33 Undervalued Stocks for the Third Quarter

Here are our analysts’ top ideas in each sector for the coming quarter.

For the new list of Morningstar’s top analyst picks, read our latest edition of 33 Undervalued Stocks.

U.S. stocks rose 8.4% during the second quarter of 2021, as measured by the Morningstar US Market Index. We think stocks are slightly overpriced today: The median stock in our North American coverage universe trades at a 4% premium to our fair value estimate.

Less than 12% of the stocks we cover have Morningstar Ratings of 4 or 5 stars, observes Dave Sekera, Morningstar's chief U.S. market strategist, in his latest stock market outlook.

"While we expect strong economic growth to last well into 2023, we think the markets have overextrapolated earnings growth too far into the future," he notes.

Here are some specific undervalued stocks across sectors that are among our analysts' best ideas.

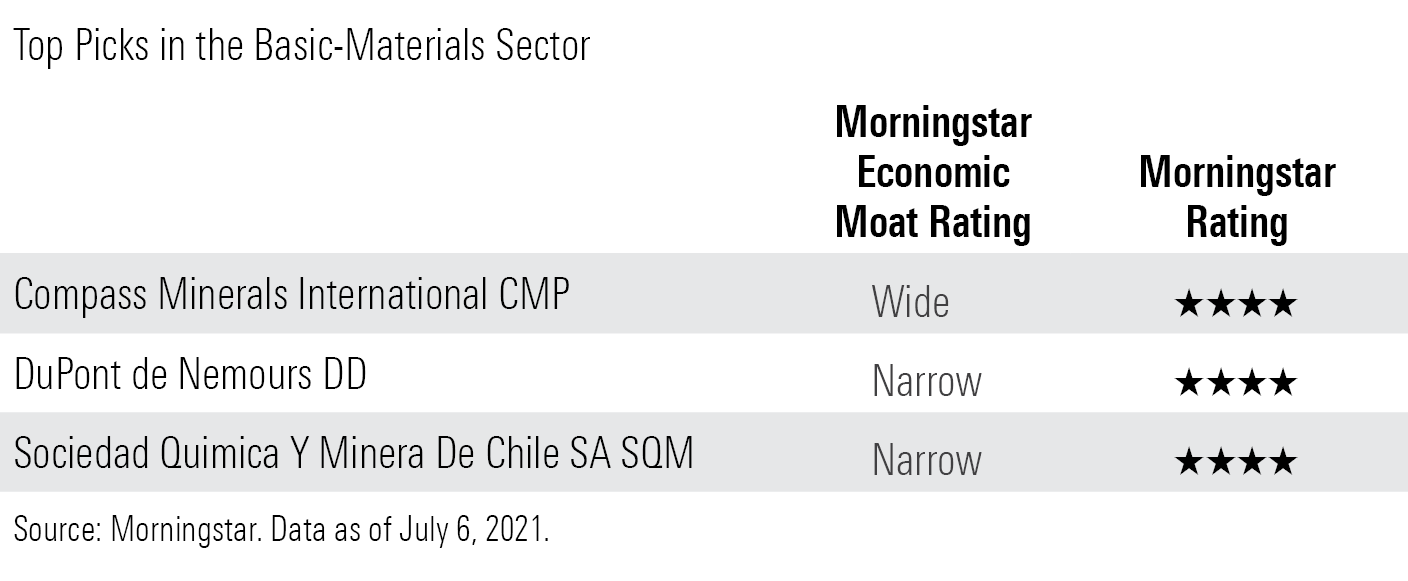

Basic Materials

Basic-materials stocks lagged the broader market during the second quarter but have still massively outperformed since the depths of the pandemic, observes director Kris Inton. None of the basic-materials stocks in our coverage universe trade in 5-star range today.

Lithium prices have risen since the start of the year, thanks to rising electric vehicle sales and reduced supply in 2020, reports Inton. Demand continued to recover for chemicals producers, and we expect a continued volume recovery through 2021. Lastly, de-icing salt prices fell for the 2020-21 winter, but thanks in part to reduced supply from a mine closure, we expect prices to rise in the 2021-22 season.

