Chinese Tutoring Stocks’ Harsh Lesson in Risk Management

Funds from Davis and Virtus SGA took the biggest hits.

The Chinese Communist Party’s spate of regulatory interventions that began with halting Ant Group’s late 2020 IPO recently took a severe turn. Its direction surprised even seasoned portfolio managers and hurt their investors, while its fallout highlights the importance of risk management.

Profitable No More

First reported on July 23 and confirmed on July 24, the CCP issued a series of edicts that will turn China’s thriving, if unruly, after-school tutoring market into a nonprofit industry and prohibit even indirect foreign ownership in these businesses, including three U.S.-listed Chinese education stocks whose robust share-price gains had been lucrative for their owners.[1]

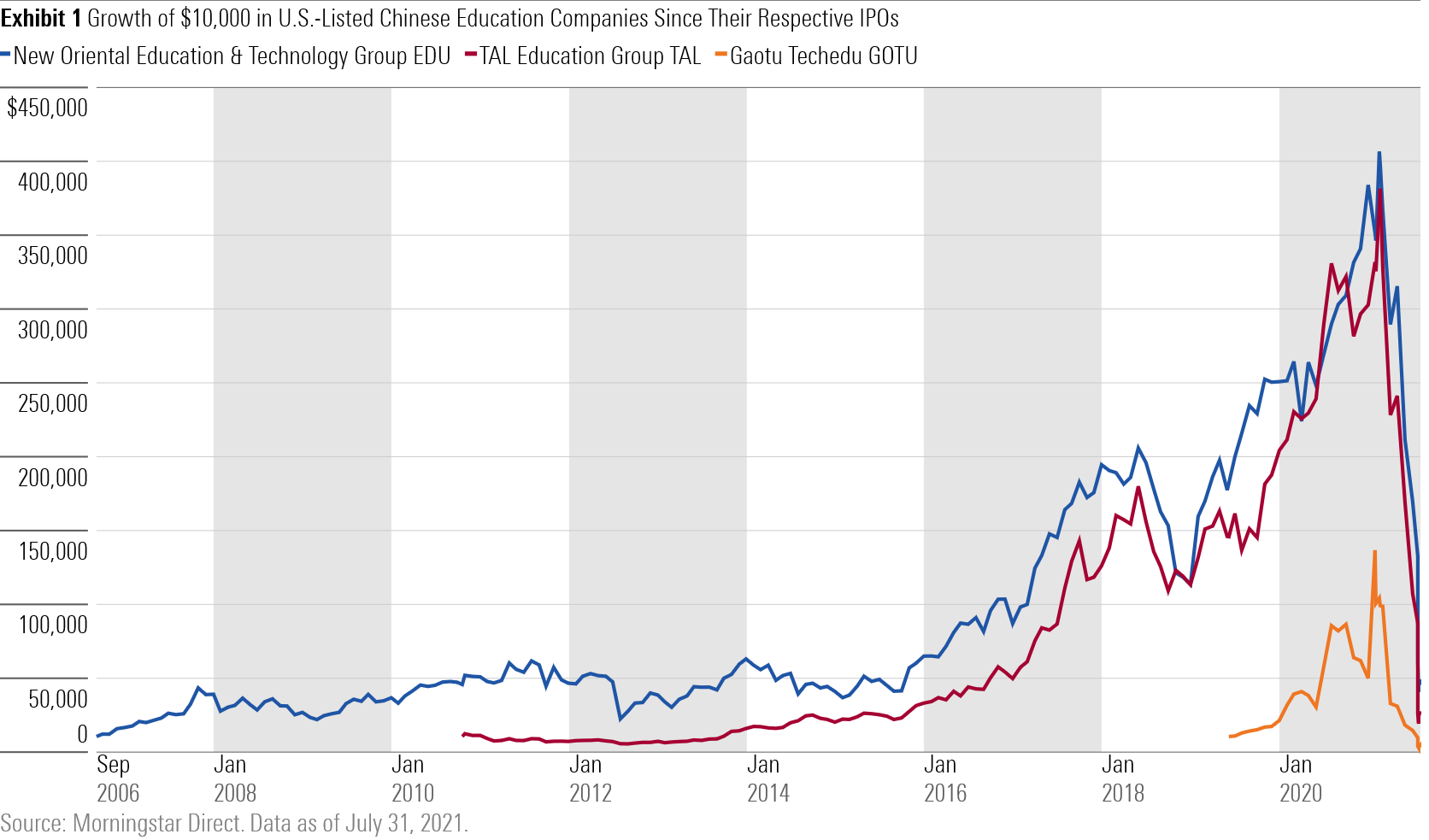

The edicts ended months of speculation that has crushed the share prices of New Oriental Education & Technology Group EDU, TAL Education Group TAL, and Gaotu Techedu GOTU (formerly GSX Techedu). Their combined market caps, which exceeded $100 billion in early 2021, fell to $8.4 billion by the end of July. Unless investors had taken some gains along the way, even those who held New Oriental or TAL for many years lost money.

