Facebook, Alphabet Still Have Upside Potential After Strong First Half

Surging advertising demand drives online media shares higher as traditional media firms scramble to bulk up.

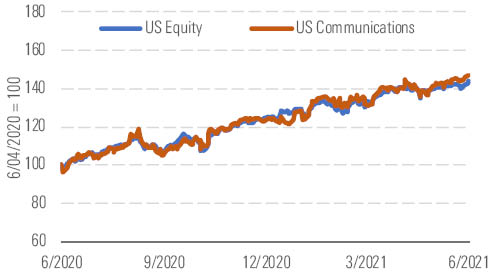

The Morningstar US Communication Services Index continues to outpace the broader market, beating the Morningstar US Market Index by nearly 3 percentage points during the second quarter, taking outperformance so far in 2021 to about 4 percentage points (Exhibit 4a).

Facebook and Alphabet have led communications shares higher. - source: Morningstar

Internet giants Alphabet and Facebook have accounted for most of the sector’s gains, with their shares up 42% and 32%, respectively. Despite the strong performance, we believe both stocks still provide solid upside potential, as each trade in 4-star territory.

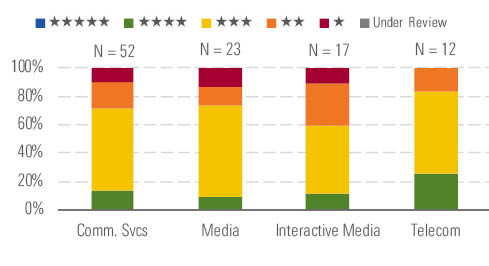

We see opportunities across the communications landscape. - source: Morningstar

As 2021 has progressed, we’ve sharply increased our expectations for advertising growth based on both cyclical and emerging longer-term factors. Companies, including a wave of newly formed businesses, are clamoring to attract increasing consumer spending, while the shift of commerce online during the pandemic shows no sign of reversing. These trends should drive strong revenue growth for both firms. We also remain convinced that the regulatory challenges facing Big Tech firms are manageable.

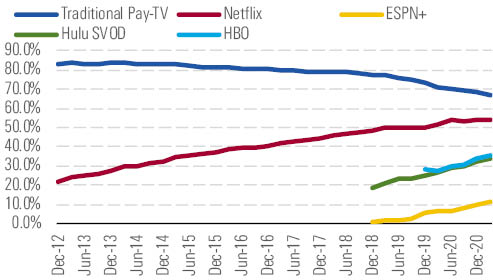

Streaming services are on the rise as traditional TV declines. - source: Morningstar

The sector’s performance laggards have delivered the biggest developments of 2021 thus far. AT&T announced in May that it will spin off its WarnerMedia business, merge it with Discovery, and “resize” its dividend payout. While investors haven’t cheered this news, we believe AT&T is taking necessary steps to rectify past mistakes. The new media company should have the scale, content breadth, and management focus needed to take on Netflix and Disney.

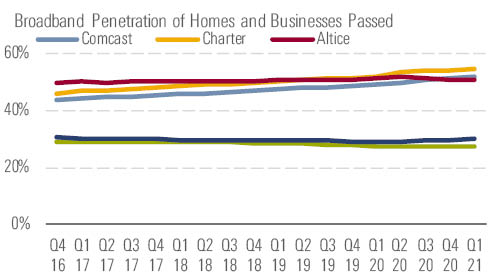

Cable companies continue to dominate broadband markets. - source: Morningstar

The remaining telecom business should emerge with a stronger balance sheet, allowing it to increase capital spending. AT&T plans to increase investment in its fiber-optic network, connecting 3 million new homes and businesses annually over the next several years. This expansion will provide incremental competition to cable companies like Comcast and Charter for consumer broadband customers, which we expect will cause their growth to slow. In addition to the broadband opportunity for AT&T, we suspect the fiber expansion will support its wireless network, providing differentiation against Verizon and T-Mobile in some areas.

ViacomCBS capitalized on the Archegos Capital ordeal to issue $2.6 billion of new equity at favorable prices in March. While we believe ViacomCBS has adequate scale to compete for streaming customers, the additional capital should serve it well.

Top Picks

Alphabet GOOG Star Rating: ★★★★ Economic Moat Rating: Wide Fair Value Estimate: $2,925 Fair Value Uncertainty: High

As the economy recovers, we remain confident that accelerating growth in brand ad spending along with the return of ad spending in the travel industry and ongoing spending on direct-response ads will further strengthen revenue growth for Alphabet. Data, such as that from the Transportation Security Administration, indicate a slow but gradual recovery in travel. Plus, more agreements with publishers should help growth. In addition, while businesses accelerated digital transition in 2020, which helped Google's cloud business, we think strong demand remains for that business-to-business segment, driving further rapid growth and diversifying Alphabet's revenue base.

Lumen Technologies LUMN Star Rating: ★★★★ Economic Moat Rating: None Fair Value Estimate: $18 Fair Value Uncertainty: High

Lumen remains too cheap, in our view. We believe it is on sound footing financially, so its ability to continue generating cash outweighs a top line that keeps declining. The free cash flow yield on the equity is about 20%, and we forecast free cash flow to remain relatively stable. While we don’t see an obvious catalyst to drive the stock higher, Lumen’s 7% dividend yield is well covered—the payout ratio over the last two years has been about 33% of free cash flow. Remaining free cash (about $2 billion annually) is being used to pay down debt. Less than $10 billion in debt matures over the next five years, and net debt/EBITDA is about 3.5.

ViacomCBS VIAC Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $61 Fair Value Uncertainty: High

With the recombination of Viacom and CBS, we believe the new firm has the content breadth and depth to ensure that its roster of channels remains entrenched in any traditional television offering while also providing plenty of material for Paramount+, its revamped direct-to-consumer streaming offering. ViacomCBS' roster of paid streaming services, which also includes Showtime, has posted strong growth recently, even though the shift from CBS All-Access to Paramount+ only happened in March. The free Pluto TV platform is also growing rapidly. Finally, as movie theaters reopen, the firm's film studio should benefit nicely.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)