What's the Future for Bond and Stock Returns?

The outlook for bonds is clearer than that for stocks.

Unreliable Bonds

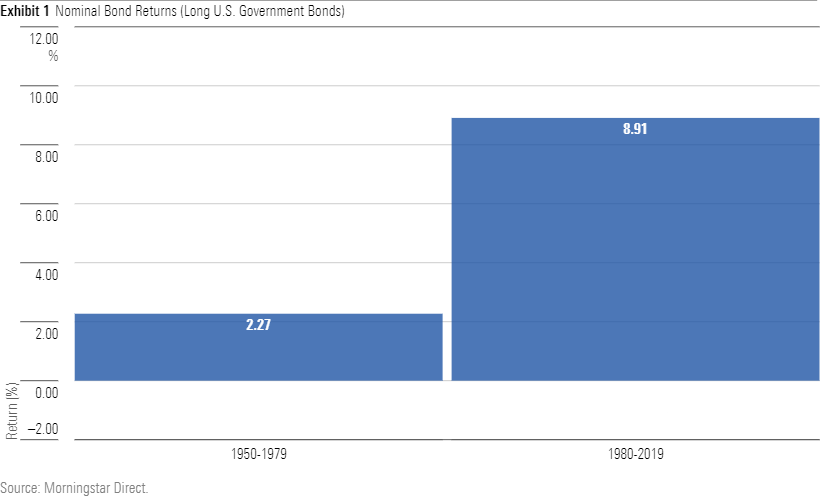

The 70-year history of U.S. bond returns can be summarized in three words: bad, then good. From 1950 through the early 1980s, bonds were best avoided. Since that time, they have been outstanding. That bond performances have run cold and hot can be seen in the chart below, which depicts the annualized return for long government bonds for the three decades from 1950 through 1979, then for the next 40 years, through 2019. The discrepancy is stark.

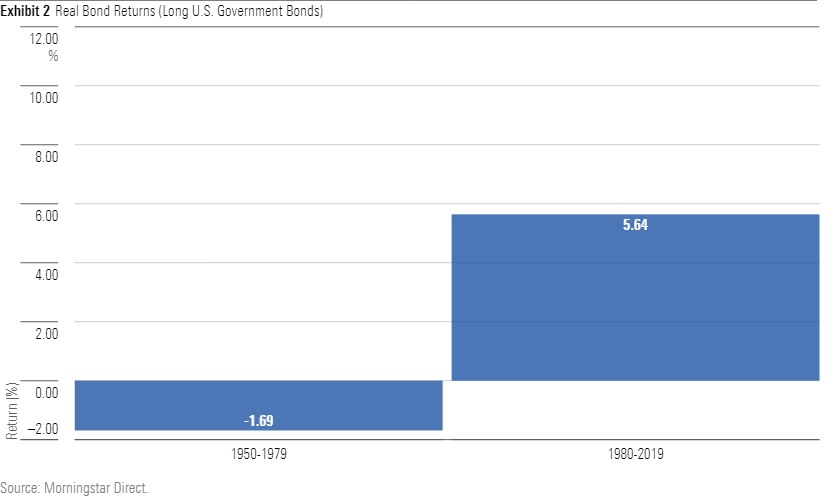

Adjusting for inflation doesn’t alter the conclusion--it exacerbates it. Not only was inflation higher in the first period than in the second, but the rate of inflation also exceeded the returns from long bonds, meaning that in real terms long bonds were losers. The longer investors held them, the poorer they became.

By annualizing the results, the chart understates the contrast. The compounded numbers tell the real story (so to speak). In 1950, placing $10,000 in long government bonds returned only $6,000 over the next three decades, after considering inflation. In contrast, those who invested $10,000 into those same securities in 1980 grew their stake to almost $90,000 during the next 40 years. For one generation, long bonds meant penury. For the next, they meant prosperity.

Changing Attitudes

Bonds behaved differently because investors changed. In 1950, Americans needed little encouragement to buy high-quality bonds, which had profited during the Great Depression while stocks collapsed. Consequently, investors were willing to accept modest 2% yields on long bonds, even though inflation had averaged 5.5% through the previous decade. The deal wasn’t attractive, but neither were equities, and cash paid 1%. Where else could you go?

By 1980, the appeal of bonds had faded. Thirty years of losing will do that to an asset class. Besides, stocks had begun to look better. Although equities had also struggled during the 1970s, they had outperformed bonds, just as they had done in the two previous decades. Investors therefore demanded more from bonds. No longer would they settle for 2% yields. Long bonds needed to offer more. When the 1970s ended, the yield on 30-year Treasury bonds was 10.3%.

The round trip is now complete: Bond yields are once again at 2%. Much of that decline is attributable to reduced inflation expectations. However, the payout on long bonds has fallen even further than those expectations. Projected inflation for the next 30 years, obtained by comparing the yield on conventional Treasuries to that of inflation-indexed securities, is 2.3%--higher than the 30-year bond yield. Once again, investors are likely to lose with long bonds.

