Where Investors Are Putting Their Money in 2021

These seven charts show bond markets recovered, and stocks posted broad gains.

If 2020 was a year of extremes for mutual fund investors, 2021 has been a year of returning to some semblance of normalcy in the financial markets--or at least as normal as it can get with the economic ripples of the pandemic still playing out.

Against this backdrop, we took a look at where fund investors have been putting their money so far in 2021.

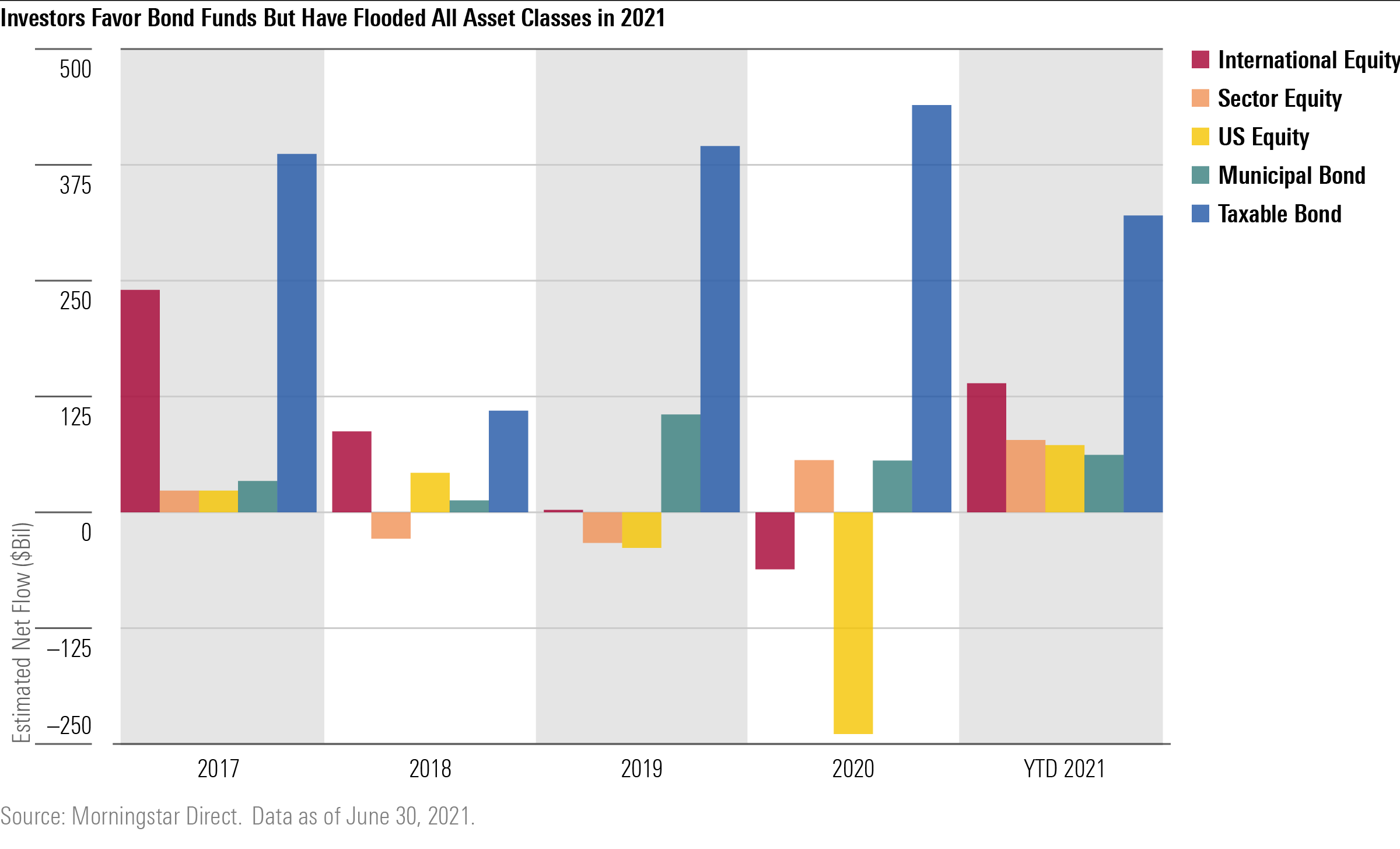

1. Investors Pile Into Bonds … and Everything Else, Too

As in years past, investors are favoring bond funds by a wide margin. At the current pace, they are on track to invest a record amount into taxable-bond strategies.

