VMware Goes Beyond Virtualization for Growth

Independence from Dell is a good thing for this underappreciated tech firm.

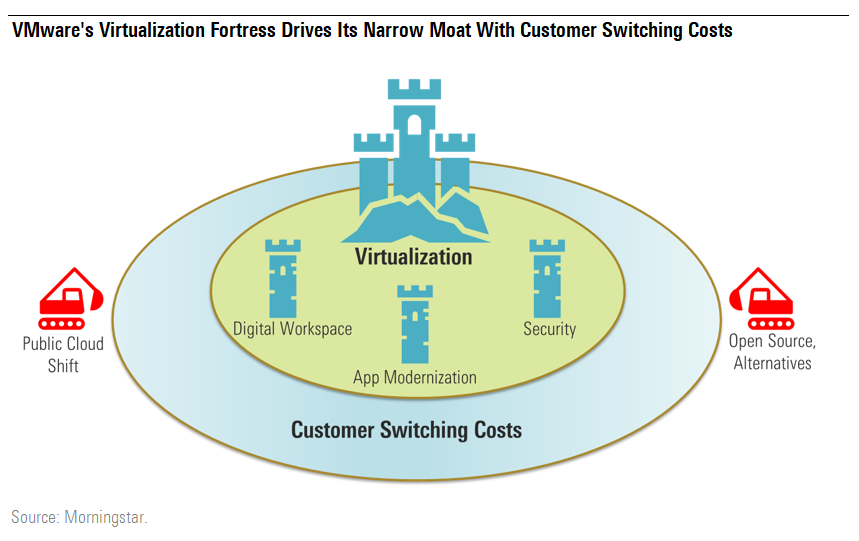

We believe VMware VMW offers an attractive investment opportunity as one of our top technology ideas. Dell Technologies’ DELL investment in VMware has been a well-known overhang, but with an anticipated spin-off toward the end of 2021, we believe investors can now rest easier with the prospect of no more pillaging of the virtualization king. In our view, and to the benefit of long-term investors, the market is overlooking VMware’s potential as a stand-alone entity with various growth catalysts that may not be apparent. Our narrow economic moat rating reinforces our belief that VMware possesses sustainable competitive advantages as the IT landscape becomes increasingly cloud-centric.

VMware’s virtualization market dominance is pressured by organizations adopting public cloud infrastructure and hence purchasing fewer on-premises servers to virtualize. However, myriad challenges exist in performing the cloud leap. We view VMware’s value within cloud infrastructure as the easy path for moving workloads and processes, explaining why more than 4,300 cloud providers, including the hyperscalers, are partners. VMware has become the commonality across clouds, and we believe its neutral approach will be a differentiator as organizations attempt to get the best out of each network location. Tight cloud partner integration and the shift toward selling subscriptions and software-as-a-service solutions build the base for our forecast five-year revenue compound annual growth rate of 9%, along with robust free cash flow generation to support investments in higher-growth opportunities outside of server virtualization.

In our view, the products adjacent to VMware’s core server virtualization are discounted by the market and represent the largest opportunity for growth and the ability to further lock organizations into its ecosystem. VMware has built strong and growing franchises in digital workspace enablement, virtualized networking, and storage, and we expect the burgeoning areas of modern application development and cybersecurity to catalyze growth. VMware enables commonality across data center operations, networking infrastructure, various parts of the cybersecurity stack, device management, and modern application development. The expansion from core server virtualization can establish VMware as the glue between infrastructure, developer, and security teams. It took years of investments and performing a few larger acquisitions to get here, but we believe VMware has the right assets to accomplish its “any application on any cloud on any device anywhere” strategy as a stand-alone entity.

Key Takeaways

- We believe the market is pessimistic about VMware's ability to remain a key provider of IT solutions in a cloud-first world, as well as its ability to navigate a subscription and SaaS transition as organizations shift away from virtual machines. We also believe investors are concerned about growth after VMware spins off from Dell. We disagree with these sentiments and find this negativity as the foundation for an attractive investment opportunity for long-term investors.

- VMware's narrow moat is supported by strong customer switching costs that we expect to drive sustainable excess economic returns over invested capital. The effort to change solutions is not worth the costs, and VMware is increasingly looked at as the easy way to modernize IT, in our view. We believe VMware's solutions are foundational to organizations and are becoming the common layer between the various data center and networking locations in a hybrid cloud and multicloud world.

- While on-premises server virtualization demand may be facing headwinds, catalysts include cloud-based IT infrastructure solutions where virtualization is still needed, increased adoption of virtualized networking and storage, cybersecurity solutions for devices and workloads, modern application development management, and holistic device management.

- Beyond being the common layer for organizations, we believe that the largest overlooked advantage could be VMware's diversification with a united product strategy across the specific areas. VMware has evolved and is no longer beholden to server growth. We believe VMware has the right assets in place to execute its strategy.

- VMware has established but still strongly growing franchises in virtualized networking and storage as well as digital workspace enablement, which collectively generated about $4.4 billion in bookings as of fiscal 2020. We're optimistic about the impact of VMware combining container management for modern application development into its tried-and-true vSphere. By bridging the gap between infrastructure and development needs as organizations manage legacy and new applications, and cybersecurity concerns on the other side, VMware's cross- and up-selling possibilities are in the very early stages, in our view.

- We model a 9% five-year revenue CAGR driven by cloud infrastructure virtualization demand and adjacent products combating on-premises virtualization headwinds. By segment, we expect five-year sales CAGRs of 20% for subscriptions and SaaS, 6% for services, and flat for license. This growth expectation is occurring as VMware accelerates its pivot to subscription and SaaS offerings (46% of fiscal 2021 product revenue, up from 30% in fiscal 2019). We model adjusted operating margins to hit a trough of 29% in fiscal 2022 before expanding into the low 30s.

- Investor fears about Dell's VMware intentions can be laid to rest. We expect VMware to accelerate its pursuit of being the commonality, and neutral layer, between enterprise networks and the dominant public cloud vendors through tighter relationships with cloud providers such as Amazon, Microsoft, and Google, as well as Dell's infrastructure foes like Hewlett Packard Enterprise. VMware should be able to push out new products and updates quicker as a stand-alone entity, which could be critical as it becomes more diversified into the quickly changing developer application management and security segments.

This information was published July 20 as part of a larger report that is available to Morningstar’s institutional clients.

/s3.amazonaws.com/arc-authors/morningstar/d1ac50a8-f491-405e-b965-33941cb88799.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d1ac50a8-f491-405e-b965-33941cb88799.jpg)