Should These 11 Travel Stocks Be on Your Radar?

These companies stand to benefit from pent-up demand--but they aren’t all undervalued today.

Many of us are hitting the road, taking to the skies--or perhaps even setting sail--this Independence Day weekend. In fact, AAA estimates that nearly 48 million Americans will travel over the July 4 holiday, representing a 40% increase over last year.

In a recent Morningstar X-Ray podcast, three Morningstar stock analysts shared their outlooks for travel-related stocks as COVID-19 vaccines have become more widely available and many travel restrictions have been lifted. They also discussed opportunities--or a lack thereof--among the travel-related stocks they cover.

Here are some key takeaways from that conversation.

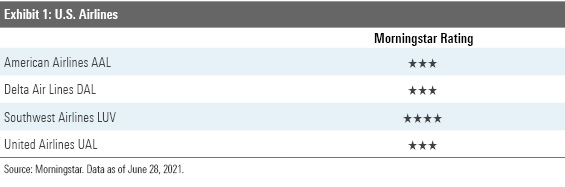

Airlines

Analyst Burkett Huey notes that domestic leisure travel has expanded dramatically in the United States as more people get vaccinated--and the airlines are hoping to capitalize. The big question, says Huey, is how much demand is coming back this summer and where's it going? That'll help determine when the airlines--which carry a lot more debt today than they did going into the coronavirus pandemic--can return to profitability. Business travel remains well below 2019 levels. We need to see the return of large conventions, argues Huey, and it remains to be seen what impact remote client meetings will have on the rest of the business travel segment. Lastly, international travel remains well below 2019 levels.

Given today’s travel picture, Huey thinks Southwest LUV is the best positioned among the U.S. airlines he covers, given that its focus is nearly entirely domestic leisure travel. The stock is slightly undervalued according to our metrics. Huey warns, however, that other airlines are about fairly valued. “I think the market has given airlines a lot of credit for reopening and a travel recovery,” he concludes.

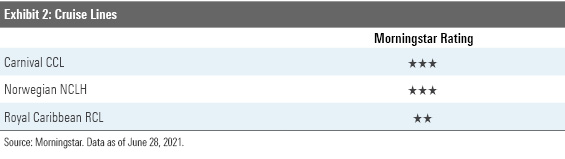

Cruise Lines

Senior analyst Jaime Katz explains that fleets are beginning to return to the seas with many new protocols in place, including lower initial ship capacities, servers working buffets, limited attendance at programs and shows onboard, HVAC updates, and enhanced cleaning protocols--as well as COVID-19 testing plans and mandatory vaccines for at least a certain percentage of travelers and crew. "These efforts are really above and beyond any efforts implemented by other travel industries," she adds. "The cruise lines are really trying to create a safe bubble for their passengers." Katz suggests that the added costs of ongoing COVID-19 protocols--which could remain intact once the virus subsides--could slow margin recovery.

Should investors therefore set sail with cruise line stocks? According to our metrics, these stocks are overpriced today. Instead, Katz suggests playing the travel/leisure theme with outdoor lifestyle names that, like cruise lines, benefit from higher employment and savings rates among consumers--and that are seeing a healthy backlog of orders that supports the shipment demand ahead. Malibu Boats MBUU and Polaris PII are two top ideas that are undervalued.

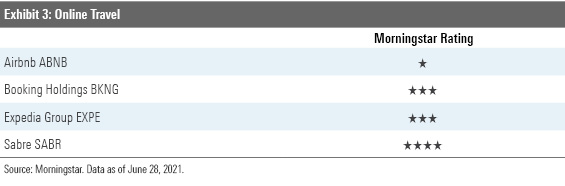

Online Travel

Senior analyst Dan Wasiolek observes that Airbnb ABNB has become a noun and a verb in our society today: The pandemic preference for local road travel and the ability to work remotely from almost anywhere allowed Airbnb's bookings--and stock price--to skyrocket. We expect Airbnb to grow at a healthy clip over the next decade, but we think investors should wait for even more of a pullback in price before buying. "At the current share price, investors are pricing in too much exuberance for long-term revenue growth and operating margin expansion," he concludes.

Most online travel companies are overvalued, but Wasiolek sees opportunity with undervalued Sabre SABR. He points out that because the company is more exposed to corporate air travel, which will recover later, the stock may experience some volatility moving forward. Interested investors therefore need to be patient with the name.

Listen to the full podcast, Market X-Ray: Wheels Up on Travel Stocks.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YQGRDUDPP5HGHPGKP7VCZ7EQ4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZM7IGM4RQNFBVBVUJJ55EKHZOU.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)