The difference in 2021 is that investors have poured money into all fund categories. If sustained in the second half of the year, this would mark the first time that has happened since 2017.

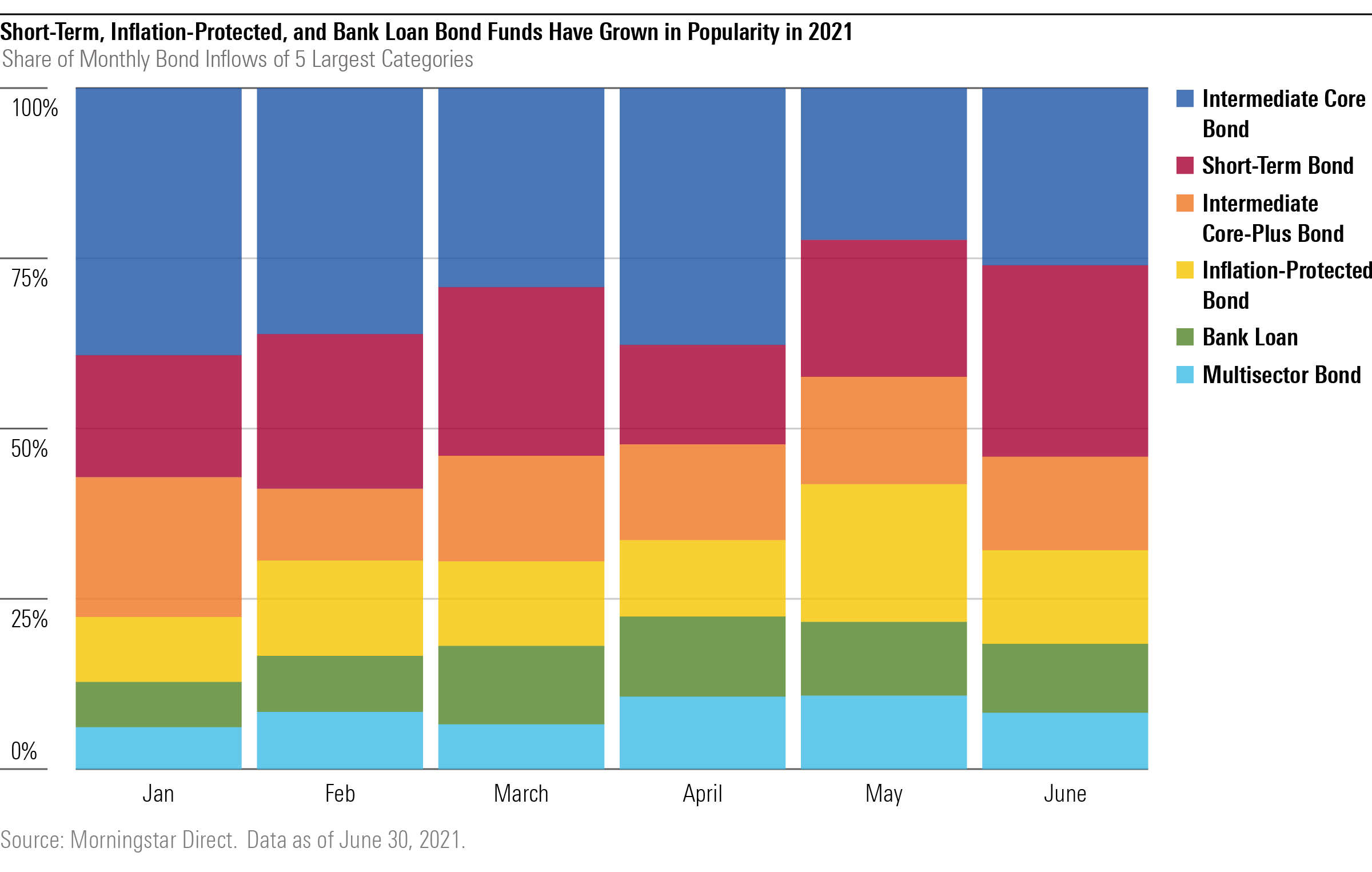

2. Short-Term and Inflation-Protected Bond Funds Grow in Popularity

Paltry yields, rising inflation, and signals from the Federal Reserve that its next move will be to (eventually) raise interest rates haven’t diminished investors’ appetite for bond funds. While intermediate core bond funds remain the most popular building blocks for portfolios, strategies that are less sensitive to changes in interest rates, as well as inflation-fighting bond funds, have risen in popularity in 2021. That was especially true in the second quarter, as inflation indicators jumped sharply.

