How to Invest in Disruptive Technology Stocks

This type of investing is not for the faint of heart, but we still see value in several of these companies.

From the eye-popping returns of ARK Innovation ETF ARKK to the big-data innovations of Palantir PLTR, investing in disruptive technology has been one of the hottest market trends of the past year. While many disruptive technology stocks still provide significant upside for investors, many have run too far, too fast as investors have overextrapolated growth expectations. For a primer on the topic, read "Are Disruptive Technologies the Next Dot-Com Bubble?"

Investing in this space exposes investors to a high degree of risk and potentially elevated volatility, but also offers the potential to generate far higher-than-average returns. As such, it has a place in investor portfolios but only as an allocation in an already well-diversified portfolio.

For investors who don't have the inclination to spend the time and effort to analyze and invest in individual stocks, it is most appropriate to gain exposure through an exchange-traded fund or mutual fund. For investors who are willing to spend the time to conduct their own individual stock analysis, we recommend owning a small portfolio of these stocks in order to benefit from diversification.

Like venture capital investing, many of these stocks will not pan out over the long term--but an investor only needs a few stocks with outsize returns to provide a significant return across this portfolio.

Investing in this space will require patience, as many of these stocks may take several years to fully play out and reach their full potential. In the meantime, investors will need the fortitude to weather heightened volatility as well as the dedication to monitor the individual companies in which they are invested.

As the technology evolves, investors will need to determine if their investment thesis for each holding remains on track and, if not, to decide to sell the stocks of those companies whose technologies may not be truly disruptive.

Which Disruptive Technology Stocks Have Value Today?

Because disruptive technology is such a broad, wide-reaching concept, it is difficult to conduct a screen to specifically identify companies that fall within the group. In addition, many such companies are not included in our coverage, as they are either early in their lifecycle and have only just begun to monetize their product or have not yet reached profitability. Companies covered by our equity research group are typically much further along in their business development and often have demonstrated profitability.

The Morningstar Exponential Technologies Index does not specifically target companies that fall under the definition of disruptive technology, but it does encompass those companies that our analyst team has identified as being exposed to exponential technologies that deliver nonlinear economic benefits--some of which may also be disruptive.

