Integrating Sustainable Investing: The Landscape of Opportunities

We’ll highlight the most popular approaches to sustainable investing, grouped by asset class.

The following article is part three of a series of excerpts from the Morningstar Research report, "Integrating ESG Into Your Client's Portfolio," available to Morningstar Office and Direct clients here.

By now you’ve identified your (or your client’s) individual priorities when it comes to sustainable investing. You’ve dissected the sustainability profile of your existing portfolio. And you’re ready to start making changes. But as environmental, social, and governance investing has evolved beyond the socially responsible investing strategies of the late 20th century, in many ways it has become more confusing. Each quarter, more and more “sustainable” investment products hit the market, and those launches are often accompanied by accusations of "greenwashing." What’s an investor to do?

Putting Philosophy Into Practice

To help make sense of the sustainable funds landscape, we’ll highlight the most popular approaches to sustainable investing, grouped by asset class. We’ll talk through the ins and outs and the pros and cons of each. This section begins with exclusionary screening, which is one of the most common approaches to sustainable investing because it can be implemented in every fund type. Following those negative screens, we’ll examine the various sustainability approaches that are used in active equity funds, passive equity funds, core and core-plus bond funds, and thematic funds. This order reflects the availability of each fund type, as measured by assets under management as of May 2021.

Eliminating the Bad

Most, though not all, sustainable funds employ some level of exclusions in determining the investable universe. Common exclusions in the United States include gambling, alcohol, pornography, civilian weapons manufacturing, tobacco, and fossil fuels. Some of these screens, such as gambling, alcohol, and pornography, are more common in funds labeled “socially responsible,” “faith-based,” or “values-based” investing strategies. Values-based investing strategies are typically aligned with a specific set of morals or ethics, such as Catholic funds or Shariah-compliant funds.

By contrast, some exclusions are driven more by the financial prospects of a sector or business category than by a predefined set of morals. For example, some fund managers choose to screen out the energy sector because they view businesses in that sector to be economically challenged in the future. This is based on a concept called financial materiality. Another driver behind exclusions may be the regulatory environment in which the fund is distributed. Funds distributed in the European Union, for example, are prohibited from investing in companies that derive more than 25% of revenue from the production of civilian weapons.

Exclusions are important to understand because they can be implemented in all strategy types. Many funds that don’t claim to pursue a sustainability mandate still screen out one or two categories of controversial businesses. Some asset managers implement firmwide exclusions. Since 2020, BlackRock, for instance, has banned actively managed funds from investing in companies that derive more than 25% of revenue from thermal coal production.

By implementing negative screens, a fund manager is deliberately narrowing the investable universe. This has historically been a common argument against ESG investing because by limiting the opportunity set a manager may be limiting the fund’s potential for outperformance. However, all investors screen their investment universes, not just sustainable or values-based investors. Value equity managers, for instance, screen out expensive companies, and growth managers exclude slow-growing companies.

Regardless of what a manager screens out from the benchmark, exclusions tilt the portfolio toward one style or another. In the same way investors should manage their portfolios' exposures to certain factors, it is prudent to monitor the portfolios' exposures (or lack thereof) to specific industries and sectors. For example, because energy stocks have historically provided a hedge against inflation, a fossil-fuels-free portfolio may take additional measures to protect against inflation.

Next, we’ll take you through the rest of the portfolio-construction process, highlighting pros and cons of the opportunities in different asset classes.

