Halfway Through 2021, ETFs Are on Pace for Another Record Year

ETFs look poised to shatter last year's flows records.

Markets rounded out a stellar first half of 2021 as they marched ahead in June. The Morningstar Global Markets Index (a broad gauge of global equities) advanced 1.11% in June, bumping its year-to-date return to 12.26%. Bonds continued to rise as well, as interest rates inched downward. The Morningstar U.S. Core Bond Index climbed 0.77%. That marked the benchmark’s third consecutive month of gains, though it has fallen 1.58% for the year to date.

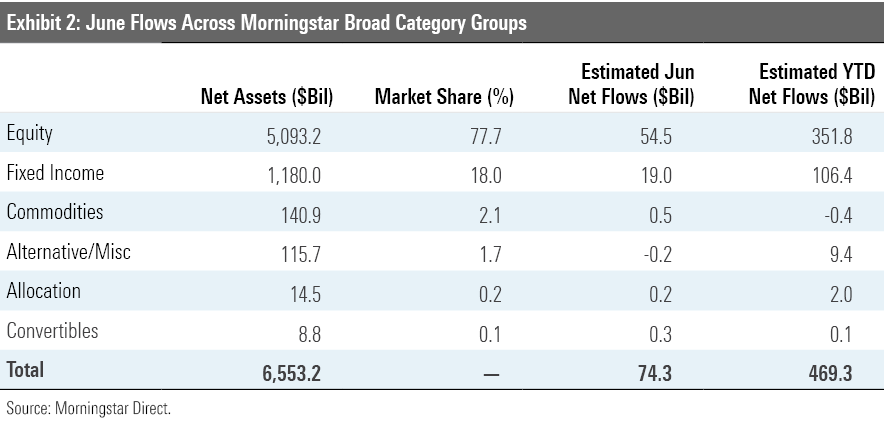

Exchange-traded funds look primed for another banner year, as investors continued to pour in new money last month. After adding another $74 billion of inflows in June, ETFs have collected $469 billion so far in 2021. The $500 billion that investors dumped into ETFs last year set an annual record, but that’s likely to be short-lived. ETF inflows are on pace to blow past that figure, perhaps as soon as next month.

Here, we’ll take a closer look at how the major asset classes performed last month, where investors put their money, and which corners of the market look rich and undervalued at month’s end, all through the lens of ETFs.

