ETFs Set Annual Flows Record--in July

ETF flows cruise past the 2020 record just seven months into the year.

Exchange-traded funds needed just seven months to break the annual flows record they set last year. Their year-to-date haul stood at $512 billion after pulling in $54 billion of new money in July, eclipsing the $500 billion that investors poured into ETFs in 2020. When the calendar turned to August, ETFs held over $6.6 trillion of investors’ money.

It was an up-and-down month for stocks, but the Morningstar Global Markets Index--a broad gauge of global equities--finished July in the black. The index added 0.49% last month, pushing its year-to-date return up to 12.81%. Bonds posted a strong month, as interest rates continued to trend downwards. The Morningstar U.S. Core Bond Index advanced 1.02%, marking its fourth consecutive month of gains and best monthly return since July 2020. Still, the index has slipped 0.52% this year to date.

Here, we’ll take a closer look at how the major asset classes performed last month, where investors put their money, and which corners of the market look rich and undervalued at month’s end--all through the lens of ETFs.

Bonds Pick Up the Slack

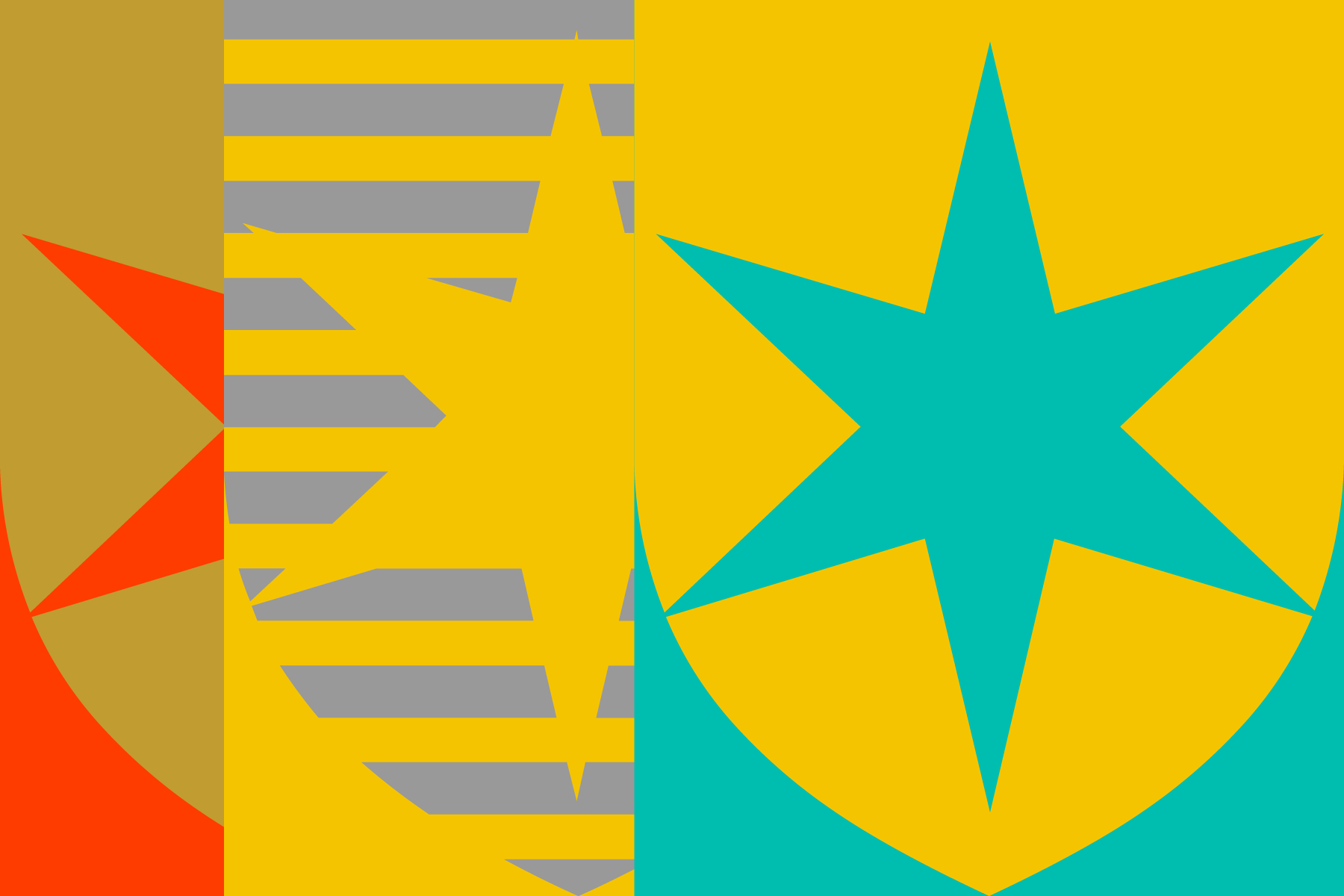

Exhibit 1 shows July returns for a sample of Morningstar Analyst-rated ETFs that serve as proxies for major asset classes. Investors in a blended global portfolio saw a 0.90% return last month. Bonds shouldered the load. Vanguard Total Bond Market ETF BND and Vanguard Total International Bond ETF BNDX added 1.16% and 1.51%, respectively. That’s the first month these funds outpaced Vanguard Total World Stock ETF VT, the blended portfolio’s stock tentpole, since March 2020.

*Blended Global Portfolio represents a 60% allocation to VT, 20% allocation to BND, and 20% allocation to BNDX.

VT has powered the portfolio for most of the year, though. Its year-to-date gain ticked up to 13.21% after adding another 0.55% in July. As has been the case for most of the year, U.S. stocks drove VT ahead last month. IShares Core S&P U.S. Total Stock Market ETF ITOT climbed 1.72% in July, while iShares MSCI ACWI ex-U.S. ETF ACWX lost 1.67%. ITOT has now outpaced ACWX by exactly 10 percentage points from the start of the year through July.

Emerging-markets stocks are responsible for much of ACWX’s recent pitfalls. Indeed, iShares Core MSCI Emerging Markets ETF IEMG, a broad portfolio of emerging markets stocks, tumbled 5.64% in July--its worst month since March 2020. A tumultuous month for Chinese stocks, which constituted about 30% of the portfolio as of the end of July, precipitated this downturn. A worldwide increase in coronavirus cases likely hurt as well. The countries that IEMG favors tend to have lower vaccination rates and more-nascent economies than more-developed areas, which could breed acute challenges should COVID-19 cases continue to rise.

