Stock Rotation Deflated These Momentum-Heavy Funds

These funds rode momentum stocks higher, but some didn’t pivot with the value rally.

Prior to the stock market rotation out of pricey-fast growing stocks and into value names that began in October, one of the biggest factors driving top performance was momentum. As we noted in October: “Stocks that were going up kept going up, and the laggards kept lagging, leading to a winning streak that is unprecedented in the past decade.”

But that changed in a hurry. Battered energy stocks have surged and big tech names have stumbled.

So how have the funds that rode that momentum wave fared as the tide rushed out? Overall, not so well. Funds where the portfolios were loaded with stocks ranking high on the momentum scale for the most part saw performance sag. That includes a number of high-profile funds with heavy momentum stock holdings.

Momentum as a portfolio characteristic is a measure of the degree to which a fund invests in stocks already on an uptrend and sells those in a downtrend.

Over the past 10 years, momentum has far outpaced other portfolio characteristics in helping explain returns compared with factors such as market capitalization, value versus growth, or yield in helping explain returns. (See our story from last October here.)

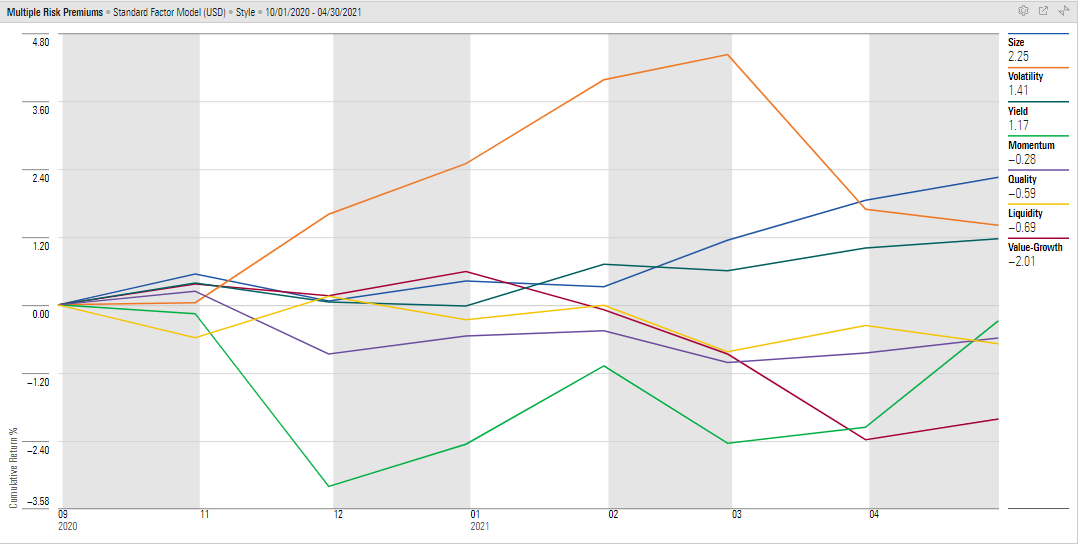

But since the end of October, momentum has turned into a slight drag on fund returns. The following images utilize Morningstar’s Risk Model tool to show the relative performance of different portfolio attributes.

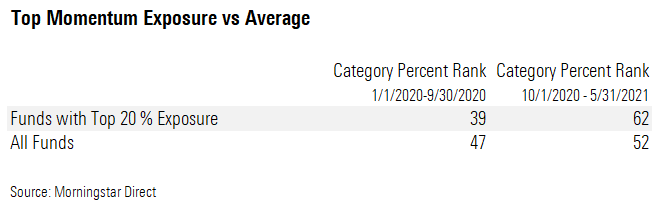

Unfortunately for shareholders in funds with the heaviest momentum readings, many of these funds saw their performance sag as the market rotated in favor of value stocks. As Morningstar analyst Daniel Sotiroff noted, strategies heavy on momentum are vulnerable to both strong changes in direction among wide groups of stocks and strength in value stocks.

With that in mind, we looked at how funds with strong momentum stock profiles have handled the shift in market trends since October.

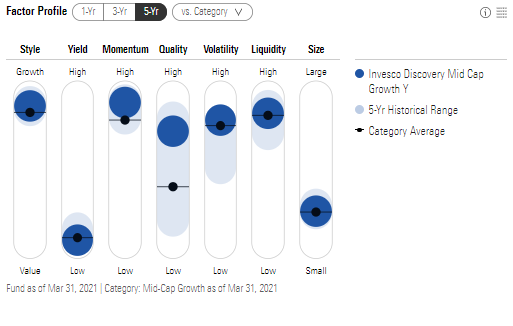

To do so, we looked to Morningstar's Factor Profile data, which measures a fund's portfolio based on seven metrics: size, style, yield, momentum, quality, volatility, and liquidity. (Morningstar Direct and Office clients can find a step-by-step article on how we pulled the data here.)