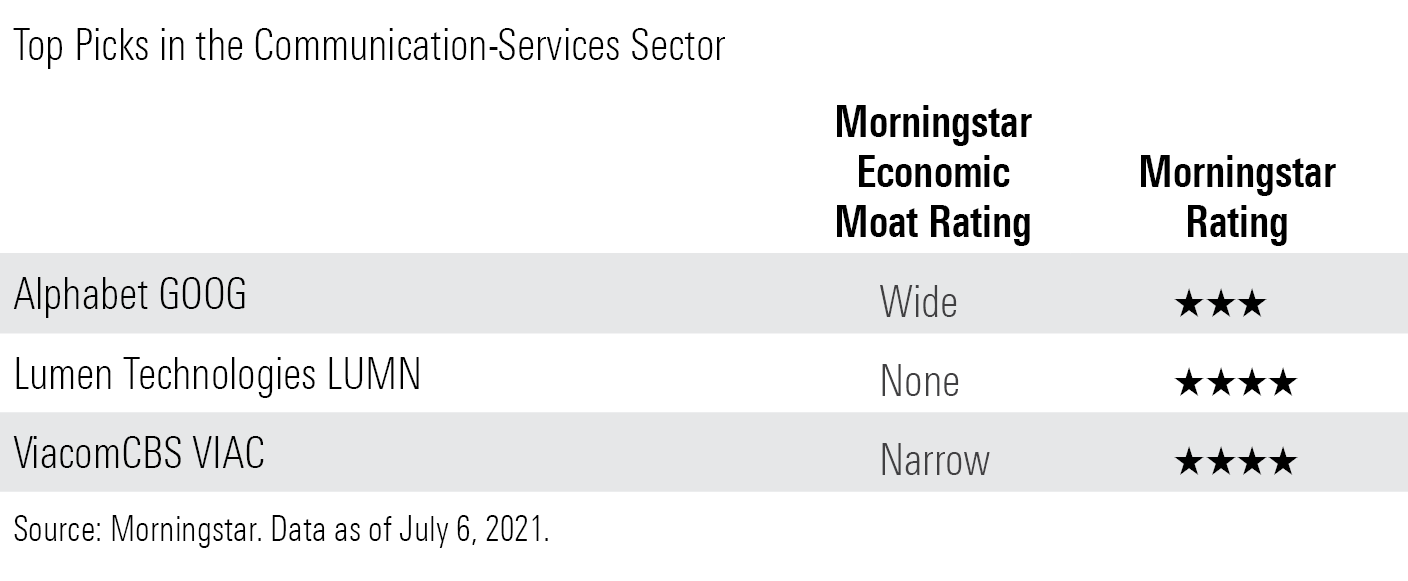

Communication Services

Communication-services stocks as a group outperformed the broader market during the second quarter, with Internet giants Alphabet GOOG and Facebook FB accounting for most of the sector’s gains, notes director Mike Hodel. “As 2021 has progressed, we’ve sharply increased our expectations for advertising growth based on both cyclical and emerging longer-term factors,” he adds.

On the development front, AT&T T announced it will spin off its WarnerMedia business; we think the new media company should have the scale and content needed to take on the likes of Netflix NFLX and Disney DIS, asserts Hodel. ViacomCBS VIAC issued new equity in March, and we think the additional capital should serve it well.