A Balanced Blend

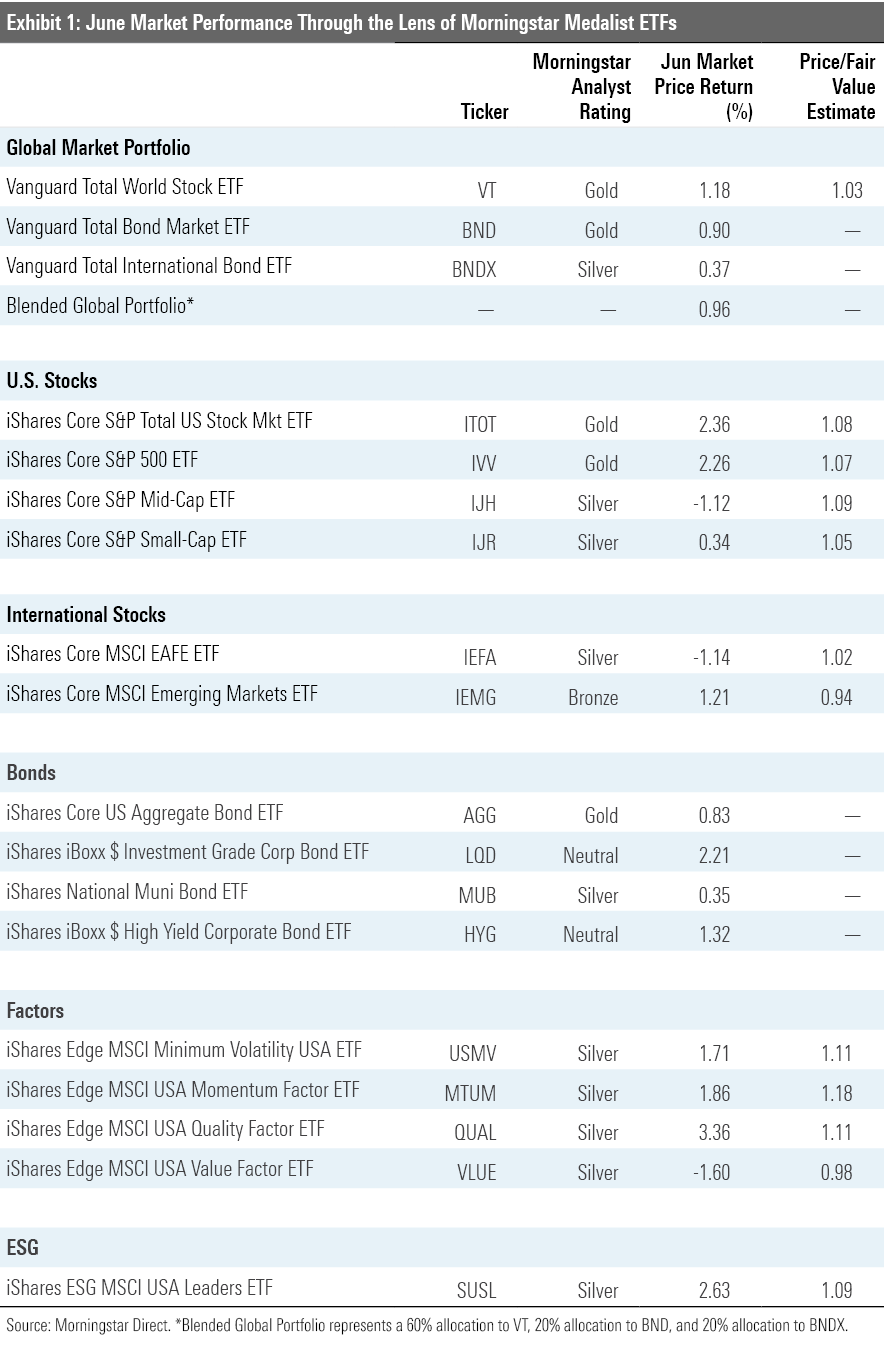

Exhibit 1 features June returns for a sample of ETFs with Morningstar Analyst Ratings that serve as proxies for major asset classes. Investors in a blended global portfolio saw a 0.96% return last month. It was a balanced effort. While Vanguard Total Bond Market ETF’s BND 0.9% contribution looks fairly modest, that’s the fund’s best one-month return since November 2020. So far this year, the portfolio’s bond sleeve has widely trailed Vanguard Total World Stock ETF VT, whose 12.59% year-to-date return has pushed the blended portfolio ahead.

U.S. stocks drove most of VT’s returns last month, while the international side of the portfolio faltered. The U.S. has led the way for most of 2021; iShares Core S&P Total U.S. Stock Market ETF’s ITOT 15.25% year-to-date return comfortably exceeded iShares MSCI ACWI ex U.S. ETF’s ACWX 9.05% gain. Slow performance from Chinese and Japanese stocks caused most of that spread, as European stocks mostly fared well over 2021’s first half.

Leadership in the U.S. market has seesawed between value and growth stocks over the past few months, and after a value-friendly May, it was growth’s turn in June. Vanguard Growth ETF VUG added 6.02% last month, while Vanguard Value ETF VTV slid 1.25%. Mega-cap tech stocks led the charge. Most notably, Microsoft MSFT, Apple AAPL, and NVIDIA NVDA--a tech trio that collectively represents over 20% of VUG’s portfolio-- each posted their best monthly returns of the year. Value stocks have still broadly outperformed growth stocks for the year to date, but growth stocks’ recent run has put a speedbump in value’s comeback trail.

Lopsided value-growth performance manifested in the iShares suite of single-factor strategic-beta ETFs. IShares MSCI USA Quality Factor ETF QUAL--whose profitability focus lands it on the growth side of the Morningstar Style Box--had a strong month, while iShares MSCI USA Value Factor ETF VLUE sputtered. IShares MSCI USA Momentum Factor ETF MTUM climbed last month as well, but it has seemed to find itself on the wrong side of each value-growth flip-flop recently. After its growth-oriented stance hurt performance from late last year into early 2021, the fund raised its stake in the value-friendly financials sector (to 32% of the portfolio from 2%) and halved its tech exposure (to 17% from 41%) at its May rebalance. In June, financial services was the market’s worst-performing sector; tech was the best. The momentum effect works best when recent trends persist, so the market’s recent indecision has wreaked trouble on most momentum strategies.

