Vanguard Total Bond Market: A Success Story

For more than 30 years, the fund has delivered on all counts.

As Advertised

Vanguard Total Bond Market Index Fund VBMFX exemplifies the best of its industry.

Its first attribute is dependability. When launched in 1986, Total Bond Market carried an unprecedented charter: to mimic a bond index. Vanguard had already shown that stocks could be successfully indexed, through its landmark S&P 500 fund. However, replicating the leading bond index, then called Lehman Brothers Aggregate Bond Index, was a trickier task. The Aggregate held thousands of securities, rather than hundreds, and many of those securities were illiquid.

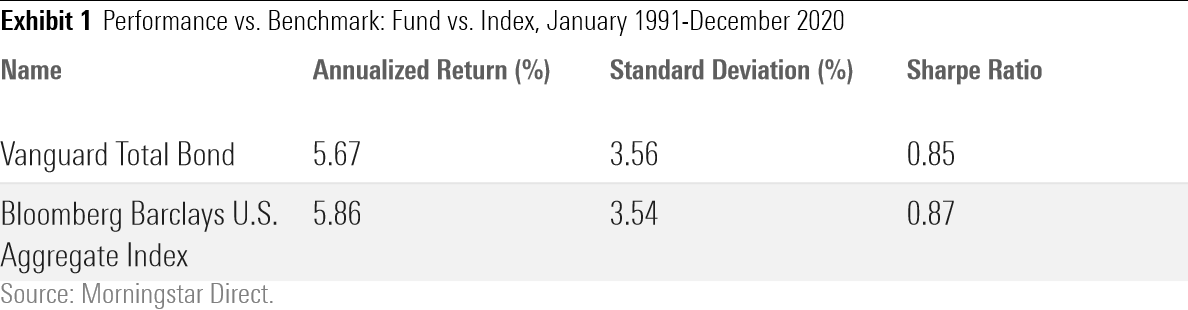

The fund has topped the expectations of even its most fervent advocates. During the past three decades, its total returns, volatility, and risk-adjusted performance have almost exactly matched that of its benchmark (now dubbed Bloomberg Barclays U.S. Bond Aggregate). Total Bond Market has behaved as promised.

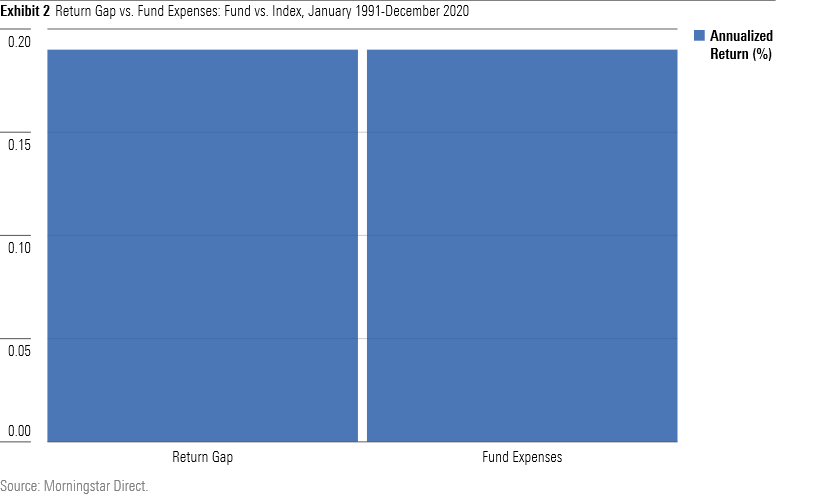

Index-fund skeptics often invoke the strategy’s “hidden” transaction fees, as neither trading spreads nor commissions appear in funds’ expense ratios. Their implication is correct; the SEC regards trading costs as investment expenditures rather than fund-company outlays, and thus exempts them from expense-ratio calculations. However, their effect on the major index funds is rarely material.

They certainly have not been with Total Bond Market. Since 1991, the fund has trailed its benchmark by an average of 0.19 percentage points per year. The chart below compares that amount with the size of the fund’s stated expense ratios, averaged over those same 30 years.

