Are Water Funds Too Watered Down?

Climate change has underscored the need for clean drinking water. Does that make investing in water funds a compelling option?

Editor's note: This article was originally published on Aug. 23, 2021.

Sitting at the intersection of two key trends in investment management--environmental, social, and governance investing and thematic investing--are water funds, which seek to invest in companies that are leaders in limiting their water usage or creating innovative solutions to increase the availability of clean drinking water.

Investors who want to address climate concerns may use water funds to target sustainability themes in their portfolios. At Morningstar, we've identified six distinct approaches to sustainable investing: apply exclusions, limit environmental, social, and governance risk, seek ESG opportunities, practice active ownership, target sustainability themes, and assess impact.

There are countless ways to justify an investment as influencing clean water availability, and this flexibility, exercised at the discretion of the manager, leads to a broad investment menu. As a result, their portfolios are often watered down with holdings that may have little to do with the business of water, which drives performance that resembles common equity indexes rather than anything differentiated.

What Options Do Investors in Water Funds Have?

There are roughly 65 water funds globally that have about $35 billion in assets under management.[1] It's a niche that's been around for a while, but it's one that continues to grow as concerns about climate-change-induced water shortages, and interest in investing in ways to adapt to or avert them, grow. Money managers have launched six new water funds over the past year, and the group has seen inflows of $3.9 billion during that period.

Unlike energy and agriculture commodities markets, the water business is fragmented and highly regulated by the municipal, agricultural, and environmental interests that use water the most.

Because of this, none of these open-end water funds invest directly in water rights or have direct exposure to the price of water. Rather, they invest in companies that fund managers believe have exposure to the price of water, either through selling it, treating it, or using it as an input. There are four broad categories that the holdings typically fall under.

- Water utilities. Regulated companies that provide clean drinking water and/or wastewater management.

- Water transportation. Pumps and pipes, as well as companies that improve water delivery.

- Water technology. Companies that produce equipment to treat or purify water.

- Miscellaneous. These companies may have little to no exposure to the water industry but may be considered leaders in water efficiency.