U.S. Funds With the Biggest Exposure

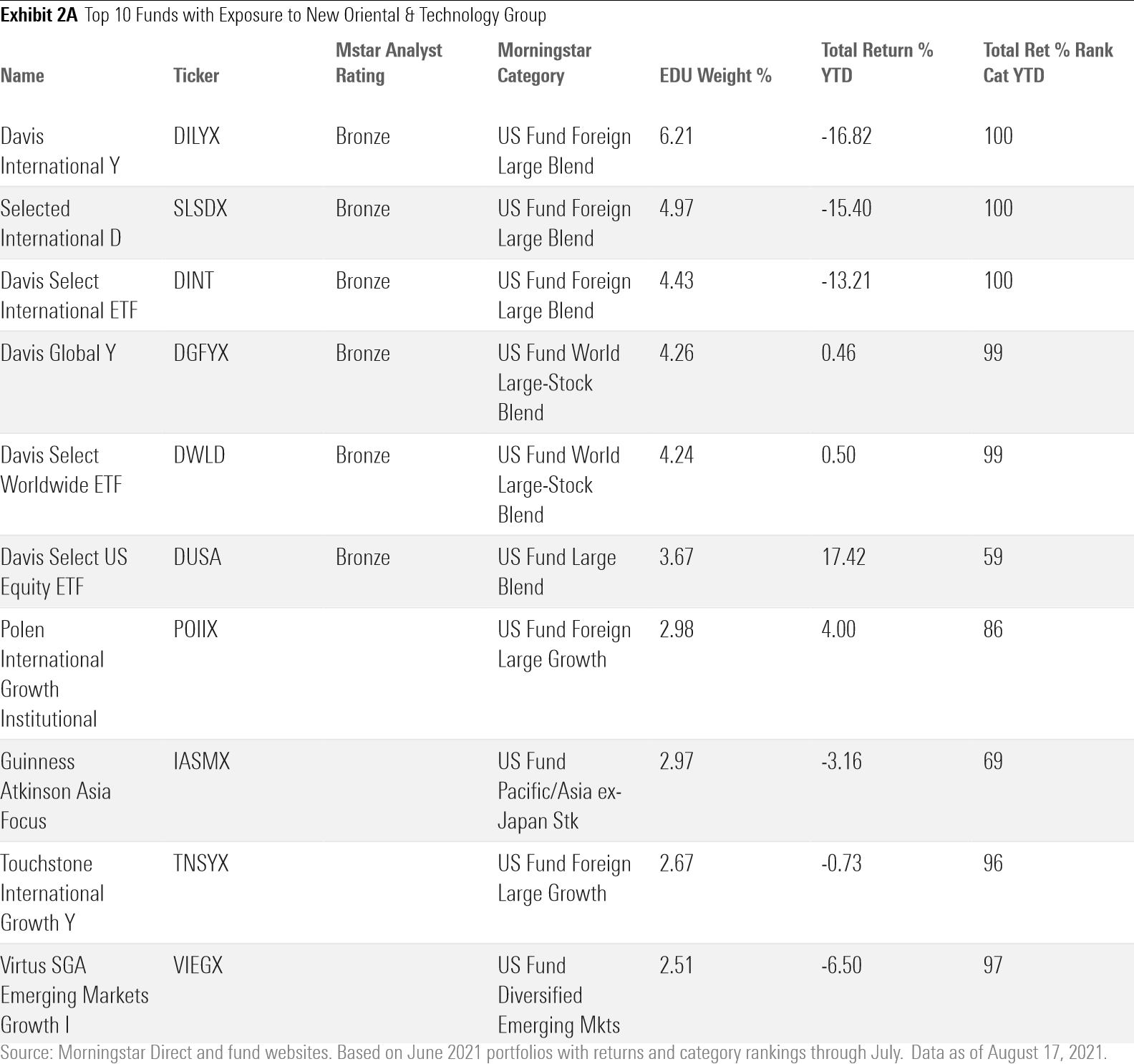

U.S. fundholders’ pain depended on their managers’ approach to position sizing. Invesco Developing Markets ODVYX likely lost more money in absolute terms than any other active fund. Its $562 million in New Oriental and TAL combined in June 2021 was the highest among offerings whose quarter-end portfolios have been disclosed thus far. But the damage was limited as its combined exposure to these stocks was only 1.05% of its $50 billion-plus in assets.

