3 Sectors With the Biggest Fair Value Increases

As second-quarter earnings season winds down, we take a look at our analysts’ valuation changes across sectors.

As the economic recovery continued to move quickly thanks in part to roaring consumer demand, Morningstar analysts increased their fair value estimates at a more modest rate during the second-quarter earnings season than they did the prior quarter. However, defensive stocks, particularly those in the healthcare sector, enjoyed slightly higher fair value boosts this quarter compared with last quarter.

Morningstar equity analysts conduct fundamental analysis and create a financial model to determine a company's intrinsic value and a fair value for its stock. While our analysts stick to a long-term approach to investing, they monitor quarterly earnings results to update their assumptions and potentially their estimates.

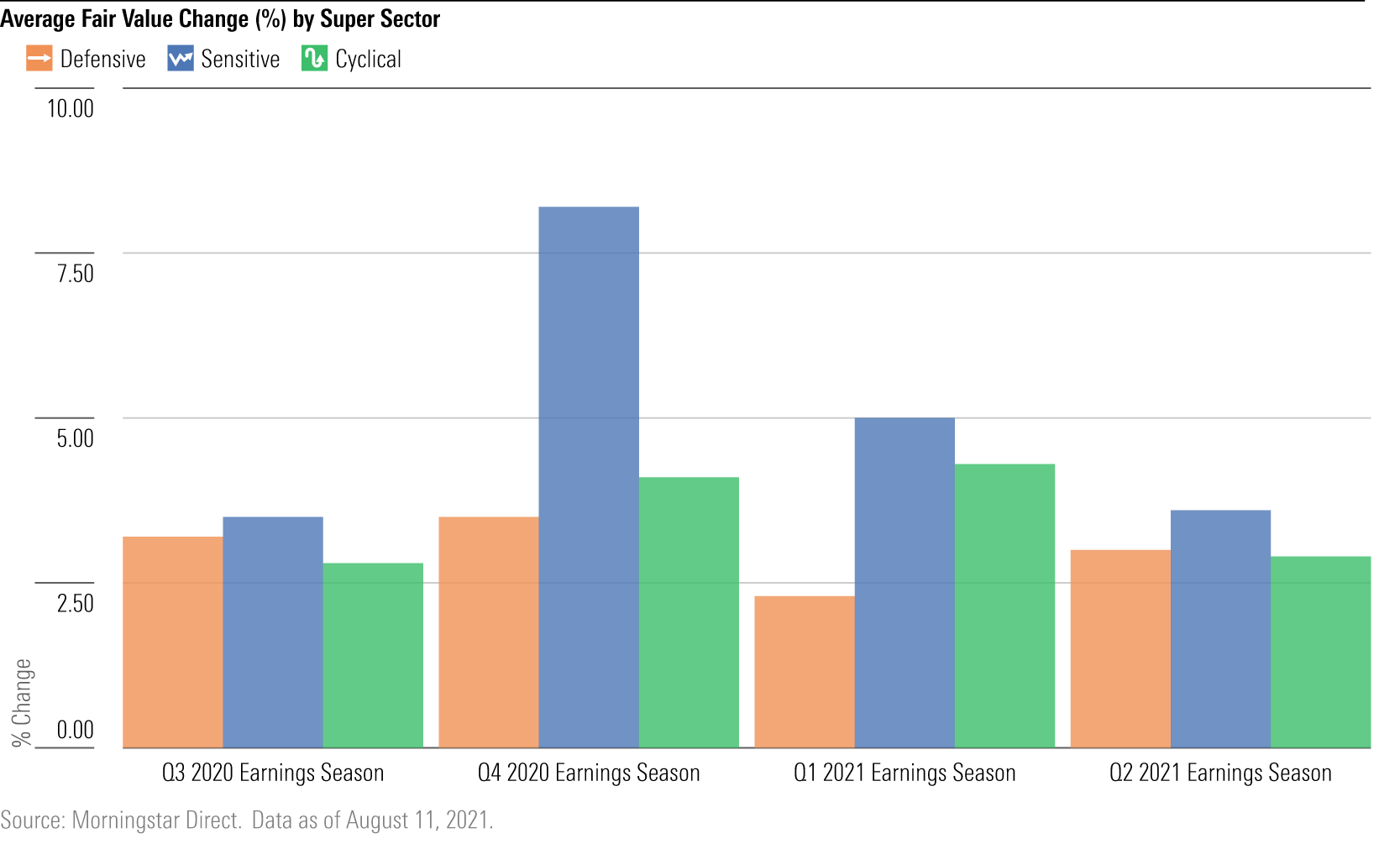

The chart below shows the average percentage change in fair value estimates throughout the past five quarters' earnings seasons. Fair value estimates were pulled from Morningstar Direct for the end dates of each quarter and compared with the estimates six weeks after each quarter.