By contrast, investors have shied away from riskier corporate and high-yield bond funds. There is one exception: High-yield municipal bond funds have drawn investors, perhaps in response to expectations of higher tax rates.

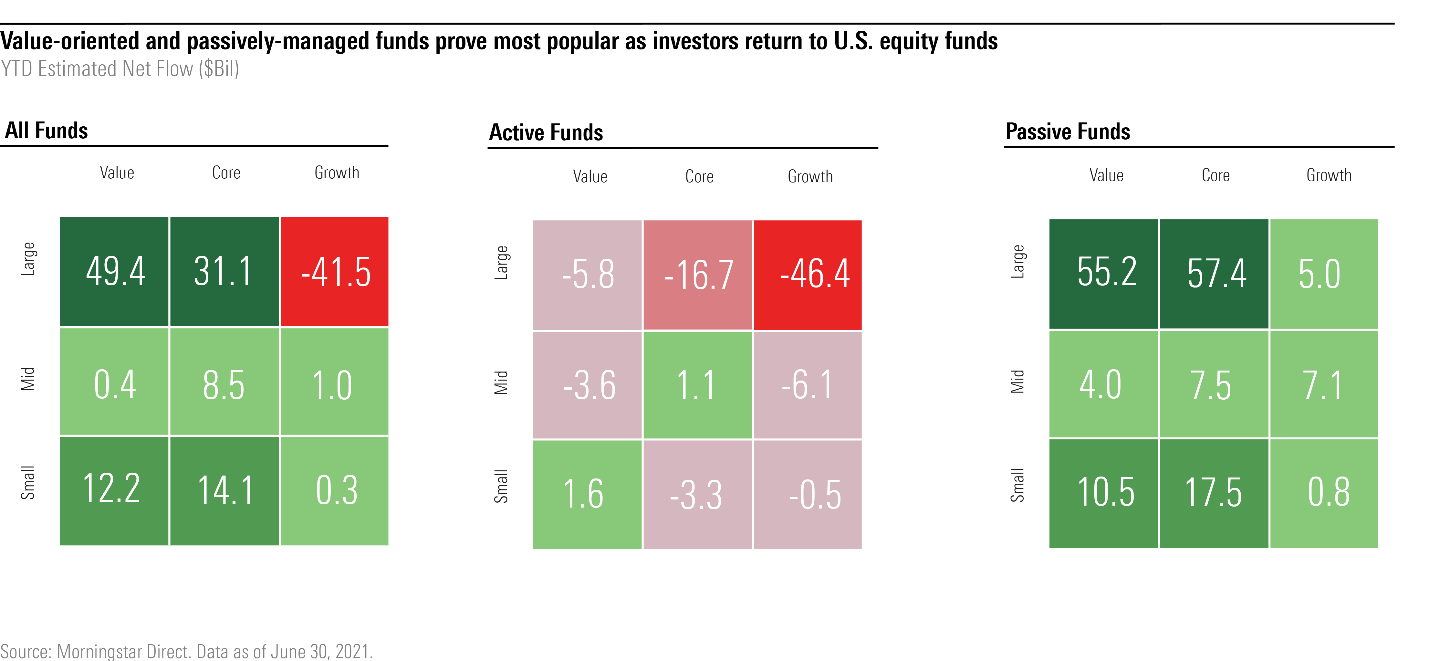

3. U.S. Equity Funds Come Back in Favor …

After disavowing U.S. equity funds for much of the past few years, investors have returned to diversified stock funds in 2021. Investors have mostly favored value funds over growth funds, and though the popularity of ARK Innovation ETF (ARKK) has waned since 2020, continued demand for the fund has boosted the mid-cap growth Morningstar Category above its value counterpart.

Small-cap and large-cap stock funds garnered the most attention, while investors continue to exit active large-growth funds.

