Revisiting ESG Integration and Market Representation

The role of the parent index in ESG strategies.

Shopping for environmental, social, and governance funds might feel a bit like walking down the supplements aisle at the grocery store. There is a vast array of products from multiple brands, each with a different tagline. It’s often difficult to gauge which is right for you, especially when the language around these products doesn’t lend itself to easy comparisons.

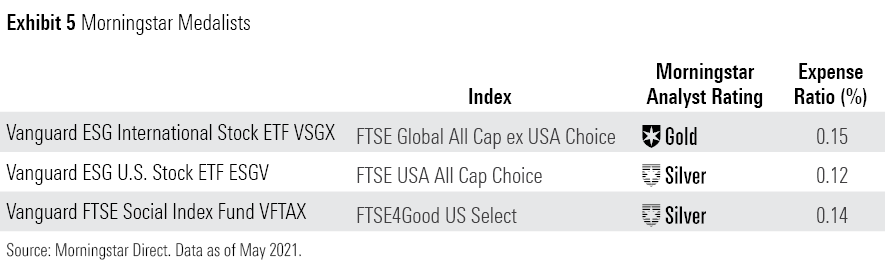

In an effort to sort out what's what, we previously shared a simple framework to help investors sort ESG strategies. More recently, I animated this framework with a case study that focused on three ESG-intentional indexes from MSCI that underpin five different Morningstar Medalist funds. In this article, I will further animate the key factors that investors should consider when they peel back the label on ESG-intentional index funds, diving into another trio of ESG-intentional indexes: the FTSE USA All Cap Choice Index and its international counterpart, the FTSE Global All Cap ex USA Choice Index, as well as the FTSE4Good U.S. Select index. Each of these indexes underpins a medalist fund.

While they are branded differently, these indexes use essentially the same ESG criteria. The key differences among them are their selection universes, as represented by their parent indexes. One of the basic premises of my previous analysis was that different ESG and other criteria were being applied to stocks drawn from the same parent index. However, this will not always be the case. The similarities and differences among the trio I examine here will highlight the impact of differences between ESG-intentional index funds’ selection universe.

An Exclusively Exclusionary ESG Framework

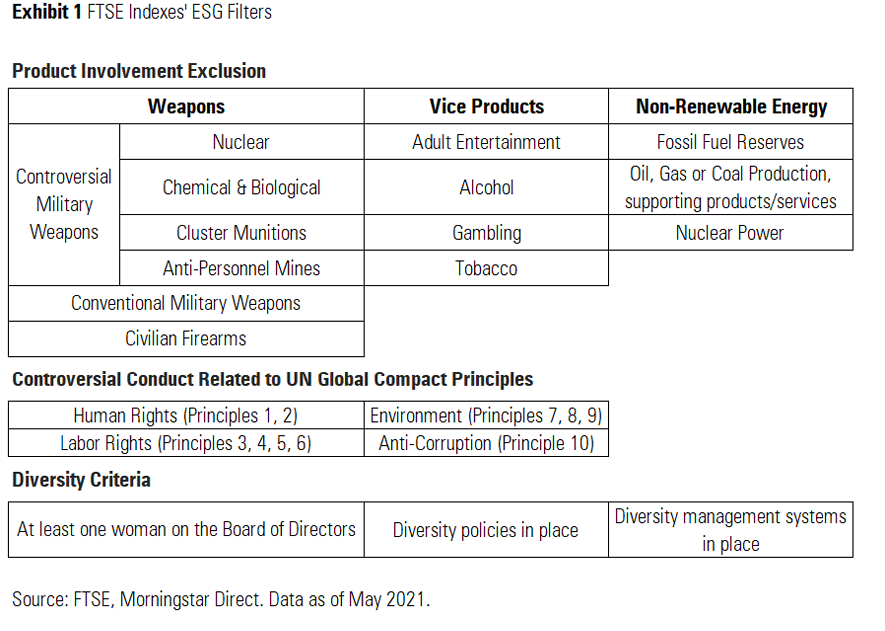

The FTSE USA All Cap Choice, FTSE Global All Cap ex USA Choice, and FTSE4Good U.S. Select indexes all employ an exclusionary approach. The indexes screen out companies that produce or extract revenue from controversial products, engage in controversial conduct, or fail two out of FTSE’s three diversity criteria. FTSE’s product involvement list covers the basic range of businesses typically excluded by other ESG mandates. Notably, as FTSE follows the Industry Classification Benchmark categorization system, the methodology has recently included cannabis producers under the tobacco industry and expanded its definition of oil and gas producers. These are minor details that should not invite much change to these indexes’ portfolios.

