Market Outlook: Stocks Look Fairly Valued

It's a good time to trade up to wide-moat companies.

At a 4% premium to our intrinsic valuations, the broad equity market in North America is at the high end of fairly valued. While many overvalued mega-cap stocks either fell or lagged the market, rising stock prices pulled up many previously undervalued stocks into fair value territory.

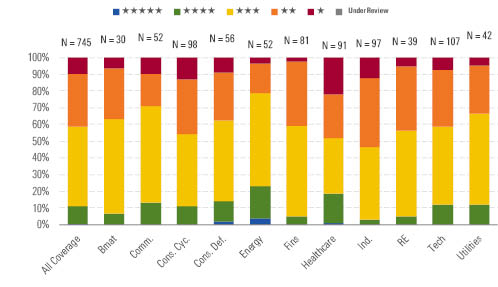

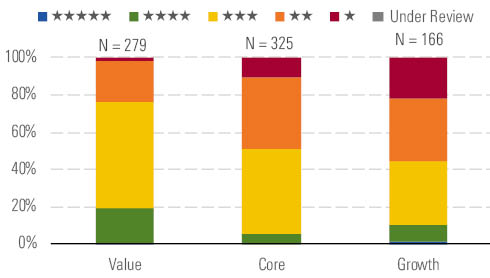

Some undervaluation remains, but in our North American coverage, less than 12% of stocks have 4- or 5-star ratings. Since 2006, there have been only six months with as low a percentage of undervalued stocks. Based on the Morningstar Style Box, we recommend a portfolio weighted toward value stocks with exposure in growth focused in the large-cap category.

Energy remains the most undervalued sector, with communications a close second; but undervaluation in communications is concentrated in a handful of stocks. With the market trading above fair value, it's an opportune time to trade up to wide-moat firms.

- This quarter, we increased our GDP forecast to 6.0% and revised our 2021 inflation projection to 2.9%; yet, we continue to expect that inflation will subside and average slightly over 2% thereafter.

- Energy stocks outperformed for the third consecutive quarter, yet the sector remains undervalued.

- Growth stocks outperformed in the second quarter but have not fully caught up to the returns posted by value stocks so far this year. Ongoing economic recovery continues to bode well for value stocks.

Broad Equity Market Trading Above Fair Value - source: Morningstar

The stock market continued its march higher during the second quarter. Earnings growth remained robust as the economy rebounded sharply from the pandemic and was bolstered by the combination of federal stimulus programs and easy monetary policy.

Although we increased our fair value assessments across a wide swath of our coverage, the market rose slightly faster and, as such, a 4% premium is at the high end of what we consider fairly valued compared with our long-term intrinsic valuations. While we expect strong economic growth to last well into 2023, we think the markets have overextrapolated earnings growth too far into the future.

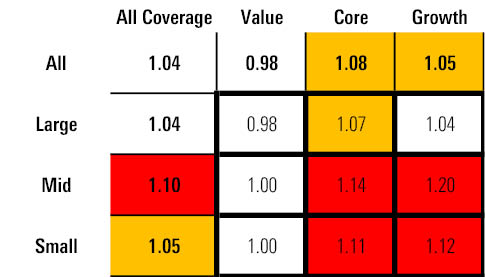

Value stocks remain fairly valued, especially compared with rest of market. - source: Morningstar

Over the past few quarters, we have highlighted that the broad market valuation had been skewed higher by a group of significantly overvalued mega-cap stocks. However, as over half of the overvalued mega-cap stocks we identified at the end of the first quarter either traded down or lagged the broad market, the amount they influence the broad market valuation has declined.

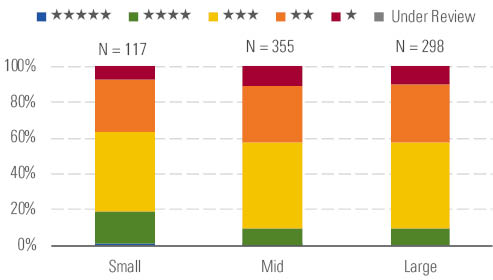

As stocks have risen, we are finding even fewer undervalued stocks. Across our North American coverage, less than 12% are currently rated 4 or 5 stars. This has happened in only six other months over the past 15 years. While valuation metrics have a poor record for timing the market in the short term, in the months following each of those instances, a correction occurred, sending the market down anywhere from 5% to over 20%.

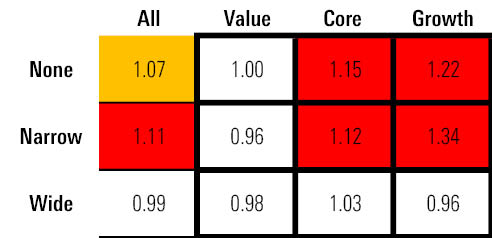

Value and growth stocks with wide moats offer value. - source: Morningstar

Stocks with wide economic moat ratings have generally outperformed the broad market this year. Yet, we continue to see an opportunity for investors to rotate into high-quality, wide-moat companies. Value stocks across large-, mid-, and small-cap categories are each fairly valued. The economic rebound over the rest of this year and into the next will continue to provide a tailwind for value companies. Overall, growth stocks appear slightly overvalued, but the large-cap growth stock category is much less overvalued than both mid- and small-cap growth stocks.

We cover fewer small-cap stocks, but they offer higher value. - source: Morningstar

Core stocks are overvalued across all the market-capitalization segments. The energy sector remains the most undervalued, with communications close behind; however, communications is skewed by Alphabet and Facebook, which account over 40% of the sector’s market capitalization. Similarly, the consumer cyclical sector appears fairly valued overall, but it's skewed by Amazon.com, which accounts for 20% of the index.

Value contains highest percentage of undervalued stocks. - source: Morningstar

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)