High Yield Means Higher Sustainability Risk

Energy stocks can fuel poor environment profiles in dividend strategies. Even so, sustainability and income aren't mutually exclusive.

Strategies focused on high-dividend-paying stocks may benefit an income-heavy portfolio, but they also can come at a higher price for the environment.

As climate-related disasters fill the headlines, it's a reminder that environmental risks can reach across society and the economy, and even into portfolios.

Dividend strategies in particular can carry high levels of environmental, social, and governance risks. To explore the connection, we put Morningstar's Portfolio Sustainability Scores to work. These scores aggregate Sustainalytics company-level assessments, which focus on the issues most likely to affect financial results.

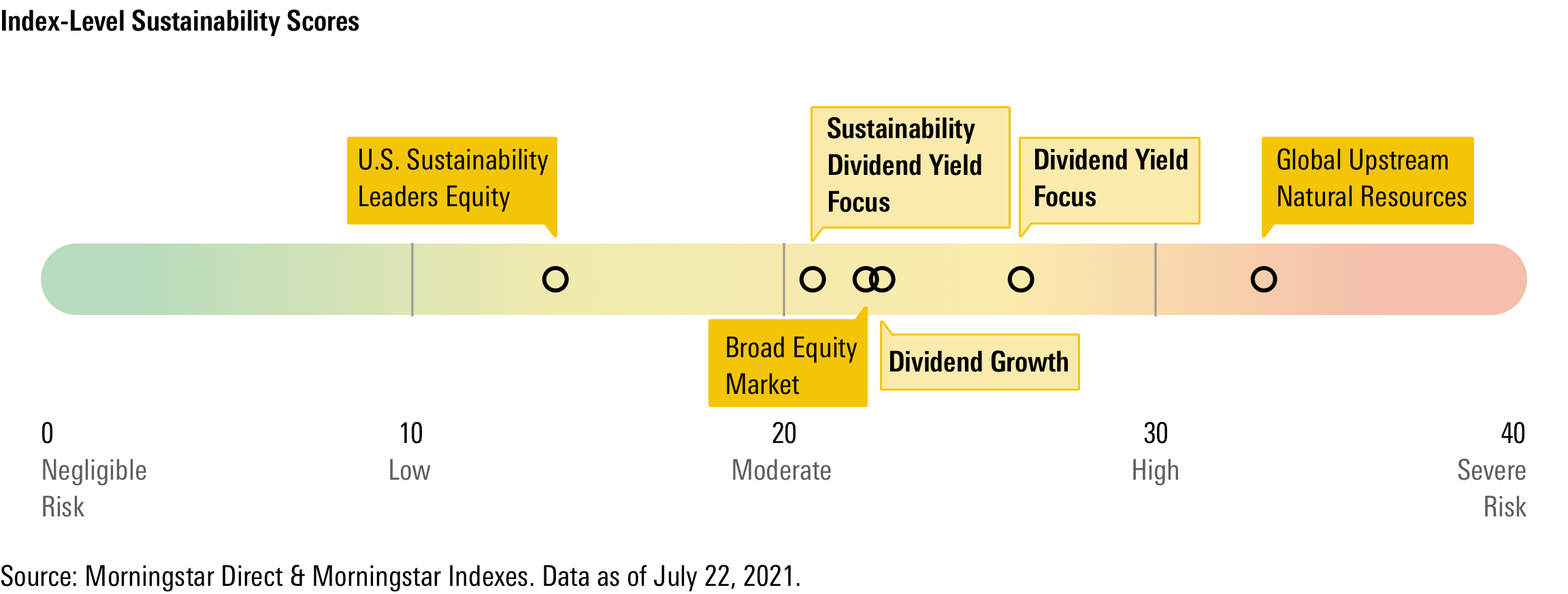

To show the connection between sustainability risks and dividend strategies, we compared the ESG Risk Scores across a number of Morningstar indexes.

As seen in the following image, the Morningstar Dividend Yield Focus Index--which tracks high-yielding, dividend-paying U.S. securities with competitive advantages and strong financial health--carries an ESG Risk Score that's 15% higher than the overall stock market, as measured by the Morningstar US Market Index.