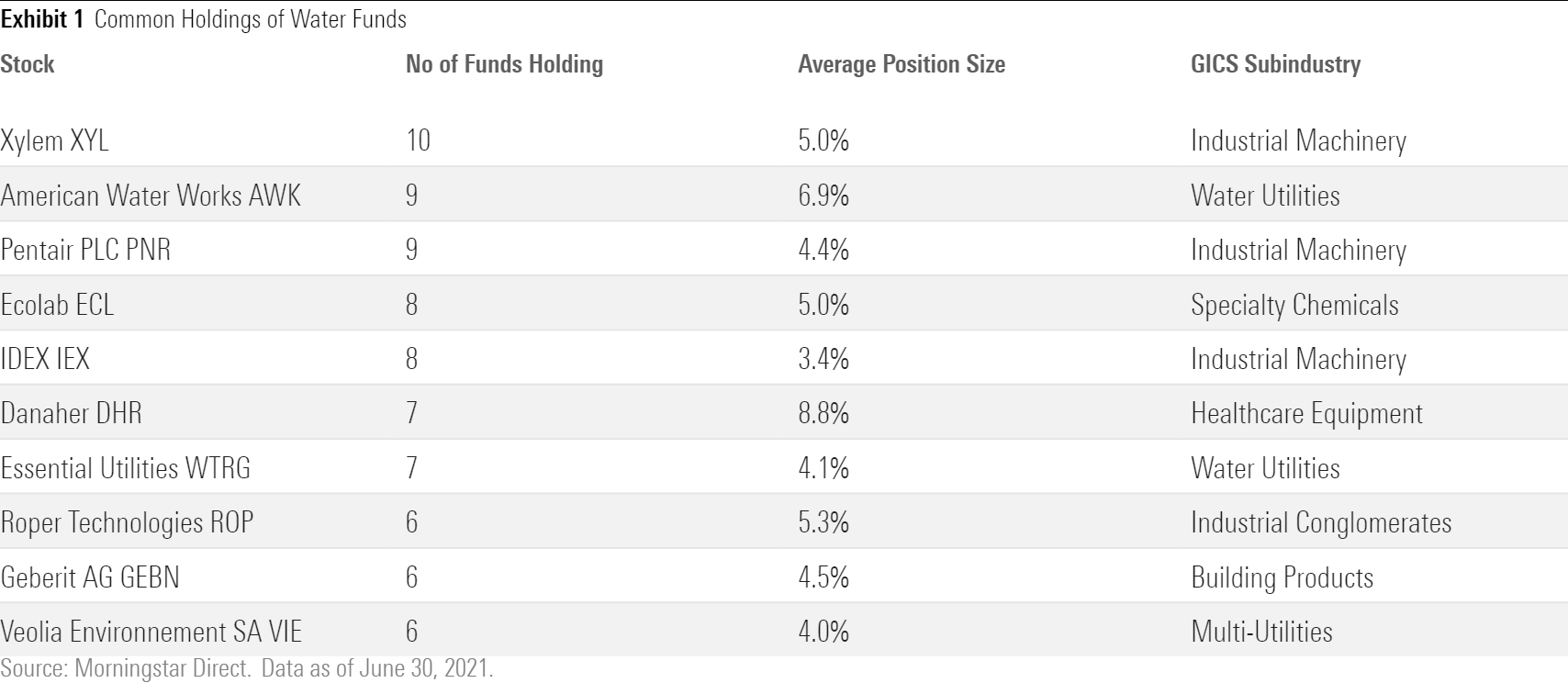

It's hard to verify whether managers are sticking to their professed water-focused strategies, because besides water utilities, there are no globally recognized aqua sectors, industries, or subindustries. You must dig into the portfolio holdings themselves. Below are the most common holdings in 10 U.S.-domiciled water funds, which have about $6.5 billion in assets under management.

Each of the 10 funds owned Xylem XYL, a water treatment and testing company. Its exposure to water availability is straightforward and intuitive, as it is for regulated water and water treatment utility American Water Works AWK and water treatment provider Pentair PNR. From there, the connection gets diluted.

Danaher DHR is a nearly 9% position in both Invesco Global Water ETF PIO and Invesco Water Resources ETF PHO. The life-sciences conglomerate includes an environmental segment with a water filtration unit. Danaher's environmental revenues, however, accounted for less than 20% of the company's 2020 revenues, and water-related business lines made up only about half of that. Still, seven of the 10 prominent water funds hold Danaher, even though 80% of its sales came from healthcare, and it's often a top healthcare fund holding.

Industrial software company Roper Technologies ROP makes smart water meters for utilities, but the conglomerate serves a variety of industries, including the oil and gas industry, college cafeterias, and toll roads. It's the second-largest holding in Fidelity Water Sustainability FLOWX, despite less than half of its revenue coming from its water business.

Further down the list are even-more puzzling holdings. PHO and PIO have sizable positions in Waters WAT, which sells drugmakers tools to analyze molecules. Its instruments have some ancillary water testing applications, though not enough to break out in the firm's financial reports. The company named after founder Jim Waters otherwise has little exposure to water.

Calvert Global Water CFWIX owns household names like Procter & Gamble PG, Nike NK, and Hyatt H because the fund's managers believe that, although they have little to do with water, they are water efficiency leaders. While that's laudable, these are not water companies.

Testing the Investing Waters

Until recently, there's been no way to see how closely equity water portfolios, with their mix of utilities, industrials, and healthcare stocks, track the spot price of water.

That changed in December 2020, when CME Group CME started trading futures contracts on the Nasdaq Veles Water Index, which tracks the spot price of water in California. That may be just one local market in one country and one economy, but it's the first instrument to offer a water price proxy, and given its size, exposure to urban and agricultural use cases, and the growing effect of droughts on water availability, California's water market provides a solid illustration of what scarcity and competing demand drivers do to the price of water.

