Are You Overpaying for Your Sector Fund?

Specialized sector funds can mean higher fees for investors.

More and more investors are turning to sector funds and their targeted stock strategies, especially when it comes to playing trends among technology, healthcare, and energy stocks. In the process, many investors are paying higher for those funds' fees despite a wealth of low-cost options.

Sector funds are an easy way for investors to home in on short- and long-term trends among targeted industries. Funds falling into this group can be relatively simple, index-tracking portfolios that cover broad stock market sectors, such as with the largest sector fund, the $75 billion Vanguard Real Estate Index Fund VGISX, or focusing on narrower industries and products, such as Global X Lithium & Battery Tech ETF LIT. In addition, there are so-called thematic funds, which includes actively managed portfolios seeking to capitalize on secular trends, such as the ARK Genomic Revolution ETF ARKG.

With their less diversified strategies, sector funds can often post outsize returns compared with the broader market. So far in 2021, energy funds, for example, are on average returning 40% and financial funds 22.5%, while the Morningstar U.S. Market Index is up 12%. Of course, performance can lag as well. At the individual fund level, iShares Global Clean Energy ETF ICLN is down 20% and ARK Genomic Revolution ETF has lost 8.3%.

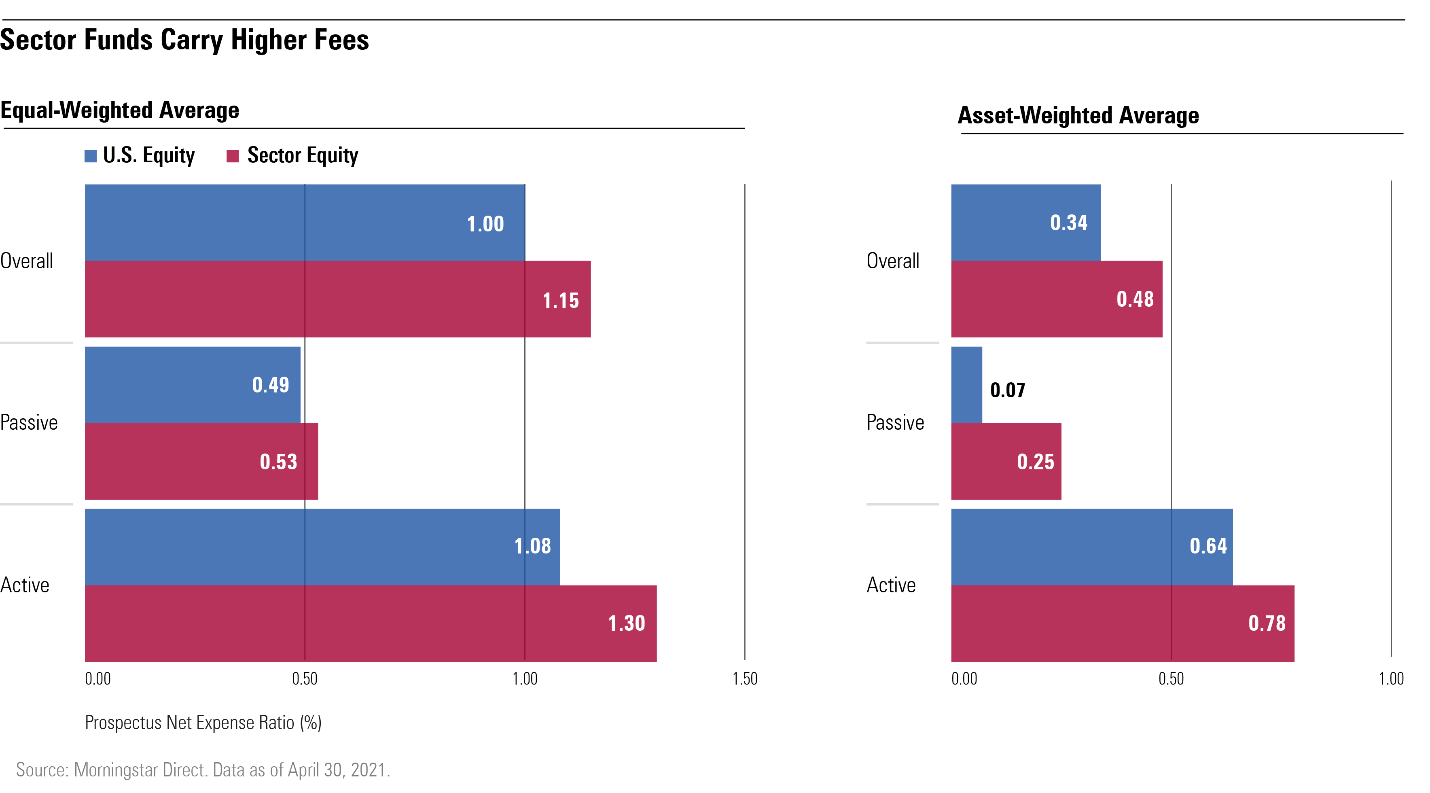

Many fund companies have decided investors should pay up for this specialization. Among the 810 sector funds, the average expense ratio is 1.15%. That's 0.15 percentage points more than the average on diversified U.S. stock funds. (Morningstar Direct clients can find an in-depth version of this article here.)

Another way to look at fees is by weighting them by where investors have put their money. On an asset-weighted basis, the gap is essentially the same, however. Investors are, on average, paying around 0.14 percentage points more for sector funds than for broadly diversified funds. At the same time, that gap actually widens when looking at the asset-weighted fees on generally lower-cost, passively managed sector funds. The asset-weighted average expense ratio for passive sector funds is 0.25%, 0.18 percentage points more than the asset-weighted average net expense ratio on a U.S. equity fund.

In general, fund companies are charging more for fund strategies that are more specialized, says Morningstar’s Ben Johnson. “Differentiated exposures come with steeper price tags,” he says.

