These Funds Hit for Power

We've developed a slugging percentage for U.S. equity funds.

In the summer, some Morningstar Manager Research analysts have been known to slip off to the ballpark to take a break from evaluating fund managers’ performance. Those warm afternoons tracking hits, runs, outs, and errors on scorecards as the Chicago White Sox rack up one of the best records in baseball and the Cubs revert to mediocrity got us wondering if a handy baseball statistic had any application for investors.

It's not the first time America’s pastime has inspired a fund performance metric. Some investors already include batting average in their scorecard. It measures how consistent a fund has been at beating its benchmark. For example, if a fund beats its index in 60 of 120 months, it would have a batting average of 50%. (In baseball terms, that would be stated as .500, but we’ll go the 50% format for clarity.) The higher the batting average the better, because it means the fund consistently outperforms the benchmark, ultimately putting an investor’s money in scoring position. As in baseball, batting average does a decent job of illustrating a fund’s performance pattern over time, but it doesn’t tell the full story. One key piece of information is missing: the magnitude of outperformance.

To help fill in the missing piece, we’ve developed a version of baseball’s slugging percentage for fund investors.

Measuring a Fund’s Slugging Percentage

Baseball’s slugging percentage helps differentiate between players who have similar batting averages but hit with very different levels of power. Two players can both bat .300, but if one of them hits only singles and the other consistently hits doubles, triples, or home runs, they can have different impacts in key game situations. The same goes for comparing funds’ performance versus the most relevant benchmark. Knowing whether a fund racks up small but consistent wins versus its index or crushes the benchmark when it outperforms can inform how investors use it in a portfolio or understand its risk/reward profile and set proper expectations for it.

To calculate the slugging percentage of active U.S. equity funds, we looked at the monthly returns for each fund over the trailing 10 years ended June 30, 2021. For each month the fund had a positive excess return versus the most appropriate index for its category, we compared it against every other fund in the category with a positive excess return that month.