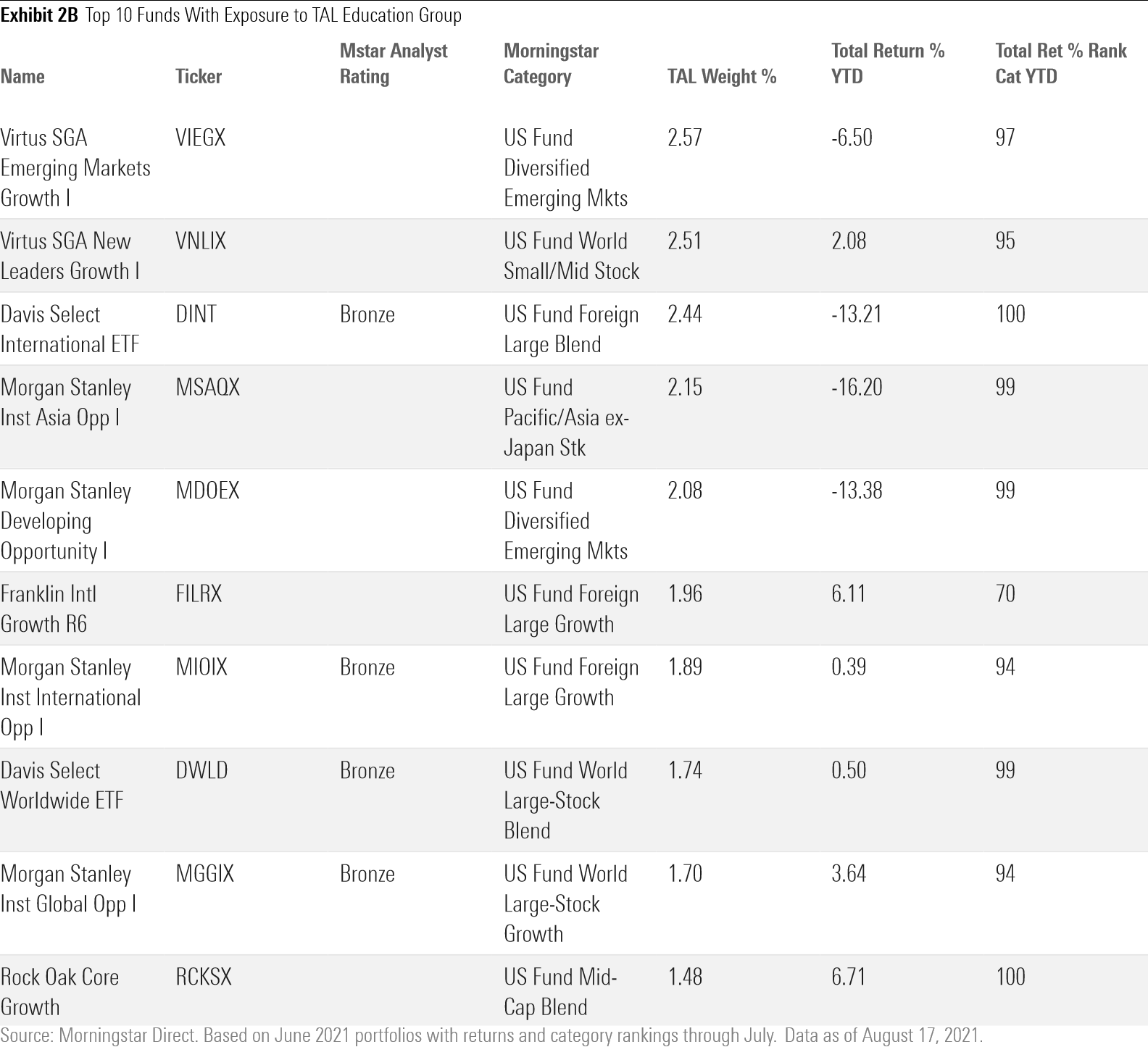

Other managers built positions more aggressively. While exposure to Gaotu was modest, with no fund holding even a 0.5% weighting, those with the biggest stakes in New Oriental and TAL had as much as 2% to 6% of assets in each stock at the end of June, and some started the year with around twice those weightings. Most of these funds have bottom-decile year-to-date showings through July in their respective Morningstar Categories.

New Oriental’s fall even blindsided Polen International Growth POIIX, a shop known for focusing as much or more on what could go wrong with a potential investment than on what could go right. Nor did Asia-based manager Kristian Heugh’s appreciation for CCP subtleties save him from losing money on TAL in Morgan Stanley Asia Opportunity MSAQX and several other strategies.

The most intrepid investors, though, bet meaningfully on both stocks, such as the three-person team behind Virtus SGA Emerging Markets Growth VIEGX and Virtus SGA New Leaders Growth VNLIX. These funds’ combined New Oriental and TAL stakes in June totaled 5.1% and 4.8%, respectively.

Yet no one had more exposure than Danton Goei of Davis Advisors. He owned New Oriental in all 11 U.S. funds he manages or comanages and TAL in five of them, and the weightings were large. In mid-2021, New Oriental was a top-10 position in four funds and TAL a top-20 stake in three. Davis International DILYX, whose full June portfolio isn’t available, likely then led the way with 8% to 9% of its assets in these two stocks combined, judging from the separate account version of this strategy.

Goei’s funds’ exposure had been even greater. Between late 2020 and early 2021, his three international strategies each had a 10%-11% weighting in New Oriental alone.

What Made New Oriental and TAL So Attractive

It's easy to see why these managers liked New Oriental and TAL. Their after-school tutoring businesses prepared students for China’s critical college entrance exam, and pivoting to online instruction enabled both companies to increase revenue through the coronavirus pandemic by 15.6% and 27.7%, respectively, with New Oriental even turning a $413 million profit.

The companies’ futures appeared bright. A consulting firm’s July 2020 study estimated that China’s K-12 after-school training market would exceed $215 billion in 2025, nearly double its 2019 size, and that consolidation in this highly fragmented market would lead to share increases “for the large and very large institutions,” such as New Oriental and TAL.[2] The industry’s two biggest players, whose combined share at the time totaled less than 8%, were thus poised for outsize growth.

Why Further Regulation Didn’t Seem so Threatening

Government intervention posed a threat, but sanguine market participants thought further regulation would ultimately help established firms by raising industry barriers to entry. Parents needed protection not from New Oriental and TAL, but from inadequately staffed smaller players and financially unstable shops like Yousheng Education, whose late 2020 collapse and inability to refund paid-in tuition led to street protests in Beijing.