Renewed concerns over COVID-19’s economic impact help explain the July currents of the U.S. market. Large-cap stocks broadly outperformed small-caps, which tend to be more economically sensitive and volatile than their better-established peers. Large-cap focused iShares Core S&P 500 ETF IVV added 2.37% in July, and iShares Core S&P Small-Cap ETF IJR lost 2.4%. Small-cap stocks still hold a year-to-date edge over their sturdier large-cap brethren, but that lead has narrowed as market leaders like Apple AAPL, Amazon.com AMZN, and Facebook FB have shaken off an early-2021 slump and rounded back into form.

Growth and value stocks’ relative performance continued to parallel the large- versus small-cap relationship in July. Vanguard Growth ETF VUG added 3.28% in another solid month, while Vanguard Value ETF VTV trailed with a 1% gain. The same economic factors that underpin large- and small-caps’ relative returns likely affect the value-growth story. The cheaper sectors that VTV favors tend to be more cyclical. For example, the fund’s energy holdings like Exxon Mobil XOM and Chevron CVX both suffered last month, losing 9% and 3%, respectively. Meanwhile, the tech firms that VUG favors emerged from the early 2020 drawdown relatively unscathed and continued to plow forward in July. VTV led VUG by about 9 percentage points over 2021’s first quarter but has trailed by the same amount from that point through July. For now, it appears that a value comeback is on hold.

Lopsided value-growth performance manifested in the iShares suite of single-factor strategic-beta ETFs. IShares MSCI USA Quality Factor ETF QUAL--whose profitability focus lands it on the growth side of the Morningstar Style Box--had another strong month, while iShares MSCI USA Value Factor ETF VLUE sputtered. IShares MSCI USA Momentum Factor ETF MTUM climbed in July as well, but it has seemed to find itself on the wrong side of each value-growth flip-flop recently. After its growth-oriented stance hurt performance from late last year into early 2021, the fund raised its stake in the value-friendly financials sector (to 32% of the portfolio from 2%) and trimmed its healthcare exposure (to 5% from 13%) at its May rebalance. In July, healthcare was the market’s best-performing sector; financials trailed only energy stocks. The momentum effect works best when recent trends persist, so the market’s recent indecision has wreaked trouble on most momentum strategies.

