U.S. Sustainable Fund Assets Reach a New Milestone in 2021’s Second Quarter

Flows took a break for the summer after their first-quarter peak.

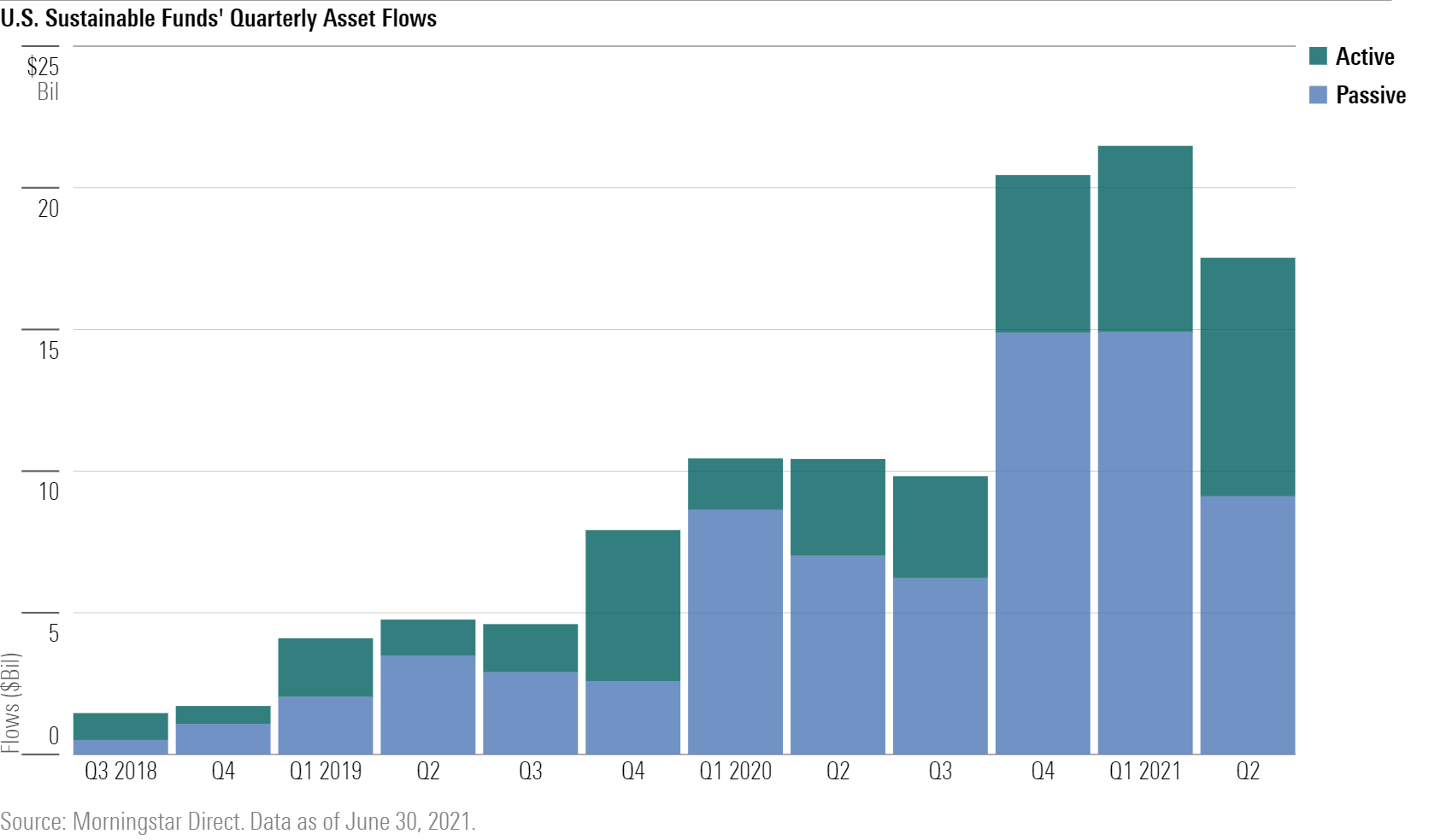

During the second quarter of 2021, flows into sustainable funds dipped below their first-quarter peak in the United States.