True, such incidents and worries about the rising cost of education and falling birth rates led China’s president Xi Jinping in March to identify the after-school tutoring market as a social problem in need of a solution, comments that presaged significant regulatory change. Still, TAL at least positioned itself as part of the solution by launching its “Safe Harbor” program, which offers “free access to online tools, content resources and operation guides to the whole industry.” That the CCP would eradicate an entire industry’s profitability amid conciliatory efforts must have seemed highly unlikely.

Investors had also previously made money betting against regulatory crackdowns. The stocks of New Oriental and TAL tanked in 2018 when Beijing education authorities’ investigations of nearly 13,000 after-school tutoring programs found more than half to be deficient. Goei, for example, took advantage of the dip to double the number of New Oriental shares Davis Global DGFYX then owned. Similarly, Heugh increased Morgan Stanley Global Opportunity’s MGGIX TAL share count by about two thirds that year. Both funds benefited from the stocks’ 2019 rebound and strong performance until early this year.

This Time Was Different

When regulatory worries first surged again in March 2021, a Credit Suisse equity analyst likened the market tumult to 2018. He expected leading tutoring companies would be able to comply with any new regulations and that they would hasten industry consolidation.

Not everyone looked past the new regulatory risks. In 2021’s second quarter, Lewis Kaufman of Artisan Developing World APHYX exited what had been a 4.7% top-five position in TAL.

Goei, however, leaned in. Beginning on March 29, he reestablished a position in TAL for the first time in years in three international funds and a global one. He also added New Oriental exposure across Davis’ lineup, including in high-conviction domestic strategies. He even bought New Oriental shares as late as July 21 in two ETFs.

Those moves proved ill-timed, to say the least. The stocks plummeted further following Goei’s additional purchases. Not until after reports of the industry’s nonprofit turn were confirmed did Goei sell TAL on July 27. He exited New Oriental before month's end. He wasn’t the only manager selling then, but his funds along with those of Virtus SGA were the most exposed and suffered the deepest losses.

A Lesson in Risk Management

The funds with the biggest exposure to New Oriental and TAL didn’t err in taking risk but in managing it. Stock-picking is challenging, and even the best investors own stocks that don't work out or run into trouble. But managers still have the responsibility of identifying stocks and sectors that carry special risks, and of avoiding overexposure to them by limiting position size.

Authoritarian governments can and have generated negative surprises for investors, and the CCP has been playing to type in that respect. Its prior actions--from halting Ant Group’s IPO to launching a cybersecurity review of ride-hailing service Didi Global DIDI only days after its June 30, 2021, IPO--should have urged caution. Proper risk management isn’t so much about what’s most likely to happen, but about protecting against the worst that reasonably could.

Dr. Gregg Wolper and Dan Culloton contributed to this article.

Endnotes [1] On July 25, the companies issued press releases stating their intention to comply with the directives and providing the following identical summary: "[T]he Opinions on Further Alleviating the Burden of Homework and After-School Tutoring for Students in Compulsory Education… [contain] high-level policy directives about requirements and restrictions related to online and offline after-school tutoring services, including, among others, (i) institutions providing after-school tutoring services on academic subjects in China's compulsory education system, or Academic AST Institutions, need to be registered as non-profit; (ii) changing the current registration-based regime for operating online Academic AST Institutions to a government approval-based regime, (iii) foreign ownership in Academic AST Institutions is prohibited, including through contractual arrangements, and companies with existing foreign ownership need to rectify the situation; (iv) listed companies are prohibited from raising capital to invest in businesses that teach academic subjects in compulsory education; (v) Academic AST Institutions are prohibited from providing tutoring services on academic subjects in compulsory education during public holidays, weekends and school breaks; and (vi) Academic AST Institutions must follow the fee standards to be established by relevant authorities."

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)