Advisor 529-Plan Landscape: Direct-Sold Plans Gain Favor

Advisors are increasingly favoring cheaper direct-sold 529 plans, and advisor-sold plans are adapting to keep up.

As financial advisors have shifted toward fee-based practices, there has been a spillover effect in their choice of 529 plans: stepped-up usage of direct-sold 529 offerings and less interest in more expensive, traditional advisor-sold funds.

One key reason for this is that advisors who have a fee-based business model have greater flexibility to choose the best plan available for their clients, regardless of the distribution channel.

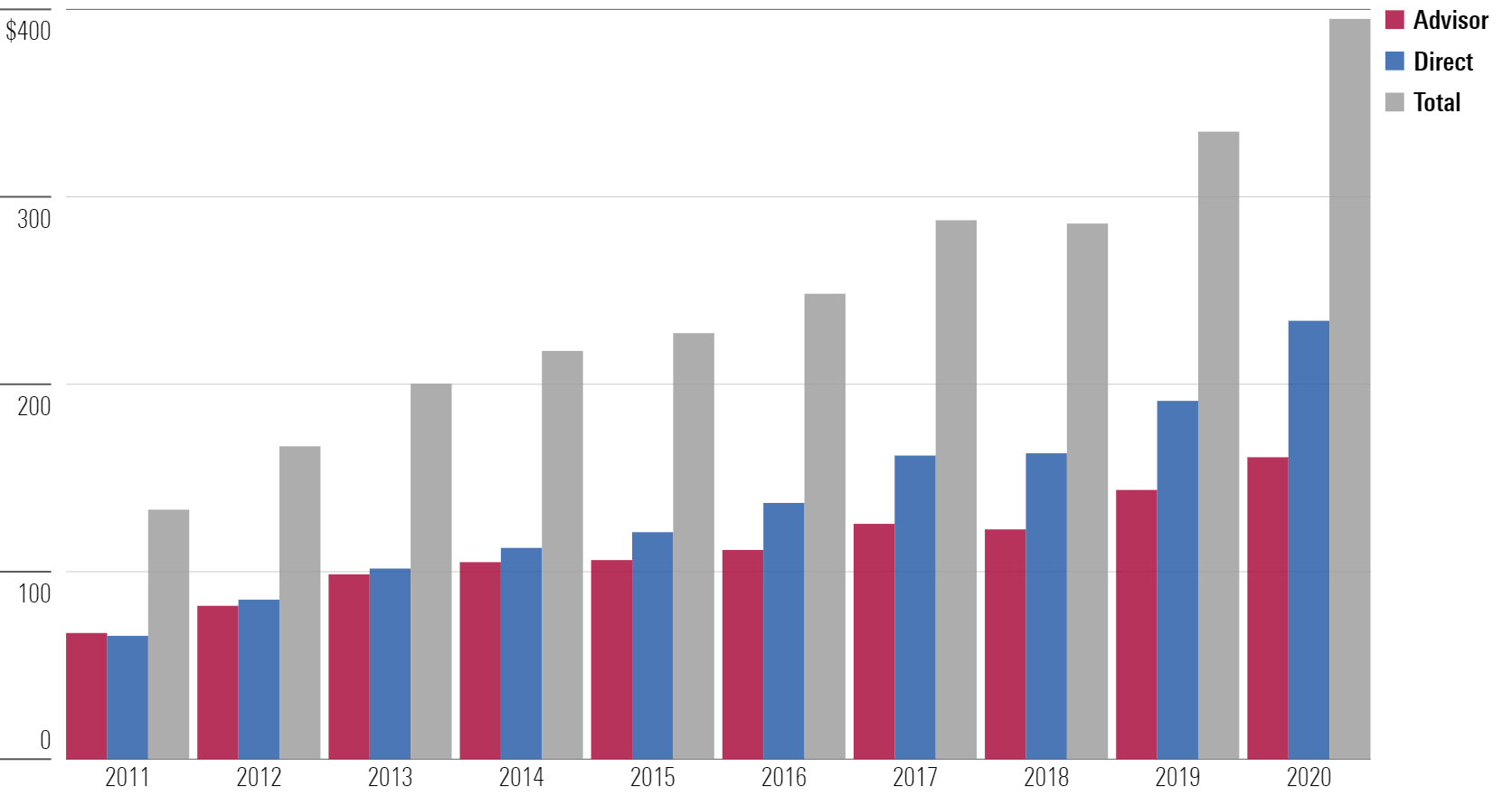

As a result, cheaper, direct-sold 529 plans have become increasingly popular with cost-conscious fee-only financial advisors. On average, direct-sold plans grew by 15% per year from January 2011 through December 2020, while advisor-sold plans (mostly offered by commission-based advisors) grew by a healthy but more modest 10% over the same period.

Here, we take a closer look at how advisor-sold and direct-sold 529 plans have evolved in that time. (Morningstar Direct and Office clients can also find the 2021 529 Savings Plan Landscape report here.)

Why Are Fees for Direct-Sold 529 Plans So Much Lower?

