What the American Jobs Plan Means for Stocks

The path to passing the plan may have changed, but its expected impact on the market has not.

As with any major initiative out of Washington, the $2 trillion-plus American Jobs Plan--consisting of a wide range of infrastructure spending priorities--has been undergoing intense negotiations between the Democratic and Republican parties. Now, following a surprise move in which the Senate parliamentarian issued guidance that essentially limits the Democrats to only one more reconciliation bill this year, the paths to how these initiatives will come to fruition have changed.

The American Jobs Plan would provide a boost to a wide range of sectors and companies, reinvigorating both traditional infrastructure as well as supporting new nontraditional infrastructure programs. However, this is not a free lunch for the equity market, as the proposed increases in the corporate tax rate to pay for the spending will be a headwind.

While there are multiple paths that can be taken to implement these initiatives, we expect they will lead to the same place and that the preponderance of the initiatives will be implemented--just at different times and in different manners.

What Stocks Stand to Benefit From the American Jobs Plan?

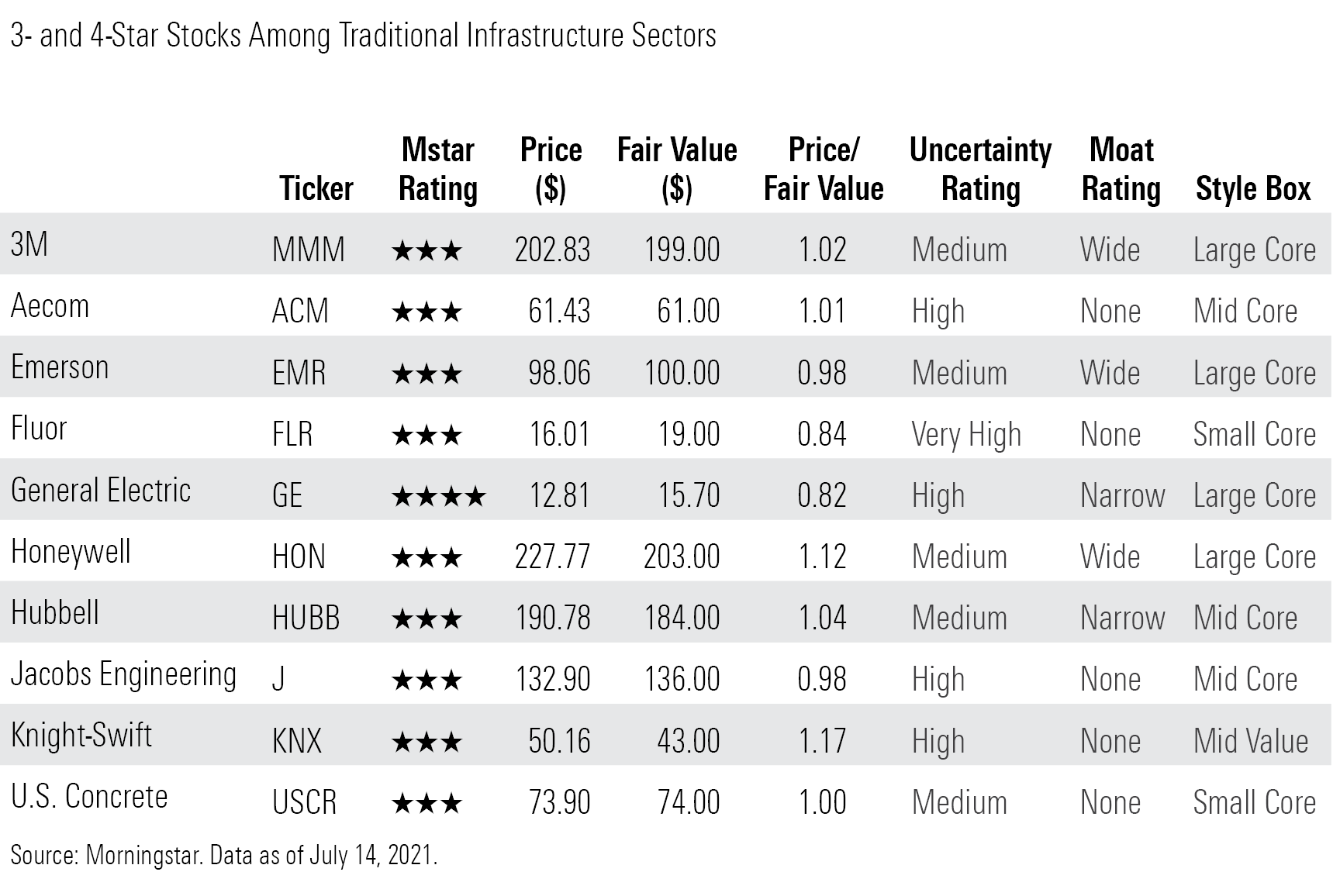

With the U.S. market near its highs--and slightly overvalued, in our view--many of the companies that might be able to capitalize on the traditional infrastructure plan are either already fairly valued or overvalued. For example, stock prices on the obvious candidates have already run up this past spring.