In the second quarter of 2021, the U.S. sustainable fund landscape saw roughly $17.5 billion in net inflows. That’s less than the all-time record, nearly $21.5 billion, set in the first quarter of 2021, but it is higher than the $10.4 billion seen one year ago in the second quarter of 2020. The broader U.S. fund market also saw lower net inflows for the period. To put it in perspective, flows into sustainable funds dipped by 18% in the second quarter, but flows into the broader U.S. market dipped by 27%.

Sustainable active funds remained on a positive trend, attracting $8.4 billion, a new all-time record. Sustainable passive funds still dominated their active peers but by a smaller degree than in the past. Passive funds attracted net inflows of $9.1 billion for the period. This represented 52% of all U.S. sustainable flows, compared with 69% in the first quarter of 2021.

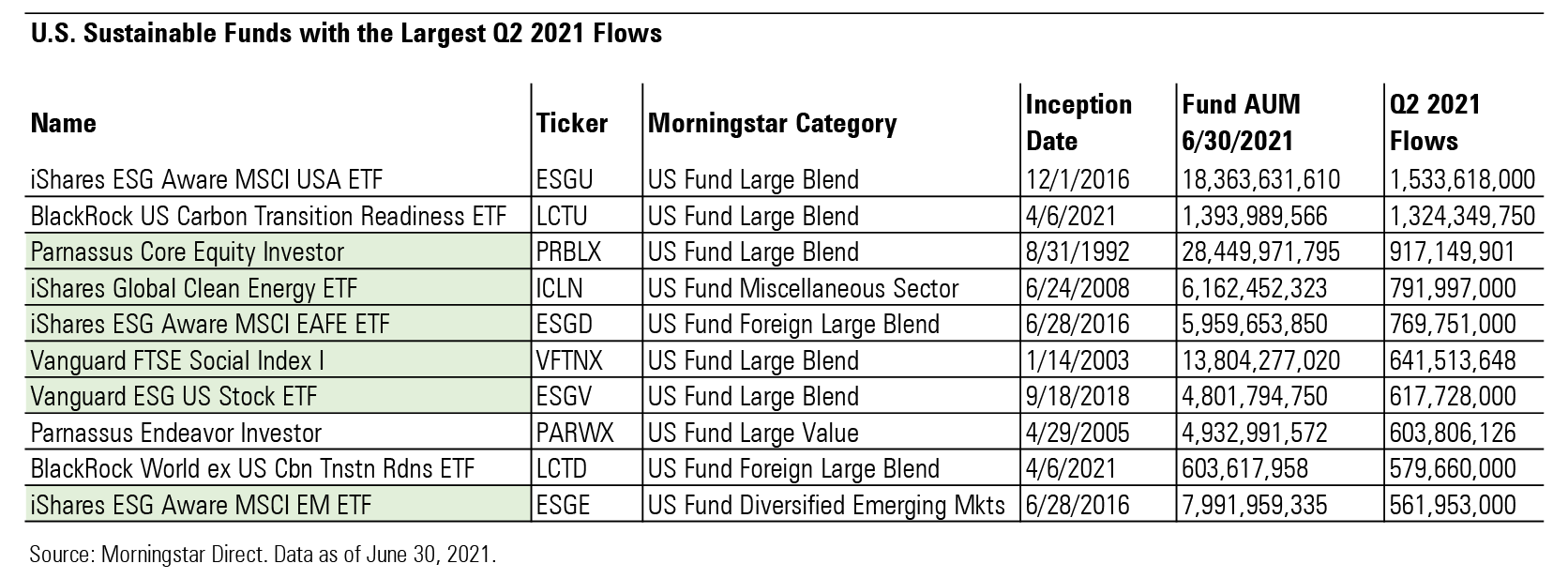

Still, six of the 10 funds attracting the most flows in the second quarter of 2021 were passive funds, and all 10 were equity funds. Six of those were also in the top 10 for the first quarter of 2021: iShares ESG Aware MSCI USA ETF ESGU, iShares Global Clean Energy ETF ICLN, iShares ESG Aware MSCI EM ETF ESGE, Vanguard FTSE Social Index VFTNX, Vanguard ESG US Stock ETF ESGV, and iShares ESG Aware MSCI EAFE ETF ESGD.

It is notable that BlackRock US Carbon Transition Readiness ETF LCTU and its international sibling, BlackRock World ex US Carbon Transition Readiness ETF LCTD, reached the top 10, as they only launched in April 2021. They join a growing list of funds focused on the transition to a low-carbon economy.

