Vanguard Is Adapting to Stiff Competition

Advice, high-conviction active, and private equity are three big initiatives.

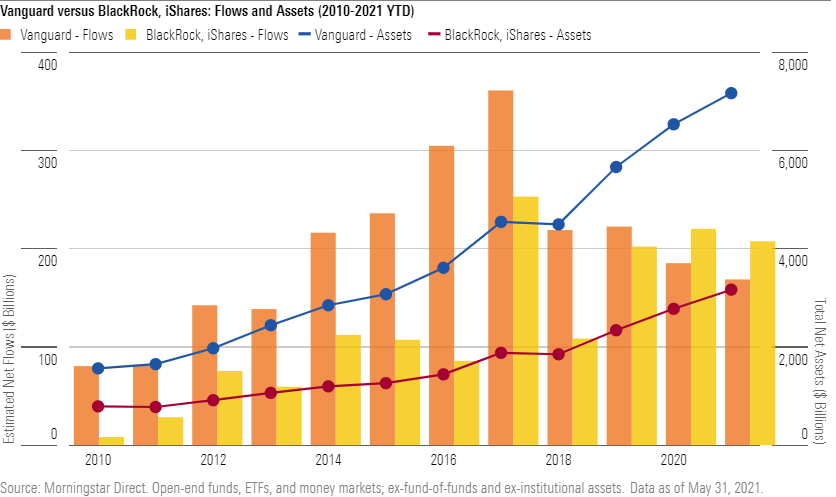

Vanguard is still the world’s largest retail mutual fund family, but it has had to adapt to stiff challenges to its hegemony. If trends persist, for example, BlackRock and its iShares ETF business in 2021 will take in more new money than Vanguard’s U.S. funds for the second year in a row.

Nearly five decades ago, Vanguard was the disrupter, adopting a direct-to-investor sales model and launching the first retail index fund. To keep from becoming the disrupted, the family has embarked on several initiatives to burnish its brand and further transform the industry. Three of the biggest initiatives are offering more advice, enhancing its actively managed stock funds, and expanding access to private equity. But these efforts pose challenges for Vanguard--including staying true to its ideals.

Fees Can Fall Only so Far

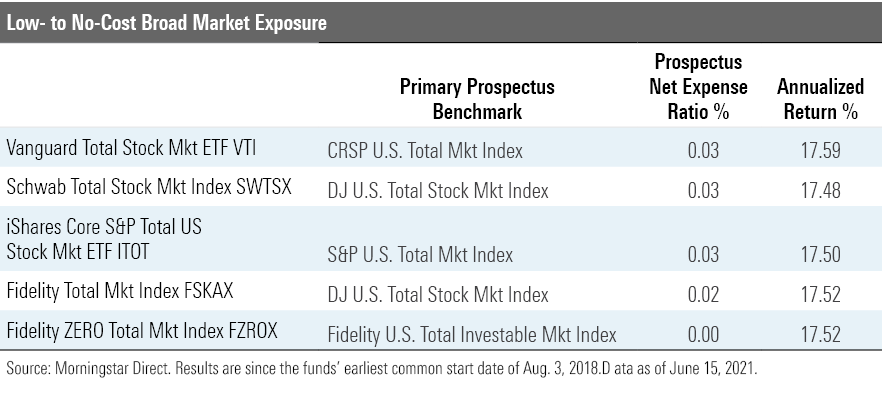

Modest fees are one of those ideals, but Vanguard is no longer always the cheapest. Although it remains the progenitor of low-cost index funds and its mutual ownership structure helps it maintain the industry’s lowest average fees, Vanguard has become a victim of its own success. Its indexing revolution has worked so well that miniscule- or even no-cost broad market exposure has become a commodity product. Indeed, Fidelity ZERO funds are free to retail investors with a Fidelity brokerage account.

Vanguard’s relentless focus on cutting its own costs can’t go much further, either. Over the past decade, its asset-weighted U.S. average expense ratio has fallen from 0.17% to 0.09%. Significant future reductions will only become more difficult, and the pace is sure to slow. Vanguard must find other ways to retain clients and attract new ones.

