5 Underperforming, and Undervalued, Stocks in Q2

These stocks struggled in the second quarter but are also trading at bargain prices.

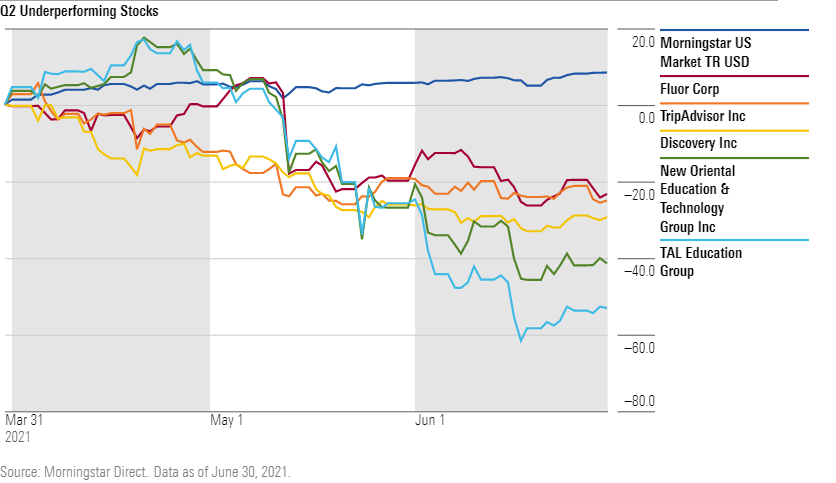

U.S. equities rallied during the second quarter of 2021, leaving fewer undervalued stocks for investors to consider. However, some names on the list of stocks covered by Morningstar analysts slumped, creating openings for value-oriented investors.