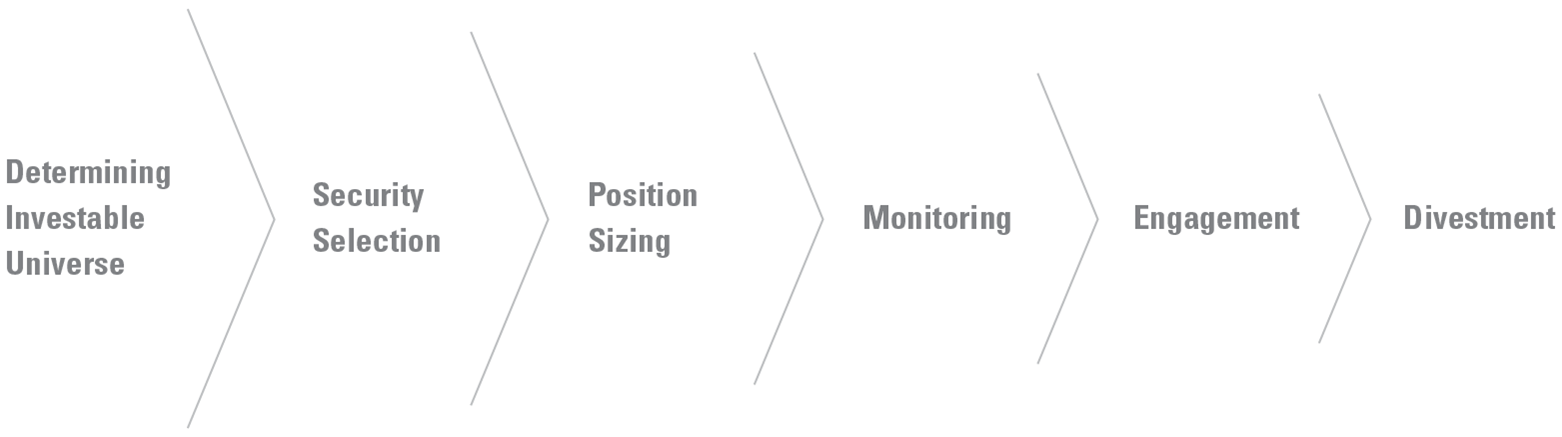

Emphasizing the Good: Active Equity Funds Of all asset classes, actively managed equity funds have the most opportunities for integrating ESG considerations. The process commonly begins by narrowing the investable universe through controversial business screens. From there, the portfolio managers choose securities, typically based on a combination of financial prospects and fundamental sustainability research. Sustainability research may take into account ESG data from third-party providers as well as proprietary analysis. From there, holdings are optimized according to various objectives. Sustainability criteria can be a driving factor here, too, in what is often termed a “best-in-class” approach. This approach typically seeks to maximize a fund’s overall sustainability profile by more heavily weighting the most impressive securities from an ESG perspective.

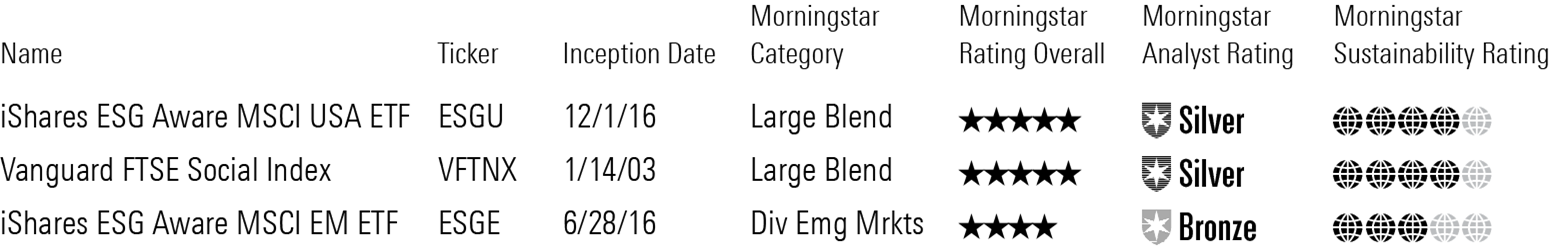

A More Hands-Off Approach: Passive Funds

The choice between active and passive exposure is always an important consideration in portfolio construction. Where active managers seek to outperform the market benchmark, passive managers run a rules-based approach that seeks to deliver returns on par with the broad market. The dilemma within sustainable funds is the same, with the added complication of ESG data. Unlike market-cap-weighted stock indexes, there's no widely agreed upon definition or standard for sustainable indexes. Rather, different index providers will have different house views on ESG data.

Passive sustainable funds can be more like traditional index funds that tilt toward a style, market cap, or region, or they can resemble strategic-beta funds, which apply fundamental criteria systematically. Like traditional index funds, these funds are often based on backward-looking data, so they can look out of step when the market takes abrupt twists and turns. As always, it’s key to understand what you own and how it fits into the broader portfolio. As of May 2021, actively managed sustainable funds retained the majority (roughly 60%) of U.S. sustainable fund assets, but their market share is shrinking. Three years ago, active funds held 82% of all U.S. sustainable assets. A few sustainable passive options are shown below.