Making Advice Accessible

Vanguard has sought to differentiate itself by offering advice--ironic, because it originally had no intention of doing so. Vanguard owed its early survival not to growth in passive assets but to its 1977 decision to eliminate sales charges and sell direct, bypassing the commission-based advice structure that then predominated. In the words of founder Jack Bogle, “[W]e staked our existence on a new distribution strategy, which required independent investors to make intelligent choices.”[1]

As assets grew and client accounts swelled and got more complicated, Bogle, to his credit, began questioning the firm’s assumption that it should not “provide custom-made investment advice and asset allocation guidance.”[2] Then, in the 1990s, Vanguard entered the advice business.

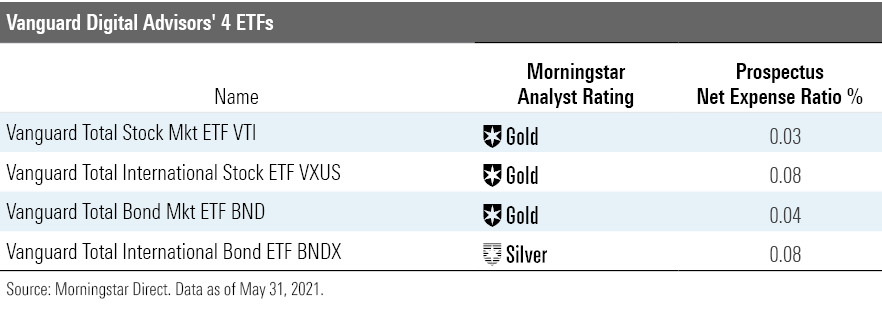

Its early efforts were difficult to scale, and a high investment minimum made ongoing advice inaccessible to most. That changed with the respective May 2015 and May 2020 launches of Vanguard Personal Advisor Services and Vanguard Digital Advisor. PAS combines automation with human expertise in the service of discretionary asset management, while VDA is a simpler digital-only version. PAS is available to investors with at least $50,000 for a fee that starts at 0.30% per year and falls to 0.05% for assets exceeding $25 million. VDA requires $3,000 and costs 0.20% annually, including fees for the four ETFs underlying its more than 300 glide paths for differing investor goals, time horizons, and risk appetites.

In some non-U.S. markets, such as China, where the family recently abandoned plans to launch index funds, Vanguard is focusing on advice. Its joint venture with China’s Ant Financial to offer a mobile-based retail service had more than 1 million Chinese users a year after its April 2020 launch.

Increased access to advice will improve investor outcomes here and abroad, but Vanguard has stopped short of offering flexible pricing models. Its asset-based fees are a bargain for most but can be sizable for very wealthy clients whose portfolios don’t need an annual overhaul. A $100 million account pays $77,500 in fees per year and a $1 billion account $527,500. Introducing an option to let those clients pay for work done rather than assets under management would likely save them money.

Investing in Its Active Business

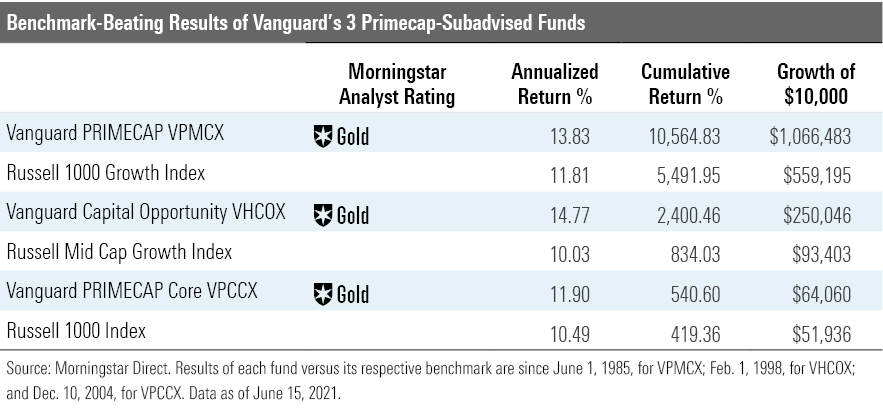

Vanguard also continues to invest in its active equities business, which will become more important as indexed options commoditize further. The strength of Vanguard’s offerings, most of which are run by multiple external subadvisors, has been their relative predictability, as Bogle himself said.[4] Combining several capable managers with similar but distinct styles in a low-fee fund tends to produce long-term results that exceed most peers’ and compete with benchmarks’. Index-beating margins of victory are often slim, though, and PAS as a rule hasn’t recommended them over passive funds.

