Now Might Be the Time to Reconsider Liquid Alternatives

Liquid alternatives have largely been an asset-allocation disappointment, but they may finally get a chance to shine.

Liquid alternatives may have gained investors' attention and cash in the mid-2010s, but, for the most part, they've underwhelmed because of their complexity, high fees, and lackluster performance.

These hedge-fund-like vehicles in a daily liquidity fund package encompass a wide range of strategies that try to achieve a variety of goals, but many claim to offer diversification from traditional market risks.

Providers and users may have set unrealistic expectations for these strategies. But amid uncertainty about the course of inflation and rising interest rates, it may be time for investors to reconsider liquid alternatives for their portfolios--provided they can keep their expectations realistic. We further explore their potential in the 2021 Global Liquid Alternatives Landscape. (Morningstar Direct clients can download the full paper here.)

The Challenges Facing Liquid Alternatives

Investing in anything other than U.S.-biased 60/40 portfolio over the past 10 years would have likely resulted in comparative underperformance. Both stocks and bonds have been historically strong during this period, while also being largely uncorrelated with each other. Several factors spurred this success, especially the several-years-long low-interest-rate environment.

Conversely, suppressed rates have been a headwind for many liquid alternative strategies. This is because they tend to benefit from higher interest rates, elevated volatility, and trending markets, which have been largely missing for much of the past decade.

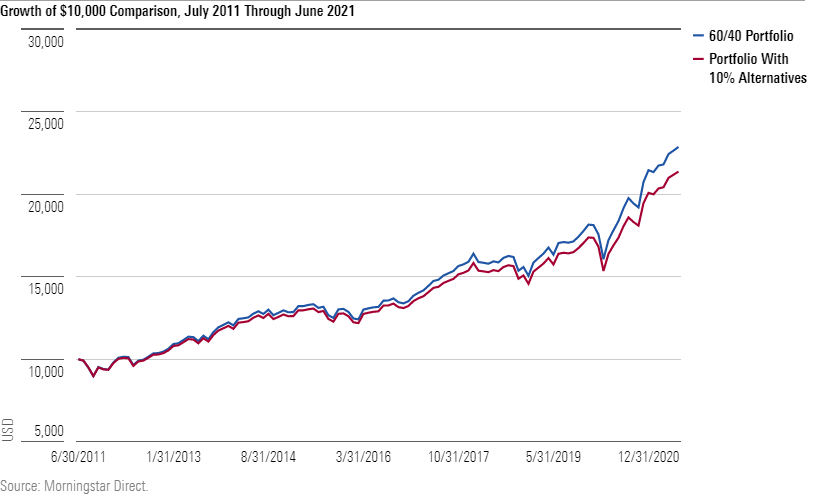

In the chart below, we compare the growth of $10,000 invested in a 60/40 portfolio (60% Vanguard Global Equity VHGEX, 40% Vanguard Total Bond Market Index VBTLX, rebalanced monthly) to one with a hypothetical 10% pro-rata allocation to the average return of the multistrategy Morningstar Category. The portfolio with alternatives clearly underperforms, but more telling is the weaker risk-adjusted returns--which these funds were supposed to improve. The 60/40 portfolio has a 10-year Sharpe ratio of 0.94 versus 0.92 for the portfolio with alternatives.

In addition to the market environment, several other factors have contributed to liquid alternatives' difficulties during the past decade:

- Fund complexity: While not desirable in mutual funds, complexity is often a feature rather than a bug among liquid alternatives. Some funds can tap into the most exotic financial instruments, such as variance swaps, options structures, or VIX futures. This creates additional challenges for fund selectors.

- Regulatory constraints: Good regulatory intentions can pose challenges for liquid alternatives. Whether it's former hedge fund managers adapting their processes or multi-asset managers expanding their capabilities, most liquid alternatives managers are inhibited by UCITS or 1940 Act rules and constraints.

- Style: The underperformance of risk factors common to liquid alternative funds in recent years has been a headwind.

- Investor returns gap: The difference between investor returns and reported total returns can be taxing on investors, especially in liquid alternatives. Flows often pursue the next fancy new strategy, only to flee once performance stalls.

- Diworsification: A prolonged bond bull market and strong decade for equities penalized anyone who diversified away from a traditional 60/40 portfolio--diversifying for the worse, or "diworsification."

Opportunity on the Horizon for Liquid Alternative Investors

All this said, liquid alternatives purveyors have learned some lessons over the past 10 years.