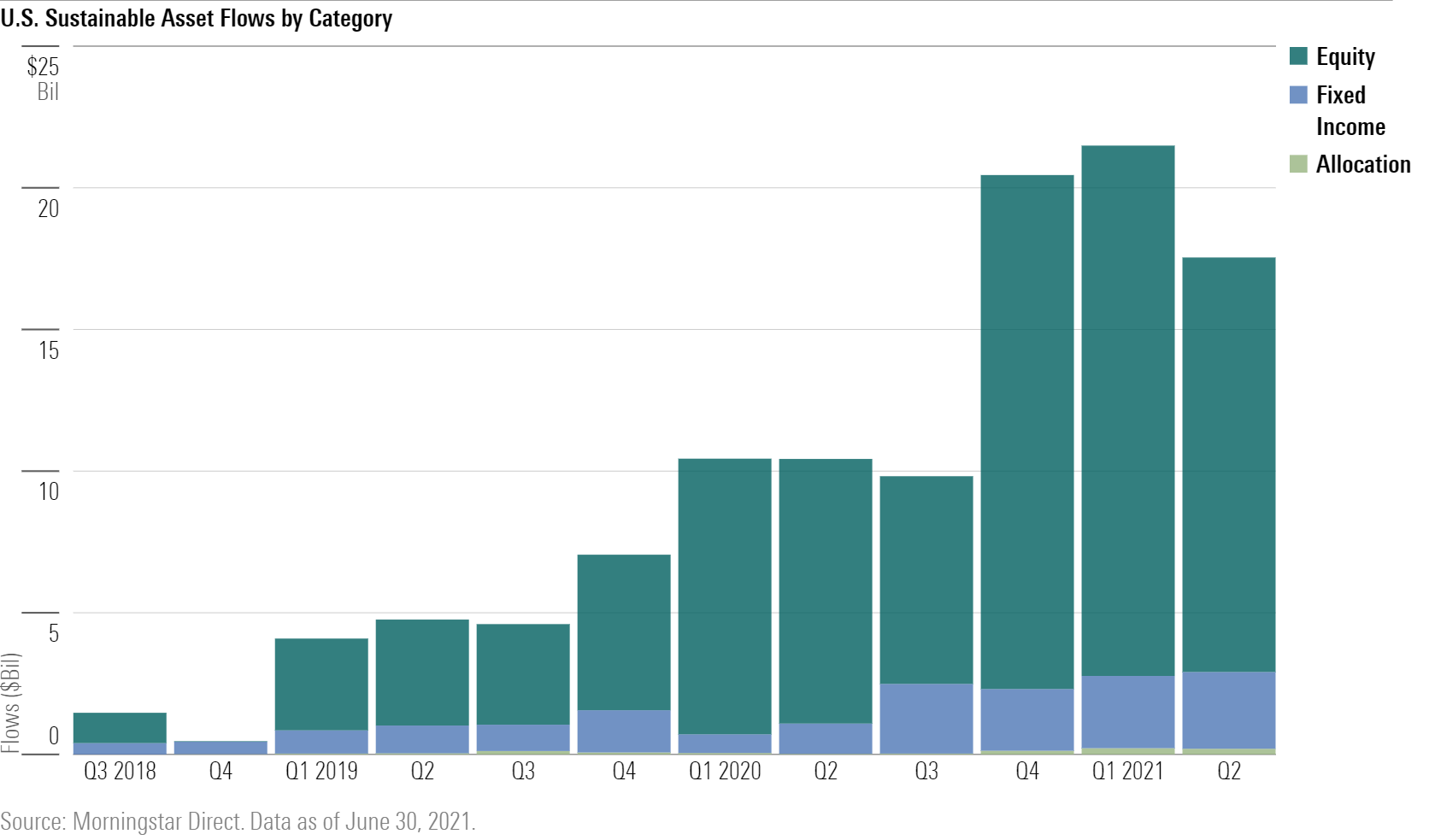

Equity funds made up the lion’s share of flows, as they typically do. In the second quarter of 2021, equity funds attracted $14.6 billion, or 83% of all sustainable fund flows. On average over the three years that ended in March 2021, equity funds have attracted 75% of U.S. sustainable fund flows, peaking at 93% of flows in the first quarter of 2020.

Flows into sustainable fixed-income funds have been growing steadily, however. They crossed the $2 billion threshold for the first time in the third quarter of 2020, and they have stayed above that mark since. In the second quarter of 2021, they reached a new record at $2.7 billion. The best-selling sustainable fixed-income fund was Invesco Floating Rate ESG AFRAX, which netted just over $550 million for the period.