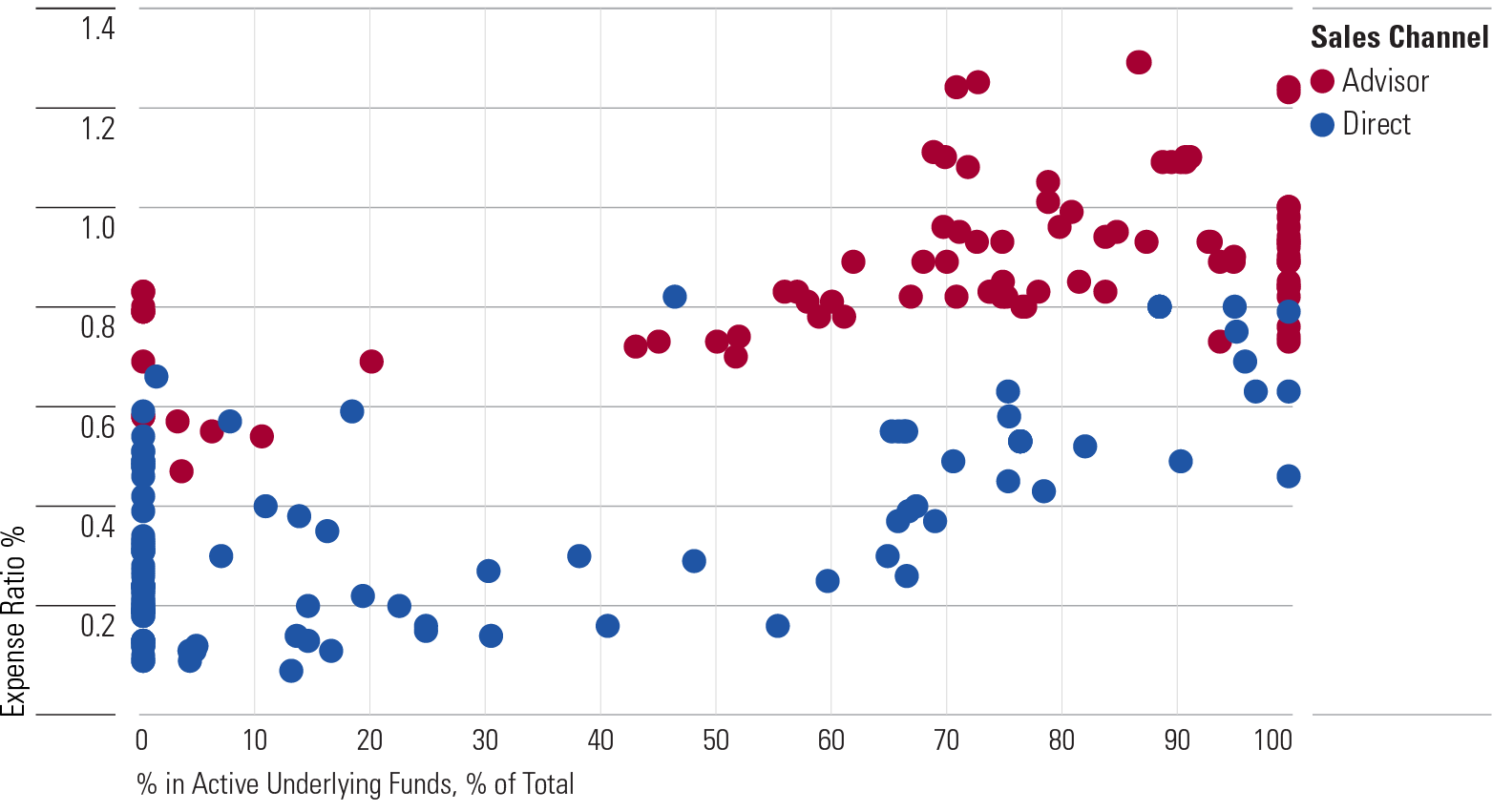

Even as overall assets in 529 plans have grown, there’s still a wide gap between fees charged for direct-sold and advisor-sold plans. For an age-based portfolio, the most popular investment option for college savers, the average fee in direct-sold 529 plans was 0.35% at the end of 2020 as compared with 0.89% in advisor-sold plans.

There are a two primary reasons for this fee gap:

1. Plans sold through an advisor cater specifically to financial advisors who receive commissions based on the funds their clients invest in. These commissions tend to drive fees higher in advisor-sold plans’ age-based portfolios, regardless of the type of underlying funds the portfolios use.

2. There are differences in the types of funds typically found in advisor-sold versus direct-sold age-based portfolios. The teams behind advisor-sold plans tend to favor actively managed funds--which charge higher prices--while direct-sold age-based options heavily favor low-cost index funds. The chart below plots age-based portfolios according to their average total expense ratio and their average percentage of underlying funds that are actively managed.

The tracks plotted at the top right of the chart, which include age-based portfolios with higher fees and a higher use of actively managed funds, are more often distributed through advisors. Because advisor-sold plans include fewer options that track indexes, investors in those plans often end up with the higher-cost options.

Rating Advisor-Sold and Direct-Sold 529 Plans Direct-sold 529 plans are adapting their lineups to attract fee-based advisors, increasing their comparability to advisor-sold plans. For instance, Utah's my529 has a web portal for fee-based advisors and has adapted its lineup by adding customizable options, which gives advisors greater flexibility without clogging their lineups with static options that might confuse do-it-yourself investors.