More recent launches (and those that have managed to build long track records) have featured more-investor-friendly strategies, relatively lower fees, and new ways of accessing uncorrelated risk premiums. These improvements could help investors stick with alternative strategies.

Liquid alternatives' promise of positive, less correlated returns may become more valuable if stock and bonds struggle to offer the same diversification benefits and returns in less accommodating market regimes. The inherent flexibility to mitigate, diversify, or eliminate traditional risk exposures, incorporate broader asset types like currencies or commodities, or take advantage of falling markets may help investors derisk their equity holdings.

As mentioned, classic 60/40 stock-bond portfolios have served investors well in a period of expansive central-bank policies and low interest rates, but those conditions will not always prevail. Investors accustomed to a near-double-digit return each year for the past decade will need to recalibrate their expectations. Elevated stock prices, rising interest rates, and resurgent inflation are all results of the huge rebound from March 2020 lows.

How to Incorporate Liquid Alternatives Into a Portfolio

Liquid alternative results vary widely, so choosing an average or below-average strategy will lead to vastly different portfolio outcomes. To strengthen investors' manager selection tools, Morningstar redefined its alternative categories in April 2021.

Measuring alternatives' success also requires a more nuanced approach: There are often no passive options available and the strategies often prioritize diversification and minimizing losses over maximizing gains.

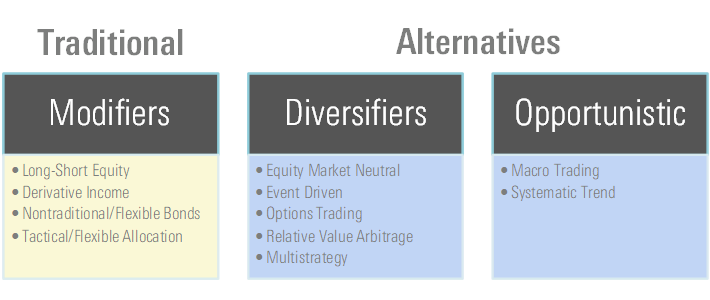

As investors think about liquid alternatives' role in their portfolios, they can loosely group strategies by their objectives, volatility profile, and targeted risk components. The following table suggests one such group scheme. Investors may find strategies in all three buckets that meet their needs because the groups' attributes are not mutually exclusive.

Source: Morningstar.

The strategies that are considered "modifiers" are not alternatives since they still rely on traditional market exposures like equity, credit, and rates. Modifiers are still correlated with common risk factors but use shorting and/or derivatives to temper losses in struggling markets. As a result, they tend to lag in bull markets. Investors seeking to maximize their risk-adjusted returns with a lower overall market exposure might consider funds from the categories in the modifiers group.

To assess manager success among modifiers, consider a long-short equity or derivative income strategy's ability to:

- Deliver alpha versus a relevant equity benchmark, or

- Produce competitive risk-adjusted returns according to measures like the Sharpe ratio.

The "diversifiers" not only take the common risks in equity and bond markets but aim to broaden those risks by increasing the use of nontraditional or alternative risk factors/betas to find more-diversified sources of return. Nontraditional betas target volatility, carry, market-neutral value, or defensive factors--some of the risks commonly found in hedge fund portfolios--in a long-short, typically market-neutral fashion. In the short term, the benefits of this risk diversification may vary, and the strategies can lose money.

Correlations between the nontraditional and common risk factors can be high, especially during periods of elevated uncertainty as shown in the chart below. In other words, they most likely won't protect capital during market crashes.

In the long run, this group of strategies can help portfolios. With generally low equity sensitivity, these strategies should still temper losses while adding value elsewhere.