Now that’s a match! To be sure, the numbers won’t always line up so precisely. Transaction costs do exist. Clearly, though, they are negligible for Total Bond Market, which severely limits its trading activities. For all practical purposes, the fund provides the returns of its index, minus its expenses.

Considering the Competition

Of course, matching a benchmark isn’t useful if that index performs poorly. Vanguard has been fortunate in that bonds have enjoyed a long bull run since Total Bond Market was introduced. However, if the fund’s absolute results have lain outside its control, its relative performance has not. When Total Bond Market was launched, Vanguard maintained that, regardless of the markets’ direction, or how other funds behaved, its cost advantage would ensure superior performance.

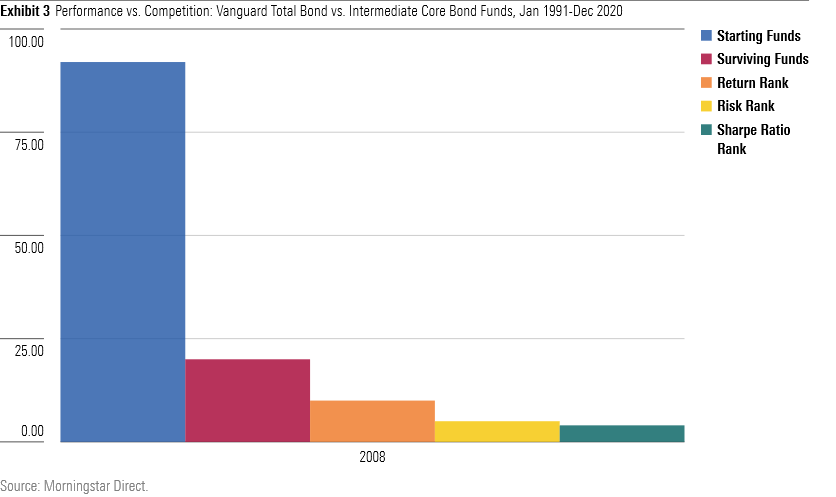

That has indeed been the case. Thirty years ago, there were 92 intermediate core-bond mutual funds. Since then, 72 have disappeared, through liquidations or mergers. Thus, Total Bond Market has bested those 72 funds. Among the 20 remaining funds, Total Bond Market has posted the tenth-highest return, the fifth-lowest standard deviation, and the fourth-best risk-adjusted performance.

Admittedly, Total Bond Market hasn’t outgained three fourths of the surviving funds, as have most of Vanguard’s stock index funds. Viewing the contest more broadly, though, there certainly is glory in placing tenth among 92 starters. Also, while Total Bond Market has ridden an absolute tailwind, it has battled a relative headwind, as most of its rivals have courted moderately greater risk. Should the bond market reverse course, the fund’s return ranking will probably increase.

The Direct Approach

Bond funds do have a drawback. The price for a bond fund never rests. At no time can shareholders count on getting the amount of the original investment back, should they redeem their shares. In contrast, if a directly owned bond is held until its maturity date, investors can recover 100% of their original outlay. There is an advantage to such certainty.

However, unless direct bond investors wish to accept “event risk”--that is, the possibility that some of their holdings will default or be called--they must restrict themselves to high-quality issues that pay relatively low yields. (Although bond funds also face event risk, the danger to them is much reduced, because their portfolios are so highly diversified.) Chief among them are Treasuries.