Vanguard is making room for active options within PAS, though. It has been evaluating subadvisors to introduce new high-conviction active equity strategies for clients able to tolerate the extra risk and volatility that comes with focused portfolios versus more-diversified ones. If Vanguard picks talented managers, these less predictable strategies will have greater potential to trounce their benchmarks over many years, as have Vanguard’s three Primecap-subadvised funds. These are now available only to investors enrolled in Vanguard’s Flagship Services and PAS clients, and two of the three have $25,000 annual contribution limits.

Firms like Primecap are hard to find, but Vanguard has had success with Baillie Gifford, too, and its current high-conviction manager search could unearth others. Their strategies’ capacities will likely be limited, however, putting a cap on how many investors could benefit.

Vanguard could widen PAS active options further by considering non-Vanguard strategies from other top-tier asset managers, as many financial advisors would. Unfortunately, it isn’t. Vanguard is sticking to the industry norm of pitching its own product rather than seeking the best option for investors, regardless of the source.

Democratizing Private Equity

Vanguard is trying to democratize yet another asset class by offering private equity. Unlike in the public market, PE investing requires an initial pledge of capital that can be called upon in whole or in part at any time within the commitment period, typically five years. Once deployed, investments are difficult to trade and their outcome often uncertain for years. Private equity investments can lead to such outsize returns that a few hits will cover up for many misses and produce results, even after hefty fees, that are competitive with if not much better than those of public equities over the same period. There is a wider range in outcomes, though, and the risk of losing money for good is higher.

Diversification is even more important in private equity, which led Vanguard to partner with private equity fund-of-funds purveyor HarbourVest in February 2020. The ensuing pandemic sell-off did little to quell enthusiasm. Three months after closing its first PE offering at nearly double its target size, Vanguard in May 2021 expanded access to its nonadvised qualified clients and said it expected high-net-worth PAS clients would be eligible “in the near future.” PE allocations within target-date funds are an eventual possibility, too.

Vanguard’s PE efforts show many hallmarks of its investor-centered ethos. The partnership’s profitability for HarbourVest doesn’t become meaningful until its fund exceeds an 8% annualized hurdle rate. Vanguard has other PE firms it can consider should HarbourVest’s capacity become a problem. Although Vanguard raised commitments quickly, it is allocating assets slowly to avoid buying at a PE market top.

Still, some of Vanguard’s PE statements read like justifications for the asset class. For example, “Vanguard expects a broadly diversified PE program with exposure to top-performing managers to outperform global equities by 350 basis points at the median” and to “meaningfully improve” a liquid portfolio’s likelihood of success “absent significant market tilts.”[4]

A PE allocation isn’t akin to global public equities and includes market tilts. Historically, U.S. early-stage tech, biotech, and communications services companies, clustered in Silicon Valley and Boston, have dominated the PE market.[5] Vanguard could instead compare PE results with indexes and top-performing public equity managers with similar exposures as a better gauge of investor success.

On Mission

Although Vanguard’s continued retail dominance isn’t a forgone conclusion, its relevance is almost assured. Vanguard’s three promising, albeit imperfect, initiatives suggest it is more on mission than not, striving to increase investors’ chances for success in new ways.

[1] Bogle, J.C. 2002. "Character Counts: The Creation and Building of The Vanguard Group." (New York: McGraw Hill), P. 197.

[2] Slater, R. 1997. "John Bogle and the Vanguard Experiment: One Man’s Quest to Transform the Mutual Fund Industry." (Chicago: Irwin), P. 193, 195.

[3] Bogle, J.C. 2019. "Stay the Course: The Story of Vanguard and the Index Revolution." (Hoboken: John Wiley and Sons), P. 134.

[4] Kinniry, F., et al. 2021. "The Case for Private Equity at Vanguard." Private Equity Perspectives, P. 11. https://institutional.vanguard.com/iam/pdf/UHNWPEBR_022021.pdf

[5] Nicolas, T. 2019. "VC: An American History." (Cambridge: Harvard University), P. 1, 184-193, 275.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)