As growth stocks have started to re-establish their footing, so have large caps. IShares Core S&P 500 ETF IVV outpaced iShares Core S&P Small-Cap ETF IJR by about 2 percentage points in June to cap off a quarter in which it nearly doubled its small-cap counterpart’s returns. Smaller stocks tend to be more volatile and economically sensitive than their better-established peers, so they have flourished as the market rebounded from the coronavirus-driven drawdown last year. However, the market is a forward-looking mechanism, and small-cap stocks’ recent slowdown invites the question of whether a post-pandemic economic reality is already fully embedded in their stock prices.

The broad U.S. market’s sustained run has bred rich valuations. ITOT traded 8% above its fair value in May, as measured by fund’s Morningstar price/fair value estimate. The lone U.S. fund in Exhibit 1 to see its price/fair value ratio shrink in June was VLUE. While this likely owes to poor recent performance rather than fair value estimate increases, it indicates that some of the best domestic value may in fact lie in VLUE.

Fully Stocked

Steep valuations have not rattled investors, as they continued to pour into stock ETFs in June. The $55 billion of inflows that stock ETFs added last Month represented about three fourths of all ETF flows in June. Stock ETFs have absorbed nearly $352 billion in new money so far in 2021, which is about 7 times the year-to-date flows they tallied at the end of June 2020.

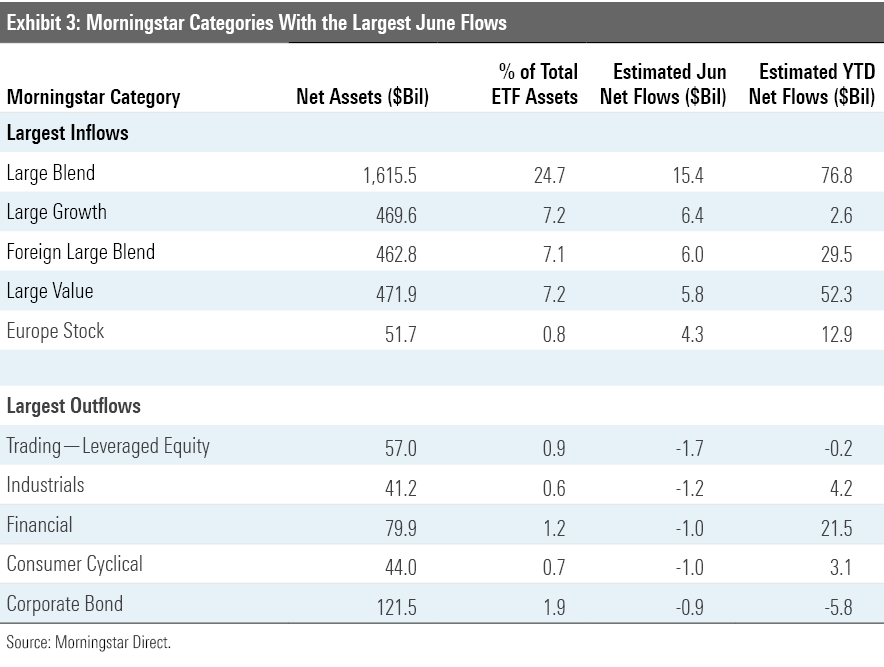

U.S. small-, mid-, and large-cap value ETFs collectively added $7 billion last month, bringing their year-to-date tally up to $66 billion in flows. Value funds have benefited as investors have mostly opted for ETFs investing in statistically cheaper stocks in 2021. That said, growth ETFs collected $7 billion of their own in June after pulling in only $3 billion this year through May. Recent performance may help explain the direction of investment. Growth stocks thrived last month, while financials and industrials ETFs--the two worst-performing sectors in June--saw combined outflows of over $2 billion.

