Higher Inflation Could Benefit Financial-Services Companies

After recent runup in prices, the sector is about 10% overvalued.

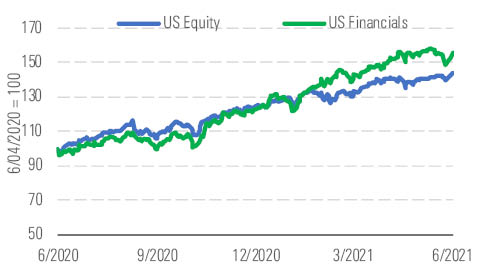

The Morningstar US Financial Services Index has outperformed the Morningstar US Market Index over the previous year, returning 55.4% compared with 43.9%, and slightly outperformed in the second quarter, up 9.5% compared with 8.1% for the market.

Financials outperformed in the second quarter. - source: Morningstar

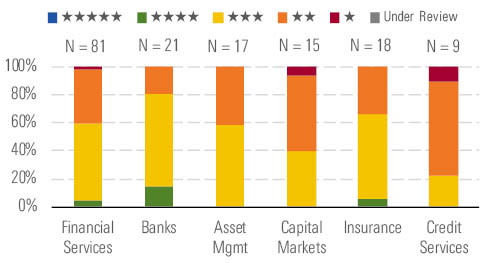

After the recent increase in stock prices, the median North American financial sector stock trades at a 10% premium to its fair value estimate compared with about a 9% premium at the end of the first quarter of 2021 and an 11% discount at the end of the second quarter of 2020. We currently rate less than 5% of the North American financial sector stocks that we cover as undervalued 5- or 4-star stocks, with the remainder about evenly split between fairly valued 3-star stocks and overvalued 2- and 1-star stocks.

Most financials are fairly valued to overvalued. - source: Morningstar

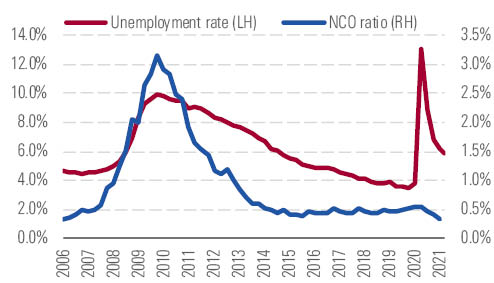

Banking executives increasingly believe that the U.S. government’s fiscal and monetary stimulus has created a “bridge” that is long and strong enough to span much of the gap between the COVID-induced economic downturn and when the economy becomes more normal. The unemployment rate continues to decline, and loan charge-off rates at commercial banks remain exceptionally low. Loan delinquencies are likely to increase near the end of this year when heightened unemployment benefits tail off. Charge-offs should follow in early 2022, but total charge-offs should be manageable, and banks have significantly more capital to withstand loan losses now than in 2008.

Charge-offs are low but expected to increase in early 2022. - source: Morningstar

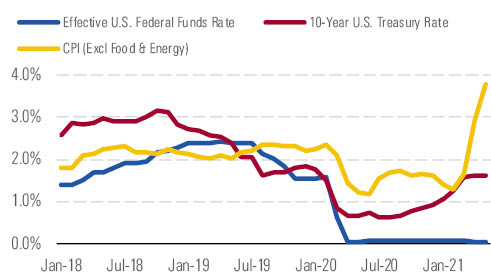

Recently high inflation has people wondering whether the U.S. Treasury will pull back on its loose monetary policy sooner rather than later. Expectations for an economic recovery and higher inflation have been building since the fourth quarter of 2020, as exemplified by the increase in the 10-year U.S. Treasury yield to over 1.5% from about 0.8% in October 2020.

Long-term interest rates and inflation have risen. - source: Morningstar

Inflation has definitely arrived, with the Consumer Price Index, excluding food and energy, increasing 3.8% in May from the previous year. It’s debatable whether the recently high inflation is only a transitory effect from the reopening of the U.S. economy; however, higher-than-expected inflation and interest rates should help financial sector companies, such as payment firms and banks.

Top Picks

American International Group AIG Star Rating: ★★★★ Economic Moat Rating: None Fair Value Estimate: $60 Fair Value Uncertainty: High

American International Group announced upcoming changes to its management team and its intention to separate its property/casualty and life insurance operations. At the start of March 2021, Peter Zaffino took over as CEO, with former CEO Brian Duperreault moving to executive chairman. Arguably, Duperreault’s work as CEO remained unfinished, but Zaffino has been a key lieutenant in the company’s turnaround efforts, and we see this move as confirmation that AIG will maintain its positive course. From a strategic point of view, we also like AIG’s announced intention to separate its life insurance operations.

Berkshire Hathaway BRK.B Star Rating: ★★★ Economic Moat Rating: Wide Fair Value Estimate: $293 Fair Value Uncertainty: Medium

We are impressed by Berkshire Hathaway's ability to generate high-single- to double-digit growth in book value per share. Believing it will take some time before Berkshire succumbs to the impediments created by the size of its operations and that the ultimate departure of CEO Warren Buffett and Vice Chairman Charlie Munger will have less of an impact on the business than many believe, we are always looking for opportunities to put money to work in the name. Berkshire currently has a ton of cash on hand and a disciplined share-repurchase program in place, making it an ideal defensive name in a slowing economy or down market.

Wells Fargo WFC Star Rating: ★★★★ Economic Moat Rating: Wide Fair Value Estimate: $52 Fair Value Uncertainty: Medium

We think Wells Fargo offers unique upside in the sector. Wells comes with a lot of baggage, which is one reason we believe the stock remains somewhat cheap while most of its peers trade at or above our fair value estimates. The company is still in turnaround mode, and we think the bank still has several years remaining of cutting out expenses, while reinvesting into the bank’s core franchises and attempting to reboot growth will remain an ongoing process. The bank is one of the most rate-sensitive names under our traditional U.S. bank coverage, which should give the bank a uniquely strong revenue tailwind if rates do start to rise. Higher rates, the lifting of the asset cap, and future expense cuts are all catalysts for Wells that could drive additional outperformance.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TQKIUI6SDRCQFMUBSWCMD7OKPI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)