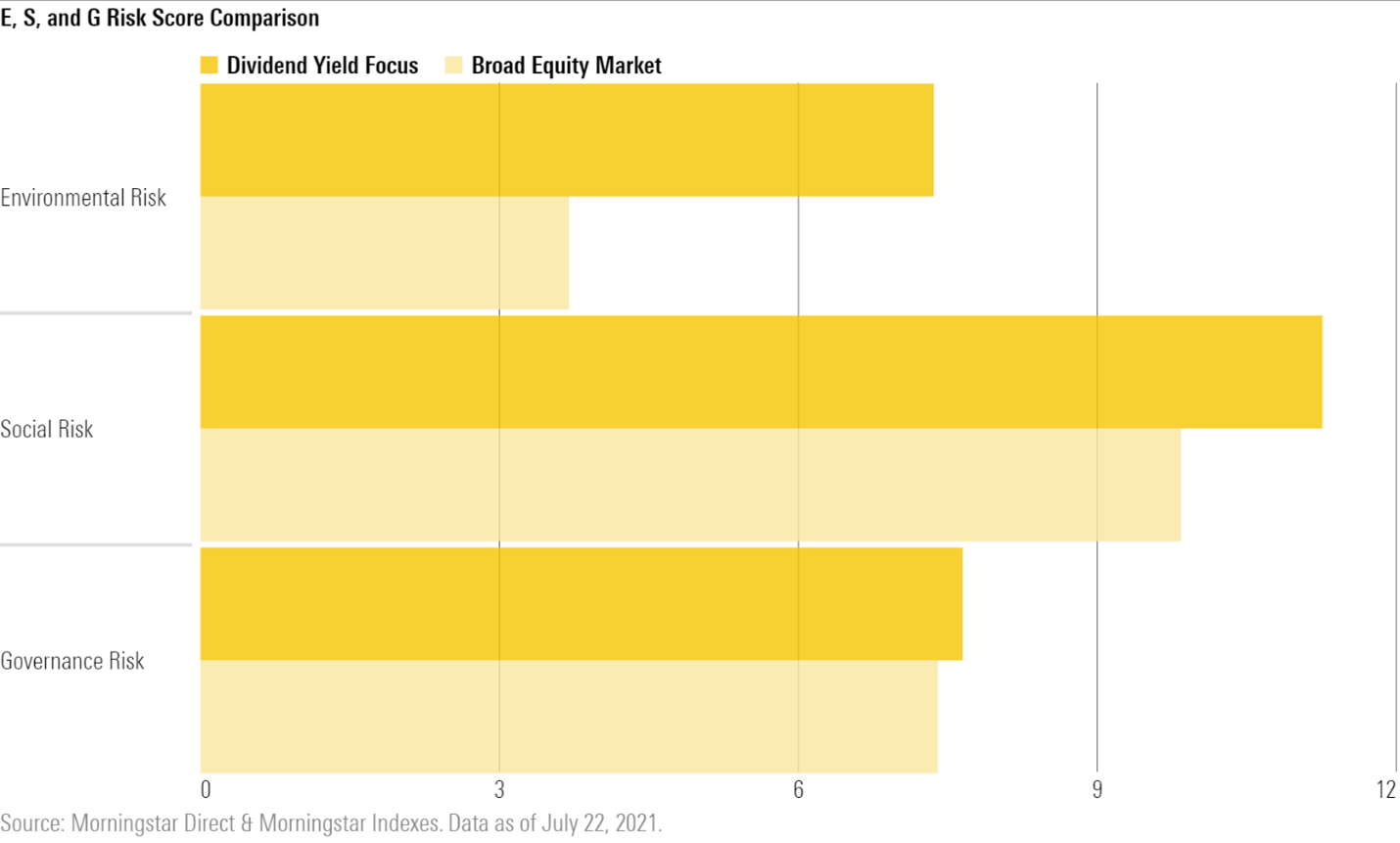

We can understand this dynamic by looking at the source of the higher ESG Risk Scores on the Morningstar Dividend Yield Focus Index compared with the broad market.

The companies in the Morningstar Dividend Yield Focus Index carry above-market risk across environmental, social, and governance areas, but the biggest difference stems from their added environmental risk.

