers.

A more beneficial method of charitable giving is the donor advised fund, or DAF. A DAF is like a charitable IRA. You get a deduction as soon as you contribute to the account, the money grows tax-free, and you can "take money out" by designating grants to charities of your choice over as long a period of time as you wish. It's easy to set up through a local community foundation or a national provider, such as Schwab, Fidelity, or Vanguard. Although you can write a check to the DAF, you save more taxwise by transferring appreciated shares or property.

For those over age 70 1/2, a qualified charitable distribution, or QCD, is an option to make charitable contributions of up to $100,000 per year directly from an IRA. This essentially allows a deduction for contributions even if you don't itemize. By paying the contribution from your IRA, rather than deducting it as an itemized deduction, your adjusted gross income is reduced, which can also lower your tax on Social Security income. And you can even use your RMD for a QCD.

Do Consult a Financial Professional

I'm not just saying this because I've been a tax planner and a financial advisor. As you can see from this list, even people with relatively simple finances have lots of complex decisions to make. Plus, it is often the case that one financial decision affects another aspect of a financial plan, especially when it comes to taxes.

I recommend a team consisting of a CPA to provide tax-planning advice, a financial planner to model scenarios and help with your budget over the different phases of retirement, and a trusted insurance broker for any long-term-care insurance or annuities.

You should also utilize your advisor's advice (and/or management) for portfolio investments. First, because you should have better things to do than manage your investments, and second, a qualified professional will usually do a better job for you in the long run. Professional management will ensure that your portfolio is not too aggressive or conservative, maintain a diversified portfolio, provide tax management, and advise you on your spending budgets on an ongoing basis. Be sure to work with a Registered Investment Advisor. RIAs are the only professionals legally required to put your interests first (above their own).

Sheryl Rowling, CPA, is head of rebalancing solutions for Morningstar and founder of Rowling & Associates, an investment advisory firm. She is a part-time columnist and consultant on advisor-focused products for Morningstar, and she continues to actively work in the advisory business. Morningstar acquired her Total Rebalance Expert software platform in 2015. The opinions expressed in her work are her own and do not necessarily reflect the views of Morningstar or of Rowling & Associates LLC.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U772OYJK4ZEKTPVEYHRTV4WRVM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/256953a9-ba08-4920-baa8-ccdc229ed9f9.jpg)