Dividend Stocks Are Back, Fixed Income Not So Much

The value rotation has given new life to laggard equity-income strategies.

After a brutal 2020 for dividend stocks, income-generating names are paying off for investors in 2021. But for investors who look to bond strategies for income, this market has been a struggle. And from an income perspective, stocks still offer attractive yields relative to bonds.

As the global economy recovers, inflation is on the rise and value has trounced growth. Equity market leadership has rotated away from the pricey, fast-growing stocks that had been leading the market's bounceback from the pandemic collapse.

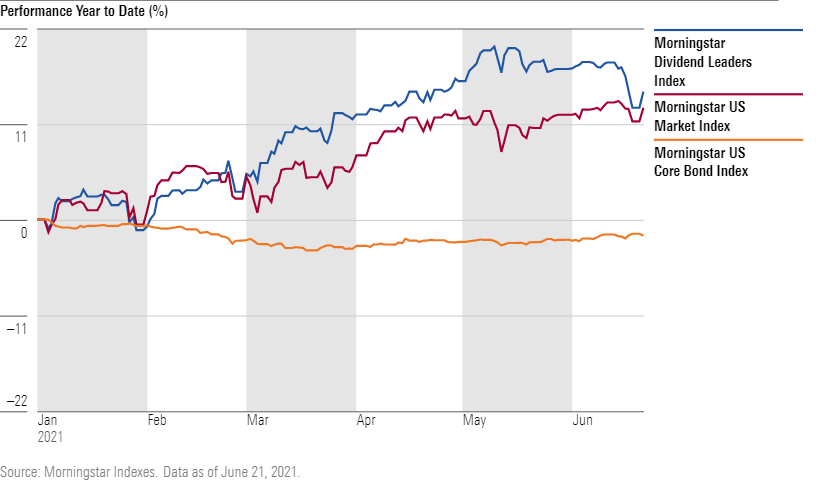

Riding the value rebound, the Morningstar Dividend Leaders Index, which highlights high-income U.S. stocks, has advanced more than 14.7% for the year to date through June 21, 2021, compared with 12.0% for the Morningstar US Market Index. The dividend index has been led by financial-services and consumer stocks. Meanwhile, the Morningstar US Core Bond Index has lost 1.8% for the year to date.