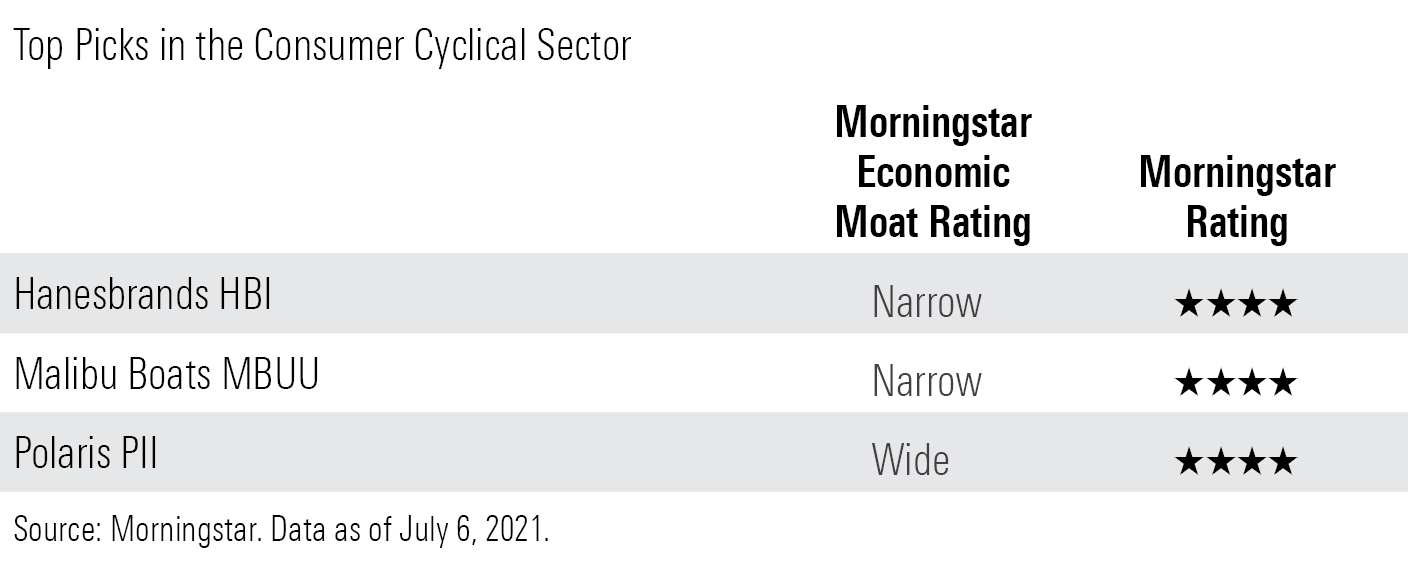

Consumer Cyclical

Consumer cyclical names lagged the market in the second quarter after a sizable outperformance over the trailing 12 months. Not surprisingly, the median consumer cyclical stock is about 12% overvalued, estimates director Erin Lash. However, we're seeing some opportunity in the powersports companies we cover: "[They] have benefited from people's desire for outdoor activities while social distancing," she notes.

As more states reopen, we expect consumers to jump at the opportunity to return to in-person dining and other immediate satisfaction experiences like bars, casinos, and travel. Moreover, global shipping delays have lengthened wait times for many discretionary goods, says Lash.

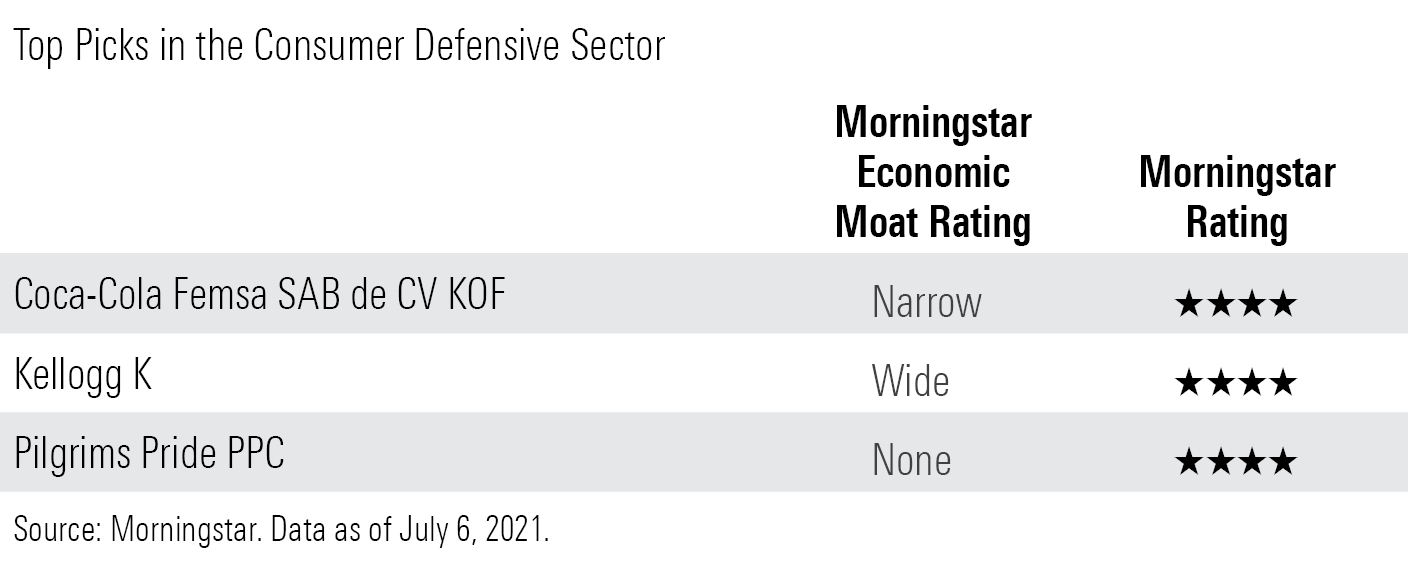

Consumer Defensive

Though the consumer defensive sector lagged the broader market during the second quarter, we still view the group as slightly overvalued by about 4%, points out director Erin Lash. Tobacco names still offer upside. "The market seems to underappreciate the cash generation these businesses boast," she says.

