12 Stocks to Avoid

These stocks are all extremely overvalued by our standards--and carry a good deal of uncertainty, too.

Death and taxes are two of the few certainties in life. In investing, too, there are few certainties. Of course, we can improve our chances of investing success by, say, favoring low-cost, broadly diversified funds. Or by purchasing the stocks of companies with solid competitive advantages.

One thing would seem to be for certain, though: Investing in stocks with unpredictable cash flows when they're trading at nosebleed valuations is a recipe for failure. These are stocks to avoid.

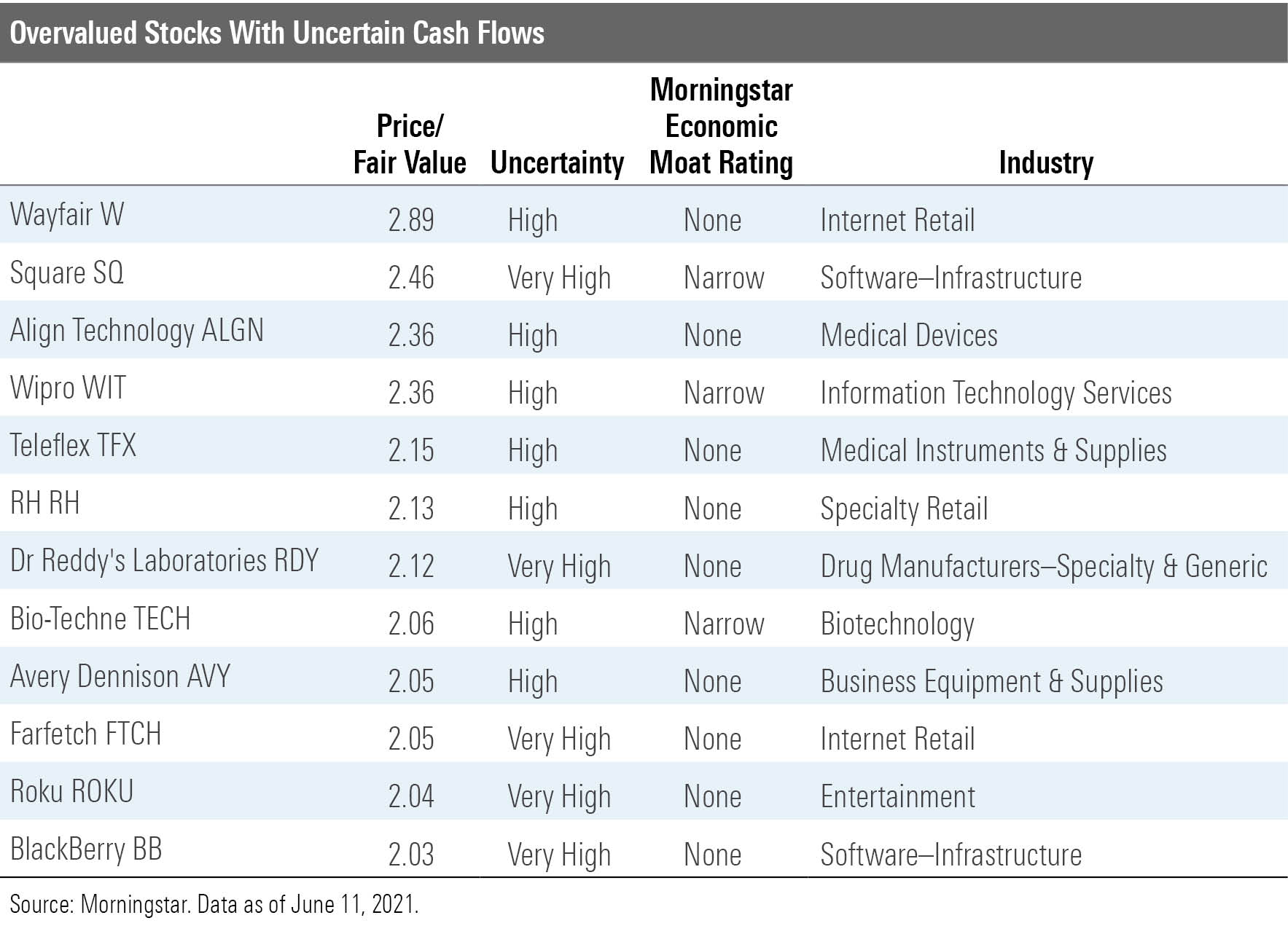

For today's screen, we're isolating stocks with high or very high fair value uncertainty ratings that are trading at least double our fair value estimates.

Before we share the results, let's step back and review what the uncertainty rating is. The uncertainty rating represents the predictability of the company's future cash flows--and, therefore, the level of certainty we have in our fair value estimate of that company. We value a company based on a detailed projection of its future cash flows, and discount those flows back to today's dollars using a proprietary cash flow model. The uncertainty rating captures a range of likely potential intrinsic values for a company based on the characteristics of the business underlying the stock, including such things as operating and financial leverage, sales sensitivity to the economy, product concentration, and other factors. If the range of potential intrinsic values is narrow, the company earns a low uncertainty rating. If the range is great, the company earns a high uncertainty rating.