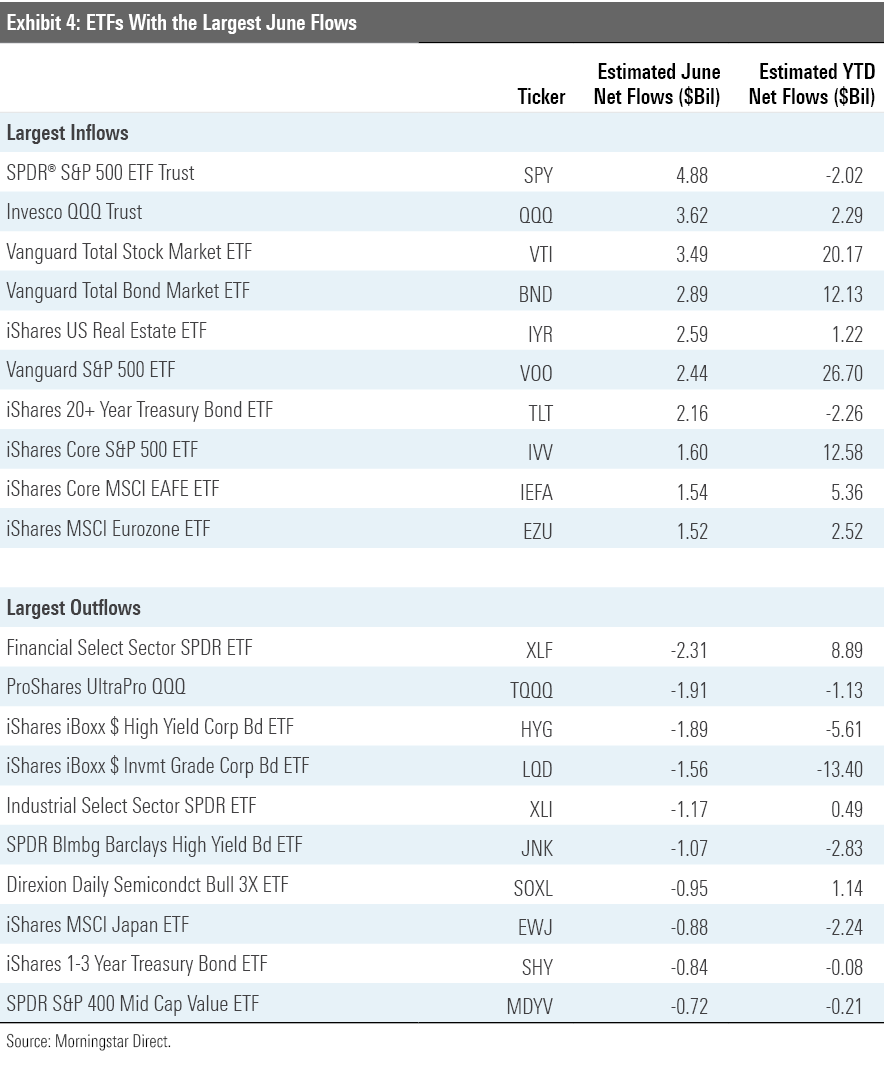

Many investors continued to turn their focus overseas, where stock valuations look somewhat more attractive than they do stateside. ETFs in the foreign large-blend Morningstar Category pulled in $6.0 billion last month. That raised their year-to-date haul to $29.5 billion, which ranks third among all categories behind U.S. large-blend ($76.8 billion) and U.S. large-value ($52.3 billion). Among ETFs investing in stocks from foreign developed markets, iShares Core MSCI EAFE ETF IEFA and Vanguard FTSE Developed Markets ETF VEA led the way, jointly collecting about $3 billion in flows. These two funds traded at 2% and 1% premiums to their fair value estimates at June’s end. While these would be take-it-or-leave it valuations under most circumstances, they register as mildly attractive when ITOT trades 8% above its fair value. Investors hunting for cheap stocks may eye emerging markets--iShares Core MSCI Emerging Markets ETF IEMG carried a 6% discount at May’s end and collected $1 billion last month--but this month entails a unique array of risks to consider.

Whichever the market, plain-Jane broad index ETFs received the most investment in June. Three S&P 500 trackers--SPDR S&P 500 ETF Trust SPY, Vanguard S&P 500 ETF VOO, and IVV--cracked the top 10 largest inflows. International broad-based options like IEFA and iShares MSCI Eurozone ETF EZU cracked the top 10 as well. So far in 2021, investors have favored the market’s simplest, cheapest options.

