The Promise and Peril of Ethereum

Ethereum has the potential to revolutionize the entire financial landscape, but this cryptocurrency is a high-risk investment asset.

If you're still getting up to speed on the cryptocurrency space, you've probably heard of Ethereum, which ranks as the second-largest cryptocurrency after bitcoin. Following in the footsteps of John Rekenthaler, I'll write this article with Morningstar's typical audience in mind--well-informed investors who own conventional securities, such as mutual funds and exchange-traded funds, but haven't yet added cryptocurrencies to their portfolios. This article will explain some of the basics of the Ethereum protocol; I'll discuss ether as an investment asset in my next article.

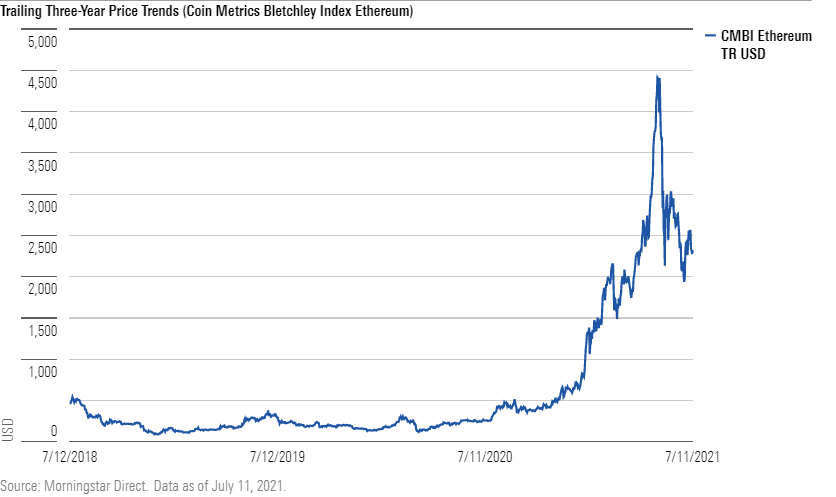

As the chart below illustrates, ether (the official name of the cryptocurrency) is an extremely volatile asset from an investment perspective, even compared with bitcoin. But Ethereum (the broader term for the protocol that enables decentralized finance applications through smart contract functionality) is worth knowing about because of its potential to revolutionize the entire financial landscape. That means even those who decide not to invest in ether will likely be affected by Ethereum in some way.

Ethereum 101

Ethereum is a decentralized network of computers envisioned as the next-generation version of the Internet (also known as Web 3.0). Founder Vitalik Buterin envisioned it as an open-source platform that can execute smart contracts without relying on a centralized institution as a trusted intermediary. It's designed to avoid many of the key shortcomings of Web 2.0: A handful of large companies control development systems and data centers, which limits development, centralizes trust, and introduces single points of failure. Ethereum is designed to execute contracts and transactions, which enables it to function as a platform for building and running software applications. Because its functionality is well-suited for financial operations, it's often described as programmable money, or, in Lyn Alden's apt description, as an operating system with a side of money.

Ethereum promises to revolutionize the entire financial system because of its potential applications in so many different areas. Here's a quick summary of some of the main use cases.

- Smart contracts: Ethereum allows people to set up terms of agreement with contracts that automatically execute when the terms are met, eliminating the need for intermediaries such as attorneys and banks.

- DeFi: This term refers to an entire field of decentralized finance applications, covering many key pieces of financial infrastructure that traditionally rely on intermediaries, including borrowing, lending, trading, settlement and clearing, insurance, asset management, commercial banking, real estate, and more. The value of assets held and traded in DeFi apps totaled about $53 billion as of July 1, 2021, based on data from DeFi Pulse. One popular DeFi app is Aave, a lending platform that allows ether holders to loan out their ether for a predetermined period and earn a fixed or variable interest rate. Uniswap is another widely used application that allows users to earn fees by providing liquidity to a market that exchanges ether with other cryptocurrencies such as stablecoins (digital currencies that are linked to a more stable underlying asset, such as notional currencies or gold).

- NFTs: Nonfungible tokens are digital forms of art (including videos, paintings, music, CryptoKitties, and other collectibles) with built-in coding that makes them unique (nonfungible) and protects ownership rights. NFTs can also be used to assign digital scarcity to other items, such as user profiles, admission tickets, memes, and tweets; the built-in identifier provides a way of tracking the item's unique identity and ownership.

