Sustainalytics: What Climate Litigation Means for the Oil & Gas Industry

This article first appeared on the Sustainalytic blog, available here.

As the global economy is focused on recovery, the oil and gas industry faces a growing wave of shareholder activism and climate litigation due to a heightened focus on an accelerated transition as an indirect impact of the pandemic – painting an increasingly bleak picture for those within the industry.

Breaking down Shell’s court ruling

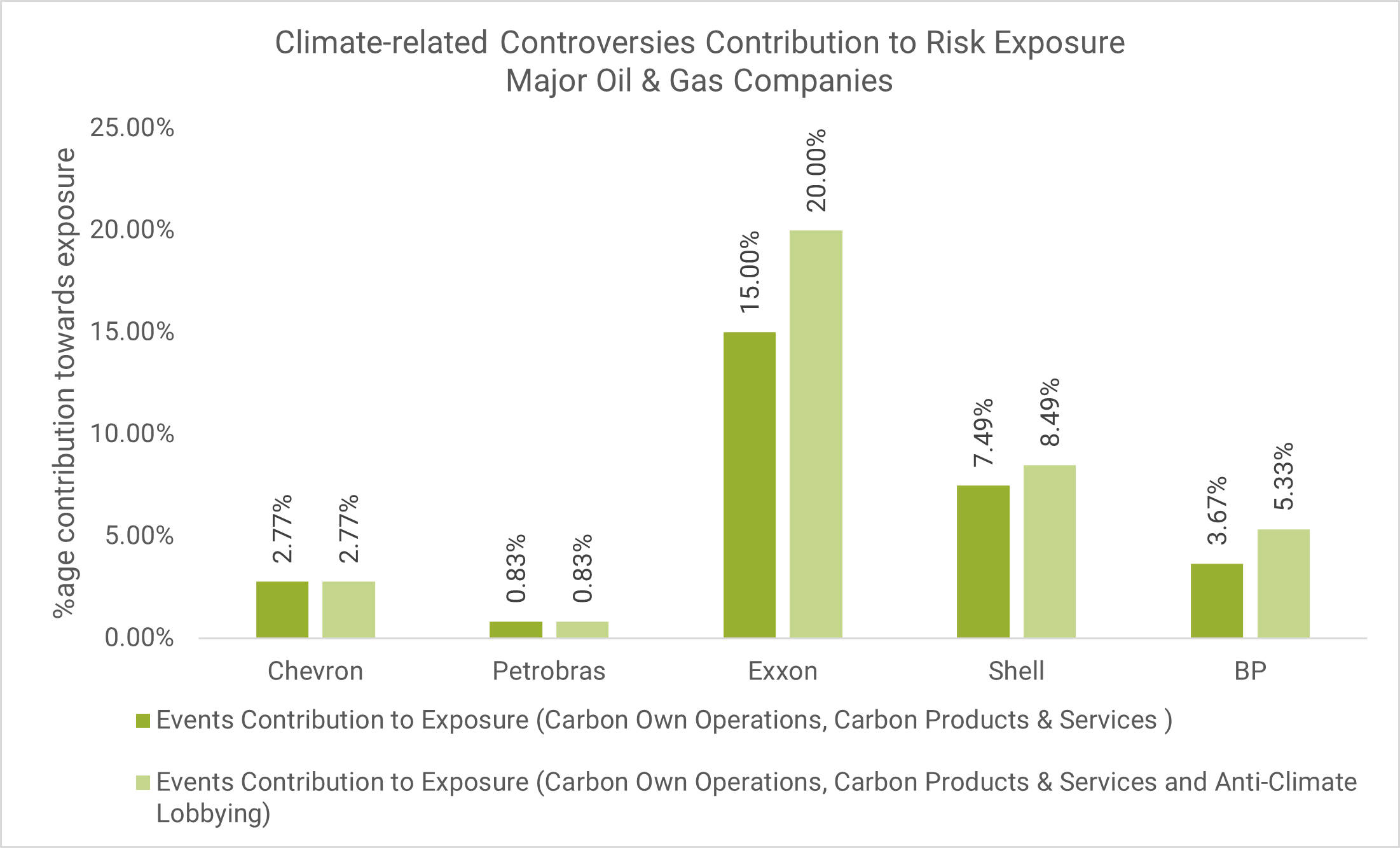

In May 2021, the outcome of litigation against Royal Dutch Shell (i.e., Milieudefensie et al. v. Royal Dutch Shell plc.) in the Netherlands has raised significant questions regarding the legal risk companies may potentially face regarding the strength of their climate commitments. As noted in Sustainalytics' Controversy Research [1] coverage of the ruling, the language used in the court's decision represents a serious development in the ongoing efforts to accelerate a low carbon transition within the oil and gas industry. The current and potential future impacts of this type of litigation and other climate-related controversies are already impacting ESG ratings by increasing exposure to risk, as demonstrated in the figure below.