While stock ETFs have been the star of the 2021 show, bond ETFs are quietly on pace to match the record-setting $212 billion they collected in 2020. After adding $19 billion last month, their year-to-date inflows sit at $106 billion. Short- and intermediate-term bond ETFs have accounted for most of it, as concerns over rising rates diminished the appeal of longer-term bond funds over the first few months of 2021. Shorter-term bond portfolios continued to lead the way in June, but longer-term options picked up some steam as rates have stabilized. Long-term government ETFs collectively absorbed $2.9 billion in June after heavy outflows in May. Inflation-protected bond ETFs had another strong month as well. They pulled in $3 billion of new money, indicating that inflation remains at the front of many investors’ minds.

ARK Reclaims its Top-10 Spot

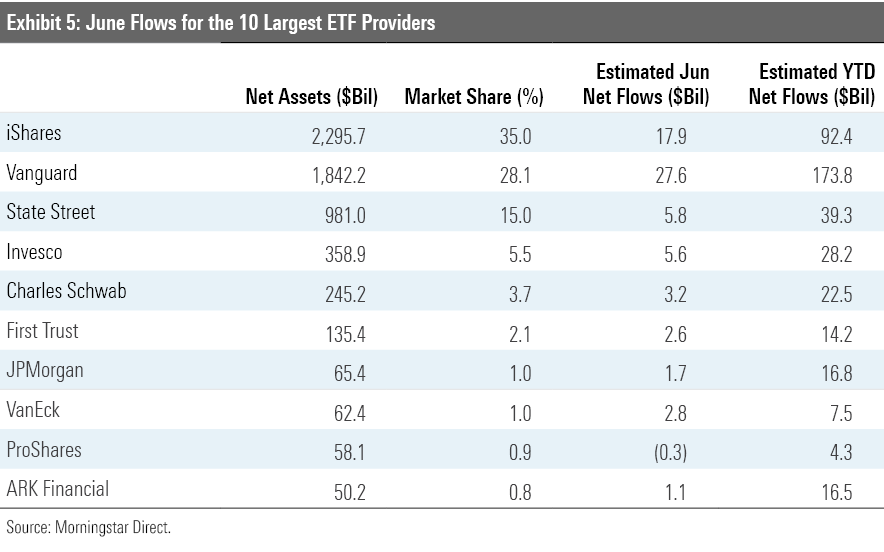

Vanguard extended its streak atop the ETF provider flows table to seven months in June, as the firm’s ETFs raked in $27.6 billion. At the end of June, the fund’s $173.8 billion year-to-date haul exceeded the combination of its next three closest competitors’ (iShares, State Street, and Invesco).

ARK Invest returned to the 10 largest ETF providers list in June after briefly conceding its spot to WisdomTree. The firm pulled in $1.1 billion last month, but it was excellent performance rather than a flood of new money that sent ARK back to the leaderboard. The firm’s ETF lineup delivered an asset-weighted return of 13.8% last month, headlined by a 16.9% gain from ARK Innovation ETF ARKK, its flagship fund. That’s a marked turnaround from the previous five months, when the fund lost 22.4% and ranked dead last among its mid-growth category peers. Hefty inflows followed this firm’s tremendous run in 2020--whether the same story unfolds after June remains to be seen.

Cheap Isn’t Always Cheap Enough

The fair value estimate for ETFs rolls up our equity analysts' fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing this value by the ETFs' market prices yields the price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

