ESG Outperformed in the Second Quarter

Tech stock revival boosts sustainable strategies.

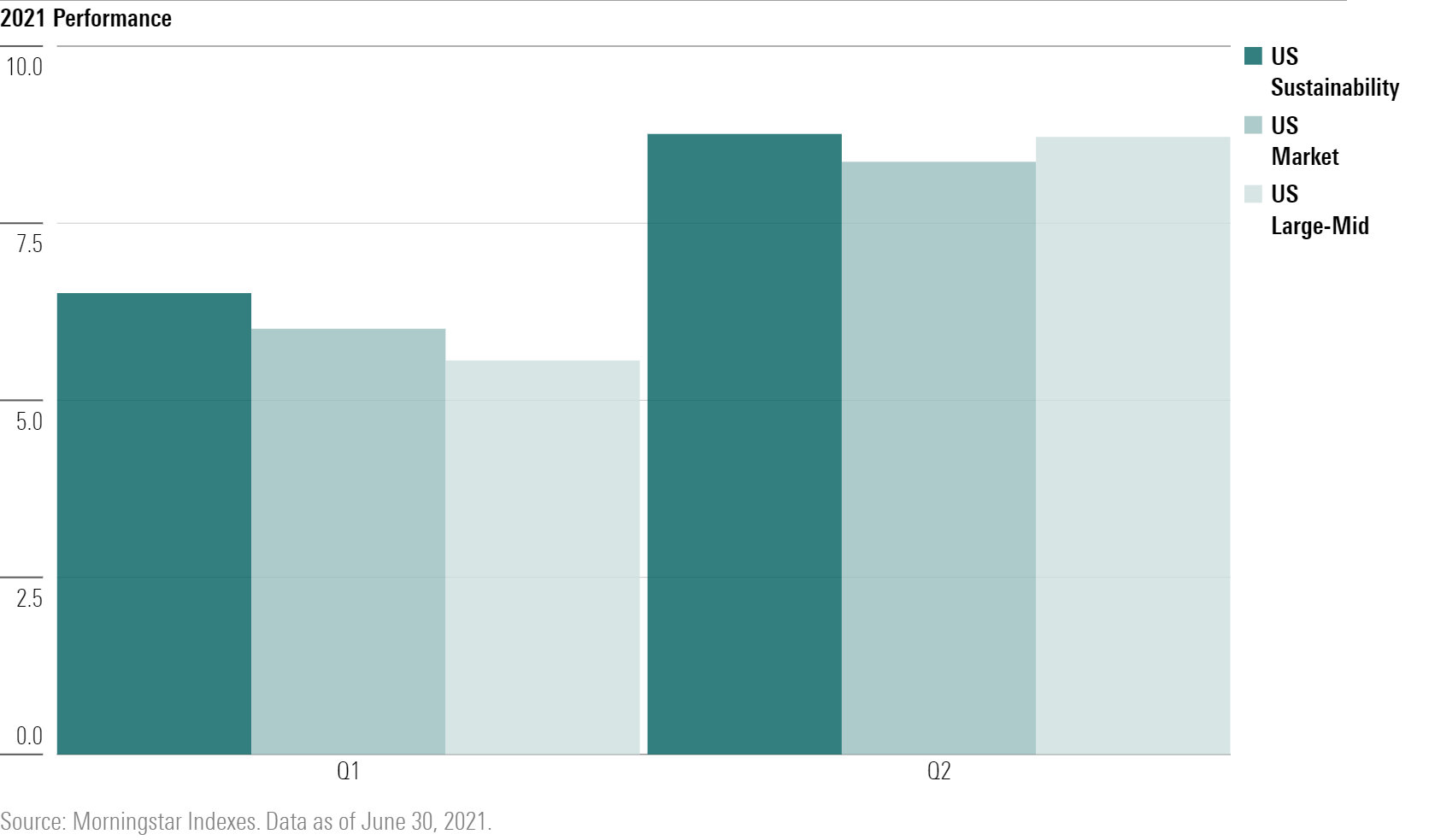

Sustainable investment strategies broadly outperformed their non-ESG cousins in the second quarter thanks mainly to a revival among technology stocks.