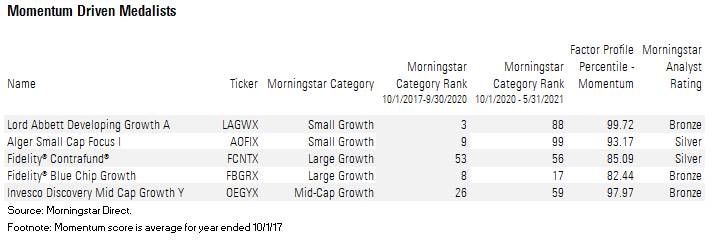

For this article, we screened for Morningstar Analyst Rated-funds with the highest portfolio momentum scores for the year ended Oct. 1, 2017 and compared returns from two very different market backdrops. The three years starting Oct. 1, 2017, through Sept. 30, 2020, captured some of the worst performance on record for value stocks when compared with growth stocks.

Over this three-year period, the Morningstar US Large Value Index returned an annualized 3% while the Morningstar US Large Growth Index returned 23.5% per year.

The tide changed in October. From October 2020 through May 2021, the Morningstar US Morningstar US Large Value Index returned 32.6% and the Morningstar US Large Growth Index returned 14.8%.

Against this backdrop, here's how performance for some Morningstar Medalist funds stacks up:

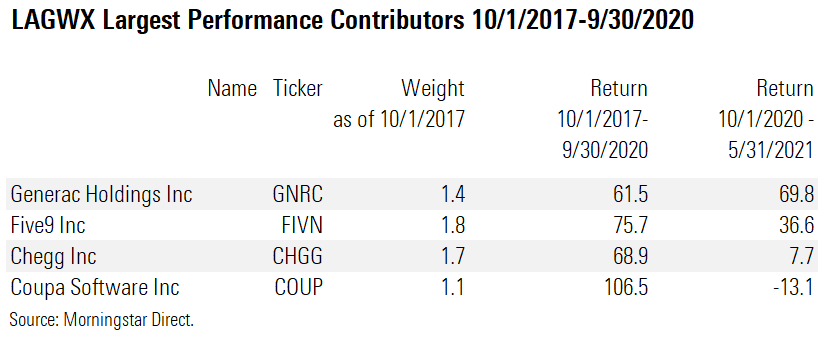

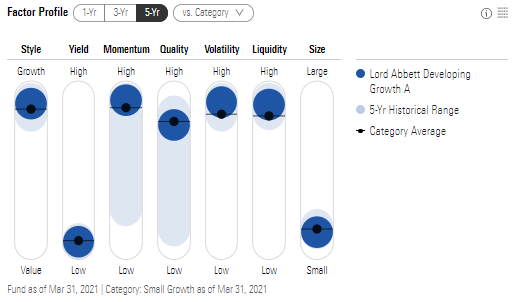

Lord Abbett Developing Growth A LAGWX, with a Morningstar Analyst Rating of Bronze, had the highest momentum exposure of any analyst-rated fund. In his report on the fund, analyst Adam Sabban notes the fund’s momentum-inclusive approach: “Managers initiate positions in stocks on the rise” and ride winners while selling losers quickly. During the strong period for momentum stocks, the fund outperformed, returning an annualized 26.4% largely owing to healthcare and technology holdings (determined using attribution within Morningstar Direct). The largest contributors to the fund are shown below.

During the period of value’s outperformance beginning in October, the fund underperformed significantly, finishing in the 88th percentile in its category since Oct. 1, 2020, with a 27.1% return. The fund was underweight in strong financial services and energy stocks and overweight among the lagging healthcare sector.

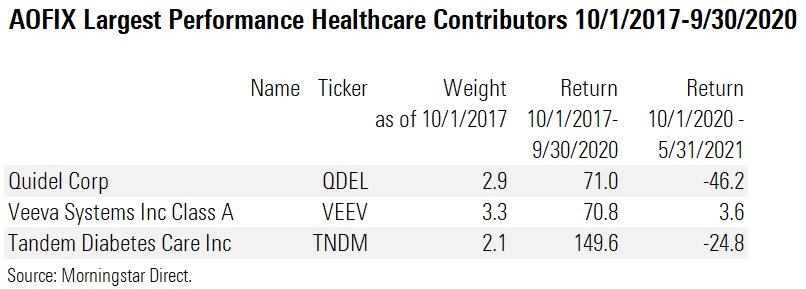

Alger Small Cap Focus I AOFIX was in the top 7% for momentum exposure. Like the prior Lord Abbett fund, Silver-rated AOFIX was a top performer during the momentum and growth period but was unable to transition successfully for the value period, finishing near the bottom of its Morningstar Category with a 13.8% return for the period. The fund was overweight strong performer technology and had strong healthcare picks driving its 23.8% annualized return.