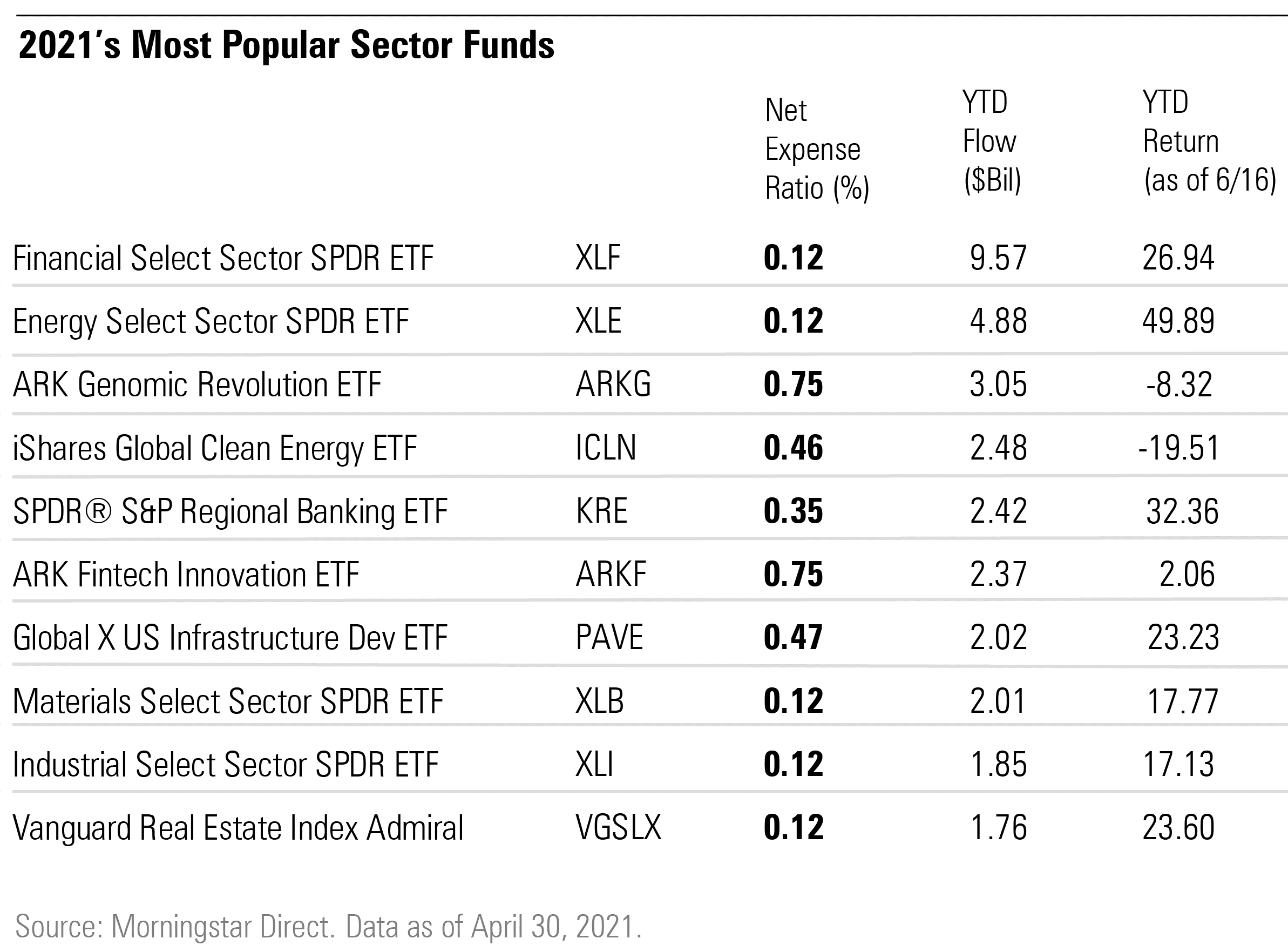

The range of fees is evident when looking at the sector funds that have seen the heaviest flow of investor dollars so far in 2021. Five of the funds carry expenses of only 0.12%, but investors have also been willing to pay for more-expensive funds. Global X US Infrastructure Development PAVE charges 0.47% and iShares Global Clean Energy ETF charges 0.46%.