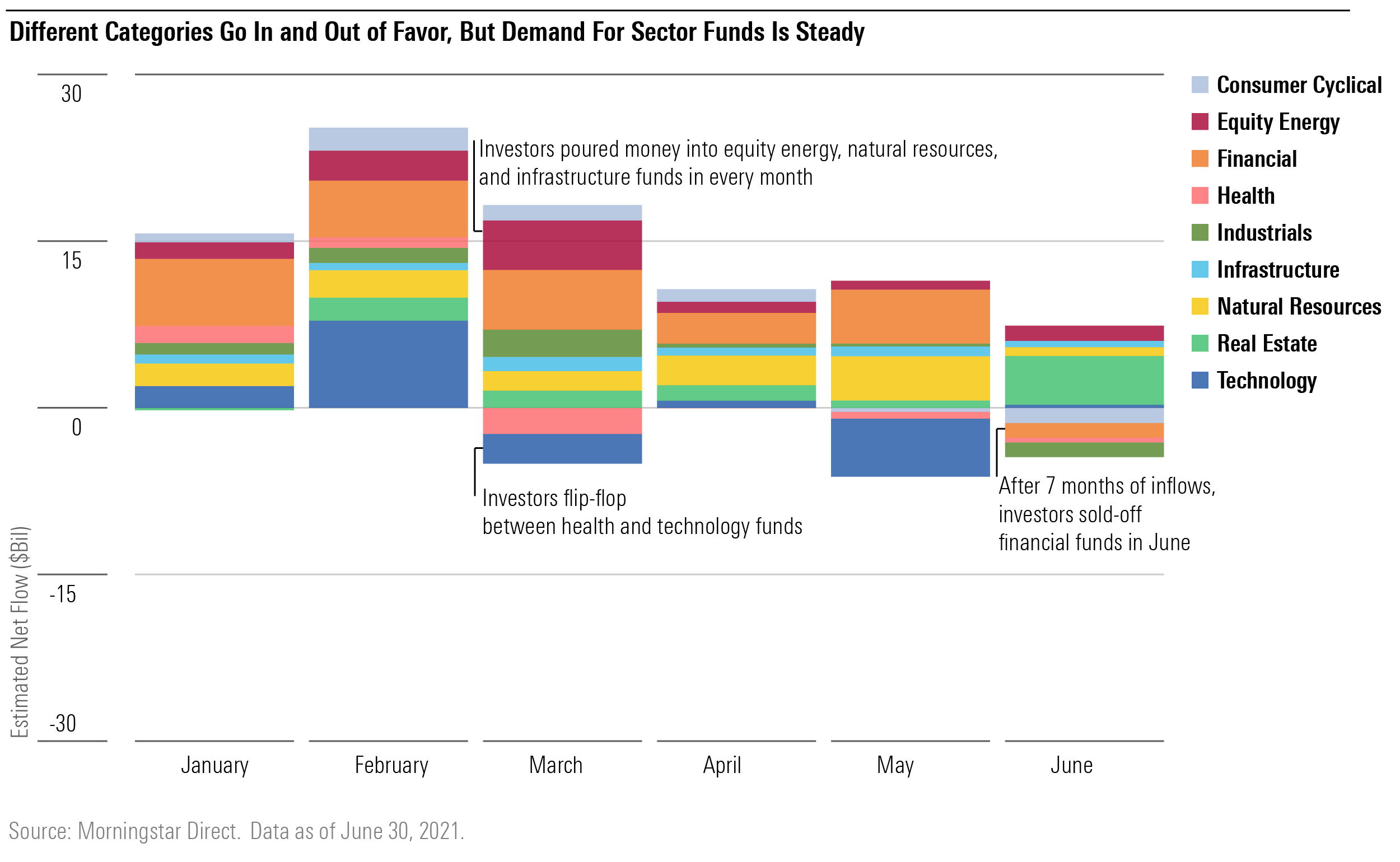

4 … Sector Funds Are Even Hotter …

Despite the risks of more narrowly focused funds, investors have moved $78 billion into sector funds so far in 2021. That’s already ahead of 2020’s total inflows of $56.2 billion. If sustained, this would be the largest inflow for sector funds ever. In particular, investors have flocked to financials, natural resources, and equity energy funds in 2021. Technology and health funds--the apple of investors' eyes in 2020--have been less popular.