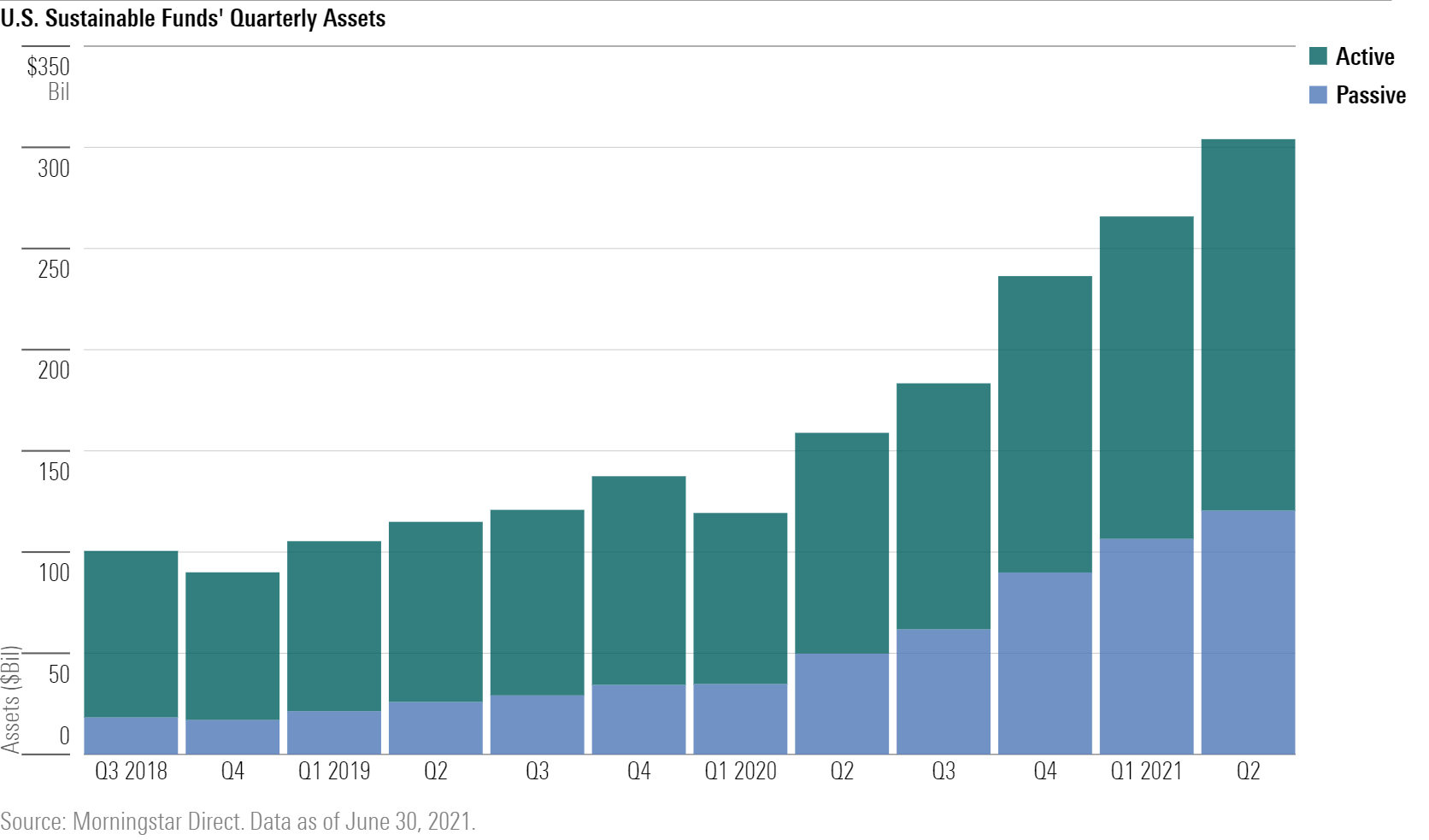

Assets in Sustainable Funds Top the $300 Billion Mark

Assets in U.S. sustainable funds have stayed on a steady growth trajectory. As of June 2021, assets totaled more than $304 billion. That’s a 14% increase over the previous quarter and nearly double the $159 billion record set one year ago. Active funds retain the majority (60%) of assets, but their market share is shrinking. Three years ago, active funds held 82% of all U.S. sustainable assets.