Cost inflation is running rampant, and we don't expect the pressure to subside in the near term owing to elevated demand and supply-chain disruptions, she contends. In addition to passing along some of the costs to the consumer, we expect firms will also work to drive out inefficiencies.

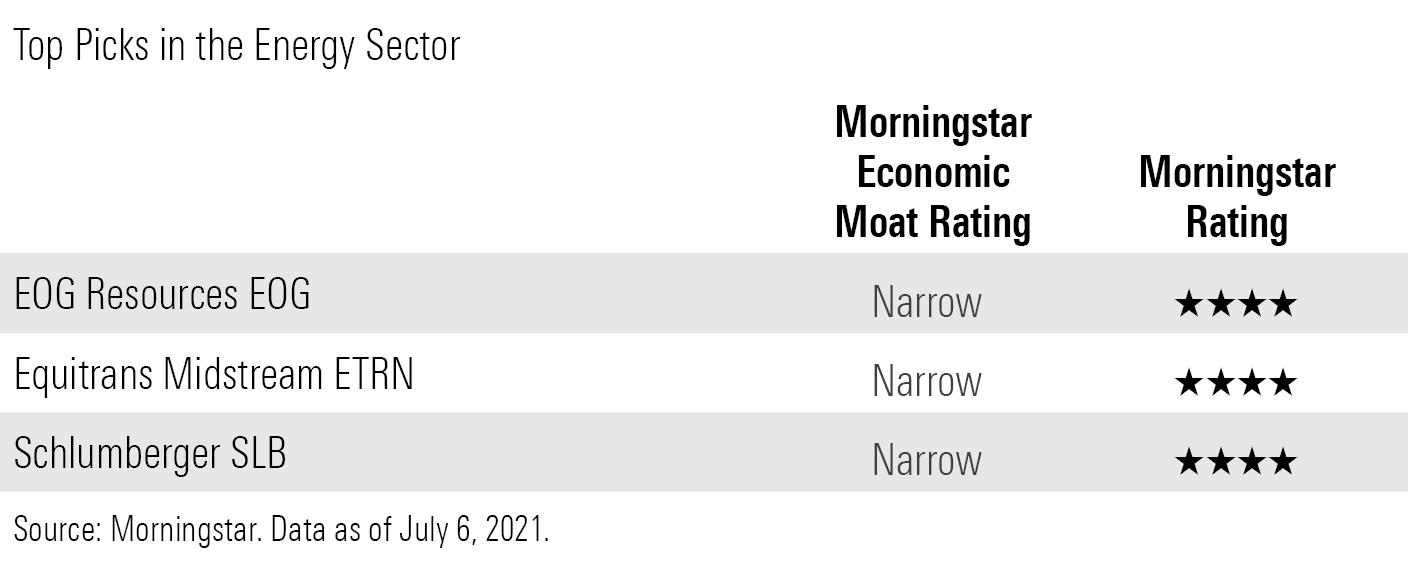

Energy

Energy stocks rallied for the third quarter in a row, and we expect a full recovery in demand by 2022, notes director Dave Meats. Energy stocks as a group are about fairly valued, but there are opportunities across all segments--with services and integrated names trading at meaningful discounts.

We think oil prices today are frothy, with the West Texas Intermediate benchmark currently 33% higher than our $55 per barrel midcycle forecast. "Without an abrupt change in strategy from OPEC or the U.S. shale industry, the oil markets will remain tight this year, and short prices could climb even higher," suggests Meats.