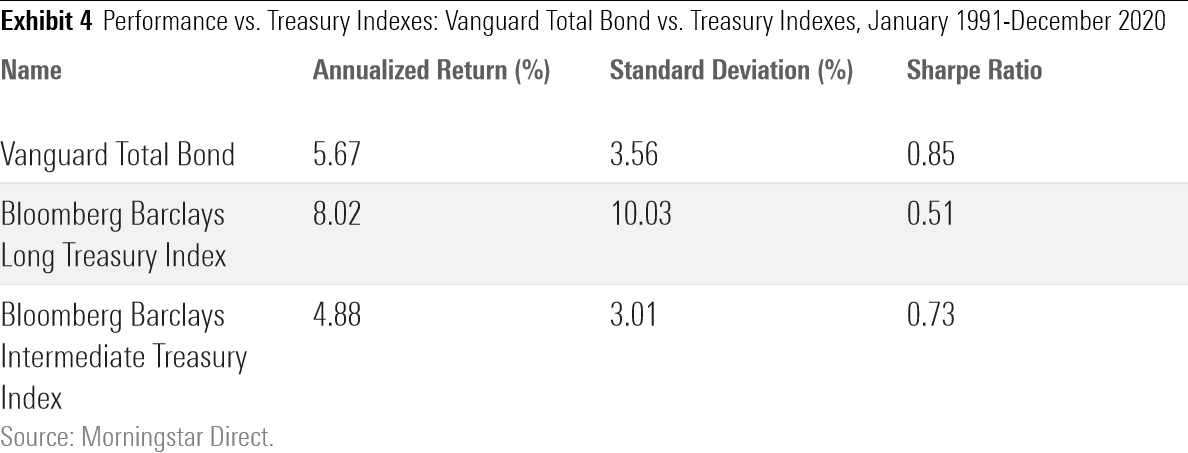

And Total Bond Market has more than held its own against Treasury portfolios. Naturally, the fund has been unable to match the returns of long Treasuries; quite literally, they don’t make bonds like that anymore. But it has outgained the Bloomberg Barclays Intermediate Term Treasury Index over the past 30 years, and it has posted better risk-adjusted performance than the Long Treasury Index, too.

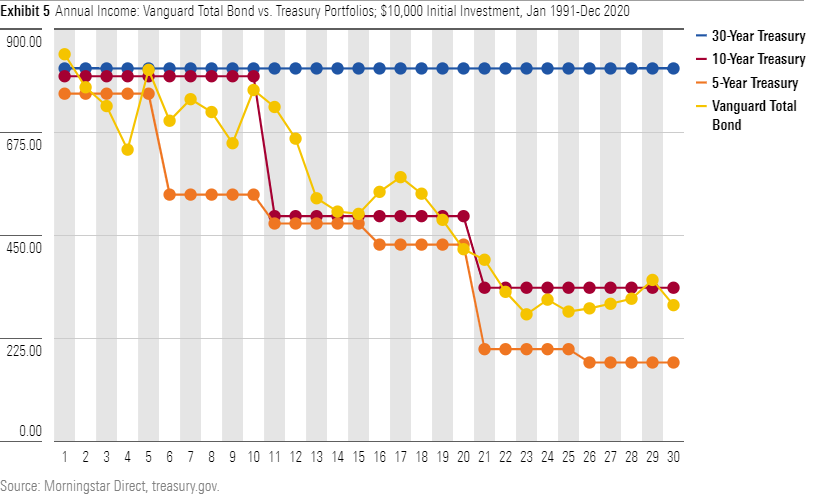

Another way of viewing the matter is to compare the income that would have been received by an investor who bought Treasuries three decades ago, reinvesting the principal into newly issued Treasuries as required, with the income distributed over the same period by Total Bond Market. The chart below depicts the annual yield for three hypothetical Treasury portfolios and Total Bond Market, assuming an initial investment in January 1991 of $10,000.

Nothing approaches the income received by an investor who was smart--or lucky--enough to have purchased a 30-year Treasury on New Year’s Day 1991. Clipping an 8.14% coupon each year, without exception, must surely be a lovely feeling. (So, less happily, must be the emotion when the bond’s principal is at last repaid and the proceeds reinvested at today’s piddling rate.) However, of the remaining options, Total Bond Market fared best. It generated more income than did either 10- and five-year Treasuries, with less volatility of yield than all three alternatives.

Summary

In the 1990s, Vanguard Total Bond Market became the biggest intermediate core-bond fund. Twenty years later, it became the largest bond fund, period. The outcome has benefited both parties of the exchange. Total Bond Market’s shareholders have received exactly what they sought. In turn, the industry has demonstrated once again that although it no longer generates much excitement, it can and should be credited for quiet competence.

Note: This article was edited after publication to correct the initial investment mentioned in Exhibit 5.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)