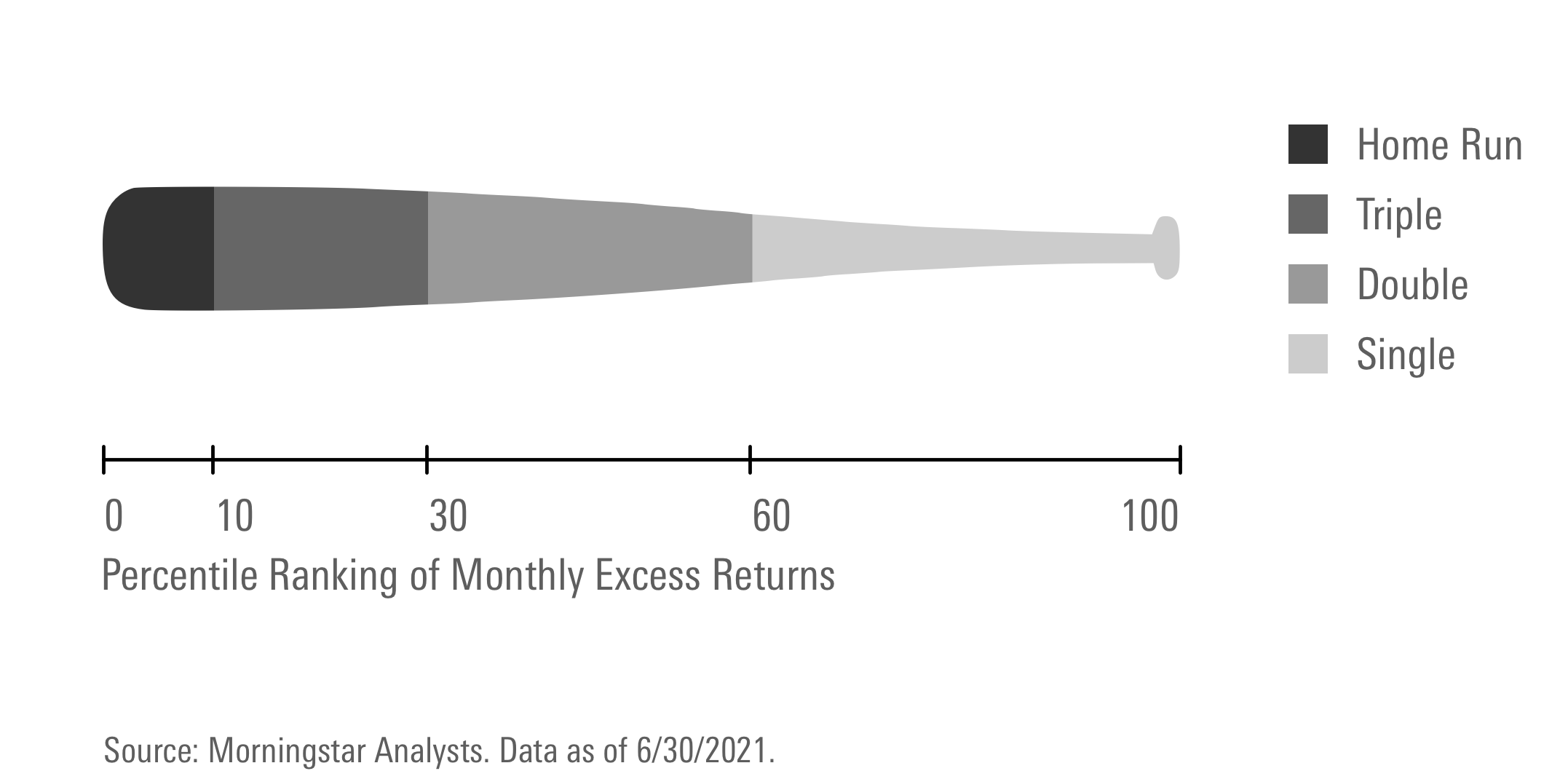

The top 10% of outperformers, measured against their peers, hit it out of the park and scored a 4. The next 20% earned a 3. Those in the following 30% received a 2. While those in the bottom 40% of outperformers hit a solid single for a 1. We then summed the fund’s total points and divided by 120 (for the number of months in the time horizon) to calculate the slugging percentage. Exhibit 1 illustrates the breakdown of how the scores were calculated.