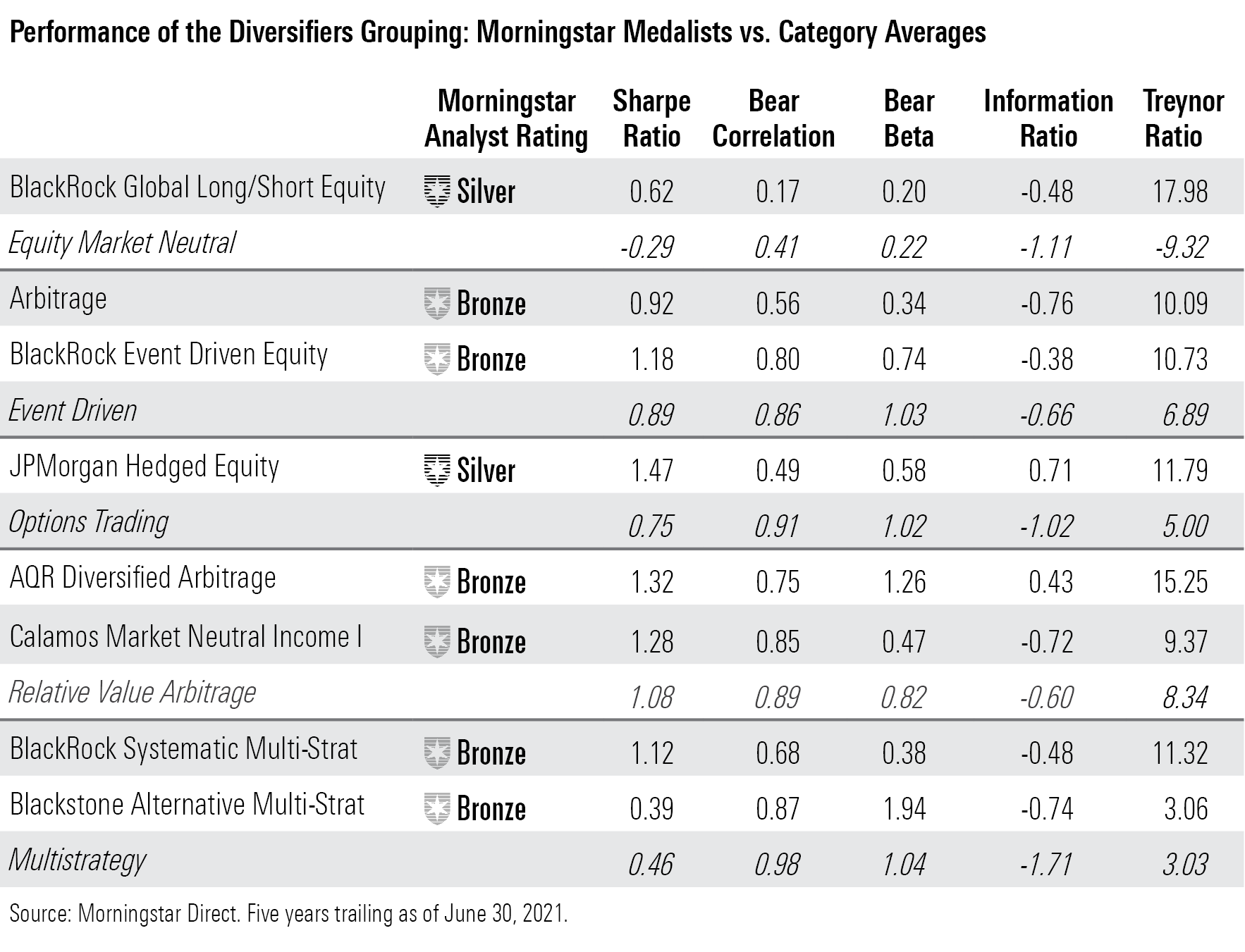

Some metrics to measure success here include downside correlation and beta statistics along with information ratio and Treynor ratio, a measure of how much additional return generated per unit of market risk.

The following table shows these stats for the five-year trailing period ended June 30, 2021, for the Morningstar Medalists in the diversifiers group versus their respective category averages. Beta, correlation, and ratio statistics were calculated using the Morningstar Moderately Conservative Target Risk Index.

Finally, "opportunistic" strategies tend to focus on absolute returns, or positive returns in all markets, and focus more on capital preservation. They move in and out of long and short positions as opportunities arise and tend to lose less in drawdowns, but they also come with more complexity. They can get caught out of step, so they often use sophisticated risk management systems to manage their many exposures.