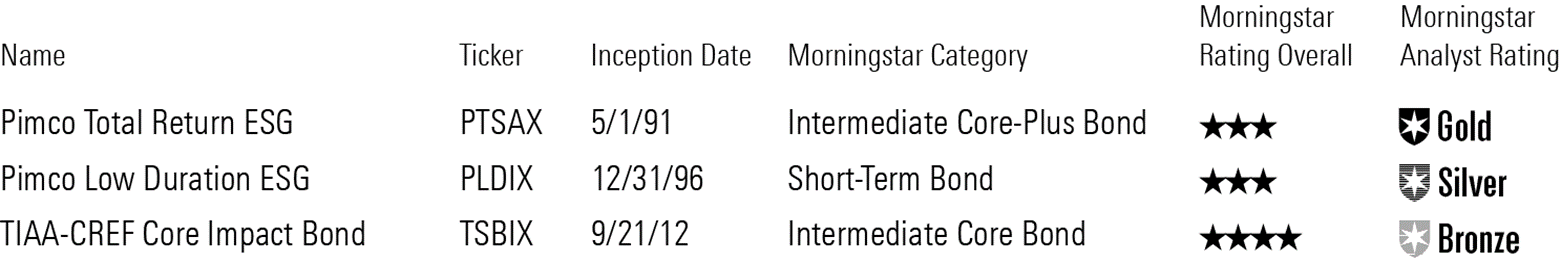

The Challenges Facing Fixed-Income Funds

Sustainable fixed-income funds tend to face greater challenges than their equity peers for many reasons. We’ll address the two main issues here.

First, except for corporate bonds, developing a framework for evaluating sustainability in debt instruments is more complicated than in equities. There are different disclosure requirements for companies issuing debt versus those issuing stock, which can lead to reduced transparency for bond investors.

In sectors such as securitized or sovereign debt, there are multiple entities and sometimes few (if any) ESG alternatives. For example, investors in agency mortgage-backed securities can choose among Fannie Mae, Freddie Mac, or Ginnie Mae, each of which are either implicitly (Fannie Mae and Freddie Mac) or explicitly (Ginnie Mae) backed by the U.S. government. Many nongovernment entities sponsor asset-backed securities linked to credit card debt or commercial mortgage-backed securities linked to malls and hotels. Besides choosing among them, ESG investors must decide whether to analyze the sustainability of the sponsor, the underlying pool of collateral, or both.

Government ESG evaluations offer an additional hurdle. Government bonds, including ubiquitous U.S. Treasuries, directly or indirectly back activities to which values-based investors may object, such as building military weapons or providing access to contraceptive healthcare. Each country’s power grid and infrastructure program still depends to some extent on fossil fuels, so it’s practically impossible for sovereign bond investors to claim zero exposure to these sectors.

The second challenge to investors is that sustainable bond strategies tend to differ significantly from the market benchmarks. In general, sustainability-challenged sectors occupy larger positions in bond benchmarks than they do in most equity benchmarks. For example, as of April 2021, U.S. Treasuries, which have little default risk but a complicated ESG profile, represented roughly 40% of the Bloomberg Barclays U.S. Aggregate Bond Index, the most popular benchmark for core bond funds. Any values-based portfolio that shuns Treasuries would diverge from its benchmark and court more credit risk, a trade-off many bond investors don't want to make. Additionally, as of May 2021, energy made up roughly 13% of a widely used high-yield bond benchmark, the ICE Bank of America U.S. High Yield Index. Any high-yield ESG bond fund that screened out energy would perform very differently from its benchmark and peers and might be hard for many advisors to recommend.

The Bright Side of Bond Funds

Fixed-income funds, however, hold a significant advantage over equity funds in impact investing. Unlike equity instruments, debt securities can be earmarked for specific projects and initiatives, more directly linking an investor’s capital to sustainable outcomes. Options to invest in bonds ostensibly funding sustainable projects have increased since the European Investment Bank issued the first Climate Awareness bonds in 2007 and the World Bank followed up with its own Green Bond in 2008. Although some have questioned the sincerity and efficacy of these instruments, their ranks have grown, including blue bonds, social bonds, and sustainability-linked bonds. As of April 2021, the estimated size of the global green bond market was $1 trillion USD; there are roughly 80 distinct impact-oriented bond funds globally, but the segment is growing.

Many impact-oriented bond funds design their investment processes around the United Nations Sustainable Development Goals, a set of 17 interconnected objectives with measurable, achievable targets. For example, TIAA-CREF Core Impact Bond TSBHX is one of the purest impact bond strategies out there. Management allocates part of the portfolio to bonds aligned with two Sustainable Development Goals: No Poverty and Sustainable Cities and Communities. In this part of the portfolio, management buys bonds related to low- and moderate-income housing loans, transit-oriented development, and walkable communities. Impact investing is still a niche investment approach, so these funds may court additional liquidity, credit, and sovereign risk versus a more diversified core bond fund. However, as one piece of a well-diversified portfolio, these funds can be an effective way to articulate an investor’s specific goals around sustainability.