- DAOs: Decentralized autonomous organizations are a type of next-generation corporation that relies on open-source code and distributed decision-making by the organization's members. DAOs can function as quasi-venture-capital firms because they often rely on crowdfunding to raise money for new projects and ventures.

- Other decentralized applications: Because Ethereum is fully programmable (often referred to as "Turing complete," it allows developers to build and operate any type of decentralized application. The key appeal is that as a permissionless system, it gives developers more flexibility and ownership over their work. It removes some of the barriers involved in traditional software development. For example, Apple AAPL not only requires iOS apps to go through its approval process, but it also takes a 30% cut (or 15% for smaller apps) of all revenue for apps sold on the App Store. Ethereum removes some of those barriers, although in its current form, it also comes with slower processing speeds and higher transaction fees ("gas"). (Ethereum 2.0, which I'll discuss in a bit, is designed to address those limitations.)

Ether vs. Bitcoin and Other Cryptocurrencies

Ether fills a unique role in the cryptocurrency space. While bitcoin mainly serves as a digital currency and store of value, ether also functions as a utility. It's often described as digital oil or digital gas because it's used to fuel computing power on the network, execute smart contracts, and compensate the miners who validate and verify transactions to add to the blockchain. (The Ethereum blockchain is a decentralized ledger that maintains a transparent record of every transaction and computation, eliminating the need for third-party verification.)

At a basic level, ether is somewhat similar to bitcoin. Both are digital currencies secured by cryptographic puzzles that can be used for peer-to-peer payments. Both require some type of digital wallet as proof of ownership. But ether has a much broader use case because of its programmability and critical role in decentralized finance. As a result, 30-day asset flows for ether have recently been close to 10 times as high as those for bitcoin. Because ether circulates more frequently, about 68% of the currency's supply was classified as active over the past 12 months, compared with only 46% for bitcoin. An initial set of 72 million ether was created when the Ethereum network was first launched in 2015. Unlike bitcoin, which has a hard supply limit of 21 million coins, there's currently no cap on the amount of ether outstanding.

But the supply dynamics for ether will dramatically change with the advent of Ethereum Improvement Protocol 1559, which is scheduled to be implemented in August. EIP 1559 is designed to significantly reduce transaction costs. Transaction costs are currently set by an auction system that often results in higher fees during periods of higher demand or network congestion. EIP 1559 will replace this system with one that uses the network to set prices automatically. At the same time, it will "burn" a small amount of ether whenever someone makes a transaction, effectively reducing ether's supply and increasing its value over time. This deflationary dynamic has led to the meme that if bitcoin is sound money, ether should be considered ultrasound money.

Ethereum 2.0 is another major upgrade currently being implemented. One of the major changes involves changing the security architecture from proof of work to proof of stake. Proof of work means using a high-powered computer to test a series of algorithms, or hashing functions, to validate and confirm transactions. It relies on trial and error to generate a random series of numbers and letters until the program comes up with one that matches the original value. Proof of work is highly secure, but it is also massively inefficient because it requires so much computing power and electricity.

Proof-of-stake algorithms, on the other hand, are significantly more efficient and less resource-intensive. People can lock up, or stake, a certain amount of ether to help validate transactions on the network. In exchange, they receive staking rewards. Because mining power is granted randomly based on the number of coins held in a node, it reduces the number of computations required to validate transactions. Many observers estimate that the shift from proof of work to proof of stake will reduce Ethereum's energy usage by at least 1,000-fold. It should also make the network more efficient by increasing the number of transactions per second. The Ethereum community is also planning subsequent improvements, including zk-SNARKs, rollups, and sharding, each of which has the potential to further boost energy efficiency and transaction volume.

Finally, ether currently has two different forms. In a 2016 hacking incident, an attacker broke into a decentralized venture capital firm built on the Ethereum blockchain and stole $60 million of ether. The Ethereum community voted to create a "hard fork" to restore the network and recapture the stolen funds. This fork created two different versions of the blockchain: Ethereum Classic (the pre-fork version) and Ethereum (the post-fork version). Each network has its own corresponding version of ether, although the classic ether is more of a legacy currency that's no longer widely used.

Conclusion

I've only lightly scratched the surface of Ethereum here. In my next article, I'll take a closer look at ether as an investment asset.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)