The Best Categories for Sluggers

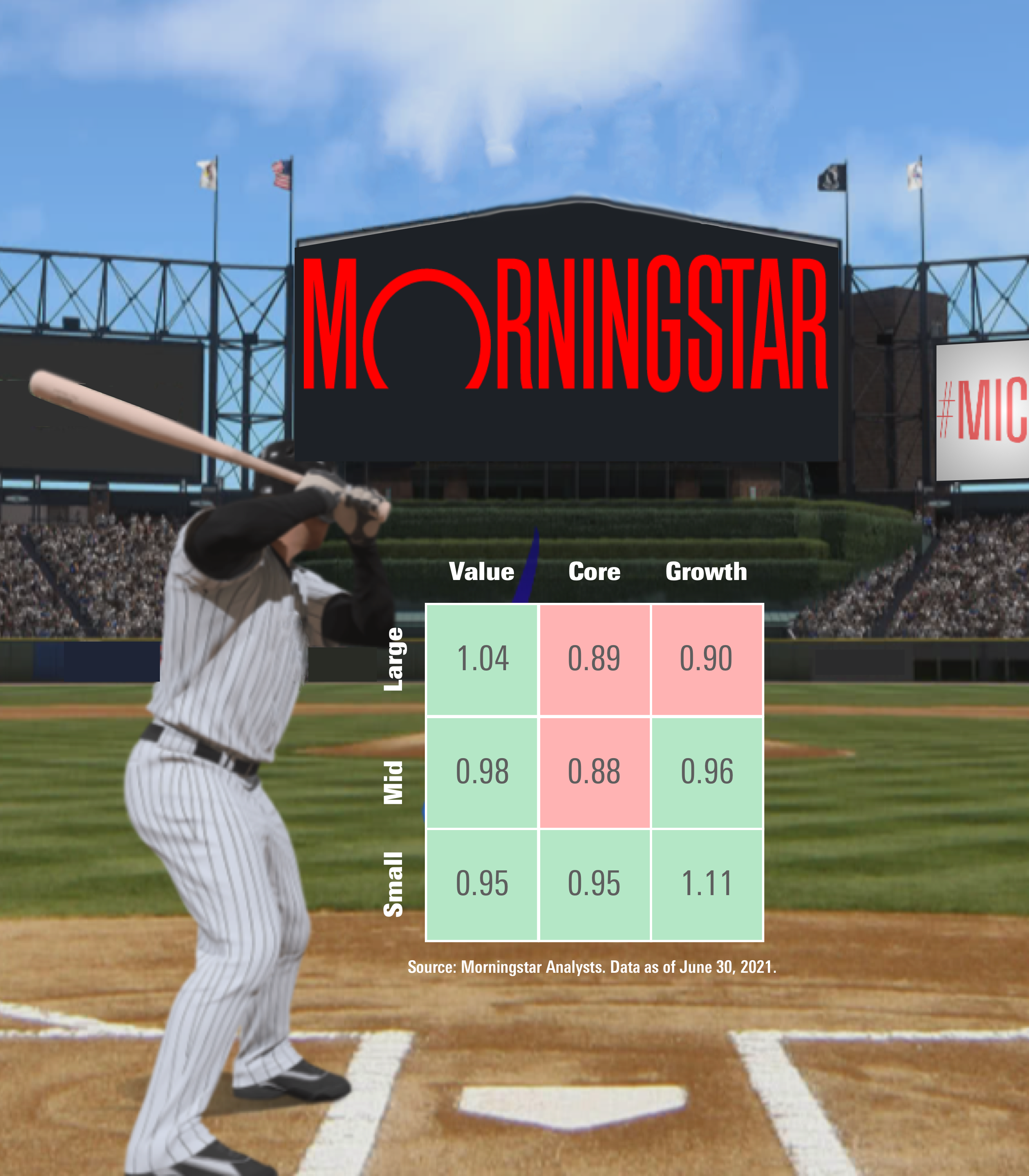

Similar to playing in a home-run-friendly ballpark, some Morningstar Categories produce more sluggers than others. Exhibit 2 shows the median slugging percentage for each U.S. Morningstar Style Box category over the 10-year period. A fund with a higher slugging percentage is better because it tended to outperform both its index and its category peers.

Funds in the small-cap growth category produced the highest median slugging percentage across the nine categories that comprise the equity style box. These findings corroborate Morningstar's Active/Passive Barometer, which also finds that active managers in that category have one of the better chances of outperforming passive peers. The median batting average within the category is the only one over 50%. This means more funds tended to beat the index each month.

The U.S. large-blend category had one of the lowest median slugging percentage of the nine categories, indicating funds had more difficulty beating the Russell 1000 Index. The median batting average in the category was also among the lowest, with funds hitting past the benchmark only 44% of the time. The index has been one of the toughest to beat historically; it’s like the Cy Young of benchmarks.