Overall, these exclusions are modest. They can help investors avoid firms with some of the worst ESG metrics in the eligible universe, but their omission will not result in an exemplary ESG portfolio. Without best-in-class ESG ranking or weighting measures, these portfolios will still include firms with questionable ESG credentials. Indeed, all three of the medalists tracking the indexes have earned a Morningstar ESG Commitment Level of Basic, as their ESG bona fides are only skin deep. But their Morningstar Sustainability Ratings paint a different picture. As of April 2021, the pair of U.S. stock funds both received an Above Average (4-globe) rating, while the international fund received a Below Average (2-globe) rating. As the Sustainability Rating is based on how the funds rank within their global Morningstar Category, this is largely a reflection of the differences between the funds’ selection universes and category peers.

Different Starting Points

The light-touch exclusionary approach to ESG integration taken by these three funds is why they’ve been assigned a Basic ESG Commitment Level and is evident in their low level of active share against their respective parent indexes. Among ESG-intentional index strategies, a fund’s degree of ESG integration tends to be positively correlated with its active share. Index funds that combine negative filters with a best-in-class approach to selecting and weighting stocks on the basis of ESG merit tend to have higher active share. Those more like the trio under the microscope here tend to have low active share.

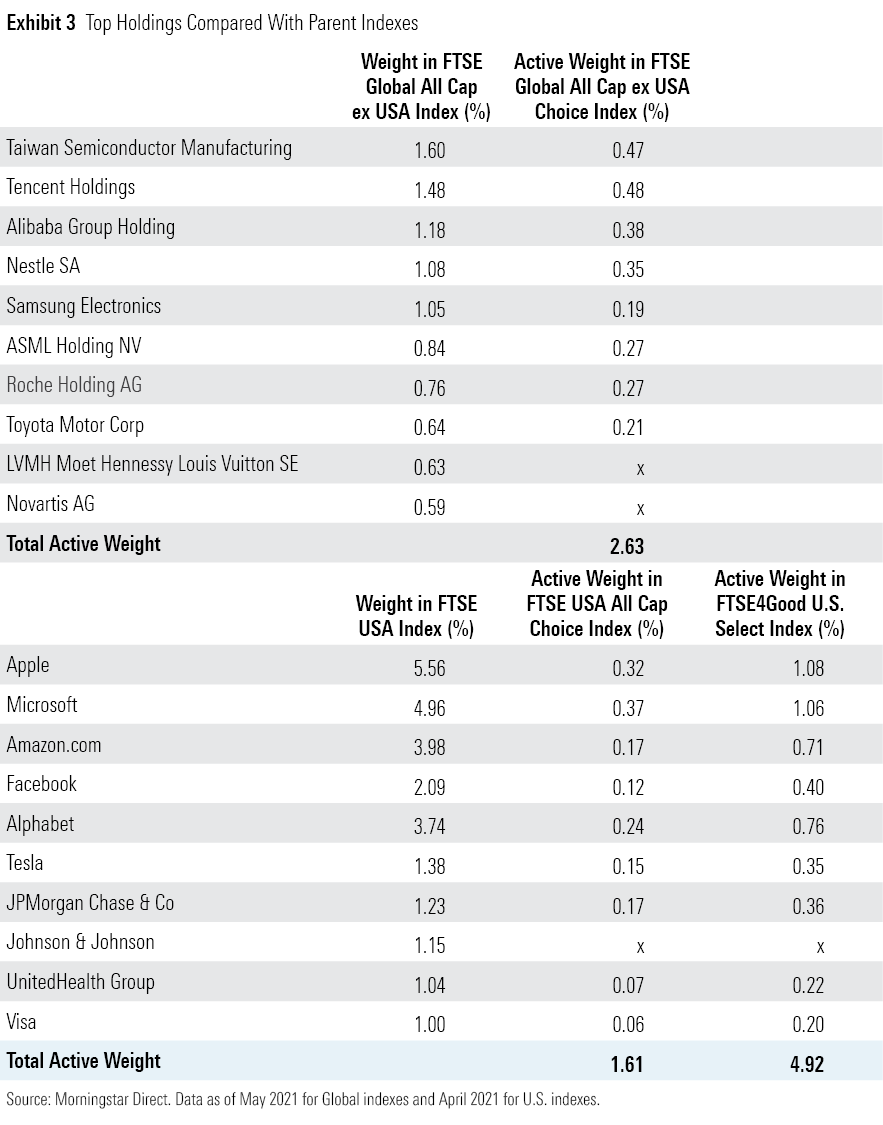