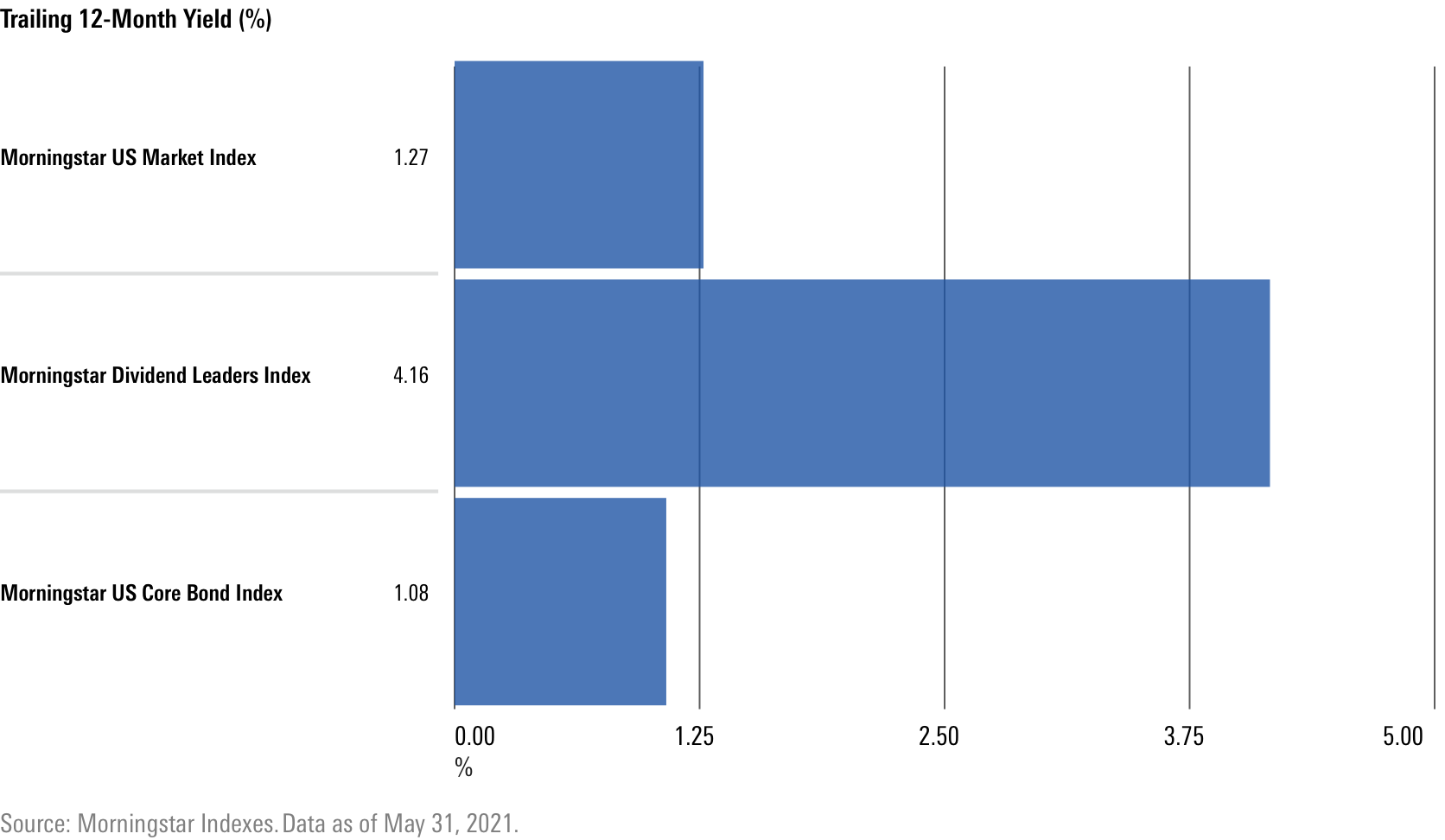

From a payout perspective, income investors who stuck with dividend payers through the difficult days of 2020 have been rewarded. The Morningstar Dividend Leaders Index's more than 4% yield for the trailing 12 months compares favorably with both the overall equity market and the Morningstar US Core Bond Index.

How We Got Here

It's been a rough stretch for dividend stocks.

Dividend payers went through a long period of underperformance in the wake of the 2008 financial crisis. First, the meltdown in the financial-services sector hit many dividend payers. Then, in 2014-15, commodities prices tanked, undermining many dividends in the basic-materials and energy sectors. In recent years, market leadership belonged to the turbocharged FAANG stocks (Facebook FB, Apple AAPL, Amazon.com AMZN, Netflix NFLX, Google [Alphabet] GOOG) and their ilk, which are generally dividend poor.

As with so many trends, the pandemic only amplified the growth-over-value dynamic. Equity-income investors experienced 2020 as a dividend disaster.

By our count, more than one third of the dividend-paying companies in the Morningstar Global Markets Index cut their dividends last year. In the United States, where the dividend commitment is strongest, 91 out of 981 payers reduced, suspended, or eliminated shareholder payouts in 2020. Among the hardest hit were travel booking, entertainment, airlines, cruises, and hotels. The energy and real estate sectors were decimated from the perspectives of both income and total return. Reliable payers like Walt Disney DIS and Shell RDS.B fell victim to pandemic-driven economic devastation.

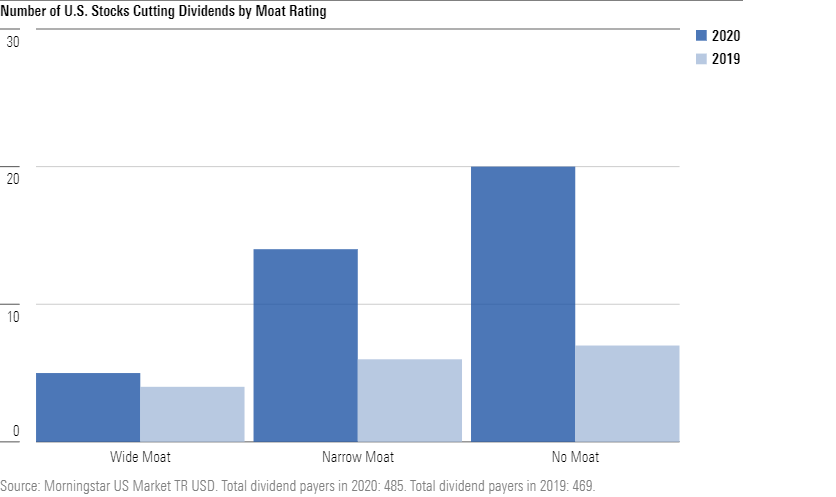

Though 2020 slammed investors with nearly twice the number of dividend cuts recorded in 2019, companies with economic moats (sustainable competitive advantages) around their businesses were better able to sustain their shareholder payouts.

