4 Very Undervalued Wide-Moat China Stocks

A regulatory crackdown has left some big names at cheap prices.

A spate of regulatory crackdowns from China’s government on technology and consumer companies has made a wide swath of Chinese stocks sharply cheaper in recent weeks.

Compounding matters for China-based companies, the Securities and Exchange Commission announced in late July that it sought to tighten disclosure requirements for Chinese companies looking to be listed on U.S. exchanges. The new requirements would have China-based firms clearly detail the nature of their Variable Interest Entity vehicle by which they are listed in foreign exchanges and how foreign investors do not directly hold shares in China-based companies but rather a shell company. China-based firms will also need to disclose whether they were denied permission to be listed on foreign exchanges, allowing investors to ascertain whether the company will face future regulatory crackdowns from the Chinese government.

Morningstar analysts believe that the markets are overreacting and that, for long-term investors, the sell-off could provide opportunities to pick up some of the country’s dominant names at a hefty discount.

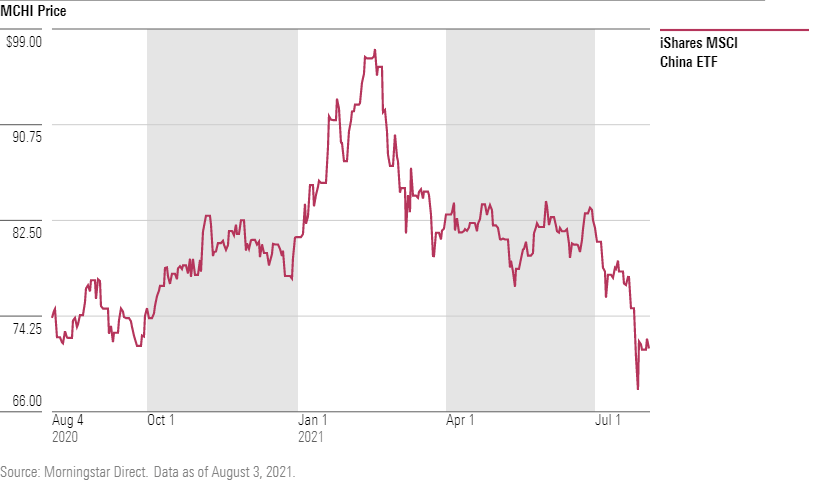

Heading into 2021, China stocks had a long rally, as the country was the first major economy to recover from the pandemic. However, share prices began to fall back to during the first quarter, a trend that accelerated in recent weeks with the Chinese government’s moves to rein in the private education services sector and in the face of new rule-making from China’s regulators, such as the Ministry of Industry and Information Technology.

For example, iShares MSCI China ETF (MCHI), which holds 13.2% of its assets in Alibaba Group (BABA) and 12.4% in Tencent (TCHEY), has fallen nearly 27% since reaching an all-time high on Feb. 17. While it’s now up from its lowest levels of the year, the $6.2 billion fund has lost 11.4% since the beginning of July and is down 12% for the year to date.

Hit particularly hard were Chinese Internet stocks. But investors may be pricing in regulatory risk to an extreme, says senior equity analyst Chelsey Tam.

“We don’t see material concrete impact from this at this stage,” Tam says. “I believe strongly that the Chinese government does not want to kill the sector, but it just wants to regulate the sector to enhance user privacy and national security, eliminate monopolistic practices that constrain the growth of small-medium enterprises, and ensure social equity.”

As these kinds of widespread declines can often lead to opportunities, we screened through Morningstar’s coverage of U.S.-listed China stocks for shares that our stock analysts feel are undervalued compared with their fair value estimates for the companies. For this part of the screen we used the Morningstar Rating for stocks; stocks trading at 4 or 5 stars are considered undervalued.

As a second layer on the screen, we looked for the companies that our analysts have given a wide Morningstar Economic Moat Rating, which means Morningstar believes the company holds a competitive advantage in its industry and will be able to enjoy excess returns from its capital for more than 20 years.

The companies below were the results of our screen. They all come with steep discounts to their fair value estimates.

Three of the stocks on our list have been hit with particularly heavy losses in the past few months. Tencent slid the most, down 28.6% since April 1; Baidu (BIDU) followed with a 24.6% loss; and Alibaba Group fell 12.9% since the beginning of 2021’s second quarter. Yum China Holdings (YUMC) is the only stock that held in positive territory since April 1, up 3.9%.

With these declines, all four stocks slid heavily into undervalued territory compared with their fair value estimates. A price/fair value ratio below 1 represents undervalued.

Tencent, in particular, clocks in at substantial 45% discount to its fair value for the first time in since August 2018. Following that decline three years ago, the stock returned 118% through its all-time high set in February.

Tam says regulation risk out of China is unpredictable and creates high levels of uncertainty. “Investors should look for a big margin of safety before investing in these names.”

Tam covers three of the stocks pulled from our screen: Alibaba Group, Baidu, and Tencent. Here are some of her thoughts on the stocks:

Alibaba

“Seven government departments, including the State Administration for Market Regulation, have published a notice to protect the rights of delivery staff, which is expected to put pressure on Alibaba’s local consumer services division’s profit.” Tam wrote in her most recent analyst note on the stock. “In the March quarter, local consumer services accounted for 4% of Alibaba’s revenue. Given Alibaba is much more diversified, we believe the impact on Alibaba should be small. We estimate the maximum impact of enrolling the riders in social insurance on Alibaba’s cost would be CNY 3 billion.”

Baidu and Tencent

Tam cites the recent rectification measures announced by the Ministry of Industry and Information Technology as one of the regulatory concerns of these two companies. The rectification focuses on a few areas, but Tam doesn’t believe they will have severe consequences on either stock. The first area is preventing services from blocking links to competing products or services. Tam doesn’t believe this restriction will affect either company’s ability to monetize its network. The second area is improving measures to protect users’ rights. “Even if our coverage companies engage in such activities, we think the penalty will not be severe,” Tam writes. The last rectification area is improving data security by limiting user data collection. Tam believes this may reduce advertising efficiency for both Baidu and Tencent.

Yum China Holdings

Senior equity analyst Ivan Su draws a line between Yum China Holdings and many other China-based company stocks.

Unlike Baidu or Tencent, where investors own shares indirectly through a structure known as a variable interest entity, Yum is registered in Delaware, thereby allowing U.S. investors to directly hold shares in it. As for the potential of China-based stocks being wholly delisted from the United States, Su says, “That would be an extreme measure, but if it does happen, investors still have the ability to convert U.S. shares into Hong Kong shares. Therefore, I think recent regulatory risks are a bit overblown.”

Su thinks Yum China Holdings is definitely an opportunity investors should appreciate in part to its current discount and wide moat rating. “Investors should feel reassured because YUMC is not a tech company; it really just sells fried chicken to people, and so YUMC’s futures are very stable and highly predictable.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)