But these indexes’ starting universe is an important variable that needs to be considered. In this instance, despite the fact that these three indexes all use the same ESG criteria, their active share is materially different. The FTSE Global All Cap ex USA Choice Index has a 27% active share versus its parent index, while the U.S.-focused benchmarks have active shares of about 16%. As the FTSE Global All Cap ex USA Choice Index casts a much wider net than its U.S. counterpart, there are naturally more holdings that do not pass its screens.

While the differences between the U.S. and international indexes are clear, there are also nuanced differences between the two U.S. benchmarks’ selection universes. The FTSE4Good index draws stocks from the FTSE USA Index, which captures U.S. large- and mid-cap stocks. The FTSE USA All Cap Choice Index begins with the FTSE USA All Cap Index, a total market index that spans into micro-cap territory. The more expansive market-cap spectrum covered by the FTSE USA All Cap Index alleviates some of the concentration concerns caused by the exclusions of its ESG variant. With more than 1,400 holdings, the portion of assets allocated to the FTSE USA All Cap Choice Index’s top 10 holdings has trended under 30%. The FTSE4Good index, like many other top-heavy ESG strategies, briefly rose above this threshold with its 486-holding portfolio during the peak of the pandemic recovery in August 2020. Nonetheless, as both indexes and their parent benchmarks are market-cap-weighted, the differences between the two are marginal. The FTSE USA All Cap Choice index allocates more than 6% of its assets to small- and micro-cap stocks compared with 0.03% for the FTSE4Good index. And both funds have approximately the same active share (roughly 16%) versus the FTSE USA Index.