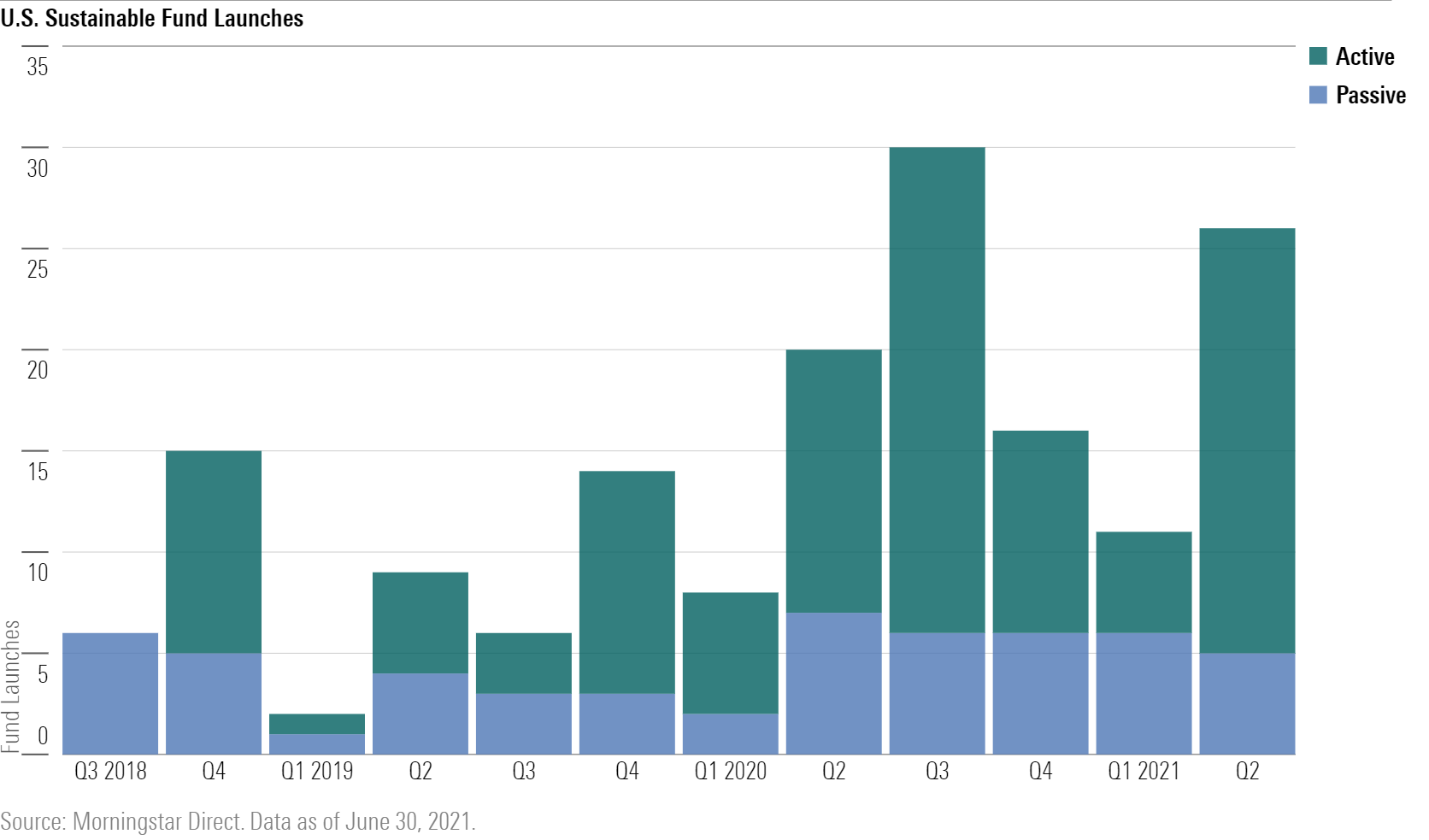

New Funds Launch With Sustainability in Mind

As U.S. flows into sustainable funds have gained traction, asset managers have responded by growing their sustainable fund lineups. In the second quarter of 2021, 25 funds were launched in the U.S. with sustainable mandates. This is the second-highest number of sustainable funds launched in one quarter, just trailing the record of 30 funds set in the third quarter of 2020. Of those 25, 19 were equity funds, and 15 were ETFs.