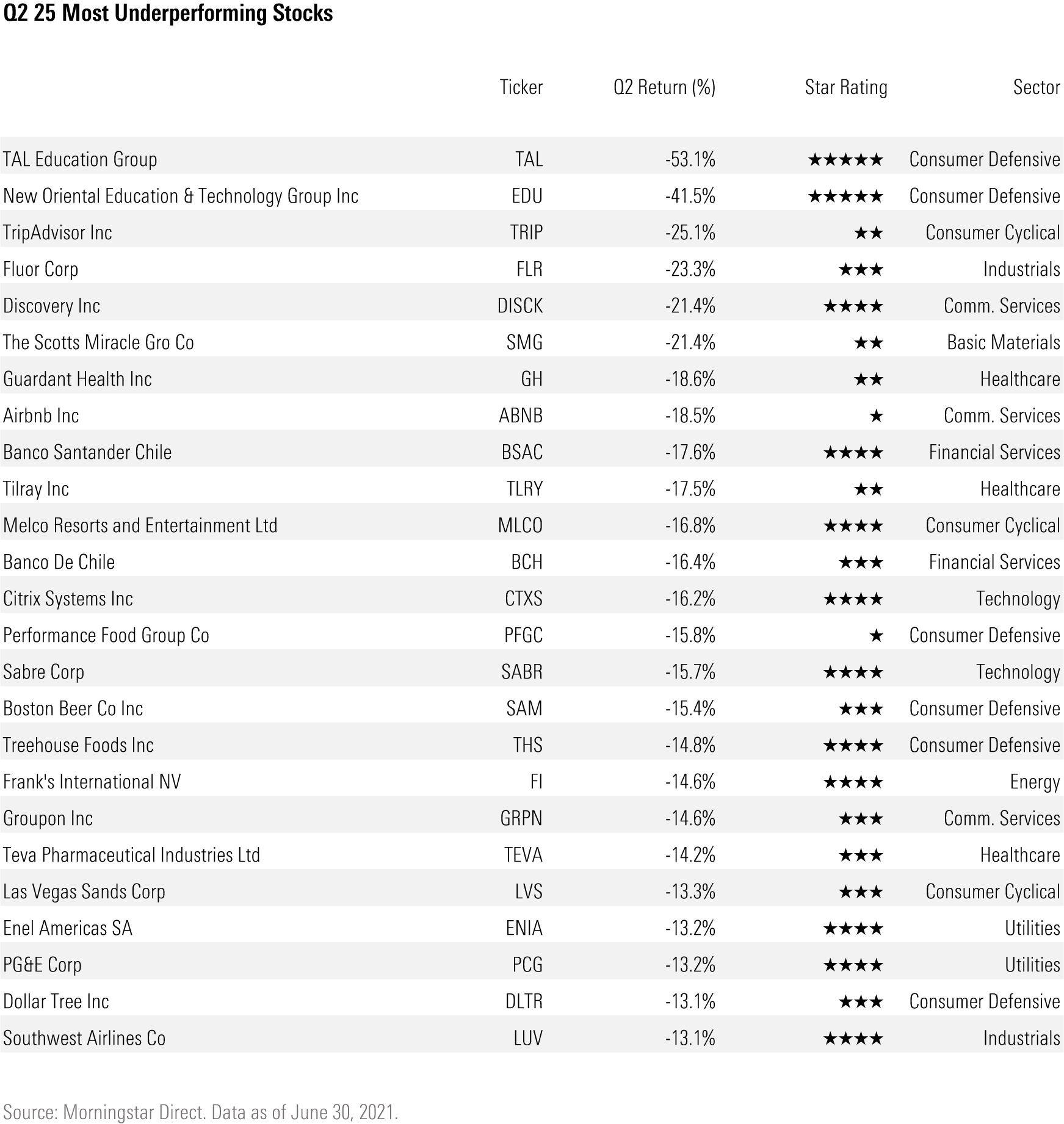

For this article, we screened from among the 838 U.S.-listed stocks with Morningstar analyst reports for the shares of the 25 worst performers in the second quarter. Then we looked at how the share price now compares to our analysts' fair value estimates.

The full list of 25 stocks can be found at the end of this article, but here’s a look at the five worst performers.

Suffering the largest second-quarter decline among the stocks on the list was TAL Education Group TAL, which fell by 53.1%. Not far behind was New Oriental Education and Technology Group EDU, with a second-quarter loss of 41.5%. Both are major players in the afterschool educational resource market in China and took it on the chin amid news that the Chinese government plans to step up regulation of the industry. Streaming-media play Discovery DISCK posted the third-largest decline at 29.4%.