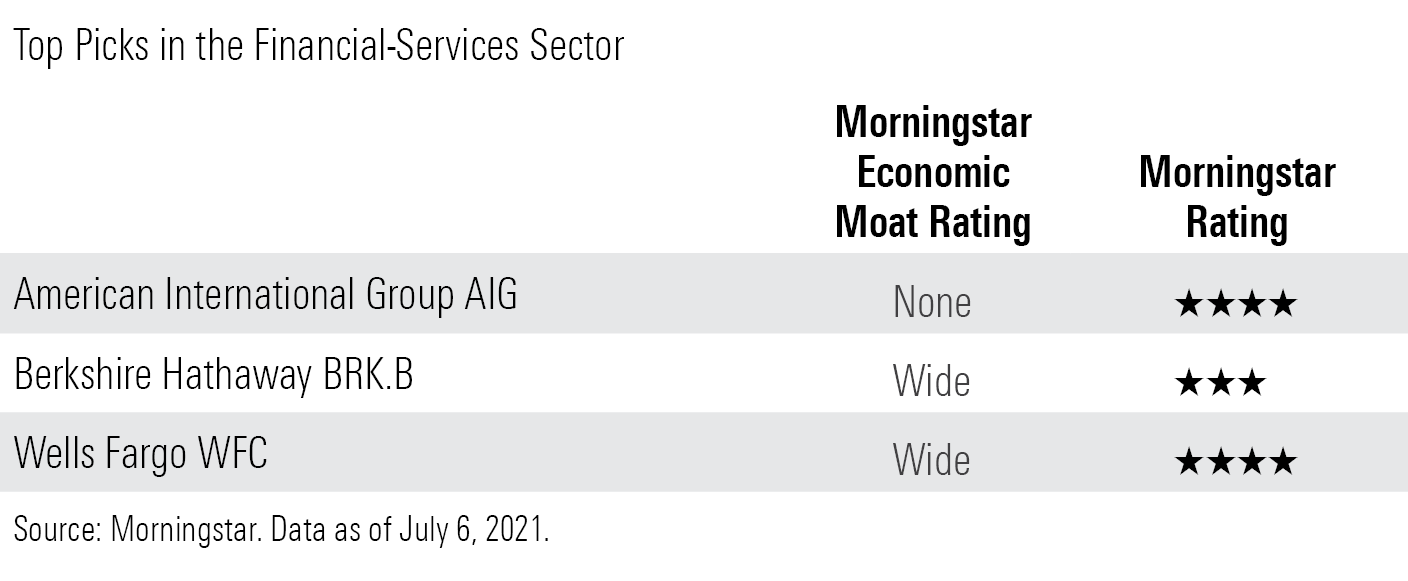

Financial Services

Financial-services names slightly outperformed the market during the second quarter. Not surprisingly, the average stock in the sector trades 10% above our fair value, comments director Michael Wong.

"Inflation has definitely arrived," notes Wong. Whether higher inflation is transitory or not remains up for debate; nonetheless, higher-than-expected inflation and interest rates should help many financial-services companies, including payment firms and banks.