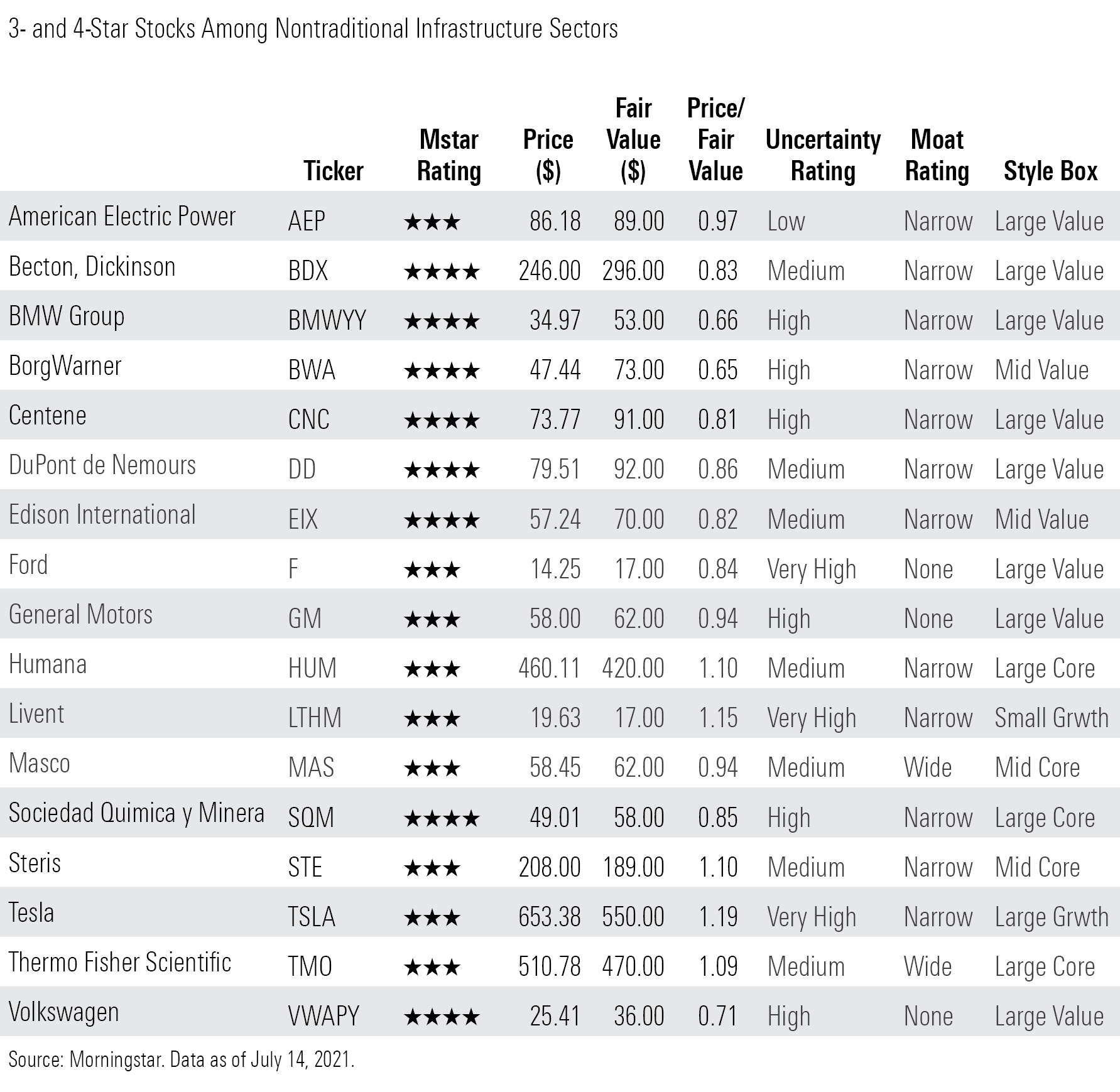

We think the most opportunity for currently undervalued 4-star stocks can be found in sectors that are not traditionally considered to be infrastructure plays.

Different Paths Lead to the Same Endgame

This has certainly not been an exception to the old Washington rule to expect the unexpected. Originally, we expected that the Democrats would look to pass two budget reconciliations this year: first to address the American Jobs Plan and then to address the American Families Plan. This is because these reconciliation bills can be passed with a simple majority and do not need to attract enough Republican votes in the Senate to overcome the filibuster.

However, one thing we did not expect was the Senate parliamentarian's guidance that will essentially limit the Democrats to only one more reconciliation bill this year.

So, we see two potential paths to address both the American Jobs Plan and the American Families Plan:

- Democrats attract enough Republican support to bypass a filibuster and bring a new bill to the floor to pass a substantial amount of the American Jobs Plan, focusing on traditional infrastructure. Then, the Democrats utilize the budget reconciliation process later this year to address the nontraditional infrastructure spending not included in the bill along with other priorities such as the American Families Plan.

- If they are unable to reach a bipartisan agreement, we expect the Democrats to lump both the Jobs Plan and Families Plan together into a much larger reconciliation bill later this year and push it all through on a purely partisan basis.