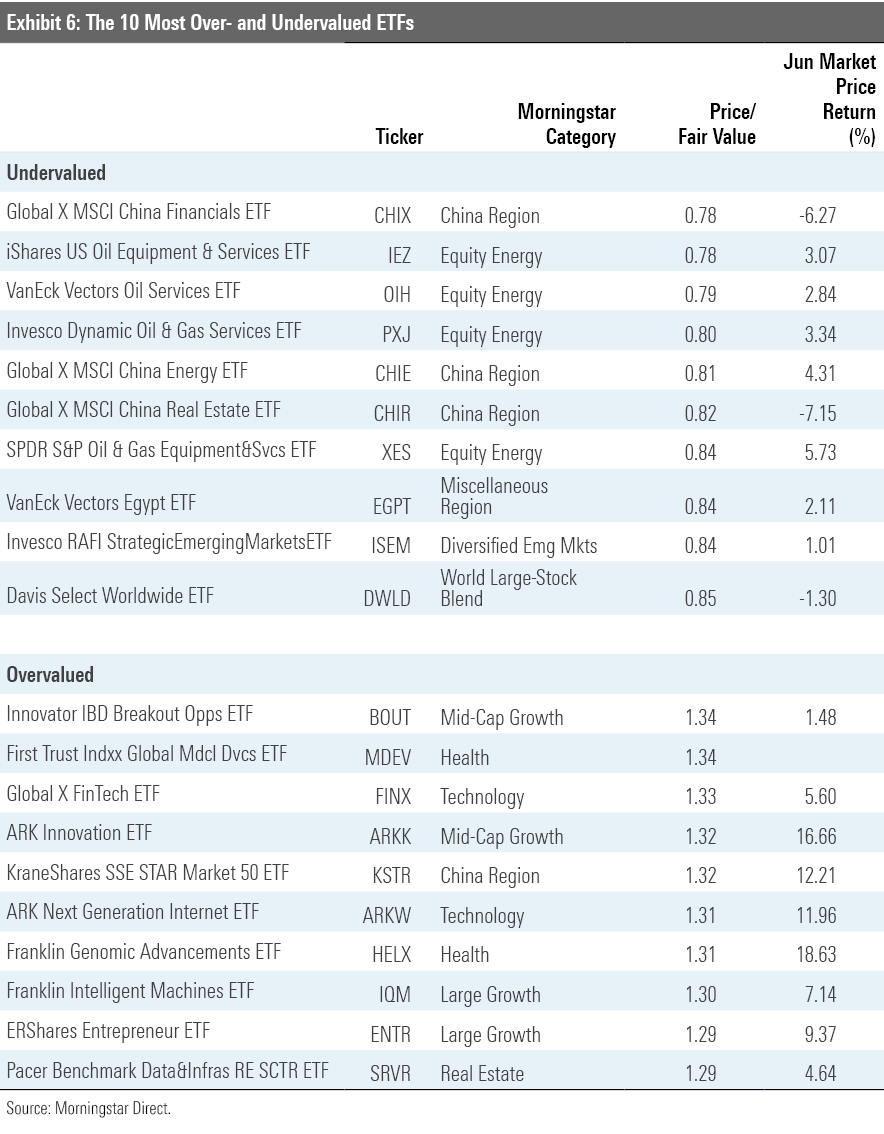

Since the coronavirus-driven drawdown in early 2020, energy-focused funds have been a fixture in the “undervalued” half of Exhibit 6, which features the 10 ETFs trading at the largest discounts to their fair value estimate. The sector broadly tanked when the pandemic took hold last spring, as demand vanished and supply continued to flood the market.

The economy has recovered, however, and so have many of these funds. Energy has handily outperformed all other U.S. sectors for the year to date through June. For example, iShares U.S. Oil Equipment & Services ETF IEZ added 3.07% in June, raising its year-to-date return to 37.23%. That this fund--and its energy peers--remain considerably undervalued despite a torrential first half of the year underscores two points: 1) Energy funds were incomprehensibly cheap at the market’s nadir last March; and 2) compelling valuations in today’s stock market are few and far between.