During the strong period for value stocks, the Alger fund was overweight healthcare and underweight financial services and consumer cyclical. Quidel QDEL was the largest detractor for the fund during this period, leading to its 13.8% return between October and May.

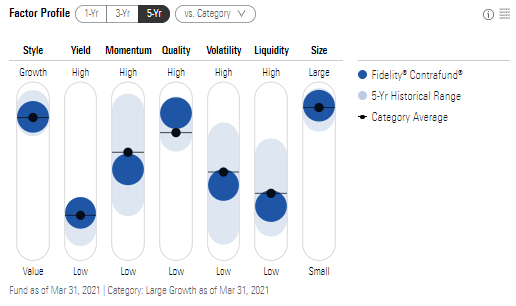

Fidelity Contrafund FCNTX offers a different story. The Silver-rated fund ranks near the top based on momentum, but the performance of the portfolio was in the middle of the pack for both time periods. Morningstar’s Amy Arnott noted that the fund’s strong momentum reading “doesn’t necessarily reflect an investment strategy geared toward buying momentum stocks, but is more likely a side effect of positive stock-price performance trends for holdings such as NVIDIA NVDA, Cloudflare NET, and Shopify SHOP.

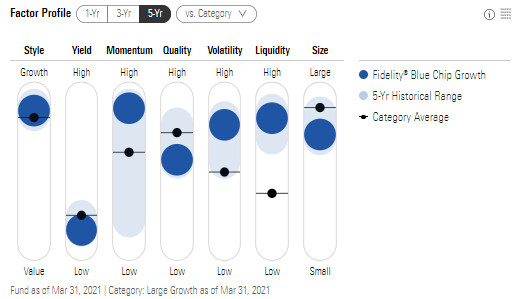

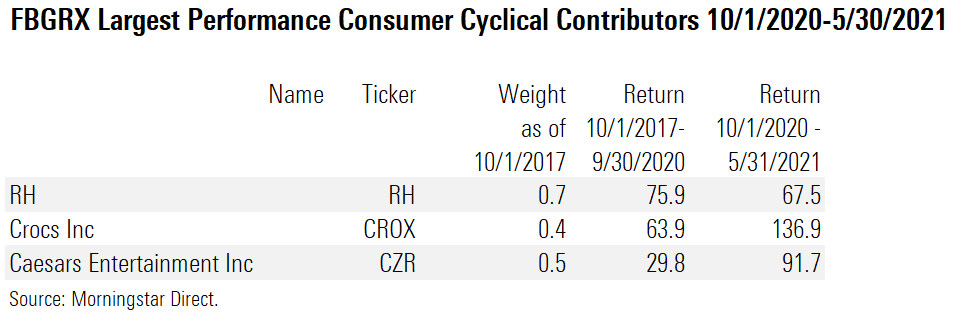

Fidelity Blue Chip Growth FBGRX, meanwhile, performed well in both time periods. The Bronze-rated fund ranked in the 82nd percentile for momentum exposure.

FBGRX outperformed during the momentum and growth period with help from sector allocations in consumer cyclical and technology, while simultaneously being light in industrials. The fund then outperformed during the value comeback on the back of its consumer cyclicals leading the way, returning 25.2%.

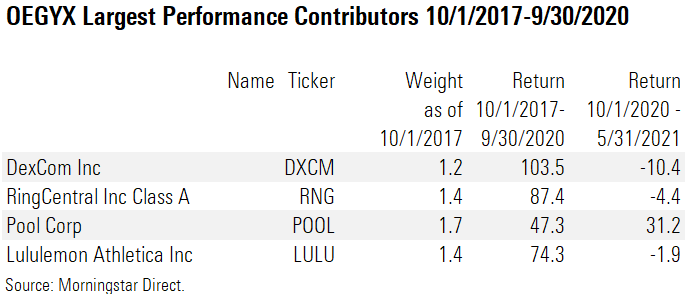

Invesco Discovery Mid Cap Growth Y OEGYX was in the top 2% for momentum exposure. The fund had above-average performance during the momentum and growth run thanks to healthcare and industrials, earning an annualized 18%.

The fund underperformed in the value period with zero to minimal exposure to both energy and real estate, both sectors that posted strong returns. The fund gained 24.8% from October through May.

/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d8236d6f-dcec-4d1b-b5ba-e086adefd364.jpg)