While U.S. stock valuations still look somewhat lofty, several ETFs saw their Morningstar price/fair value estimate drop in July. Some, like IVV, saw modest changes that likely stem from fair value estimate increases for some of its holdings. VLUE, on the other hand, went from trading at a 1% discount to a 5% discount, which likely owes to its rocky performance over the past couple of months. While investors may hesitate to pile into a fund on the decline, this Silver-rated fund offers a unique value opportunity in an otherwise still-frothy market.

Inflows Continue to Cruise

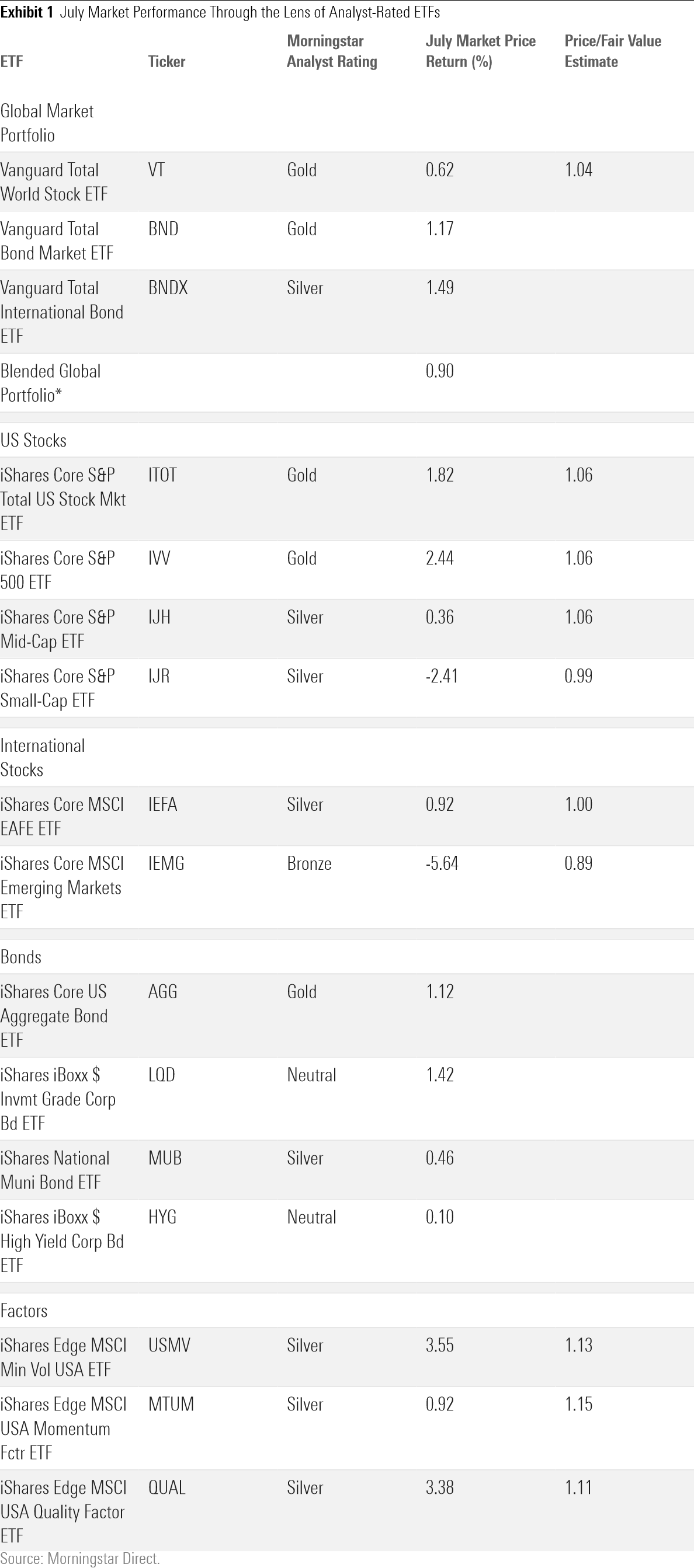

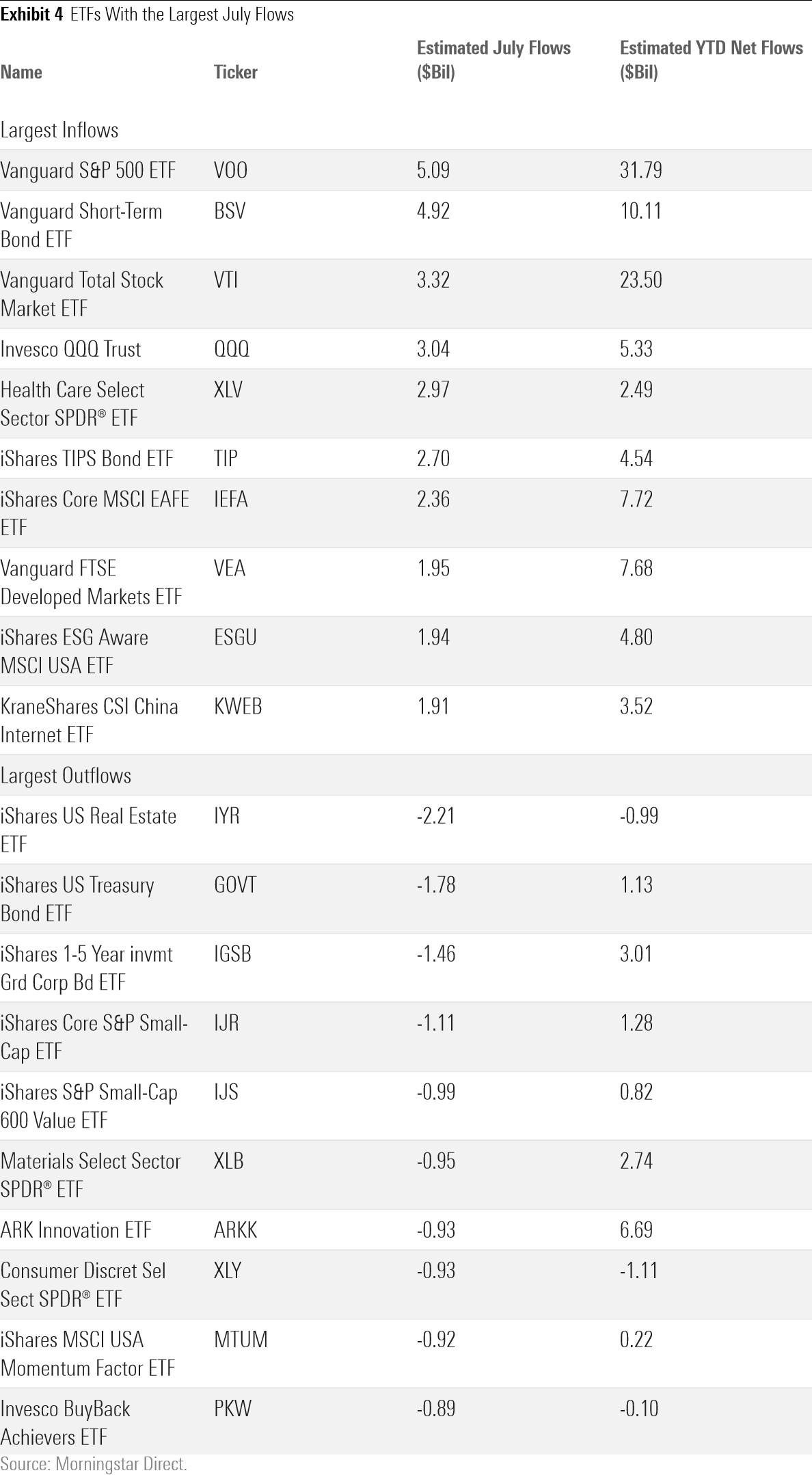

Ironically, the month that marked the ETF flows record was the year’s slowest to date. ETFs hauled in about $54 billion in July. The previous low from this year was the $66 billion investors poured in in May. Still, this month’s ETF take exceeds last July’s by about $18 billion.

Stock ETFs continued to lead the charge in July. After collecting another $37 billion last month, they have claimed over 75% of all ETF flows for the year to date. Last year, equity ETFs received only 46% of all inflows. Although July flows cooled off from the previous few months, investors maintained their conviction in stock ETFs despite a richly valued market and looming COVID-19-induced economic obstacles.