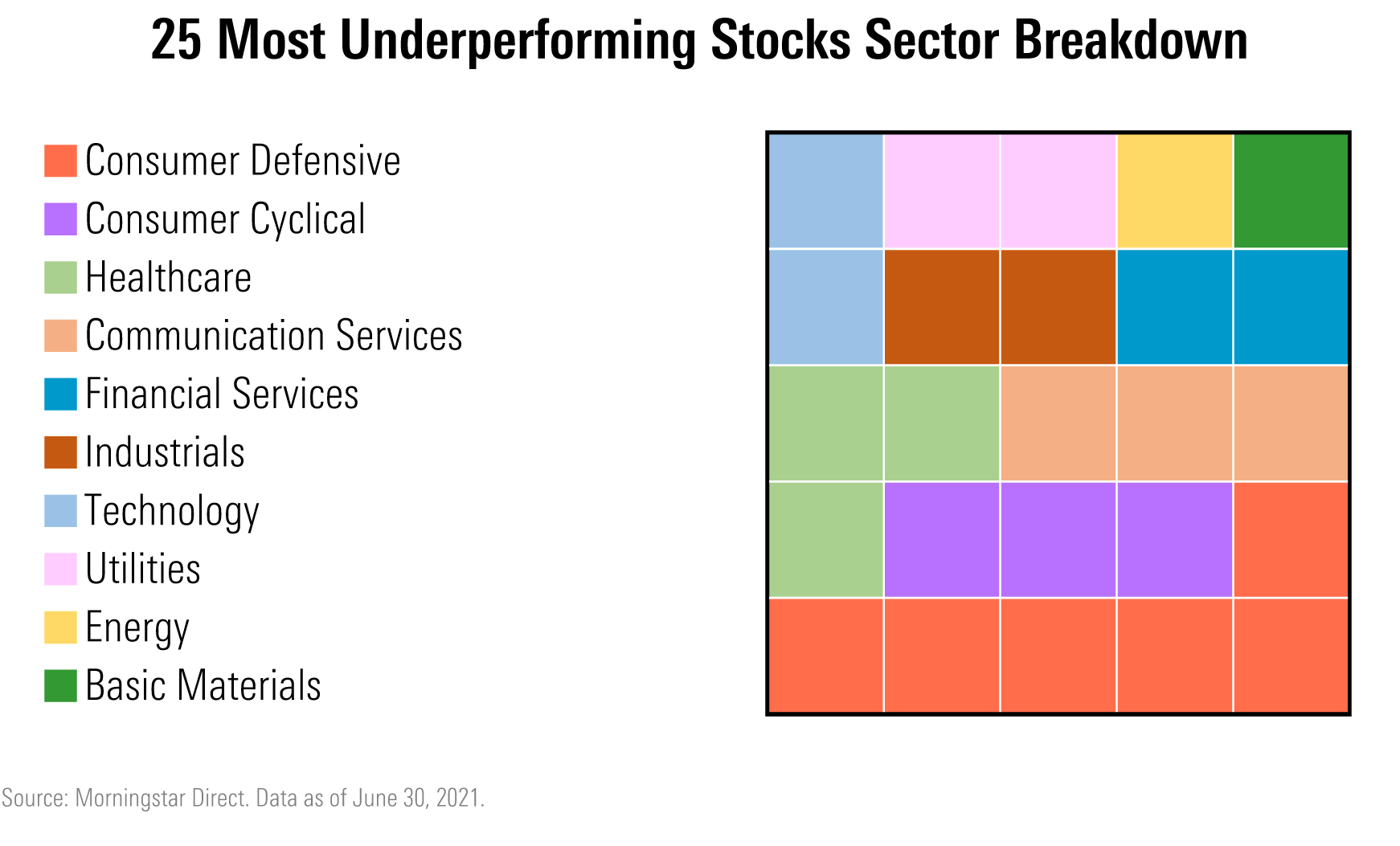

Pulling back the lens, the sector with the largest concentration of consumer defensive stocks makes up the bulk of the 25 worst-performing stocks in our coverage list for the second quarter.

When it came to valuations, for six of the stocks among the 25, the big declines didn’t dent their overvalued status. That included Airbnb ABNB, down 18.5%, TripAdvisor TRIP, down 25.1%, and Performance Food Group PFGC, down 15.8%. Those three remained well above our analysts’ fair value estimates.

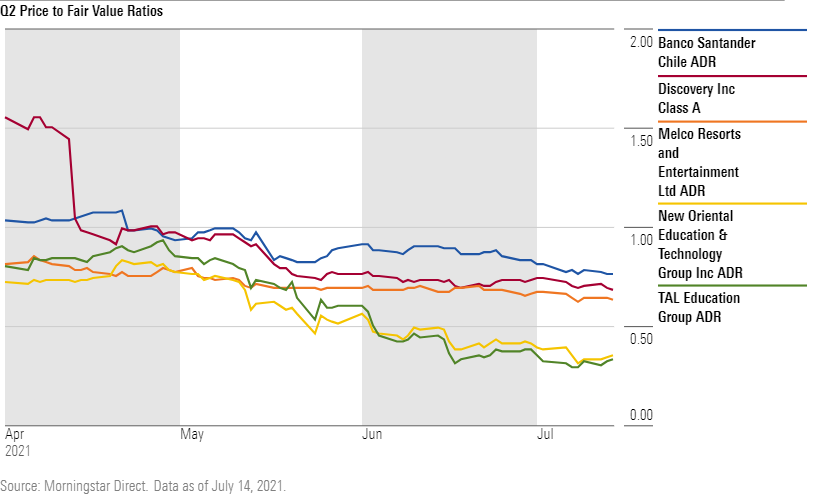

But for 12 of the names, the declines left them meaningfully undervalued compared with Morningstar’s fair value estimates.

The following five stocks were trading at the largest discount to fair value as of the end of the quarter:

After those second-quarter declines, TAL Education Group now trades at a 67% discount to its fair value, New Oriental Education & Technology Group is at a 65% discount, and Discovery is 32% below its fair value.