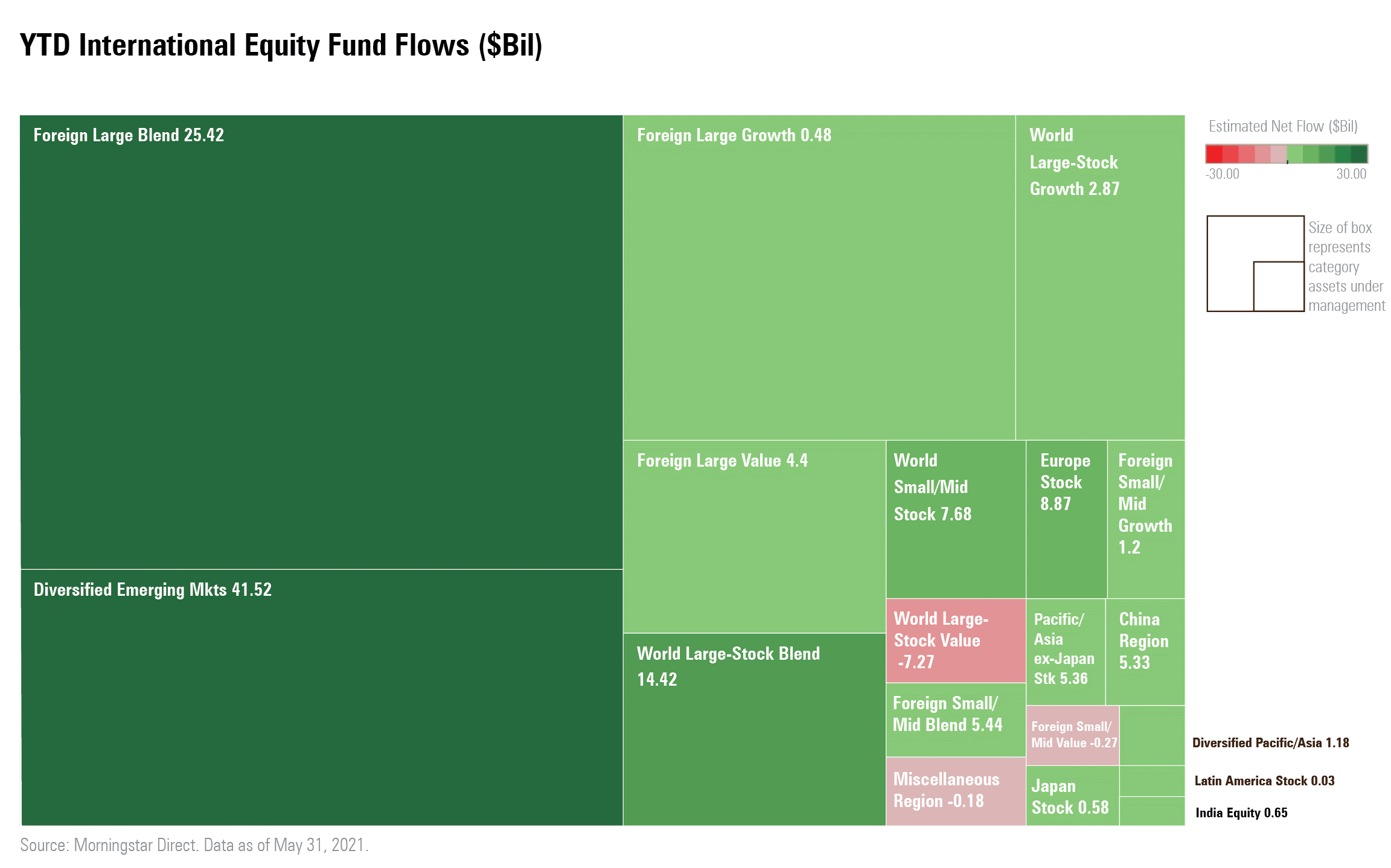

5. …But International Stocks Have Been the Big Destination

A search for undervalued opportunities appears to have sent investors to non-U.S. stock funds. They have moved nearly as much money into international equity funds as they have with U.S. equity and sector funds combined.

Investors seem willing to make riskier bets as diversified emerging-markets funds have been the most popular. The large-blend, Europe stock, and China region categories have been other popular destinations in 2021.

