Who Wants Cryptocurrency in Their Retirement Plan?

Most people remain hesitant, but there's a small crypto-curious contingent.

Remember when that guy in Florida struck a deal to pay for two pizzas with Bitcoin back in 2010? It was a bizarre event at the time. And yet today, 11 years after the infamous purchase, Bitcoin and the larger concept of cryptocurrency are household names.

The use of cryptocurrency in the financial industry remains controversial, but it's making moves toward broader acceptance: What that guy paid for those two pizzas would be worth $380 million today. And Coinbase COIN, the largest cryptocurrency exchange in the United States, recently issued its IPO.

So, will cryptocurrency be at the forefront of investing in the years to come--in funds, exchange-traded funds, and more? We can't yet know, but the possibility led me to wonder: How would people respond to the idea of having cryptocurrency in their retirement portfolios?

I posed this question to participants in a recent survey. I asked them to rank a set of 16 potential retirement plan features, including the option to invest in cryptocurrencies, in order of most to least preferred.

Overall, investing in cryptocurrencies ranked quite low. But there were some interesting nuggets of information in the details.

What Do You Value in a Retirement Portfolio?

The 16 features that the participants ranked were:

- The availability of professionally managed "set it and forget it" investment options (for example, target-date funds).

- Auto escalation over time (the amount you contribute is increased automatically).

- The availability of "alternative" investments (real estate investment trusts, commodities, and so on).

- The option to make aftertax (Roth) contributions.

- The option to invest in cryptocurrencies, like Bitcoin or Dogecoin.

- An employer match (that is, your employer contributes a certain amount to your account based on the amount you contribute).

- The number of available investment choices.

- A means to "roll over" funds from other retirement plans.

- The availability of investments focused on environment, social, and governance factors.

- The availability of professional advice.

- The availability of investments focused on diversity, equity, and inclusion.

- Auto-enrollment in the plan (you're enrolled automatically and contribute money without having to do anything).

- A statement of your portfolio's performance delivered each quarter.

- The reputation of the company managing your account

- A mobile application that allows you to check your balances.

- Automatic rebalancing of your account (that is, your investments are adjusted to match your asset allocation).

This survey went out to a nationally representative set of Americans as part of a larger study we conducted. In total, about 1,400 people answered this question.

We'll discuss the findings around the other 15 features in future articles. But when it comes to cryptocurrency, participants broadly considered it a lower priority in a retirement fund. In fact, the single most common ranking for cryptocurrency was 16 out of 16: Approximately a fourth of the sample (24%) ranked it last, and only 3% ranked it first. (The mean and median ranks were 11.08 and 12, respectively, out of 16.) Investors thus seemed wary of adding such funds into their retirement portfolios.

A Small Group of Younger People Find It Very Appealing

Still, if there's one group that tends to be more interested in cryptocurrency, it's younger investors. The data appear to reflect this notion: Age accounted for about 4.8% of the variance in the rankings of cryptocurrency. The older the participants, the less important they found cryptocurrency to be in their retirement plan.

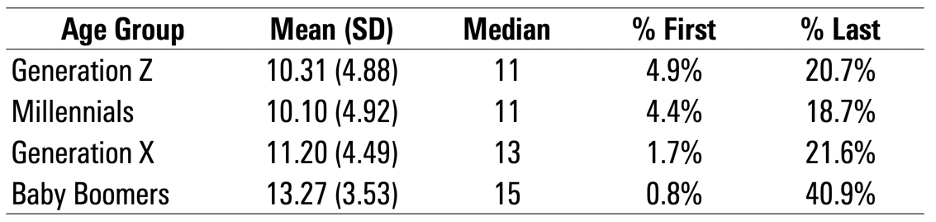

I explore this correlation in more detail in the chart below, which breaks down the desirability of cryptocurrency by generation. It displays the average and median ranks by age group, as well as the percentage of the age group that selected cryptocurrency to be the most important and the least important feature of a retirement plan. (That is, "% First" indicates the percentage of the age group that ranked cryptocurrency as its most desired feature; "% Last" indicates the percentage of the age group that ranked cryptocurrency as its least-desired feature.)

Differences in Ranking Cryptocurrency as a Desired Feature in a Retirement Plan

We can unpack some generational differences here. Younger adults (including generation Z and millennials) were approximately 5 times as likely to prefer cryptocurrency in their retirement plan as the oldest generation. Similarly, baby boomers were approximately twice as likely as any other generation to rank cryptocurrency last.

Still, although younger investors appear to find cryptocurrency more appealing than older investors, there is a general hesitancy to add it to their retirement portfolios. It may be 5 times as likely to be interested in cryptocurrency, but that interested group still adds up to less than 5% of the broader population of younger investors.

Don't Get Too Caught Up in the Hype

So, is cryptocurrency becoming the hot asset people desire in their retirement portfolios? So far, the answer appears to be "no."

Investors ranked cryptocurrency as the least important feature in a retirement plan more frequently than any other feature. Breaking the results down by age difference, however, hints that a small group of younger investors finds cryptocurrency to be an important asset to have in a retirement fund.

Thus, while advisors might find it worthwhile to gauge clients' interest in cryptocurrency, particularly millennial and generation Z clients, it shouldn't be a primary factor in decision-making. People still tend to desire traditionally attractive features such as good employer matches and the availability of professional advice.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)