Two other stocks that appeared on our screen were Melco Resorts and Entertainment MLCO and Banco Santander Chile BSAC. Melco, which suffered a 16.8% loss in the second quarter, now trades 37% below its fair value. Banco Santander Chile holds a 24% discount, with most of the discount coming from its 17.6% loss in the last quarter.

Here’s what Morningstar analysts have to say about these five names:

TAL Education Group TAL "TAL Education demonstrated a narrow moat rating for its intangible assets with its strong brand reputation as a leading afterschool tutoring operator in China with premium ASP over its industry peers and with favorable government policy support. We see TAL has established the means and scale to manage its teaching resources and curriculum well.

"With China’s plans to regulate the afterschool tutoring sector, the market has speculated possibly banning the business for weekend and summer vacation services. However, while the market is panicking, we do not see the government going to the extreme. We expect share prices to be violate in the near term but currently see TAL as attractive.”--Jenny Tsai, senior equity analyst

New Oriental Education & Technology Group EDU "New Oriental Education, or EDU, is a large-scale leading provider of private tutoring in China. EDU offers a diversified portfolio of educational programs, services, and products to students in different areas. A key tenant of EDU's strategy is to improve operational efficiency in the near term. We believe that EDU will continue to open new learning centers each year. EDU is guiding 20%-25% year-over-year growth per year for its learning center capacity for the next three years.

"We assign EDU a narrow moat rating due to its intangible assets with its strong brand reputation and also EDU is one of the very few providers able to charge its students a 20%-30% price premium over the majority of its peers as a leading afterschool tutoring operator in China with favorable government policy support.

"With China’s plans to regulate the afterschool tutoring sector, the market has speculated possibly banning the businesses for weekend and summer vacation services. However, while the market is panicking, we do not see the government going to the extreme. We expect share prices to be violate in the near term but currently see EDU as attractive.”--Jenny Tsai, senior equity analyst

Discovery DISCK "Discovery Communications produces and owns unique content with proven appeal to audiences across cultures and languages. This transnational appeal provides the company with the ability to repurpose the content across multiple platforms and international borders. Discovery recently entered the streaming landscape with its Discovery+ service. We expect that the service will help offset the cord-cutting challenges to distribution and ad revenue growth in U.S. as well as spark additional growth internationally."--Neil Macker, senior equity analyst

Discovery also announced a merger with WarnerMedia during the second quarter of 2021. “We think the deal provides Discovery with the scale and resources necessary to compete with Disney DIS, Netflix NFLX, and NBCUniversal,” says Macker.

Melco Resorts and Entertainment MLCO "We believe the gambling market in Macao will enjoy solid growth in the longer term. This structural tailwind is driven by the rising middle class in China and the penetration rate of less than 2% in Macao, compared with Las Vegas' 13%. With the gradual ramp-up of traffic allowed on the Hong Kong-Zhuhai-Macao bridge, new Hengqin border and the Gongbei to Hengqin extension rail, Macao's carrying capacity for tourists would increase. In addition, neighboring Hengqin Island, 3 times the size of Macao, is under rapid development to complement Macao's growth.

"As one of only six concession holders to operate casinos in Macao, Melco Resorts is ideally placed to benefit from this market dynamic, given its portfolio of properties catering to both mass-market and premium-end patrons.”--Jennifer Song, equity analyst

Banco Santander Chile BSAC "Banco Santander Chile's current weak performance is likely being driven by Chile's political uncertainty. Between 2019 and 2020, a series of riots resulted in the country starting to rewrite their constitution. On May 16, 2021, elected members of the constitutional convention stoked concerns that the new constitution would be less business-friendly. However, it's important to keep in mind that the May election has no tangible impact on Banco Santander Chile yet and likely won't for quite some time. In the meantime, Banco Santander Chile's business has continued to perform strongly despite the political uncertainty since 2019 and the impact of COVID-19. Return on equity has consistently been in the mid- to high teens.

"The bank has used new technology initiatives to maintain growth while keep its cost structure lean with the company offering new mobile applications, person to person payment, and a digital insurance broker.”--Michael Miller, equity analyst

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)