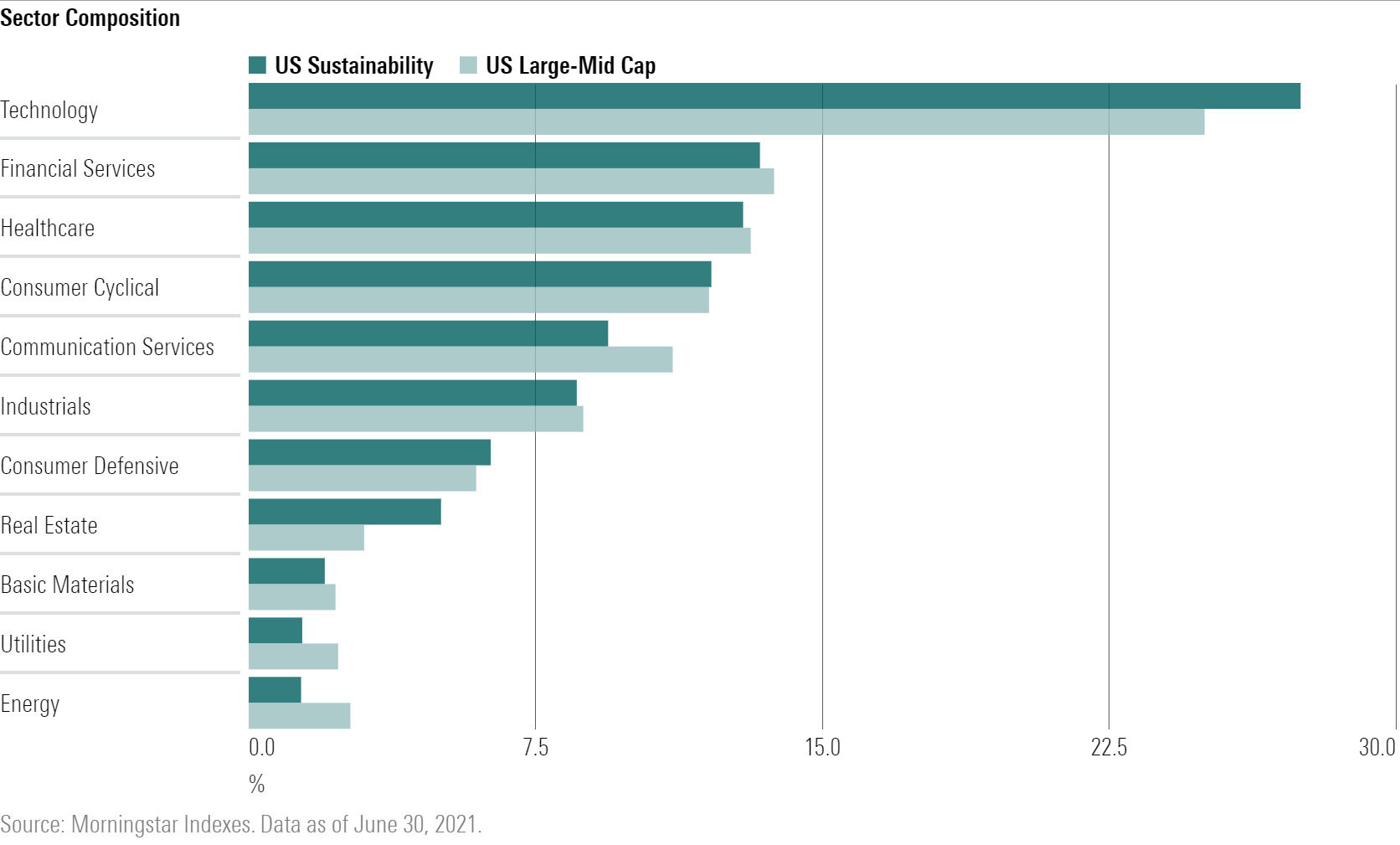

The boost from tech names such as Microsoft MSFT, a sector that represents a heavy weighting in most sustainable indexes, helped overcome the tailwind that non-ESG indexes received from continued strength in energy stocks. Non-ESG benchmarks tend to hold greater percentages in energy stocks.

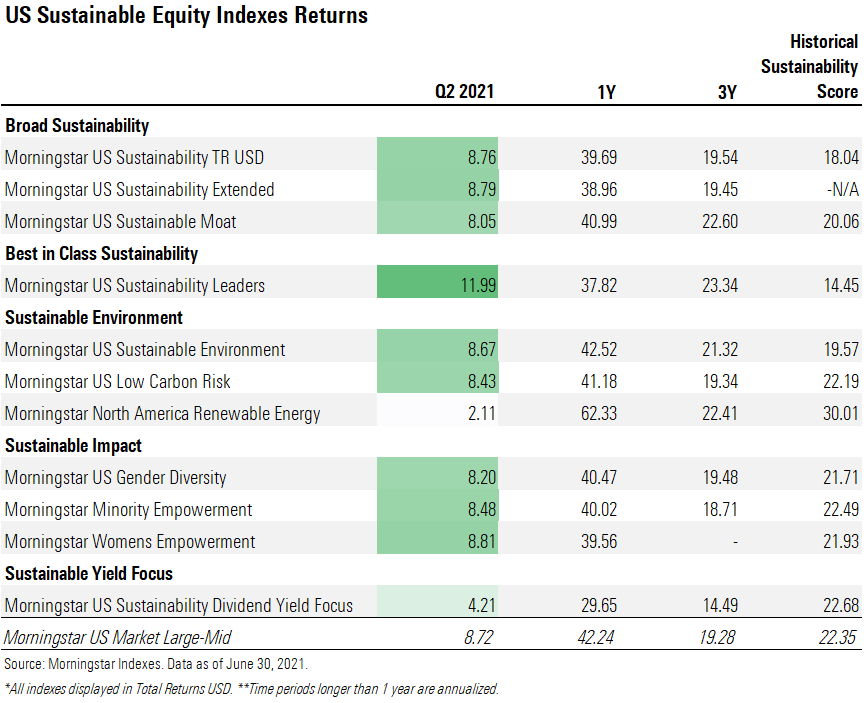

The Morningstar U.S. Sustainability Index returned 8.76% during the second quarter, edging out both the U.S. Market Index, which returned 8.72%, and the U.S. Large-Mid Cap Index, which returned 8.45%.