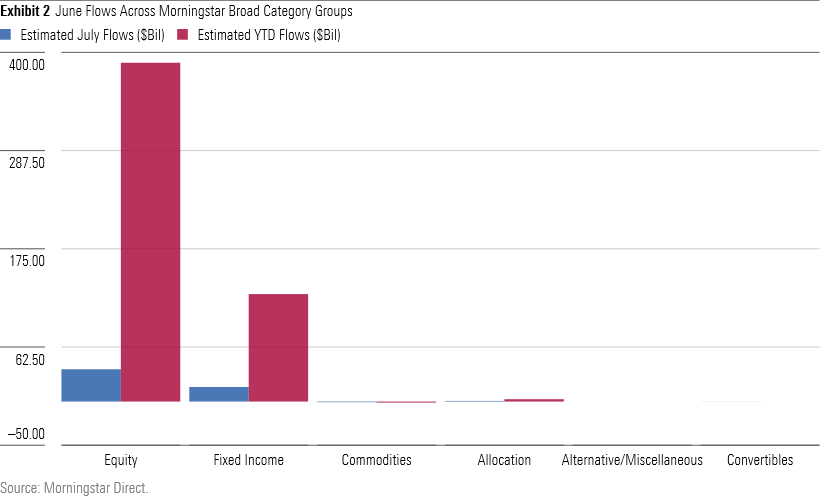

Investors seem to have noted growth stocks’ resurgence. After pulling in only $3 billion from the start of 2021 through May, U.S. large-, mid-, and small-cap growth funds have raked in over $12 billion over the past two months. Invesco QQQ Trust QQQ, the tech-heavy NASDAQ-100 tracker, led the way with a $3 billion haul last month. Meanwhile, U.S. value funds saw their first monthly outflows of 2021 in July. Small-value funds were hit particularly hard. IShares S&P Small-Cap 600 Value ETF IJS, for example, leaked nearly $1 billion as it dipped 4.36% last month. It’s difficult to say whether investors’ renewed interest in growth strategies reflects pessimism about the economy or is mere performance-chasing. Either way, the flows pendulum has swung back toward growth after favoring value for most of 2021.

Sector-specific flows match the recent value-growth reversal. Funds in the U.S. financial Morningstar Category--whose portfolios often overlap with broader value strategies--collectively bled $2.5 billion in July, the steepest outflow of any category. Declining interest rates likely spooked investors; financials stocks tend to fare better in a high interest-rate environment. The U.S. real estate and U.S. energy categories suffered outflows as well, losing nearly $1 billion apiece in July. Faster-growing sector ETFs fared well, on the other hand. Funds in the U.S. technology and U.S. healthcare sectors collectively pulled in nearly $5 billion last month.

Many investors continued to turn their focus overseas, where stock valuations look somewhat more attractive than they do stateside. ETFs in the foreign large-blend category pulled in $8.8 billion last month. That raised their year-to-date haul to $38.2 billion, which ranks third among all Morningstar Categories behind U.S. large blend ($93.4 billion) and U.S. large value ($53.4 billion). Among ETFs investing in stocks from foreign developed markets, broad offerings iShares Core MSCI EAFE ETF IEFA and Vanguard FTSE Developed Markets ETF VEA led the way, jointly collecting about $4.4 billion in flows. These two funds traded right around their fair value estimates at June’s end. That registers as attractive when ITOT trades 6% above its fair value. Investors hunting for cheap stocks may eye emerging markets--IEMG carried an 11% discount at May’s end and collected about $500 million last month--but as this fund’s nightmarish July performance shows, this space entails a unique array of risks to consider.

Cheap, broadly diversified index funds have received the most investment in the U.S. as well as in the international markets. The two ETFs that netted the heaviest inflows in July, Vanguard S&P 500 ETF VOO and Vanguard Total Market ETF VTI, are plain-Jane index ETFs with thin fees. Investors have gravitated toward the market’s simplest, cheapest options all year. Four ETFs that track the S&P 500--IVV, VOO, SPDR Portfolio S&P 500 ETF SPLG, and SPDR S&P 500 Trust SPY--have collectively raked in over $45 billion on their own this year. That would lead all Morningstar Categories except for U.S. large blend (which features these funds) and U.S. large value.

Bond ETFs posted another solid month of flows, pulling in about $17 billion of new money. Shorter-term bond funds continued to lead the way in July as concerns over rising rates have diminished the appeal of long-term bond funds in 2021. The U.S. intermediate- and short-term bond categories have absorbed $21.9 billion apiece for the year date, while the U.S. long-term bond category added only $200 million. Inflation-protected bond ETFs continued their flow momentum as well. They raked in $4.2 billion in July, marking their second consecutive month with over $3 billion in flows and indicating that inflation remains at the front of many investors’ minds.