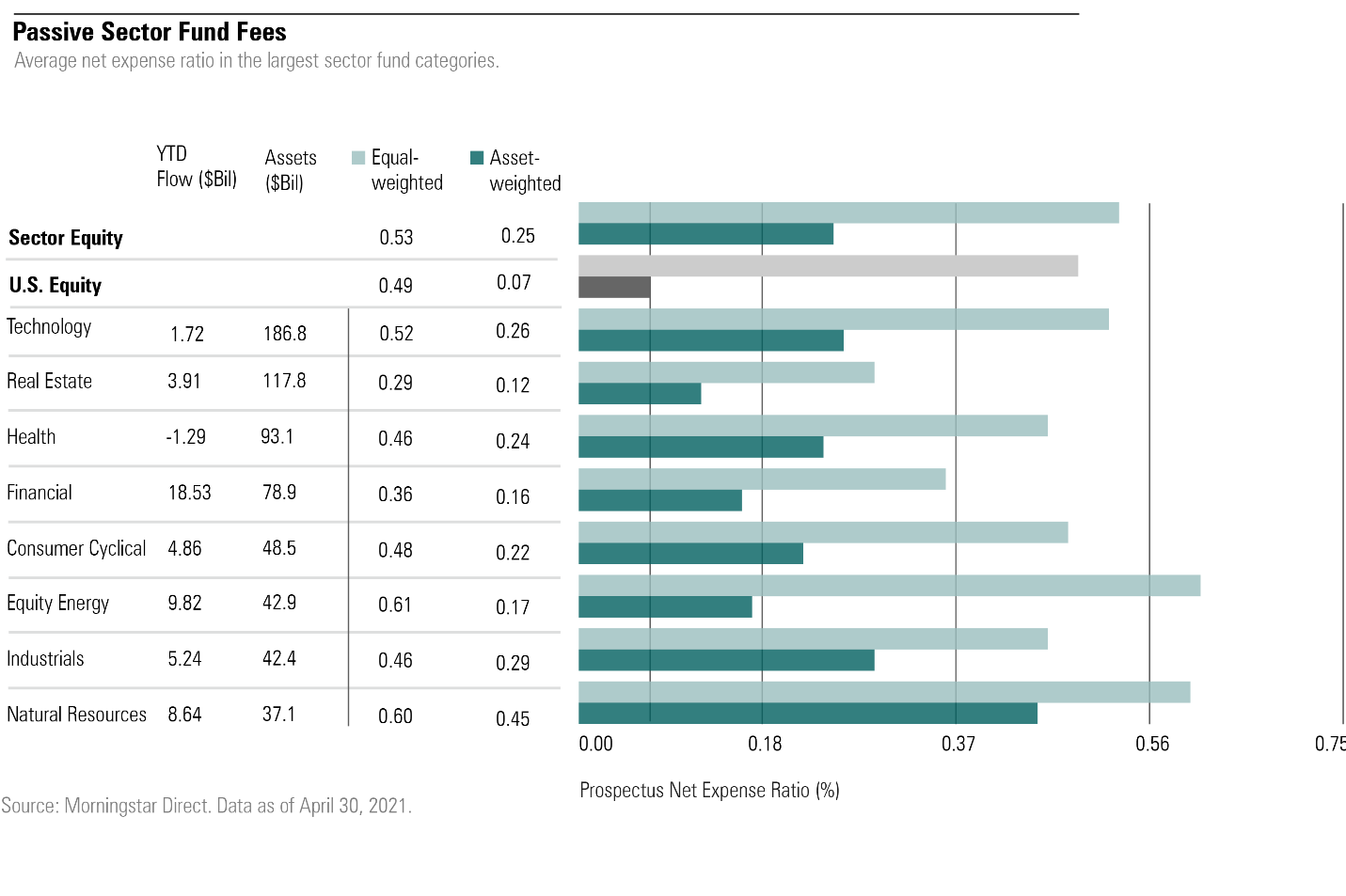

Where are investors putting their money when it comes to higher- or lower-cost sector funds? Here’s a look at trends among the biggest sectors.

Financials Over $18.53 billion has flowed into the financials sector funds this year, the most of any category. Along with real estate, the category offers some of the cheapest options. The average fee across the 12 passive financial funds is 0.29%, but investors have primarily poured their money into the cheapest funds in the category. Of the $64 billion category, $40 billion is in the Financial Select Sector SPDR Fund XLF alone, which charges 12 basis points. There are still some more specialized and pricier options in the category, including the SPDR Bank ETF (KBE, 0.35%) and SPDR S&P Regional Banking ETF (KRE, 0.35%).

Natural Resources

Natural resources have also been immensely popular--the category has grown by 43% this year, and it is home to a large number of expensive funds. The largest fund in the category is FlexShares Morningstar® Global Upstream Natural Resources ETF GUNR, which charges 0.46%, followed by Global X Lithium & Battery Tech ETF (0.75%) and Vanguard Materials ETF (VAW, 0.10%).

Real Estate

Investors are paying the least for real estate funds, and with only 21 funds in the category the asset-weighted average fee is only 12 basis points. Vanguard Real Estate ETF VNQ and Vanguard Real Estate Index Admiral VGSLX both charge 12 basis points. Together the two funds account for $60 billion, or 60% of the assets in the category.