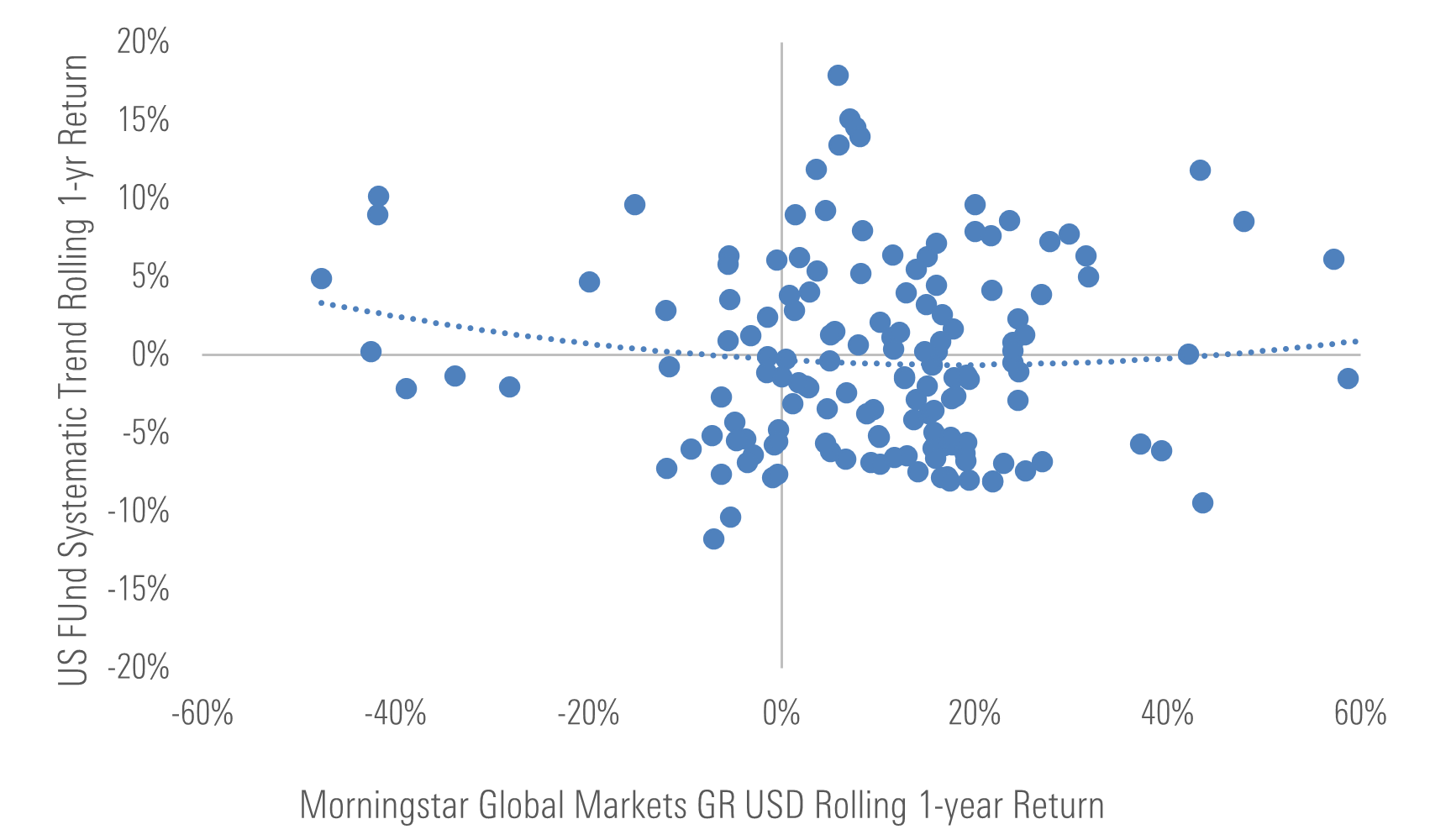

Opportunistic strategies may be systematic or discretionary, generating positive returns in ugly markets by tilting into favorable asset classes and securities or shorting less attractive asset classes and securities. As seen in the chart below, some of these strategies also can reverse market betas and exhibit positive beta in up markets and negative beta in down markets.

Average Rolling 12-Month Return of Systematic Trend vs. Global Equity Markets, January 2008 Through May 2021)

Source: Morningstar Direct.