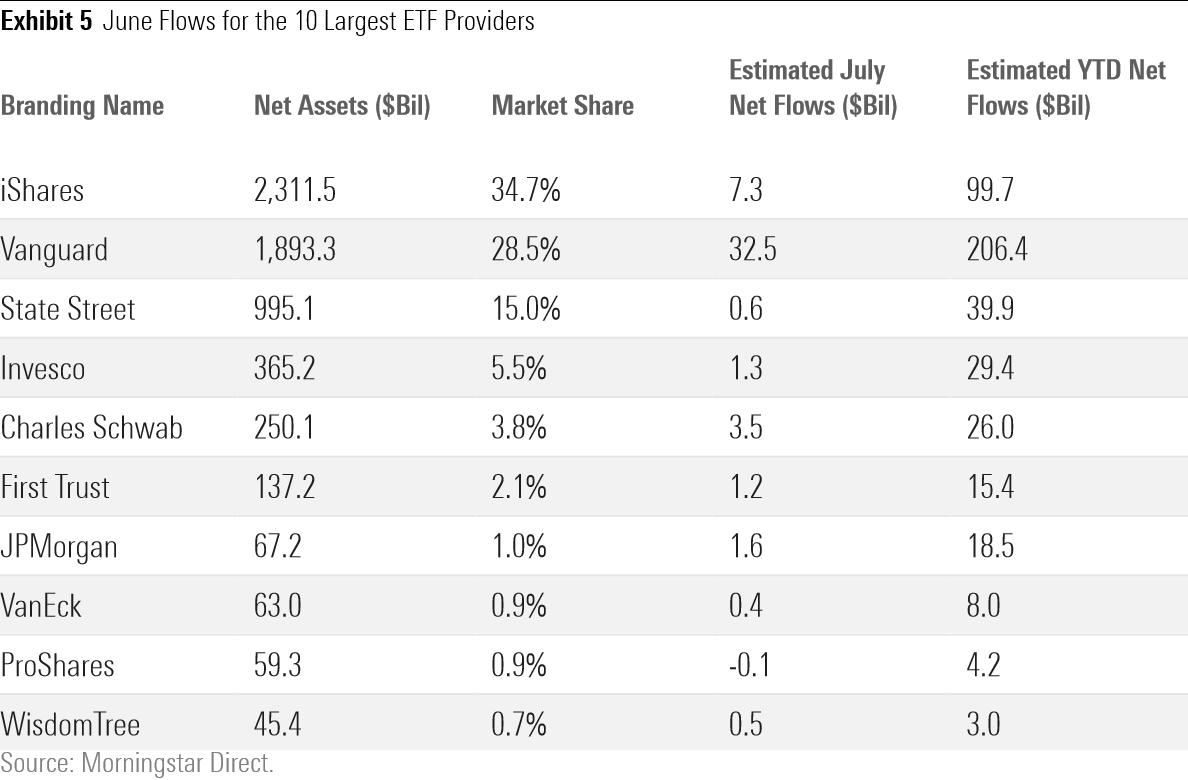

Vanguard Continues its Reign

Vanguard’s ETF lineup collected $32.5 billion in July, extending its streak atop the ETF provider flows league table to eight months. At the end of July, the firm’s $206.4 billion year-to-date haul exceeded the combination of its four closest competitors (iShares, State Street, Invesco, and Schwab).

WisdomTree and ARK Invest have jockeyed for the final spot on the list of the 10 Largest ETF Providers for most of 2021, and this month, WisdomTree came out on top. The firm collected nearly $500 million of new money in July, increasing its year-to-date inflows to about $3 billion. WisdomTree U.S. Quality Dividend Growth ETF DGRW led the firm’s ETF lineup last month, but WisdomTree Emerging Markets ex-State-Owned Enterprises ETF XSOE has been its crown jewel this year, accounting for about half of the firm’s year-to-date inflows. This fund targets emerging-markets stocks but excludes all state-owned enterprises, allowing it to sidestep some of the unique governance risks that can plague emerging-markets strategies. That said, it was not impervious to emerging-markets funds’ widespread pain; it lost 7.23% last month.