There are even cheaper options for investors who want exposure to real estate, including Fidelity MSCI Real Estate Index ETF FREL at 0.09%. More-expensive offerings include Pacer Benchmark Data and Infrastructure SRVR, which charges 0.60%.

Technology Despite investors turning away from technology funds in 2021, the category is still home to the largest number of sector funds, in part owing to a high number of thematic funds. The average fee is 0.52% but when weighted by assets it falls to 0.26% thanks in large part to Vanguard Info Tech VITAX, which accounts for 24% of all passive money in the category. The Vanguard fund charges just 10 basis points. Similarly, SPDR Technology ETF XLK charges only 12 basis points.

In the mid-expense and specialization range is First Trust Dow Jones Internet ETF FDN, a $10 billion fund that charges 0.52%, and Wisdom Tree Cloud Computers ETF WCLD (0.45%).

The technology category is also home to a number of thematic funds. First Trust Indxx NextG NXTG, which invests in companies related to the development of 5G, charges 0.70%. And Global X funds, which as a firm has seen $9 billion in inflows in 2021, charges 0.68%. The firm offers funds with themes covering cloud computing (CLOU) and fintech (FINX).

Healthcare The healthcare category saw large inflows in 2020. The biggest fund in the group is Vanguard Healthcare ETF VHT (0.10%). More specialty funds like the SPDR Biotech ETF XBI charge 0.35% and Global X Telemedicine EDOC charges 0.42%.

/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2e267c-9b75-4539-a610-dd2b6ed6064a.jpg)