Once again, most of the new sustainable funds available in the U.S. are actively managed offerings. Eight of the new funds target environmental themes, such as Global X Clean Water ETF AQWA, which seeks to invest in water treatment, conservation, storage, and distribution. Two of the new offerings focus on the theme of diversity and inclusion: Fidelity Women's Leadership ETF FDWM and LGBTQ100 ESG ETF LGBT.

Engine No. 1 Transform ETF VOTE launched in June 2021 and made headlines in its first month following the firm’s successful activist campaign to get two of its nominees elected to Exxon Mobil’s board. The ETF aims to drive sustainable change through voting and shareholder engagement.

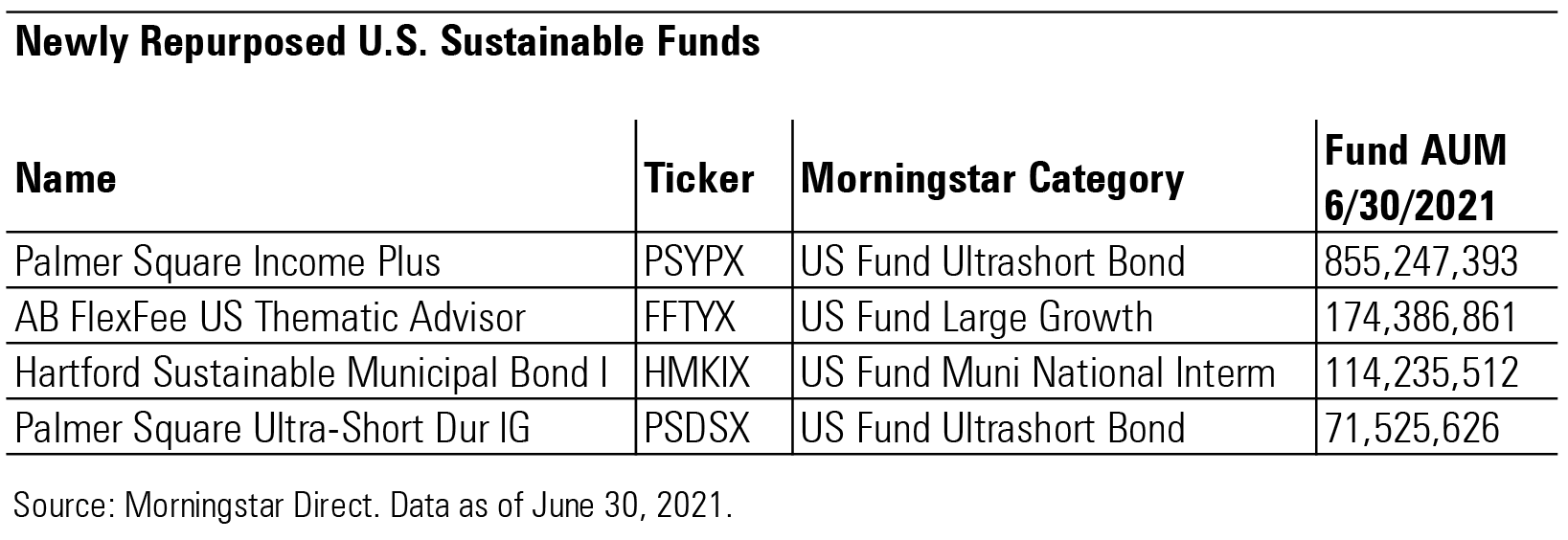

Repurposing Funds for Sustainable Outcomes

Most of the new options available to investors were launched with sustainable mandates, but firms also occasionally change the investment strategies of existing funds to target sustainable outcomes. In the second quarter of 2021, one equity and three fixed-income funds were repurposed to adopt sustainable mandates. The largest fund repurposed to incorporate sustainability was Palmer Square Income Plus PSYPX, with $855 million in assets. The fund generally seeks to align its investments with the UN Global Compact's Principles and Sustainable Development Goals.

The new offerings and the repurposed funds brought the total number of sustainable open-end and exchange-traded funds in the U.S. to 437 at the end of the quarter.

For global sustainable fund flows for the second quarter, read our full paper. Morningstar Direct clients can find the full sustainable flows report here.

/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CQP5OBZT3NBS7M76RDJCKLIFVM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/987376c2-20a0-406b-b3ec-df530324b39c.jpg)