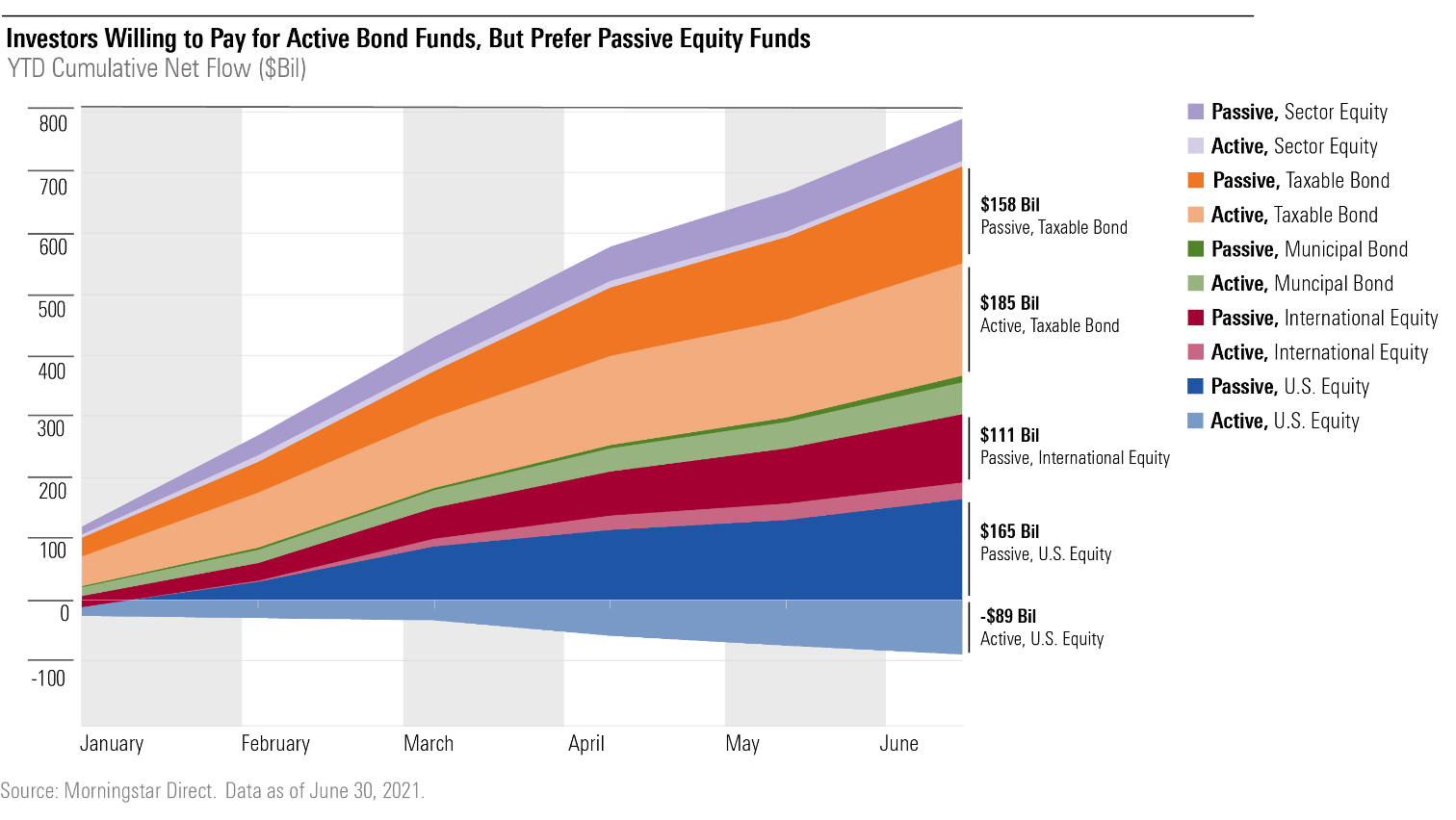

6. Active Funds Aren’t Dead Yet

For the first time since 2014, investors are on track to have on net put money into active funds rather than withdrawn. Flows to active taxable and muni bond funds have outpaced passive funds in the same groups, but the trend isn’t limited to bond funds. Active international equity and sector funds, partly bolstered by thematic funds such as ARK Genomic Revolution ETF (ARKG), are also headed to net inflows. However, investors have for the most part continued to shun actively managed U.S. diversified stock funds.