Financially healthy companies with sustainable competitive advantages were likeliest to maintain their dividends. Of the U.S. stocks that have Morningstar Economic Moat Ratings of wide, only five cut their payouts in 2020: Walt Disney, Wells Fargo WFC, Boeing BA, Harley-Davidson HOG, and Blackbaud BLKB. Of those, three had deteriorating financial health scores--Boeing, Harley-Davidson, and Blackbaud. High-quality, financially healthy companies aren't typically the highest yielders.

It bears repeating that bad things happen when investors chase income too aggressively. For both stocks and bonds, high yield equals high risk. The Morningstar US High-Yield Bond Index, for example, plummeted along with the stock market in the first quarter of 2020, shedding 14% of its value. Within the dividend-paying universe, the highest yields are often found in the most troubled areas. Lofty payouts often turn out to be unsustainable "dividend traps."

The Rebound

As a group, equity-income stocks started to mount a comeback in the second half of 2020, especially when vaccine breakthroughs were announced in November.

Since then, dividend payers have ridden 2021's value stock wave. Recovery from the pandemic has lifted economically sensitive areas, which are home to many dividend payers. The best-performing equity sectors this year--energy and financials--tend to contain generous shareholder payouts.

Some of the Morningstar Dividend Leaders Index's top performers in 2021 include Prudential Financial PRU (up 32.0%), National Fuel Gas NFG (up 28.0%), and Philip Morris International PM (up 22.6%).

Return-Free Risks?

"Don't own bonds," the blunt warning from hedge fund guru Ray Dalio in November 2020, looks obvious in retrospect. Ultralow interest rates intended to stimulate a pandemic-stricken economy had nowhere to go but up, and that means price declines on bonds and losses for fund investors. In early 2021, as the pandemic recovery gained ground, the yield on the 10-year U.S. Treasury rose from 1.0% to 1.7% in just two months.

At this point, bond yields are a bit higher but nowhere near levels that most would describe as "attractive" compared with history. Forget about the 5% yield on the 10-Year U.S. Treasury as recently as 2007; bond-income investors likely fondly recall the 3% yields of 2018.

But it's worth remembering how effectively bonds cushion losses during equity downturns. This "portfolio ballast" function was on display not only in the first quarter of 2020 but also in many prior declines--2018, 2015, and 2008, for example. Bonds were unloved throughout the years following the global financial crisis, even referred to as "return-free risks." But that didn't stop them from diversifying equity market risk, damping volatility, and preserving capital during several rough patches.

What's the takeaway for income investors? To quote financial planner Jonathan Guyton in a recent interview with Morningstar's John Rekenthaler:

"One of the great features of boring old Treasuries is they have a tendency to be negatively correlated with the stock market at exactly the time you want them to be negatively correlated with the stock market. Research bears this out. There are studies comparing portfolios with a bond component of corporate bonds to either intermediate Treasuries or T-bills. The portfolio with T-bills leads to a higher safe withdrawal rate."

Summing Up

There's nothing wrong with using dividend-paying stocks and bonds for income, but an investor's top priority must always be total return.

That's why it's also worth remembering that at the end of the day, dividend-paying stocks are still stocks. Morningstar's Paul Kaplan has identified 18 bear markets (declines of 20% or more) over 150 years of U.S. equity market history--an average of one crash every eight years. Such declines can be especially painful for investors in the decumulation stage of life.

In the end, diversification remains an effective means of capturing investment opportunities, reducing volatility, and positioning a portfolio for inevitable bumps in the road.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MFL6LHZXFVFYFOAVQBMECBG6RM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/033528a9-55cc-40aa-90a9-8d2d98697cf5.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)