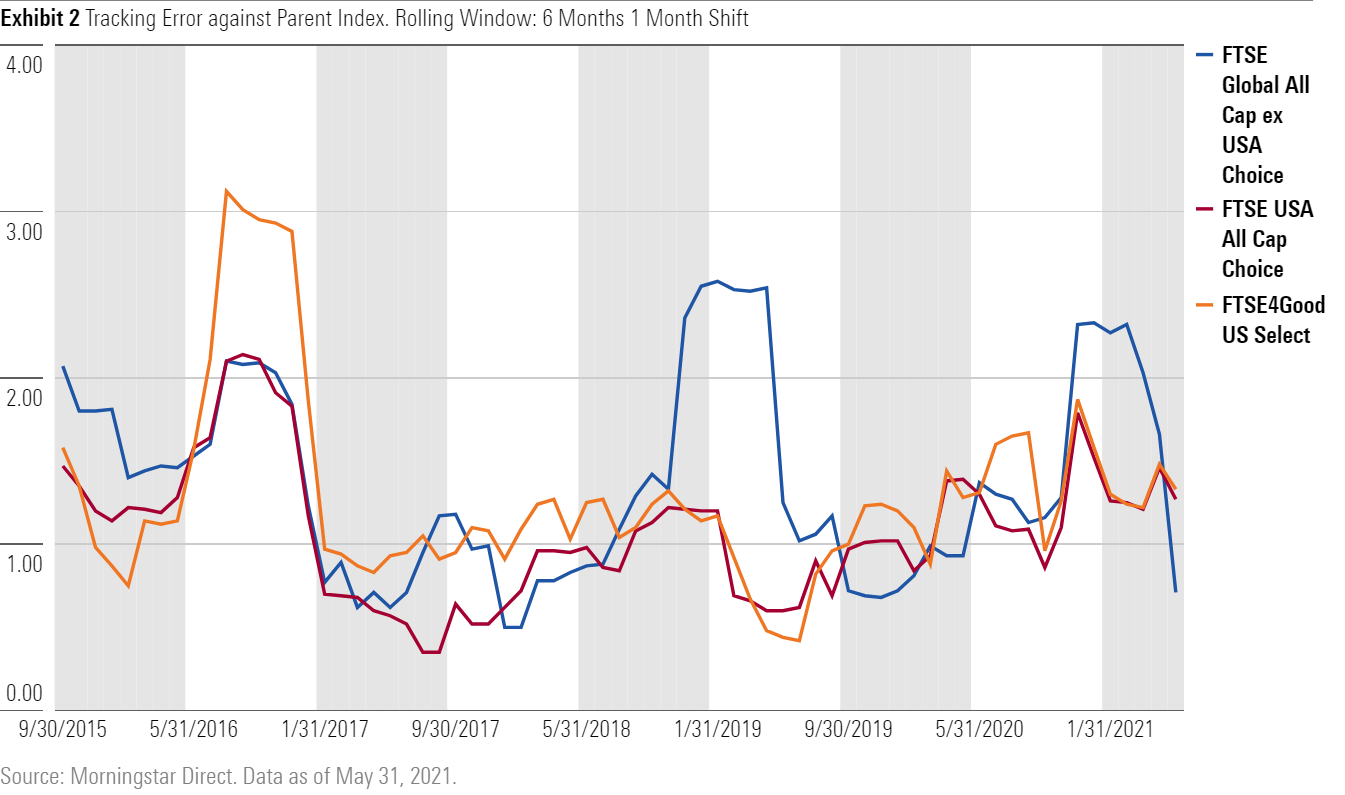

Given that these indexes’ active share against their respective parent benchmarks has been low, it is no surprise that all three have seen minimal tracking error against those same bogies. That said, there have been episodes where these exclusionary benchmarks’ omissions have cause tracking error to spike. For example, the FTSE4Good index’s top-heavy portfolio strayed a bit further than normal during the small-cap rally of 2016. The FTSE Global All Cap ex USA Choice Index also had a few hiccups during the late-2018 sell-off and late-2020 rally, in part because it is underweight in energy stocks compared with its parent index.

You Look Familiar

These strategies’ low active share is evident when glancing at their top holdings. The FTSE Global All Cap ex USA Choice Index excluded the smallest two of the top 10 holdings from its parent index. For both U.S. indexes, only Johnson & Johnson JNJ was excluded from the top 10. As a result of excluding a number of names on the basis of their negative ESG screens, the strategies re-allocate to those constituents that pass their ESG test. As a result, those names in the top 10 that make the cut receive modestly higher weightings than they’re accorded in their parent indexes.