The competitive second-quarter performance for the Sustainability Index follows a first quarter where some ESG indexes lagged their non-ESG benchmarks as energy stocks led the U.S. market by a wide margin. Buoyed by surging oil prices, the energy sector posted 30%-plus returns in the first quarter, while the technology sector returned just under 2%.

Globally and across all markets, 58% of Morningstar’s ESG-screened indexes beat their broad market equivalents during the second quarter. Within the standard Morningstar Sustainability Index family, which is methodologically aligned with the Morningstar Sustainability Rating for funds, 14 of the 22 indexes outperformed. All but two of the Morningstar Sustainability Leaders Indexes beat their broad market equivalents.

Just under half of the Morningstar Low Carbon Risk Indexes beat their non-ESG counterparts in the first quarter, and all of the Morningstar Renewable Energy Indexes lagged their broad market equivalents. (Morningstar Direct clients can find our new quarterly ESG performance PDF here.)

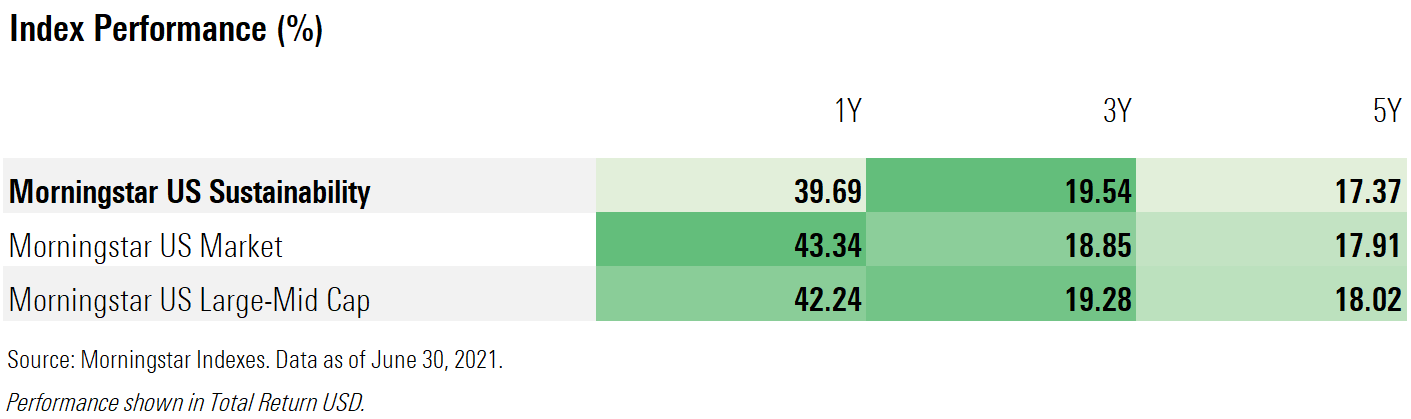

Though the U.S. Sustainability Index edged out the U.S. Market and U.S. Large-Mid Cap Indexes this quarter, over the past 12 months the Sustainability Index trailed the broader market. That underperformance reflects the rally in energy stocks, along with gains in healthcare, communication, and materials companies in the non-ESG space.

However, longer-term, sustainable investors have earned competitive returns even with the stock ESG screens.

Looking under the hood for ESG indexes, technology stocks often hold greater sway in overall performance than energy stocks. Here’s a look at the sector composition of the Morningstar Sustainability Index compared with its closest non-ESG comparison, the Morningstar U.S. Large-Mid Cap Index.

During the first quarter of 2021, tech stocks slowed, and so did sustainability indexes. Meanwhile, energy stocks rallied, but because of their light weighting, that did little to benefit the Sustainability Index.

But as tech stocks rallied in April and June, the Sustainability Index edged ahead. The index also benefited during the second quarter from gains among financial stocks and real estate. Using data from Morningstar Direct, the following chart shows the contribution to the second quarters of the two stock indexes.

Four of the five largest contributors to the index came from the technology sector. NVIDIA NVDA and Microsoft, two of the index's technology heavy-hitters, surged as large high-growth stocks made a recovery.

Editor's Note: This article has been corrected to indicate that energy stocks had a light weighting in the Sustainability Index.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CFV2L6HSW5DHTFGCNEH2GCH42U.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7JIRPH5AMVETLBZDLUSERZ2FRA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YWKBIVULT5DGJEIGAJGBA6H5ZA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)