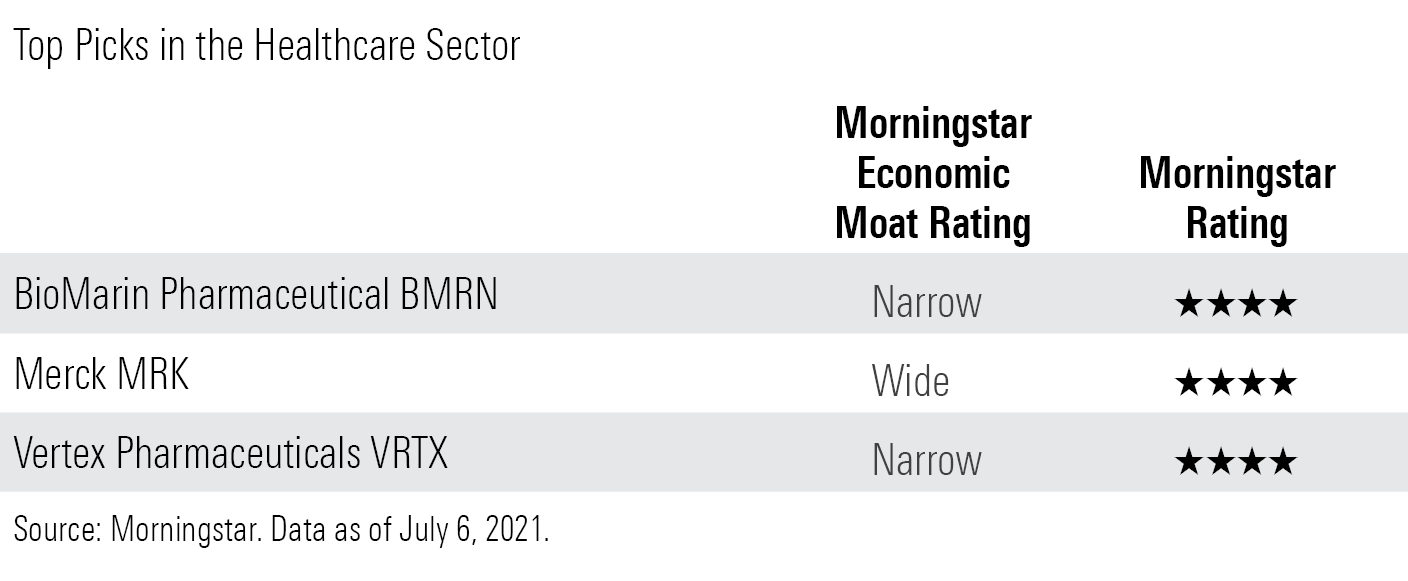

Healthcare

Valuations in the healthcare sector look a bit high, with the average stock in our coverage universe trading about 11% ahead of our fair value estimate. We think the sector's fundamentals are strong, and we expect to see accelerated earnings growth for industries affected by pandemic restrictions, such as elective procedures, asserts director Damien Conover.

The drug manufacturers and biotech firms remain the most undervalued--more than likely driven by expected changes in U.S. healthcare policy. "We expect only modest changes due to the complexity of healthcare markets and the Democrats' only slim majority in Congress," says Conover.

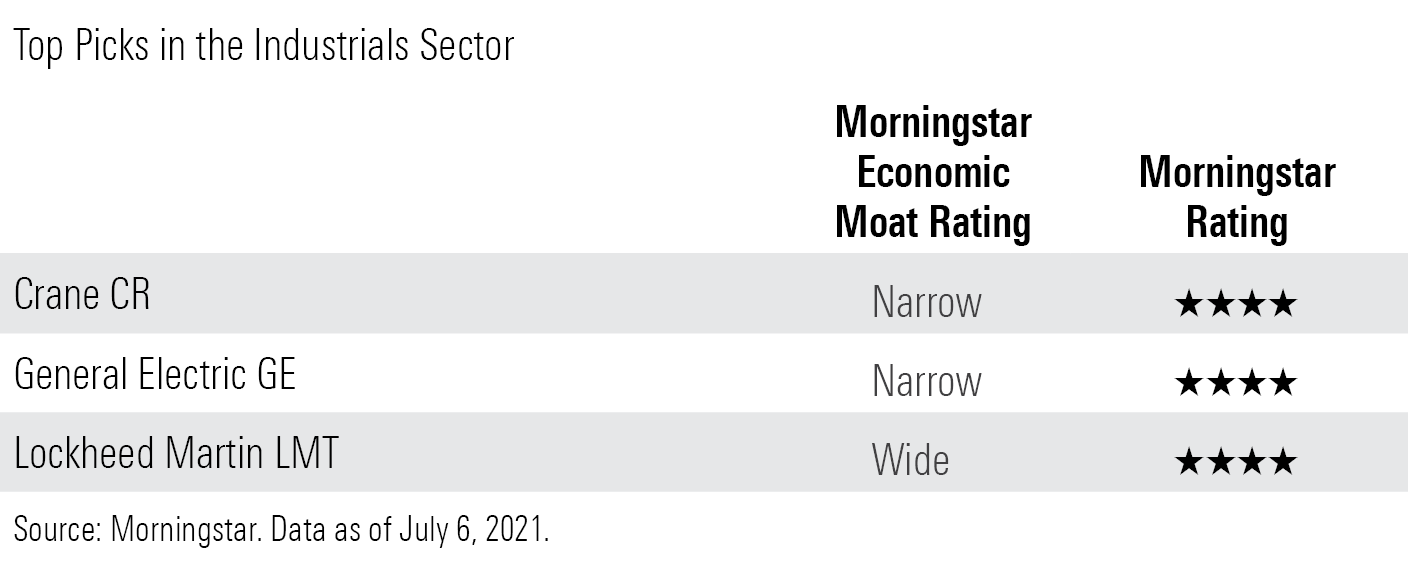

Industrials

Industrials stocks lagged during the second quarter. Despite that, the sector remains overvalued, with the median stock in our coverage universe trading about 17% above fair value. But there are pockets of opportunity, notes director Brian Bernard.

President Biden's infrastructure spending proposal should be a boon for construction-related industrials, but Bernard notes that the opportunity is already being priced into the stocks. An increase in leisure air travel has benefited airlines and aerospace suppliers; we project a full recovery for North American airlines (including business and international travel) by 2024.