This six-week period is meant to capture fair value increases as a result of earnings releases. However, keep in mind that some analysts may have upgraded fair value estimates prior to new earnings data based on other catalysts. (For a detailed explanation of the methodology, see the end of this article.)

The above chart shows the average fair value percentage change among what Morningstar calls the super sectors: cyclical, defensive, and sensitive. Cyclical sectors are those that are heavily correlated with the business cycle. As the economy grows and expands, cyclical sectors follow. Defensive sectors are anticyclical. Sensitive sectors are slightly correlated with the business cycle.

Compared against the last earnings season, 2021’s second-quarter earnings season saw more modest upgrades for sensitive and cyclical stocks, on average. Meanwhile, defensive stocks saw an uptick versus the period, with an average increase in their fair value estimate by 3%, up from the average 2.3% increase last quarter. The bulk of these upgrades were in the healthcare sector.

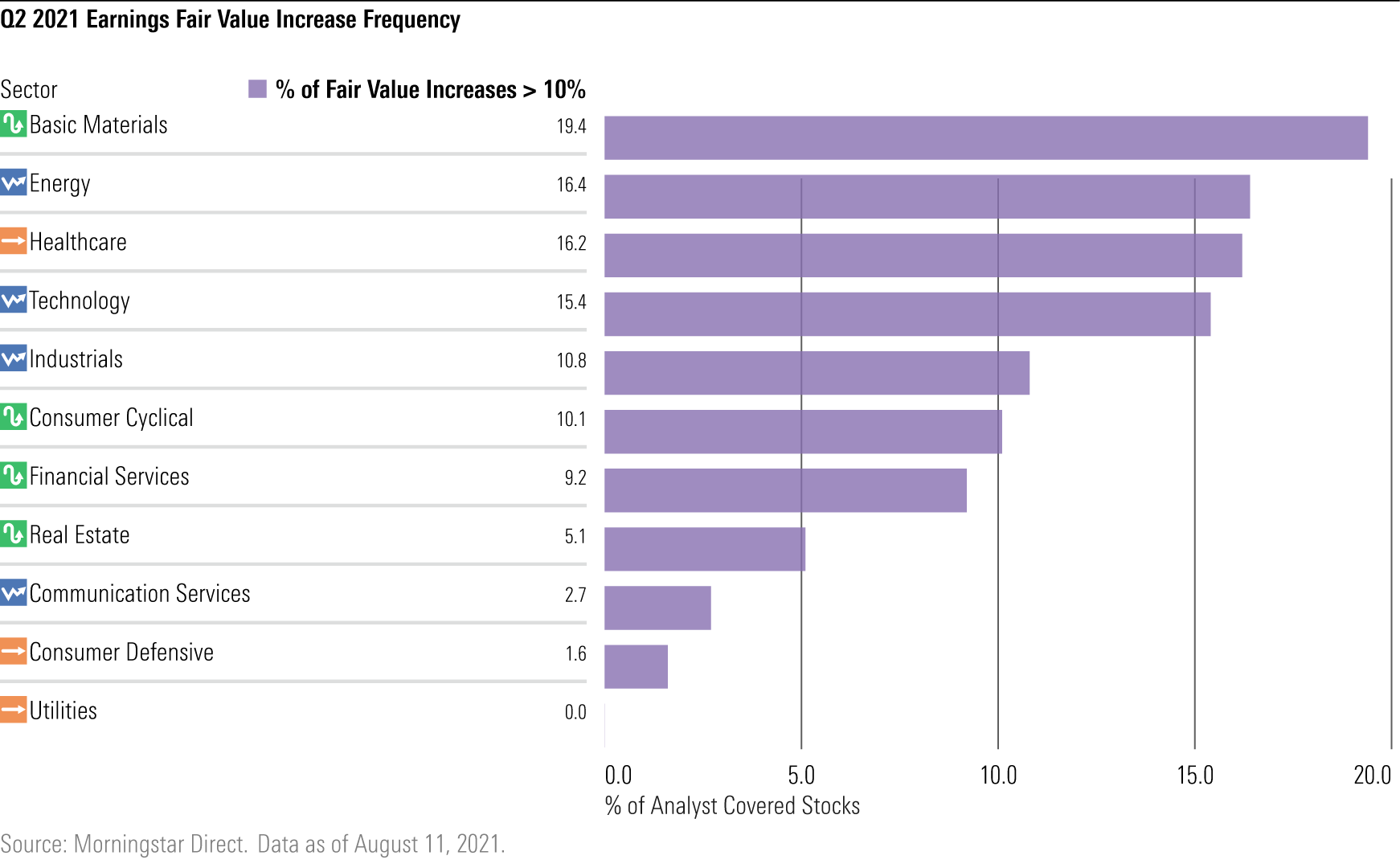

In the next table, we screened for fair value estimate increases of 10% or higher to capture the most meaningful changes.