In its ruling, the court states that companies have an “independent responsibility” relating to addressing climate change, separate from that of the state. More broadly, the ruling also identified companies as having “the responsibility to respect human rights,”

which extends scrutiny from not only a company’s GHG targets but to how it interacts and impacts society as a whole. The long lamented economic theory that business has a social responsibility to make a profit for its shareholders rings true, in that profit can only be generated where business models are adapted to meet human rights needs of the planet and to mitigate further irreversible impacts of climate change through deep and fast cuts in carbon emissions and support a low carbon economy. The ruling establishes the responsibilities companies have to the environment and society, which links back to reducing ESG risks and achieving improved risk-adjusted performance. While this ruling is based in the Netherlands and is specific to Shell (a Dutch-registered company), the ruling may prove relevant in other cases, particularly for EU-based companies with global operations like Shell, due to the court’s opinion on human rights and business responsibility.

This point was also recently noted in Morningstar's report titled Investing Toward Net Zero, [3] which acknowledges climate change as not only an existential threat to humanity but also as a material financial risk to investors. Shell, as well as ExxonMobil (which has also faced recent shareholder activism and climate litigation), are both identified within the report as being higher risk than European peers.

What can we expect from climate-related litigation against oil and gas companies moving forward?

The relative inaction of oil and gas companies is not new, despite the flurry of attention that the recent ruling against Shell has prompted. Last year, Sustainalytics reviewed [4] the efficacy of net-zero targets within major oil and gas companies, including Shell. We concluded that progress was neither rapid enough nor sufficiently backed by capital spending to reasonably mitigate exposure to transition risk while long-term commitments were being made. The review also identified low transparency on how GHG targets are set and a lack of information on whether net-zero commitments were aligned or not aligned with a science-based reduction pathway.

However, the broadening scrutiny of corporate climate commitments and the growing threat of litigation has left oil and gas companies exposed, even as the uptake of net zero commitments grows. Shell can be considered a company with relatively strong industry-level decarbonization initiatives (at least compared to its North American counterparts). Recent stakeholder scrutiny and activist litigation suggest that even oil & gas companies with advanced transition plans can still face increased pressure to take significant action.

While the Dutch court's decision demonstrates a potential gap in the oversight of carbon risk, it also represents an opportunity for Shell. Although the ruling highlights the company's underperformance and exposure to reputational risks, Shell could benefit from a stronger target, as mandated by the court. Revising their targets could lead to faster decarbonization and more rapid growth in low-carbon product segments, resulting in enhanced resiliency by supporting a low carbon economy post-2030. However, while Shell seems to understand this opportunity, based on the recent reaction [5] from its CEO Ben van Beurden on the ruling, it may open itself to further investor scrutiny and future legal hardship if it decides to appeal the decision.

Governance and board-level accountability remain the most critical opportunity for companies to meaningfully address climate change and to address transitional risks.

With corporate action and broader expectations concerning corporate responsibility beginning to diverge, it appears we’re reaching a tipping point where good climate governance and the duty to shareholders are becoming undeniably interconnected.

As noted in a previous Sustainalytics blog, [6] climate governance is corporate governance, and boards would do well to enhance their approaches and responsibilities in this area. In the recent election of three new members to ExxonMobil's board of directors – which Sustainalytics' Stewardship Services [7] provided clients with a recommendation to vote for the dissident slate – investor sentiment on board-level oversight of climate risks and opportunities resulted in substantial governance changes as investors did not feel that Exxon was addressing issues adequately.

As the G7 has now formally expressed support for mandatory climate-related disclosures aligned to the Task Force for Climate-related Financial Disclosure (TCFD), [8] misalignments with net zero-targets and exposure to carbon-related risks are expected to increase. This necessitates crucial changes to climate governance at the board level and within the broader business, particularly for companies within the oil and gas industry who continue to face increasingly material climate risks, such as those posed by climate litigation.

Sources:

[1] Sustainalytics Controversy Research.

[2] Court of the Hague Ruling, Milieudefensie et al. v. Royal Dutch Shell plc (May 2021).

[3] Morningstar Research, Investing Toward Net Zero: Applying Sustainalytics carbon metrics to Morningstar indexes (April 2021).

[5] Sustainalytics Research, Integrating Climate Risk into Corporate Governance.

[6] Reuters, Shell to step up energy transition after landmark court ruling (June 2021).

[7] Sustainalytics ESG Voting Policy Overlay.

[8] Reuters, G7 Backs Making Climate Risk Disclosure Mandatory (June 2021).

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CQP5OBZT3NBS7M76RDJCKLIFVM.png)