For Cheap, Look East

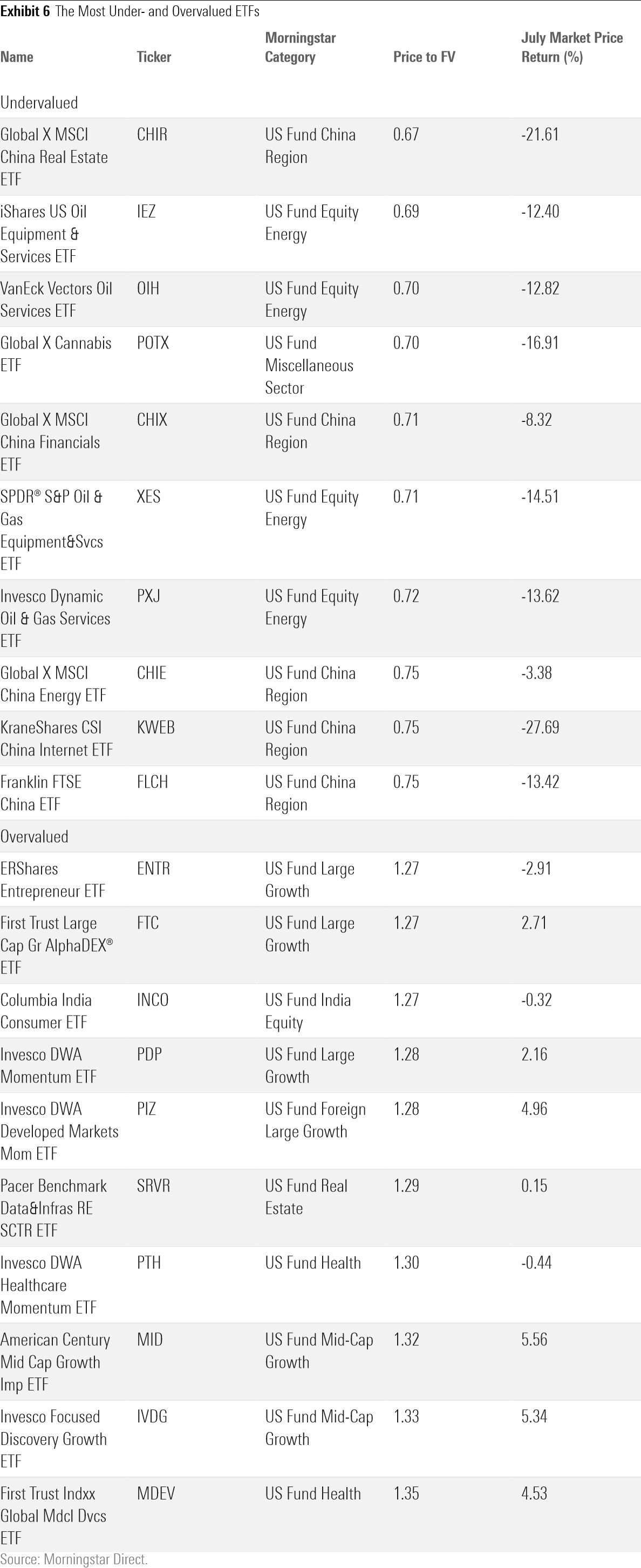

The fair value estimate for ETFs rolls up our equity analysts' fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing this value by the ETFs' market prices yields the price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

The ”undervalued” half of Exhibit 6 shows funds that traded at the lowest price relative to their fair value at the end of July. This month it prominently features Chinese funds, energy funds, and in the case of Global X MSCI China Energy ETF CHIE, a combination of both. Several of these funds now reside in the ETF bargain bin after the Chinese market’s sharp downturn in July; the MSCI China Index slid 13.84% last month.

KraneShares CSI China Internet ETF KWEB, a 52-stock portfolio of Chinese Internet stocks, is an interesting example. This fund lost nearly 28% as Beijing regulators cracked down on tech firms that handle enormous sets of consumer data. That affected nearly all of the portfolio’s holdings, including top names Alibaba BABA and Tencent TCEHY. U.S. investors flocked to KWEB as it plummeted, pouring $1.9 billion into the fund in July, including nearly $700 million in the final three trading days of the month. While there is risk that this portfolio is chock-full of falling knives, following the money reveals investor confidence that it will reverse course.