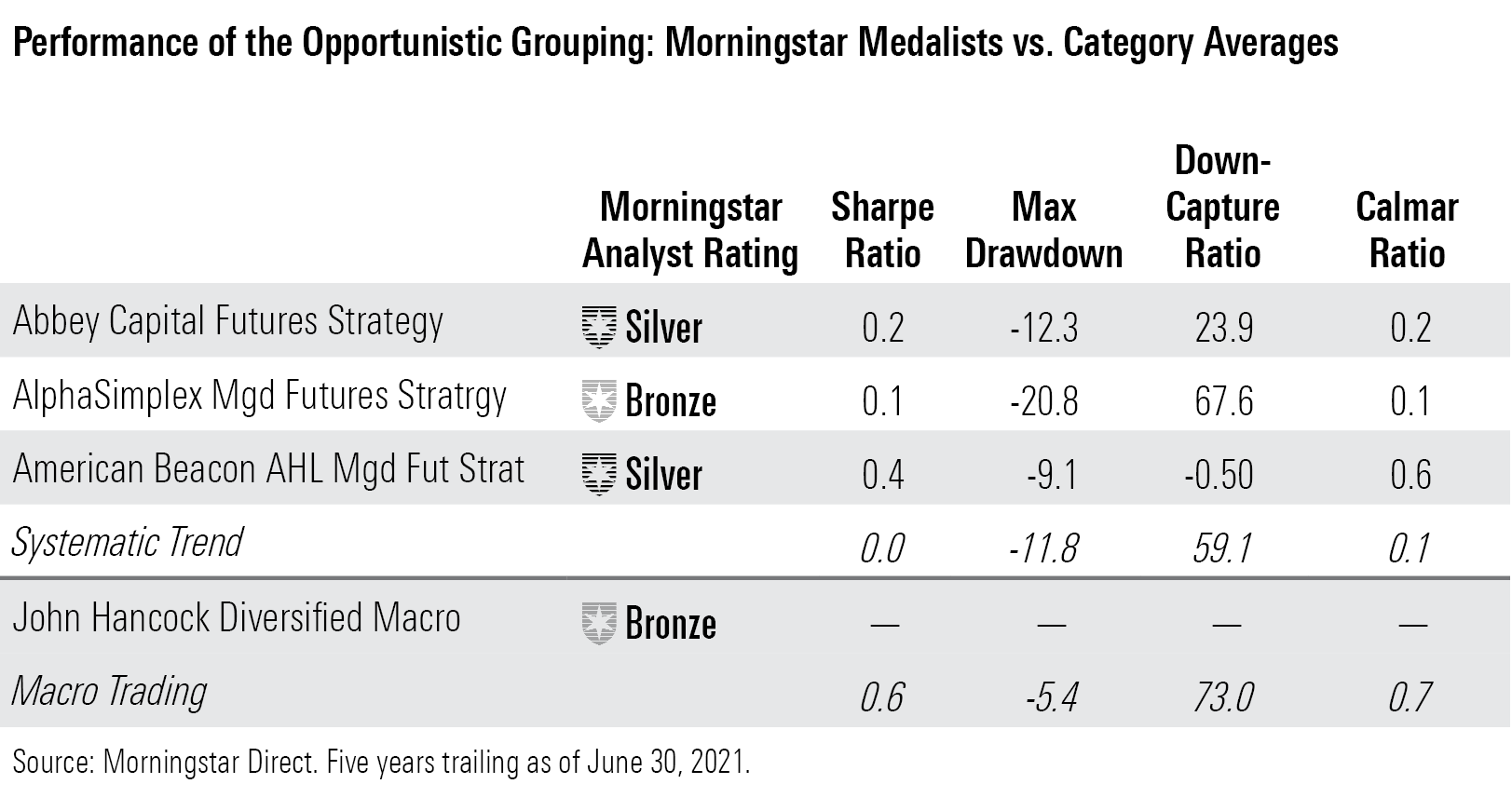

Since capital protection is one of these strategies' key features, some useful return measures for opportunistic strategies include maximum drawdown, downside capture ratio, and the Calmar ratio, which compares a strategy's return to its maximum drawdown.

The following table shows these stats for the five years ended June 30, 2021, for medalists in the opportunistic group versus their respective category averages.

Liquid Alternatives Are Ripe for the Picking

Liquid alternatives have been out of favor for several years after their initial popularity. However, like all investment styles and approaches, they likely won't remain out of favor.

Purveyors have learned some important lessons that could make the recent generation of alternative strategies easier to hold in or out of season. For investors considering dipping their toes into liquid alternatives, Morningstar's revamped categories and three-bucket framework for fitting them into portfolios can be helpful for choosing good long-term holdings and using them responsibly.

Thinking in terms of modifiers, diversifiers, and opportunistic strategies is just the starting point for narrowing down liquid alternative options: Manager selection matters, too. We'll explore this area further in coming months.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)