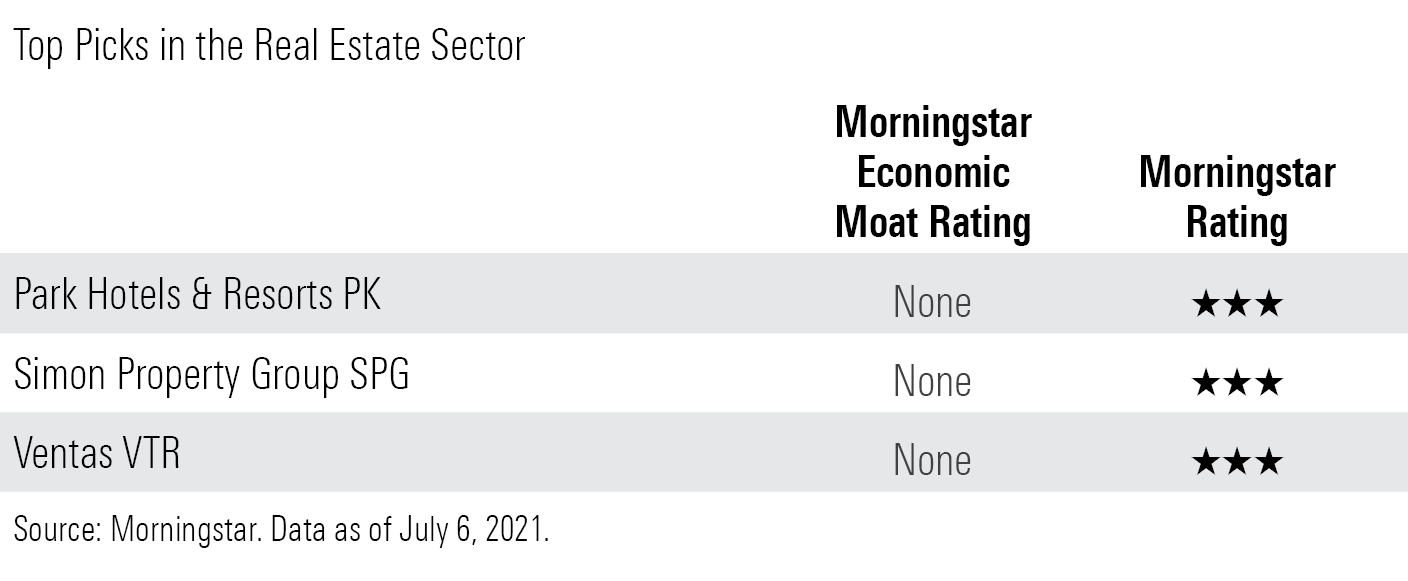

Real Estate

Since the successful development of COVID-19 vaccines, the real estate sector has performed in line with the broader market, notes analyst Kevin Brown. However, after lagging their peers for much of 2020, the hotel and retail industries have tremendously outperformed on news of successful vaccine developments. We still see some value picks among these subsectors today, says Brown.