As direct-sold 529 plans become more flexible, some advisor-sold plans--including a duo of advisor-sold plans with Morningstar Analyst Ratings of Bronze--have added share classes free of embedded commissions to stay competitive.

Ohio’s BlackRock CollegeAdvantage 529 Plan rolled out an institutional share class since 2019, charging 0.17% for an S&P 500 exchange-traded fund that rivals the cost of many direct-sold options. In 2020, Virginia’s Bronze-rated CollegeAmerica Plan expanded its lineup of F-2 and F-3 share classes for fee-only advisors, which also strip out distribution and 12b-1 fees and can cost as little as 0.25%. CollegeAmerica also offers an F-1 share class to fee-only advisors that does overlay commission fees.

Meanwhile, Illinois’ Bronze-rated Bright Directions Advisor-Guided 529 Plan has offered ETFs and mutual funds through an F share class available to fee-only financial advisors since 2012. The F share offers well-regarded Vanguard index-tracking strategies across the stock and bond universes, though it’s important to note that commission-free doesn’t always mean fee-free: Illinois’ ETFs do come at a steep 0.17-percentage-point premium to the cost of the underlying funds, most of which goes to the program manager, Union Bank & Trust.

Another ripple: In July 2020, we enhanced the methodology used to evaluate 529 plans. Because we're aiming to identify plans that will outperform peers, and price is a strong predictor of future performance, our enhanced methodology removes the distribution channel as an item of consideration and instead compares all plans' fees versus one another. Just as a plurality of advisors can pick a best-of-breed plan for their clients and no longer have to settle for the cheapest option in an expensive lot, our ratings do the same.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/s3.amazonaws.com/arc-authors/morningstar/bdf88cbd-d3d8-4661-b946-d09f9ffe196b.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/bdf88cbd-d3d8-4661-b946-d09f9ffe196b.jpg)