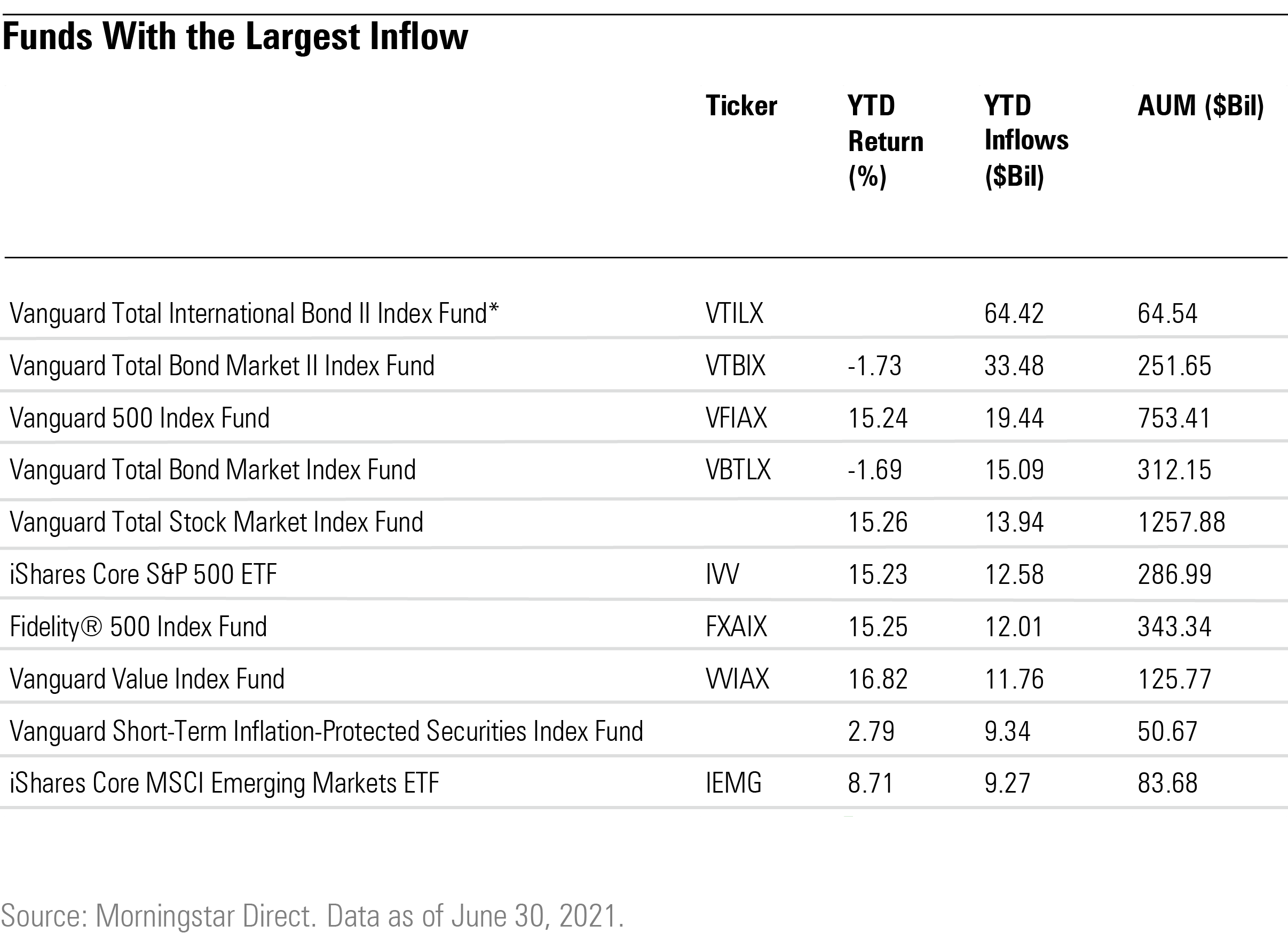

7. Vanguard Continues to Dominate

It's no surprise that Vanguard continues to dominate the list of the individual funds with the highest inflows. What's unexpected is the number-one fund on the list: Vanguard Total International Bond Index II (VTILX).

That Vanguard Total International Bond Index II has the most inflows so far in 2021 comes from a technicality, however. This fund was launched as a way for Vanguard's retirement series funds to gain exposure to international-bond funds but not impose their transaction costs on other shareholders in the original version of the fund, Vanguard Total Bond Market Index (VBMFX). So the flows into the new fund have for the most part come from investor money being shifted out of the original fund.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)