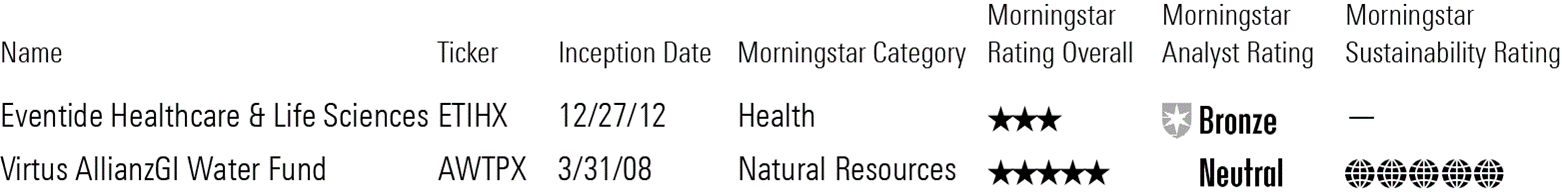

Getting Specific: Thematic and Sector Equity Funds

While equity funds remain at a remove from the direct impact achievable through bond funds, some thematic or sector funds can at least align their investments with such goals. Thematic and sector funds employ many of the same tools for integrating sustainability as their “best-in-class” ESG peers, but they tend to be more concentrated because they usually target companies aligned with specific sustainability themes. For example, healthcare fund Eventide Healthcare & Life Sciences ETIHX owns biotechnology companies that target rare-disease treatment and other unmet medical needs. Renewable energy or carbon transition funds, like BlackRock U.S. Carbon Transition Readiness ETF LCTU, target companies that score well on measures related to waste management and fossil fuel dependency. ESG criteria determine these funds’ investable universes, drive security selection and position sizing, and guide their interactions with the companies they own. The narrow focus of these funds, however, limits them to auxiliary roles in an investor’s portfolio.

Active Ownership

Sustainable investing doesn’t stop after security selection, though. There is an ongoing process for monitoring material risks and opportunities in the portfolio, both financial and ESG. In some cases, a firm’s risk management team flags any material changes to an underlying security’s sustainability characteristics, and the portfolio manager is then presented with a decision to adjust its size in the portfolio or remove it completely. Flagged ESG risks could be a result of shifting company fundamentals or could be tied to the regulatory environment in which a company operates. For example, while many ESG funds exclude tobacco companies as a matter of course, recent signals from the Biden administration may cause further divestment. In April 2021, the administration floated possible restrictions on the level of nicotine that can be present in cigarettes, which could eventually have an impact on tobacco companies’ profitability. Of course, these risks are always important to monitor, not just when they relate to sustainability topics.

Like activist investors who agitate for governance and capital allocation changes they think will increase the values of their investments, ESG investors can engage with the leaders of companies they own to lobby for sustainable policies and practices. This commonly entails writing letters to or meeting with board members and executives to discuss their strategies and goals. For instance, one large investor may push an aircraft engine manufacturer to invest in cleaner technology, or they may seek improved disclosures from a ride-sharing company about how it treats and compensates contractors and part-time employees. Large asset managers have an advantage here because their big stakes in portfolio companies command the attention of CEOs and directors. While this is the first and often preferred route for most big money managers, it’s also more difficult for the end investor to track than proxy voting, because fund companies don't have to disclose their engagements.

Escalation

When engagement fails, investors can escalate to proposing and voting on shareholder resolutions. Some large asset managers are reluctant to vote against company management, preferring to encourage improvement through conversation. Some managers intentionally invest in an index’s worst ESG companies and press them to adopt more sustainable practices. However, this approach can be difficult to execute and even more difficult to measure. In addition, the U.S. regulatory environment, which changes with presidential administrations and congressional majorities, affects fund managers’ ability to influence companies. For example, in September 2020, the SEC amended the shareholder proposal rule to raise the ownership threshold that investors must cross to propose shareholder resolutions. While the ownership thresholds may not significantly limit the engagement power of most money managers, the new rule disproportionately affects smaller asset managers and investors.

The final option, and one which most asset managers use sparingly, is divestment. If a portfolio company fails to achieve goals set through engagement, the fund manager may sell out of the company entirely. For example, a fund manager may want a company’s management to establish a plan for addressing material climate risk by a specific date. If the company doesn’t make sufficient progress, a manager may sell. This is a drastic step, but it effectively conveys the investment team’s lack of conviction in a company’s commitment to sustainability.

Another Challenge for Bond Funds

Compared with equity peers, fixed-income funds lack meaningful opportunities for active ownership. Because bond investors aren’t shareholders of a company, they can’t vote proxies, and they typically have greater difficulty convincing company management to engage on sustainability issues. In most cases, bond managers can still sell based on deteriorating sustainability criteria, but this practice is even less common than it is in equity funds, where it’s used sparingly. Rather, bond managers are typically limited to integrating ESG considerations in the earlier stages of the investment process: determining the investable universe, security selection, and position sizing.

/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Q7DQFQYMEZD7HIR6KC5R42XEDI.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FIN36RNGOFABFDS2NCP2RCCG3I.png)