So Where Are We Today?

A small working group of Democrats and Republicans has tentatively reached an agreement on $1.2 trillion of spending, of which the preponderance is largely traditional infrastructure spending, with a few smaller nontraditional aspects tacked on. We note that in order to reach this agreement, the bill does not include an increase in the corporate business tax. We think that this has a high probability of being passed and could be voted on as soon as September.

Following the passage of this infrastructure bill, we expect the Democrats will then look to utilize the reconciliation process to address both the nontraditional infrastructure spending that was not included in that bill and the American Families Plan. Democrats took a first step toward passing a reconciliation bill when they announced on July 13 that they had reached an agreement on the total budget.

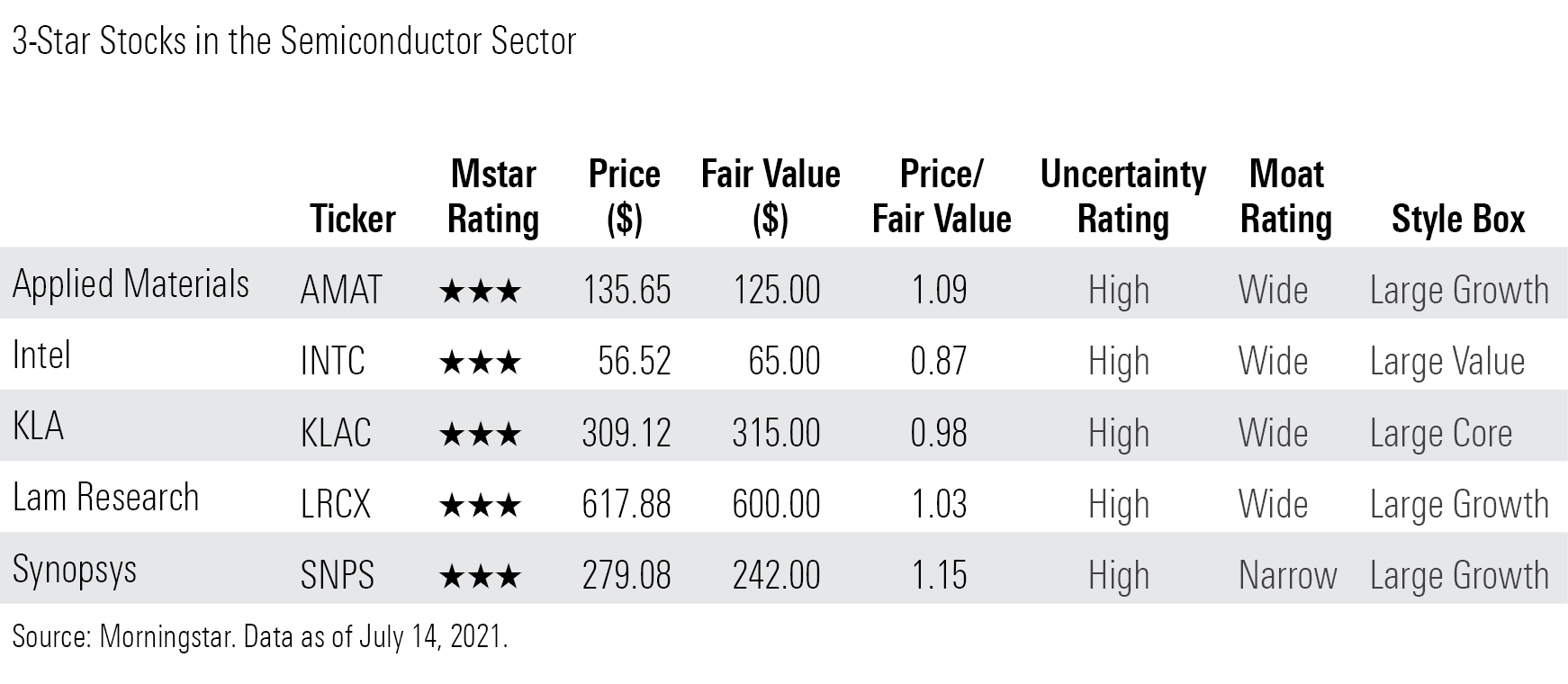

Yet, not all of the originally contemplated nontraditional spending in the American Jobs Plan will need to be included in this reconciliation. Much of the spending on revitalizing American manufacturing, especially in the technology sector, has been included in a new separate bill: the U.S. Innovation and Competition Act. This has received little media attention but was recently passed on a bipartisan basis in the Senate.

The House version has some differences that need to be worked out, but we expect this appropriation will pass. The intent of this bill is to encourage bringing manufacturing back onshore, especially for technology components such as semiconductors.

Finding Opportunity in Infrastructure Stocks

With stocks trading near their all-time highs, undervalued stocks have become increasingly scarce. With many traditional infrastructure companies already at or above fair value, investors will need to be especially adroit in choosing investments to benefit from the heightened infrastructure spending to come.

In our view, of the few undervalued opportunities that remain in the marketplace, more can be found in the sectors that would be bolstered by nontraditional infrastructure spending.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)