Parsing Performance

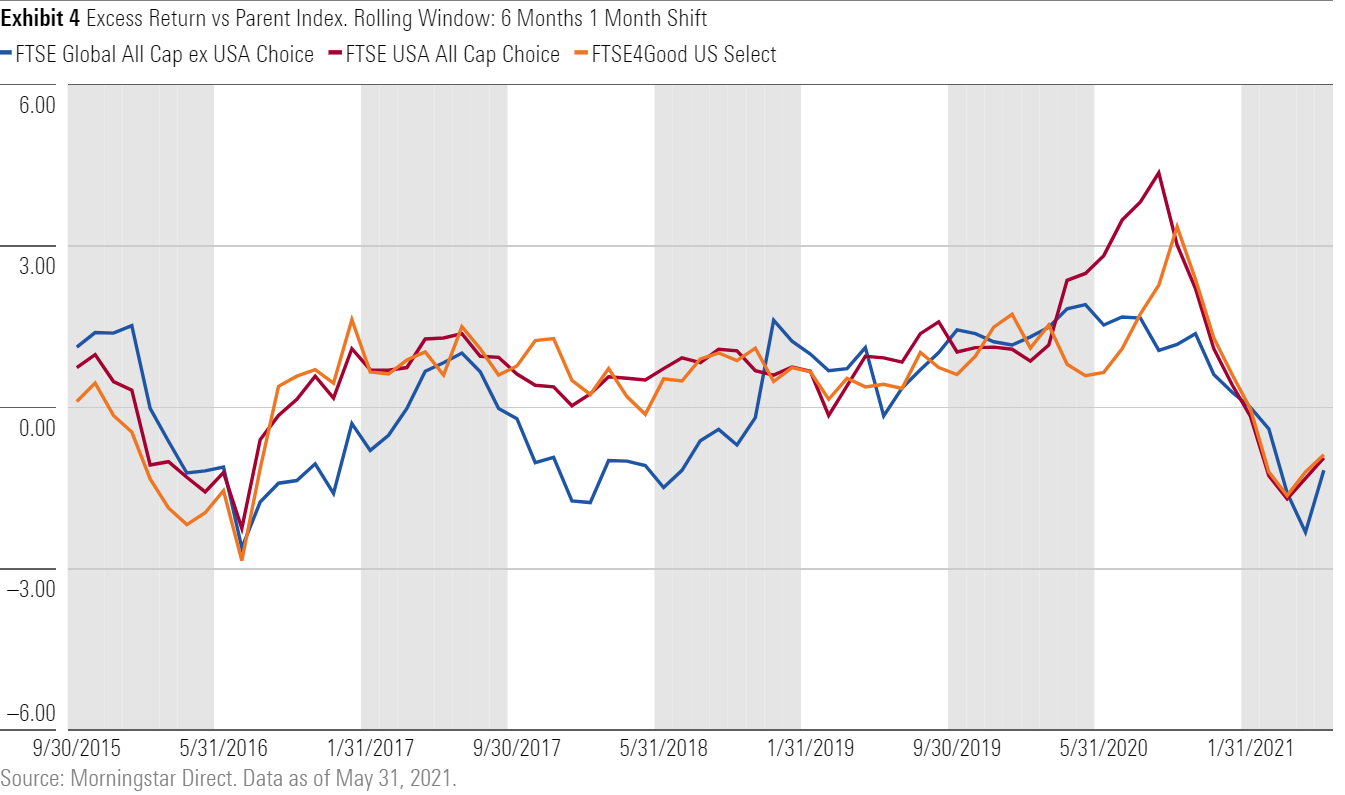

Given that these indexes do not deviate too much from their ESG-agnostic market-cap-weighted broad-market parents, we expect they will shadow their parents’ performance over the full market cycle. Indeed, this has generally been the case, with some notable exceptions. Save for the volatile markets of early 2020 and 2016, these indexes’ excess returns have tended to stay within 1 percentage point of their parent indexes over rolling six-month periods since their common inception in 2015. Being underweight in energy and overweight in technology has mostly helped over this period. That said, this did lead the ESG benchmarks to lag during value rallies in 2016 and from late 2020 through early 2021. This underscores how difficult it is to discern how these benchmarks’ ESG-driven bets will play out in the short run. The only guarantee is that they will lead these ESG indexes’ performance to be different from that of their parent indexes’--sometimes better, sometimes worse.

Mapping Back to Morningstar Medalists

These ESG indexes should rarely stray far from their ESG-agnostic counterparts. Their low level of active share means they retain the majority of the advantages of the benchmarks representing their selection universe: broad diversification, low turnover, and low costs. These considerations underpin the medalist ratings for the suite of Vanguard funds tracking them. All three funds receive High Process Pillar ratings, on par with the ratings of ESG-agnostic funds tracking indexes that are substantially similar to these funds’ parent indexes. The strategies are exposed to some ESG-driven sector bets, as is the case with most ESG-intentional peers, and maintain a slight growth tilt as a result of the recent tech overweighting. However, their top holdings largely overlap with the parent indexes, and their market caps are still highly representative of the investment opportunity set available to their category peers. The funds’ competitive expense ratios are the cherry on top--they all rank in the cheapest fee quintile of their respective categories and are among the lowest within their ESG-intentional indeed peers.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)