Is it so bad to buy an overpriced stock with high uncertainty, given that we're not highly confident in our estimate of what that company's shares are really worth? Certainly, one might argue that in the case of a high-uncertainty stock, valuation could be tossed aside and one should instead focus on something else--growth prospects, for example. Given the lack of cash flow predictability, we could be underestimating the value of these names.

However, we could be overestimating their value, too.

That's why we err on the side of conservatism: We suggest that investors avoid richly priced, high-uncertainty names. If one is truly tempted to take on the uncertainty, we'd recommend doing so with only a significant margin of safety--even if that fair value is, in itself, uncertain.

Twelve overpriced, high-uncertainty stocks passed our screen.

Here's a closer look at three of the names on the list.

Square SQ

"Although narrow-moat Square maintained its growth momentum in the first quarter and made some progress improving profitability, we remain comfortable with our $89 fair value estimate. We highlight the difficulty in estimating a long-term valuation for a high-growth, scalable business that has yet to demonstrate sustainable profitability, with this consideration being the primary driver behind our very high uncertainty rating. We continue to believe that the current market price reflects a very optimistic view of Square's long-term prospects.

"We think Square's business model, characterized by efficient client onboarding, innovative point-of-sale devices, flat fees, and an internally developed and integrated set of software solutions, allows the company to reach and retain micro merchants that are unviable for other acquirers. In essence, we believe Square's success has largely come from expanding the acquiring market, as opposed to stealing material share from existing players.

"To develop sufficient scale, Square must move past its micro merchant base, and recent results suggest it is doing just that. At this point, a bit more than half of its payment volume comes from merchants generating over $125,000 in annual gross payment volume. Furthermore, absolute growth in clients above this threshold has accelerated meaningfully over the past couple of years, while absolute growth in merchants below this threshold has largely held steady. We think the move upstream and cross-selling will allow Square to materially improve margins in the years ahead and show the viability of its business model. But we see Square as a narrow-moat niche operator, not a disrupter, with market share limited by its relatively high pricing and long-term margins constrained by its relative lack of scale."

--Brett Horn, senior analyst

Dr. Reddy's Laboratories RDY

"We assign Dr. Reddy's Laboratories a very high uncertainty rating because of its focus on commodity products in a highly competitive market that includes peers with significant scale.

"Dr. Reddy's has increased its U.S. market share predominantly through aggressive pricing of small-molecule drugs. Low-cost manufacturers actively compete for the less differentiated commodity generic drugs in the United States, where regulatory hurdles are lower than in Europe. Dr. Reddy's also established a brand in many emerging markets where rising disposable income, a fragmented customer base, and lower generic drug utilization rates offer attractive growth opportunities. Since many global nondeveloped drug markets lack a consolidated and efficient drug distribution infrastructure, generic drug manufacturers generally sell most of their products--frequently called branded generics--to independent pharmacies and physicians in these areas. Brand recognition for these generics generally supports customer loyalty and more stable prices, but governments can intervene with mandated pricing or tender-based bidding.

"Market share gains of commodity generics in the large U.S. and European regions historically provided top-line growth for Dr. Reddy's, but this has been tempered recently by intense pricing pressure with the consolidation of the sourcing entities. The company has completed numerous successful drug launches, but its manufacturing scale, research capabilities, distribution networks, and legal acumen still lag those of larger competitors, in our view. While we do expect its low-cost operating structure may sustain its current market share gains, Dr. Reddy's focus on commodified developed markets has started to erode its returns on capital.

"Management hopes to develop more complex manufacturing capabilities in market segments where limited competition supports stronger pricing power and higher profitability, but market pressures have limited the company's progress. Dr. Reddy's has made relatively strong inroads into generic over-the-counter products and also launched four biosimilars--near-generic equivalents of biotech drugs--in India and other emerging markets. However, we believe U.S. and European approval of Dr. Reddy's biosimilars remains improbable in the near future, especially in light of the firm's recent regulatory challenges."

--Damien Conover, strategist

Farfetch FTCH

"Farfetch is a leading global online distribution platform for personal luxury goods. It connects luxury buyers and sellers and offers a wide selection of products to consumers (3.9 million stock-keeping units at the end of 2017, or 10 times more than the next biggest peer, according to the company) without exposing itself to unsold inventory risk. While we believe Farfetch's business model exhibits traces of a network advantage moat source, we are currently wary of assigning it a moat, given the early stages of industry development, the company's small size and reach (3% share of the online luxury goods segment, reaching less than 1% of the luxury buying population), and lack of business model monetization.

"Although the online luxury segment is relatively fragmented (the biggest player YNAP commands around a 10% share), we believe it will be dominated by a limited number of strong global players. Still, we think there is a low probability that any one player will dominate online distribution, given the market power of the big brands and their reluctance to depend on a single party for online distribution. But neither should the space be too fragmented, in our view, given that the brands are wary of overrepresentation in too many channels, with risk of brand trivialization, excess inventory, and discounting. We believe Farfetch has potential to become one of the strong players in the industry, given its value proposition to the brands (better economics than wholesale and control over inventory and pricing retained), retailers (which are engaged in the supply chain rather than competed with), and customers (through a vast choice of products and unique items).

"Given the early stage of industry's maturity and both high risks and high opportunities for the company, we believe investing in Farfetch shares comes with very high uncertainty."

--Jelena Sokolova, analyst

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)