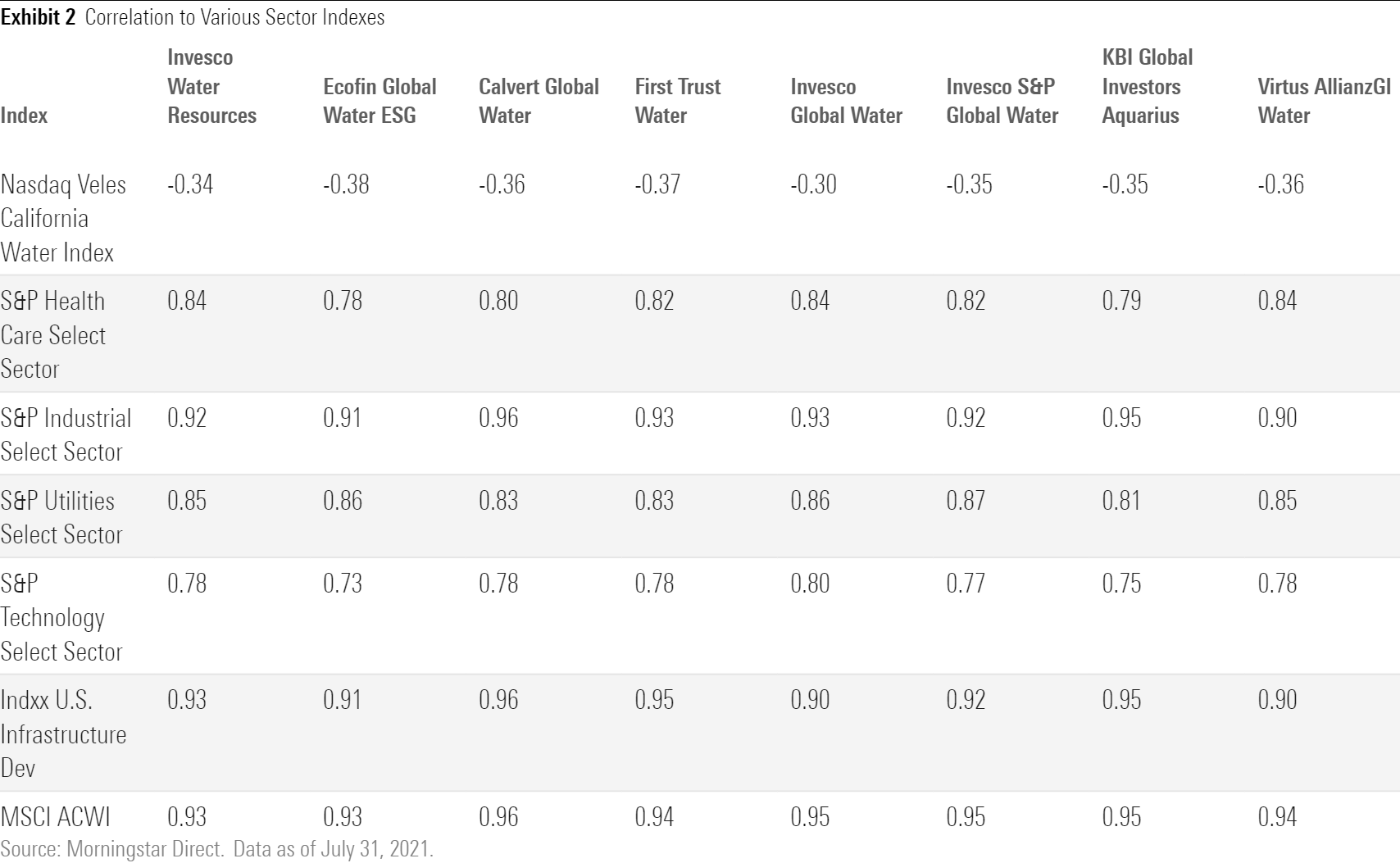

How well have existing water funds tracked that limited proxy? Not well. All eight that have been around as long as data has been available for the index since 2019 have actually tended to move in the opposite direction of the benchmark's measure of the price of water.[2]

This is uncommon for sector funds. IShares Global Energy ETF IXC has a correlation of 0.62 to the price of oil. Global X Copper Miners ETF COPX has a 0.79 correlation to the price of copper. Even the broadly diversified iShares MSCI Global Agricultural Producers ETF VEGI has a 0.46 correlation to a basket of agricultural and livestock commodities. They provide at least some exposure to the price of the commodities.