Reliable Stocks

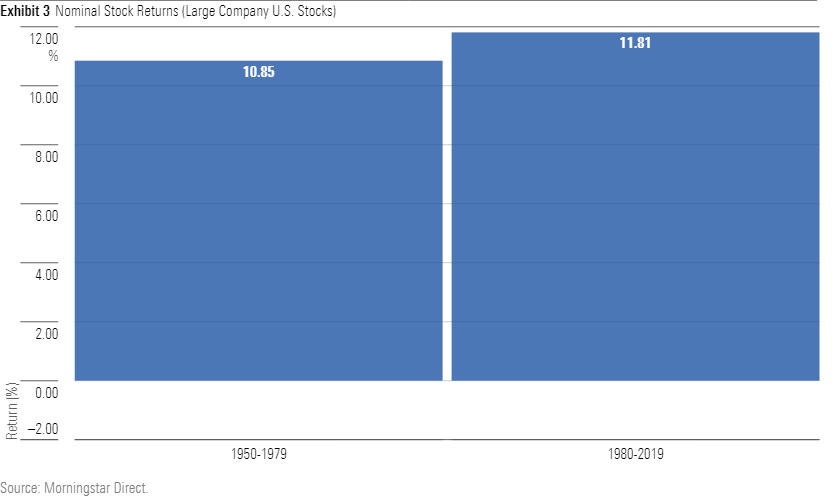

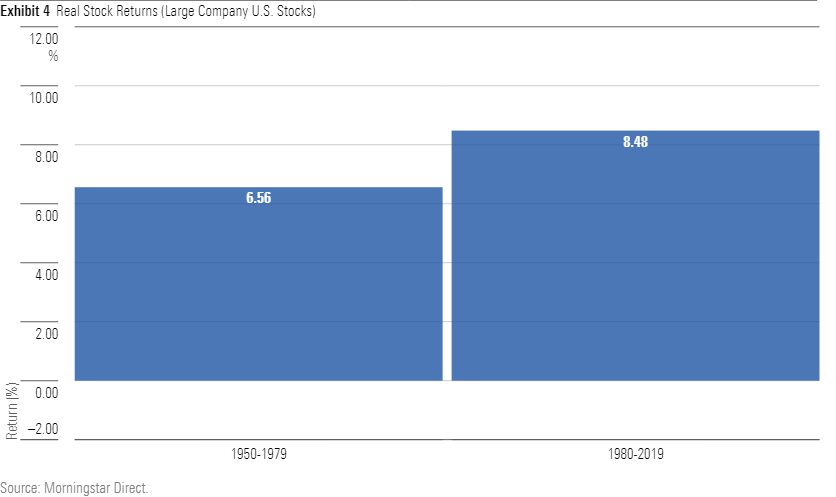

The stock market’s history is quite different from that of bonds. With equities, there has been but a single regime. (Since the Great Depression, that is.) They performed well before 1980, and then they performed well after 1980. Unlike with bonds, dividing equity returns into the two periods offers no new information.

Adjusting the calculation for inflation does create something of a gap, with the second period outgaining the first by an annualized 190 basis points, but the margin remains unremarkable. Whereas long bonds behaved dissimilarly during the two eras, the after-inflation gains for equities varied only moderately.

Such consistency can lead one to believe that stock returns are inevitable. With bonds, one period has looked very much unlike another period. Not so with stocks. For 70 years, equity returns have chugged along, reliably reverting to the mean after brief downturns. The lesson for investors has been not to worry about the hiccups, because soon enough stocks will resume their onward march.

The Pessimists

Many, of course, have argued otherwise, stating that although stocks had previously performed well, their jig was up. The corpses of such prognosticators are littered on the street. (Figuratively, of course. Fortunately for stock-market strategists, making incorrect forecasts does not draw blood.) To date, none of their claims have come true:

1) Low stock yields. Once upon a time, market observers maintained that the stock-dividend rate should exceed Treasury yields to compensate for equities' higher risk. When that line was at last crossed in 1959, they warned that stocks had become overpriced. Apparently not.

2) High CAPE ratios. Robert Shiller's cyclically adjusted price/earnings ratio attempts to put current stock-market valuations into context. When he launched the measure in 1996, Shiller hypothesized that a lofty CAPE ratio implied reduced future stock returns, while a depressed ratio would likely lead to strong results. However, with only brief exceptions, the CAPE ratio has exceeded its historic norm ever since Shiller's introduction. The stock market has not noticed.

3) Federal Reserve manipulation. For decades, critics have claimed that the Federal Reserve's interventionalist tactics have artificially propped up stock prices, which at some point would lead to a day of reckoning when the Fed's house of cards came tumbling down. So far, the house remains intact. Such failures have led me to distrust predictions of future stock-market woes. Nor, as previously indicated, can I find evidence of when stocks appear to have been over- or underpriced, as occurred with the history of bonds.

4) The New Normal. Rare is the investment expression that spawns a television show (a sitcom, no less.) The term invented by Pimco's Bill Gross to describe the investment markets after the 2008 global financial crisis did just that. However, it was more memorable than accurate. When Gross coined the phrase, he explained that both bond and stock returns would hover near 3%. The latter, obviously, has not occurred.

Wrapping Up

Bond investors have accepted lower future performance. They will not receive what bonds have returned over the past 40 years and surely must know that. The evidence is less forthcoming with stocks. For that reason, one cannot say that equities have run their course. However, it must also be granted, if bond investors have become willing to settle for less, so too may have equity shareholders. The proof is lacking, but the suspicion remains.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)