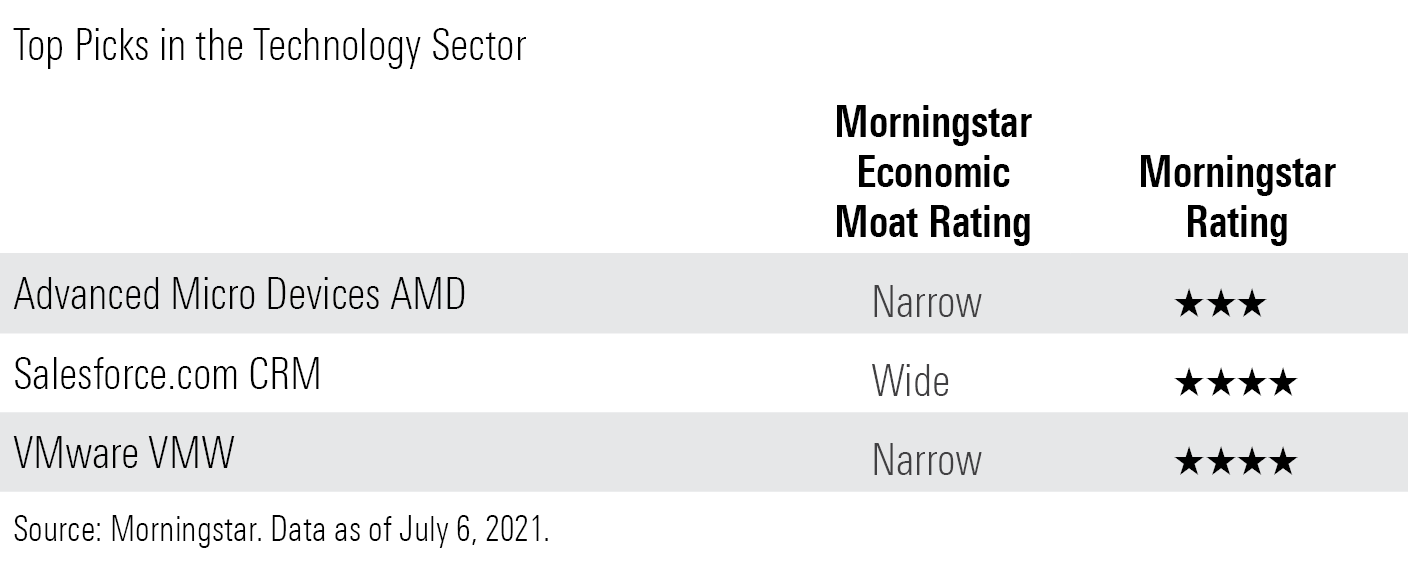

Technology

After a tough first quarter, technology stocks outperformed the broad market in the second quarter; the sector is about 8% overvalued by our metrics, reports director Brian Colello. "Across most of tech, we still see robust fundamental tailwinds supporting future growth in areas such as cloud computing, 5G, and the 'Internet of Things'," he adds.

We continue to like moaty software companies that generate revenue on a subscription basis with little risk of cancellations. Valuations are high among remote-working software names, though.

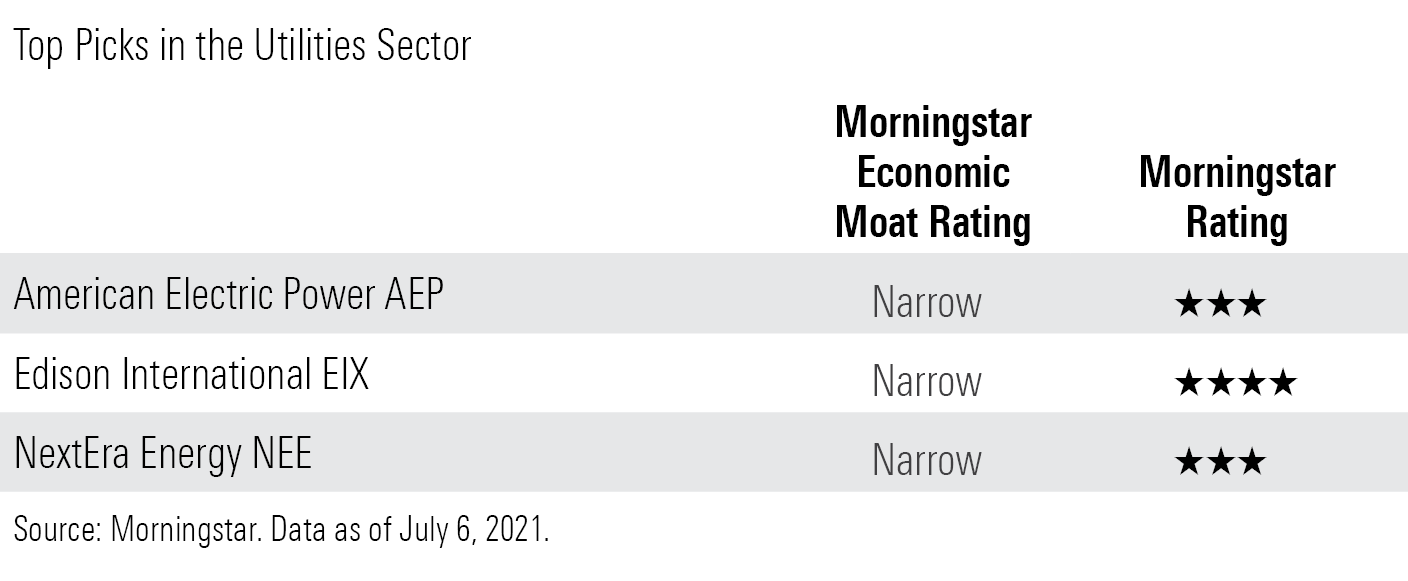

Utilities

Utilities stocks continue to lag the broader market, and with inflation on the rise and talk of rate hikes on the horizon, the sector faces an uphill battle in the market, notes strategist Travis Miller.

That being said, utilities strengthened their balanced sheets while rates were low, which provides a cushion for earnings and dividend growth. Moreover, clean energy growth is “in full throttle,” says Miller. And that pivot means a long pipeline of steady, transparent growth, he concludes.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)