Morningstar Moments: 3 Things You May Have Missed

Our analysts weigh in on Tesla's investigation, direct indexing, and seeking financial advice.

Here are the major market moments our analysts have been talking about.

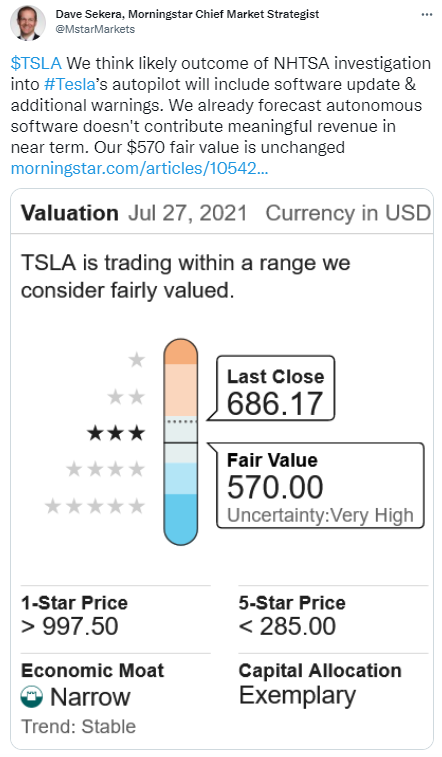

1) Open Investigation on Tesla's Autopilot Software

Between January 2018 and July 2021, 11 crashes involving Tesla vehicles using autopilot software were reported, prompting the U.S. National Highway Traffic Safety Administration to open an investigation on Monday. Analyst

shares Morningstar’s outlook on the company.

2) Is Direct Indexing “The Next Big Thing”?

Vanguard bought Just Invest, a direct-indexing firm, in July. BlackRock and J.P. Morgan have also made similar purchases. What is direct indexing? It is a customized portfolio that fits the specific needs of an investor.

tells us the benefits and drawbacks of this strategy.

3) How to Find the Right Financial Advisor

The right financial advisor out there for you--there's just a few steps to take to find the perfect fit!

encourages investors to figure out what they are looking for with this checklist first. Then, identify the right advisor by asking these key questions. Lastly, remember there is a difference between financial advice and investment advice.

Stay in the loop with @MorningstarInc and our analysts:

Dave Sekera, chief U.S. market strategist: @MstarMarkets

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/03956e27-4c76-4923-a5ab-4f03b58352a2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/03956e27-4c76-4923-a5ab-4f03b58352a2.jpg)