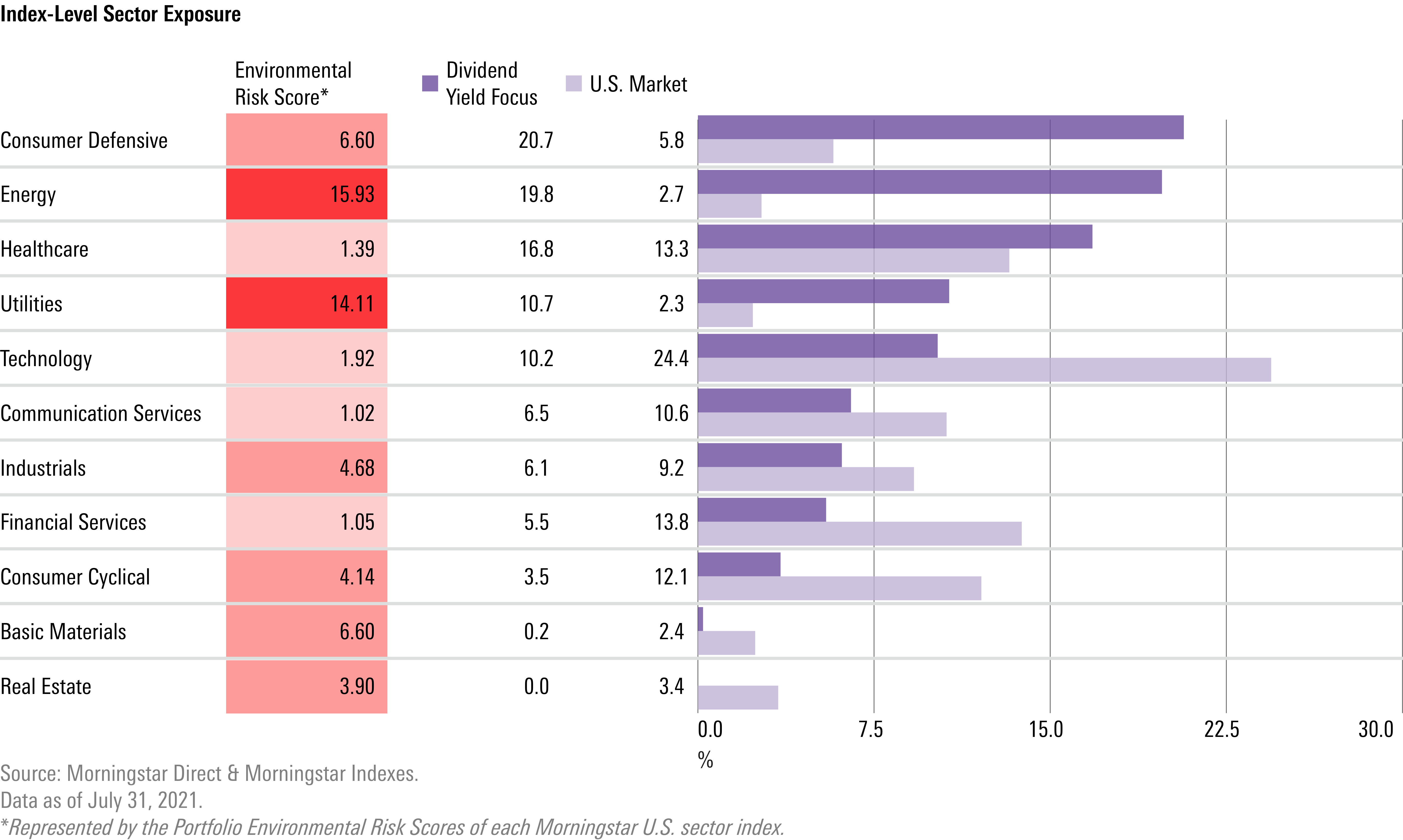

What's the source of this greater environmental risk?

Currently, the Morningstar Dividend Yield Focus Index has nearly 7 times higher exposure to energy stocks than the broader U.S. equity market. High-dividend-yielding companies also come disproportionately from the utilities sector--another carbon-intensive, environmentally risky area of the market.

The connection between higher yield and sustainability risk comes into clearer focus by drilling down into the holdings of the Morningstar Dividend Yield Focus Index. Here's a look at their yields, ESG Risk Scores, and weightings in the index.

Stocks such as Chevron CVX and Exxon Mobil XOM pay dividends much higher than the broader market, but they are also classified as having high or severe sustainability risk.

On the flip side, companies like Verizon VZ, Cisco CSCO, and PepsiCo PEP offer above-average yields and low ESG risk. This suggests high dividends and sustainable investing don't have to be mutually exclusive.

For example, the Morningstar Dividend Growth Index screens for companies with histories of uninterrupted dividend growth and financial profiles that suggest their payouts will grow in the future. Companies in this index often come from the technology and healthcare sectors, which tend to score better on sustainability measures.

As a result, the Morningstar Dividend Growth Index is less exposed to companies with high and severe sustainability risk classifications compared with the Morningstar Dividend Yield Focus Index. Overall, its sustainability risk score is on par with the broader U.S. market. High sustainability risk can be eliminated with an ESG screen. For example, the Morningstar Sustainability Dividend Yield Focus Index gives more weight to companies that score well on ESG and avoids companies embroiled in serious ESG-related controversies.

With the heavy presence of high-dividend, high-ESG-risk energy stocks, it might seem like excluding those kinds of names would leave a significant dent in the payout levels of a sustainability-free strategy. But in reality, the trade-off is relatively small.

Underlying the potential for an ESG-friendly, elevated dividend profile are a number of high-yield stocks with low sustainability risk from the Morningstar Dividend Growth and the Morningstar Sustainability Dividend Yield Focus indexes. These companies all have a wide Morningstar Economic Moat Rating, an analyst-assigned designation for companies that we expect will maintain competitive advantages and excess returns over a 20-year period. Here are some of the companies on our list:

To read more about Hidden Sources of ESG Risk, Morningstar Direct and Morningstar Office users can access the full report here.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)