The basic materials sector leads the pack, with our analysts raising the fair values for 19.4% of our coverage list in the sector by more than 10%. Energy followed with 16.4% of our covered stocks receiving fair value upgrades, and healthcare wasn’t far behind, with 16.2% of companies enjoying fair value boosts of 10% or more.

Basic Materials

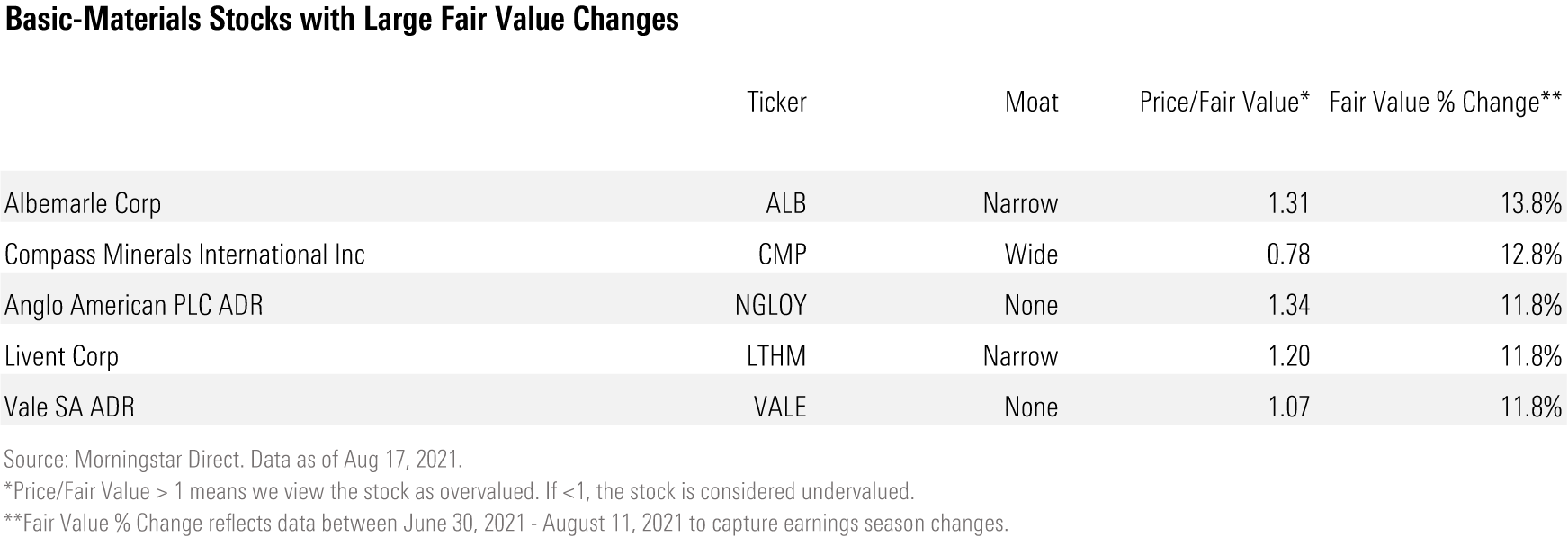

Out of the 31 U.S.-listed basic material stocks we cover, 19.4% saw their fair values increased by more than 10%. While the total in percentage terms leads the rest of the sectors this earnings season, it’s still less than the 29% of the covered basic materials stocks that received fair value boosts last earnings season.

Rising near-term commodity prices, as well as raised forecasts for materials by our analyst team, contributed to the fair value increases in the sector this season. “Commodity demand is recovering strongly, thanks initially to China’s stimulus and more recently with the developed world recovery," says sector director Matthew Hodge. Our analysts raised their near to mid-term price forecasts this month. Higher near-term prices for commodities provides higher cash flows to mining companies, leading our analysts to raise the fair value estimates of firms like Anglo American PLC ADR NGLOY and Vale SA ADR VALE. The transitory benefits of recovering economies and stimulus inflating commodity demand are expected to wane through 2021 and 2022, according to Hodge. As such, while near-term commodity price increases are expected to benefit these companies in the short to medium term, Hodge and his team have kept long-term commodity price forecasts unchanged.