Starting Lineup

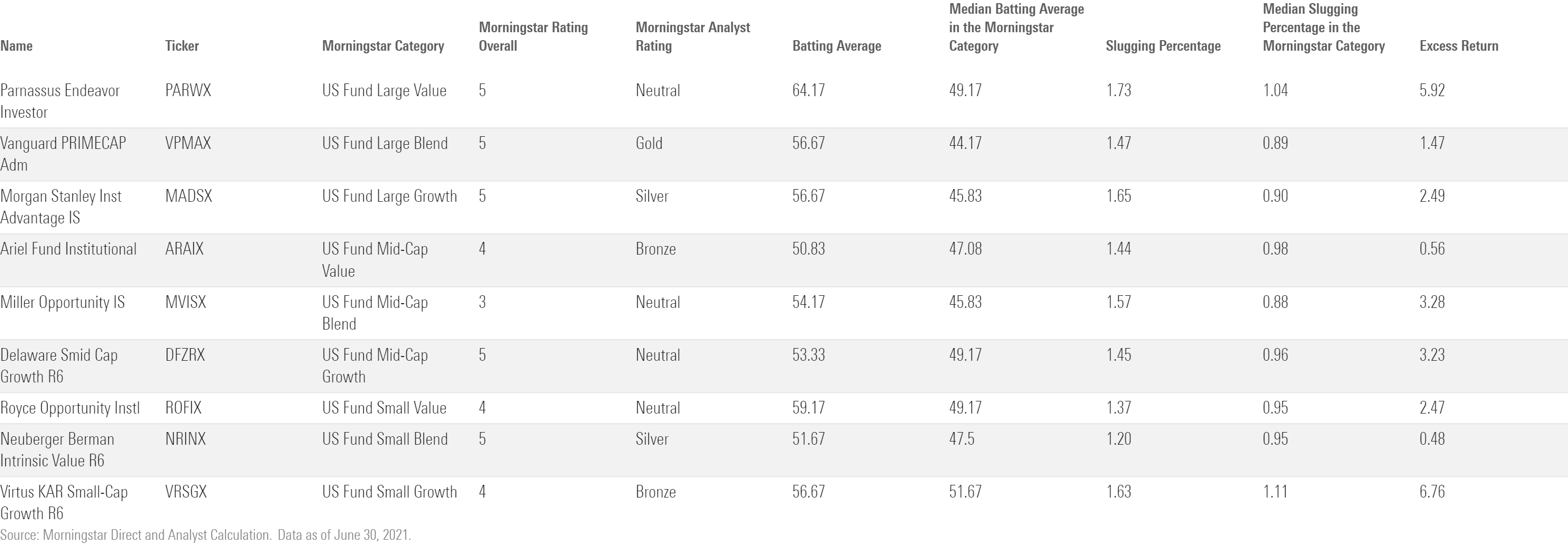

Taking a closer look, we narrowed the field to only those funds that receive a Morningstar Analyst Rating with the highest slugging percentage in each category. Of these nine funds, each has a batting average equal to or over 50% for the past 10 years. Investors should also look at how the fund’s annualized returns stacked up against the benchmark over the entire period. In the case of the top sluggers included, all nine of them had a positive excess return against their respective category indexes. Below are rated funds or Morningstar Medalists from each category with the highest slugging percentage.

Gold-rated Vanguard Primecap VPMAX posts competitive numbers in a category with a lower slugging percentage. It has been able to beat the Russell 1000 Index 57% of the time, 10 percentage points more often than the median large-blend peer. Its stable, talented team at subadvisor Primecap Capital Management takes a long-term, high-conviction, contrarian approach to growth investing.

Silver-rated Morgan Stanley Institutional Advantage MADSX in the large-growth category boasts a 1.65 slugging percentage and the largest advantage over its peers, beating the median by 75 basis points. Veteran manager Dennis Lynch, Morningstar Domestic-Stock Fund Manager of 2013, has built a unique team culture that considers a wide range of perspectives as it looks for companies that dominate their markets or benefit from a strong network effect. The squad was among the first to invest in private placements in its funds, and they recently said they would consider the popular cryptocurrency Bitcoin.

In a category with the biggest sluggers, Bronze-rated Virtus KAR Small-Cap Growth’s VRSGX slugging percentage of 1.63 beat the category median of 1.11. It outperformed the Russell 2000 Growth Index by roughly 6.8 percentage points. Comanagers Todd Beiley and Jon Christensen typically invest in 25-30 best ideas and pack most of their assets in their top 10 stocks.

Neutral-rated Parnassus Endeavor PARWX posted the highest batting average and slugging percentage in its category and also against other top sluggers. Its batting average over the trailing 10 years through June 2021 was about 15 percentage points more than the large-value category median, and its slugging percentage of 1.73 was the highest in its category. But its stats have an asterisk, as there’s a new manager in the dugout. Most of the fund's record belongs to firm founder Jerry Dodson. Billy Hwan, Dodson’s comanager since 2018, became the fund’s sole manager in January 2021 and takes a longer time horizon. He still needs to prove himself.

Extra Innings

Batting averages and slugging percentages combine two of America’s favorite pastimes--baseball and investing--and help gauge fund performance, but they aren’t perfect. They don’t account for the magnitude of funds’ losses when they stumble, for instance. As always, investors should consider other factors such as funds’ management teams, processes, portfolio roles, performance during market downturns, and expenses before investing.

Associate data journalist Lauren Solberg contributed to this report.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)