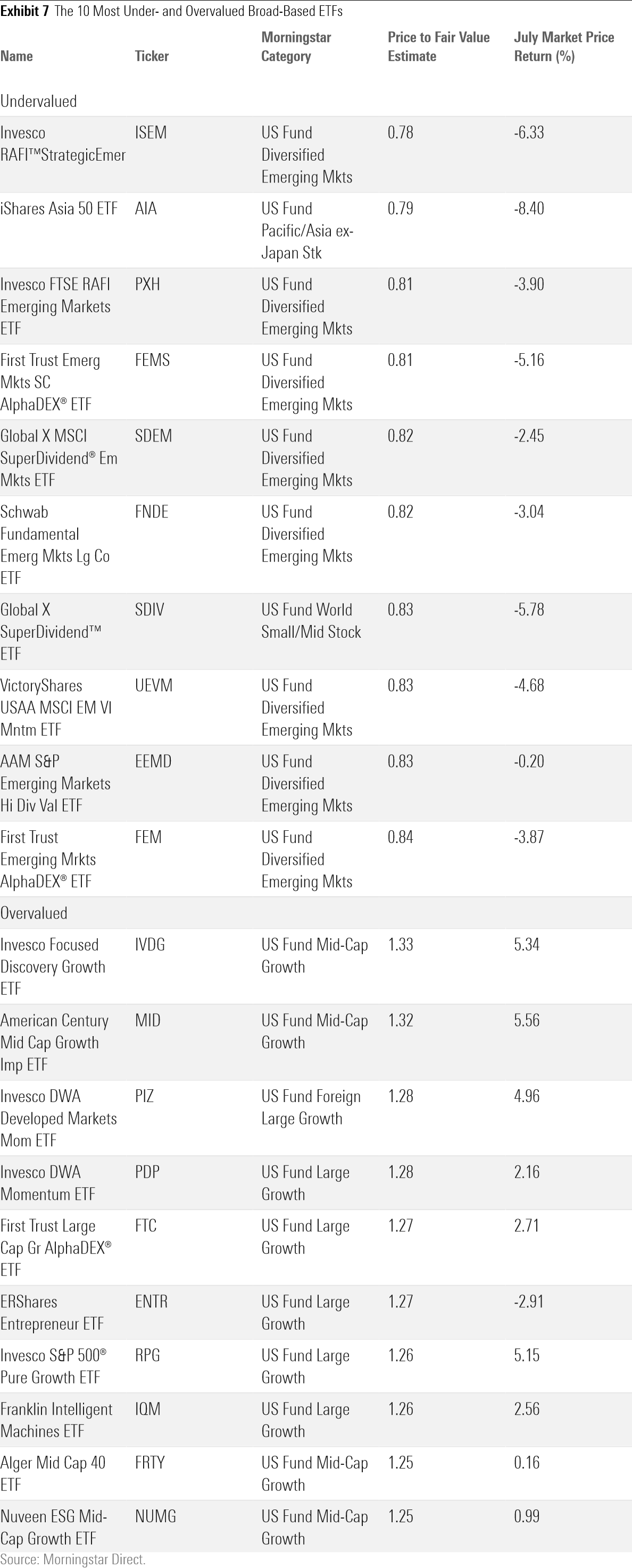

Investors hunting cheap valuations in a more diversified portfolio should likely keep their focus overseas. As Exhibit 7 shows, foreign stock ETFs dominated the ranks of the cheapest broad-based ETFs at June’s end. Most of these funds zero in on international stocks that look cheap relative to their dividends or other fundamental measures of value. The question becomes: are these funds cheap enough to offer adequate returns for the risk they court? For example, Global X SuperDividend ETF’s SDIV risk/reward profile should give investors pause. The fund’s standard deviation of returns (a measure of risk) exceeded the MSCI ACWI SMID category benchmark by 35% over the three years through June 2021. Relative to the same index, its upside capture ratio was 78% and its downside capture ratio 150% over the same span. So, the stocks featured in some of these portfolios may be cheap, but not cheap enough to compensate them for their risk.

Two Invesco funds, Invesco DWA Momentum ETF PDP and Invesco S&P 500 Pure Growth ETF RPG, headline the pricier side of Exhibit 7. Both of these steer decisively into fast-growing stocks, but that’s no guarantee they’ll outperform their large-growth category peers when growth is in favor. Both of these funds finished in their category’s bottom quartile over the five years through July--a period characterized by growth stocks’ success. A smaller-than-average market-cap orientation held both of these funds back, overshadowing their pronounced growth exposure. This underscores the importance of evaluating ETFs from all possible angles rather than trusting they’ll perform as they promise.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/09-25-2023/t_f3a19a3382db4855b642d8e3207aba10_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)