Albemarle ALB, which underwent a 13.8% fair value boost, and Livent LTHM, up 11.8%, both benefited from rising lithium prices, their primary product. “The lithium market has seen prices more than double this year due to strong demand from EV batteries, which has grown faster than supply” says senior analyst Seth Goldstein.

Energy

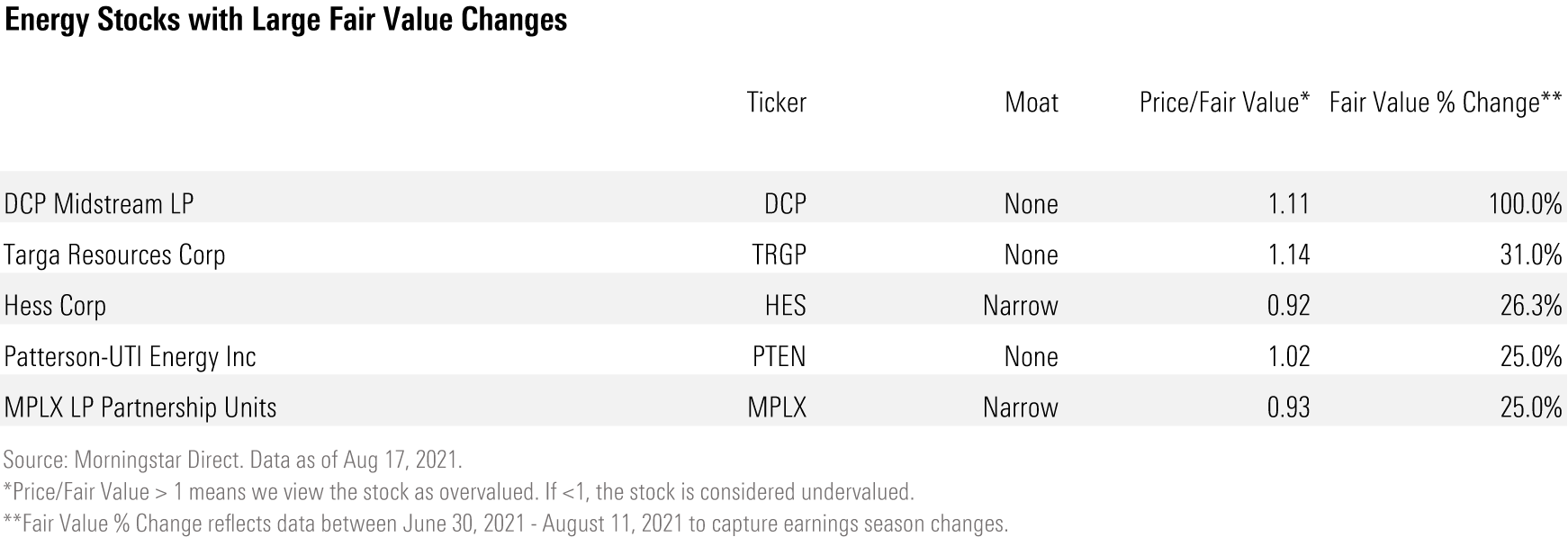

Energy companies bounced back as the global economy recovered and drove up oil prices. While our long-term marginal cost estimate of $55/bbl WTI remains unchanged, near-term oil prices have provided many companies the opportunity to improve their leverage ratios.

As energy companies often operate with fixed costs, rising oil prices widened their profit margins. Investors quickly piled into the sector as various stocks drastically appreciated. “Higher oil prices typically mean more upstream investment, more production, and higher pipeline volumes” says sector director David Meats. “However, in this case the production outlook remained fairly stable because upstream firms are unwilling to allocate more capital, regardless of the price environment, and would rather focus on debt repayment and returning cash to shareholders.”

The two stocks with the greatest fair value upgrades (DCP Midstream LP DCP increased by 100% and Targa Resources TRGP by 31%) were both highly leveraged. According to analyst Stephen Ellis, their fair value upgrades were in part attributable to appreciated stock prices allowing the companies to reduce their debt.