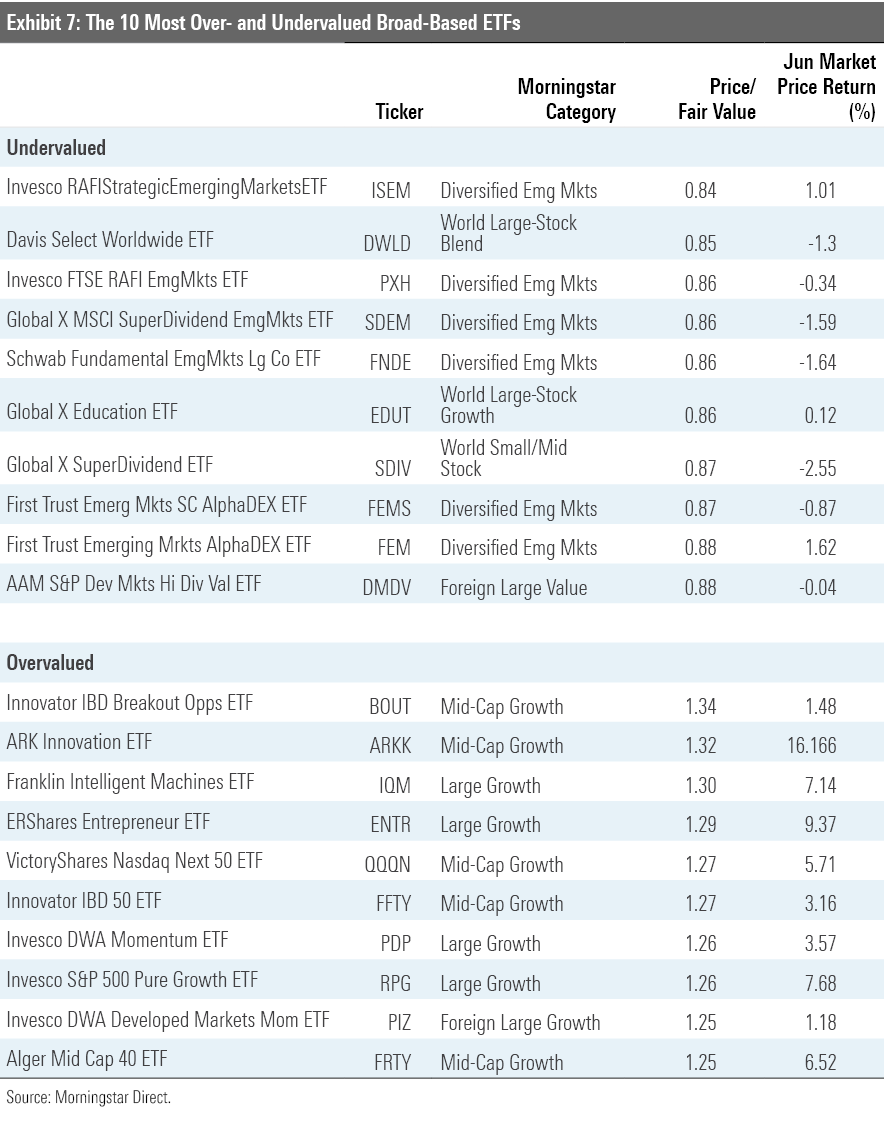

Investors hunting comparably cheap valuations in a more-diversified portfolio likely need to look overseas. As Exhibit 7 shows, foreign stock ETFs dominated the ranks of the cheapest broad-based ETFs at June’s end. Most of these funds zero in on international stocks that look cheap relative to their dividends or other fundamental measures of value. The question becomes, are these funds cheap enough to offer adequate returns for the risk they court? For example, Global X SuperDividend ETF’S SDIV risk/reward profile should give investors pause. The fund's standard deviation of returns (a measure of risk) exceeded the MSCI ACWI SMID category benchmark by 35% over the three years through June 2021. Relative to the same index, its upside-capture ratio was 78% and its downside capture ratio 141% over the same span. So, the stocks featured in some of these portfolios may be cheap but not cheap enough to compensate them for their risk.

Bronze-rated Davis Select Worldwide ETF DWLD is a more attractive member of the ETF bargain bin. While it uses a different moniker, this is the ETF version of the actively managed Davis Global fund. While it spins a relatively lean portfolio of about 30-40 stocks, it’s a sensibly constructed fund run by a proven manager and should offer a more reasonable risk/reward trade-off.

A pair of ARK ETFs headline the “overvalued” half of Exhibit 6. After a subpar start to the year, ARKK and ARK Next Generation Internet ETF ARKW posted June returns of 16.66% and 11.96%, respectively. ARKK in particular has shown its ability to dominate the rest of the market, but it may not see the same results in all environments.

Two Invesco funds, Invesco DWA Momentum ETF PDP and Invesco S&P 500 Pure Growth ETF RPG, help populate the pricier side of Exhibit 7. Both steer decisively into fast-growing stocks, but that’s no guarantee they’ll outperform their large-growth category peers when growth is in favor. Both funds finished in their category’s bottom decile over the five years through June, a period characterized by growth stocks’ success. A smaller-than-average market-cap orientation held both of these funds back, overshadowing their pronounced growth exposure. This underscores the importance of evaluating ETFs from all possible angles rather than trusting they’ll perform as they promise.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)