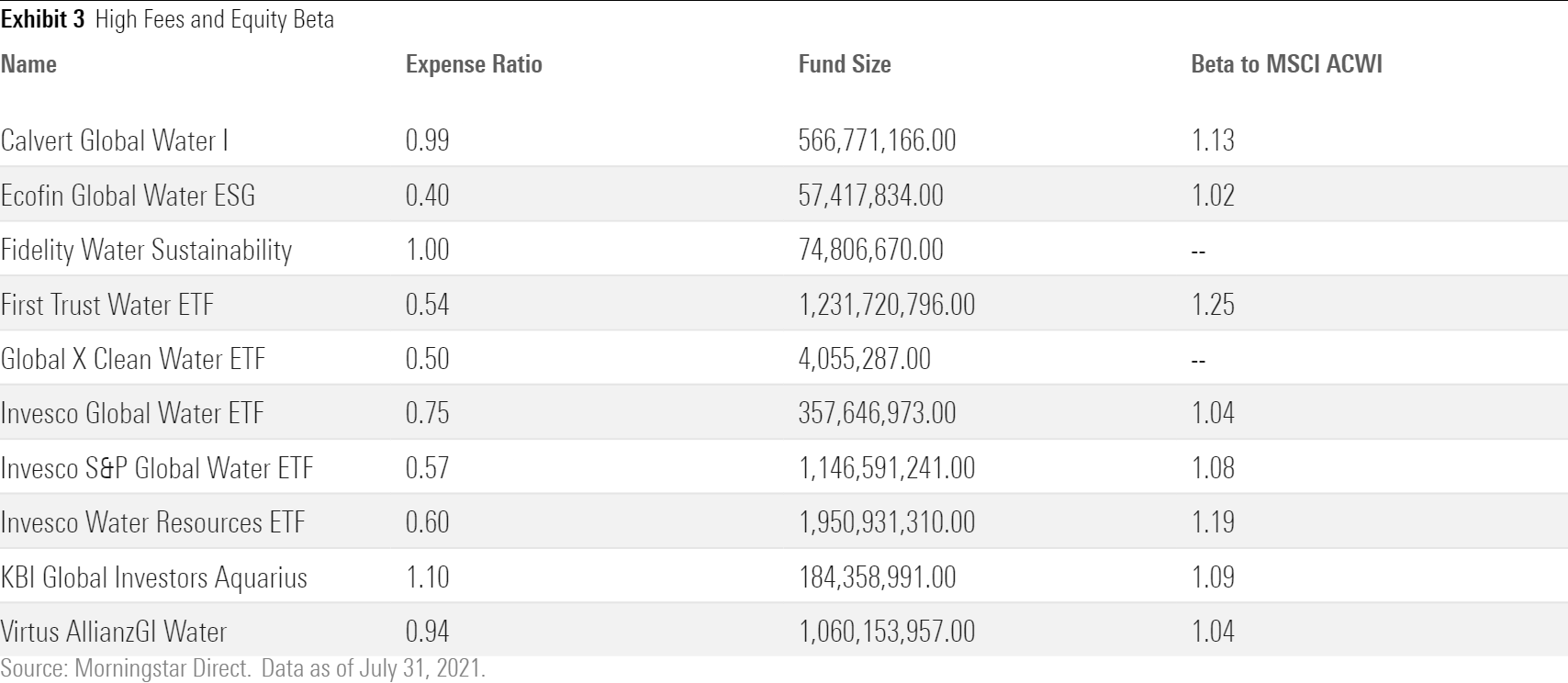

Water investors get plain old equity exposure. All the water funds have a correlation of 0.93 or higher to the MSCI All-Country World Index. Their betas (a measure of a fund's sensitivity to a specific index) range from 1.02 to 1.25, a similarly tight range that shows these funds often move in lock step with broad market indexes. In fact, the water funds trade much more like other sector funds. Most are highly correlated to the infrastructure and industrials sectors, not surprising given their holdings.

Are Water Funds Worth It?

The eclectic composition of these water funds and their performance that's out of step from the price of water stems from a dearth of opportunities to invest in water. There are few pure-play water companies, with conglomerates that oversee broad business units controlling much of the innovative technology in the space, and heavily regulated utilities doing the buying, selling, and treating of water.

Thus, the funds often stretch to find investable names and end up offering fairly standard equity exposure. Despite that, they tend to come with a hefty price tag.

So, it's doubtful you need a water fund. They are niche funds that may duplicate equity exposure elsewhere in your portfolio because many of their holdings are conglomerates that figure prominently in other, more broadly diversified stock funds. They also don't track existing, albeit limited, proxies for the price of water very well. Until products that offer more meaningful differentiation are made available, the high price tag doesn't justify the straightforward exposures.

[1] List curated by Morningstar analysts.

[2] All risk metrics measured from Sept. 4, 2019, to July 31, 2021.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)