Healthcare

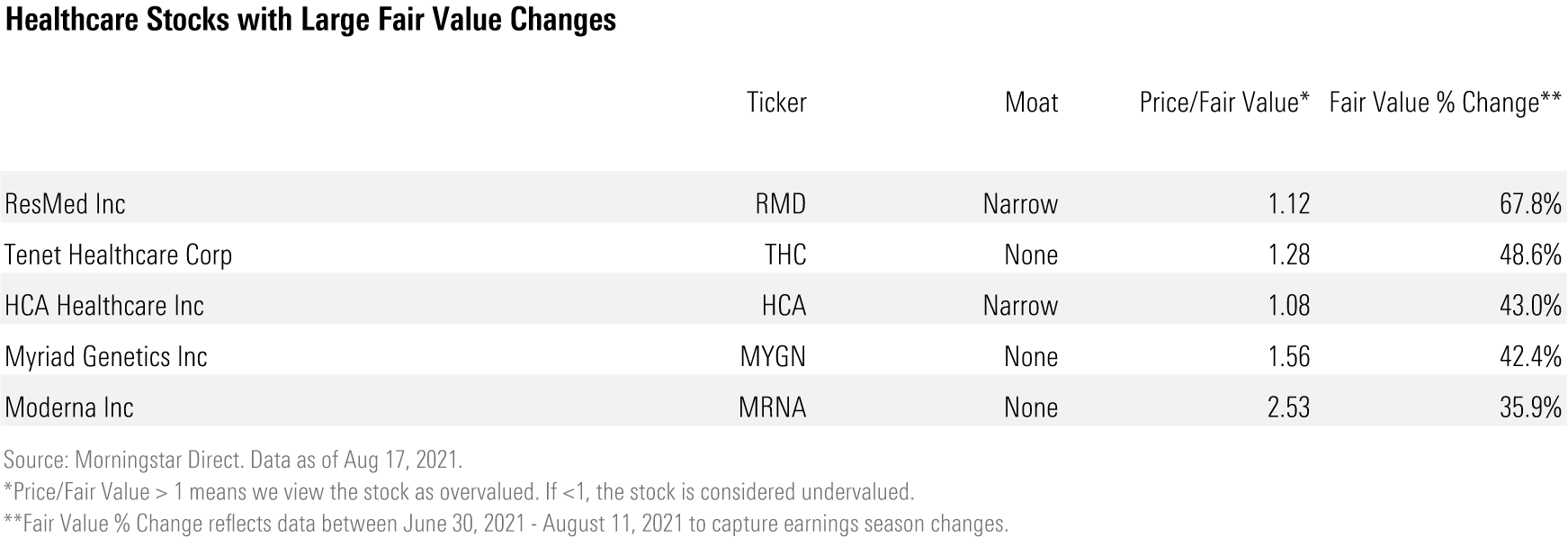

Stocks in our healthcare coverage list were given a healthy dose of fair value raises. However, unlike the increases in the basic materials and energy sectors, the fair value increases here were less sector-driven and more stock-specific.

ResMed RMD leads our healthcare coverage list with a fair value increase of 67.8%. According to equity analyst Shane Ponraj, the primary driver of the upgrade is the company’s new opportunity to capture market share from its leading competitor, Koninklijke Philips NV PHIA, as the latter recently had to recall 2 million units of its CPAP devices.

Healthcare providers Tenet Healthcare THC and HCA Healthcare HCA benefited as President Biden’s healthcare policy goals become clearer and our analysts think a major overhaul is less likely. “The Biden administration/Congress appear focused on merely increasing access to health insurance rather than more extreme options that could have changed the revenue mix and profitability of service providers,” says senior equity analyst Julie Utterback. With a public option less likely, our analysts raised their fair values on major caregivers Tenet by 48.6% and HCA by 43.0%.

Myriad Genetics MYGN has been working to transform its business structure by selling assets and launching new diagnostic tests. These changes place the firm in a better position for sustainable growth, according to sector strategist Karen Andersen, and led to a 42.4% fair value increase.

Moderna MRNA has greatly benefited from higher coronavirus vaccine contract pricing than anticipated. Andersen raised the vaccine maker’s fair value by 35.9% as a result.

Data notes: Fair value estimates were sourced from Morningstar Direct for the end dates of each quarter. In some cases, fair value adjustments may have been made prior to company earnings reports. Stocks without a fair value estimate at the beginning and/or end of the six-week period were excluded from data aggregation to account for any changes in our equity coverage list. The underlying list of stocks can change from quarter to quarter owing to changes in analyst coverage or other factors. Stocks portrayed in sector tables may not reflect those that had the largest fair value moves within the sector. Demonstrated stocks were selected to emphasize sectorwide trends and/or by the recommendation of Morningstar analysts.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KNTMDTIW3JFWJBYCASLAV3ZIJE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2M6HBDLIZD3RLWRUR7IPUIVIU.jpg)