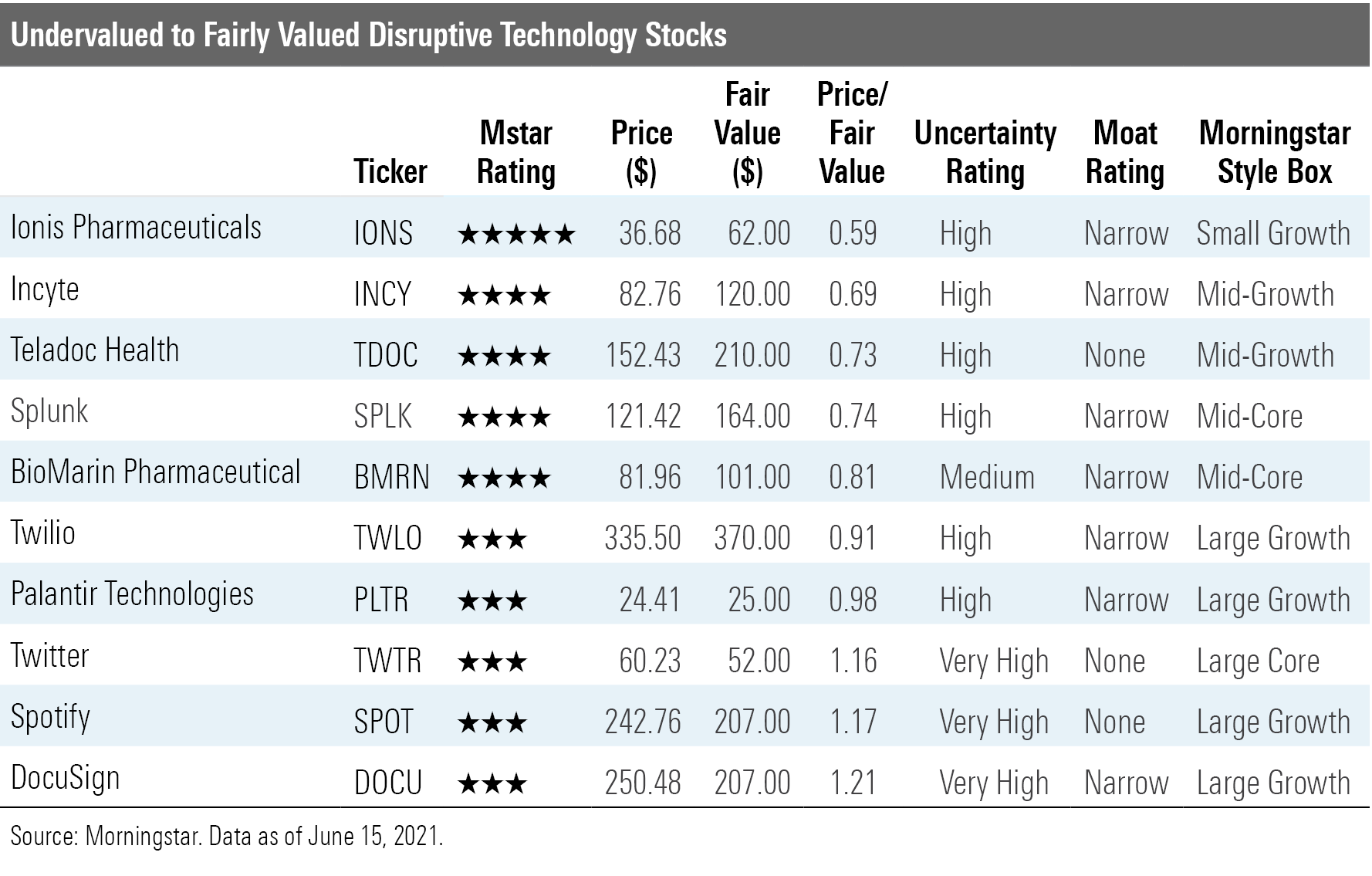

Investors can scour these holdings to begin their search for potential investment candidates. Stocks in this index span the entire economy and include not just the innovators of new technologies but also those that also stand to benefit from the adoption of new technologies. Of the approximately 200 stocks in the index, here is a sample of those that we rate as undervalued to fairly valued:

For example, Ionis Pharmaceuticals IONS is the leading developer of antisense technology to discover and develop novel drugs. Its broad clinical and preclinical pipeline targets a wide variety of diseases, with an emphasis on cardiovascular, metabolic, neurological, and rare diseases.

- Themes: Ionis is exposed to medicine and neuroscience, nano technology, and big data and analytics.

- Fair Value Estimate: We assign Ionis a fair value of estimate of $62 per share, implying a 2021 enterprise value/sales multiple of 12 times.

- Growth Forecast: Ionis relies on up-front payments and licensing fees from partners, as well as Spinraza royalties, to drive revenue today, but its pipeline should help diversify revenue by the mid-2020s. In our base case, we assume Ionis sees revenue growing to $3.1 billion by 2030 from under $1.0 billion last year, with operating margins approaching 50%.

- Morningstar Economic Moat Rating: We assign Ionis a narrow economic moat based on its proprietary antisense oligonucleotide technology, which has led to three approved RNA-based drugs and a steadily growing pipeline.

We also note Splunk SPLK, which provides software for machine log analysis. Its flagship solution, Splunk Enterprise, is employed across a multitude of use cases, including application management, IT operations, and security.

- Themes: Splunk is exposed to big data and analytics, networks and computer systems, energy and environmental systems, and robotics.

- Fair Value Estimate: We assign Splunk a fair value of estimate of $164 per share, implying a 2021 enterprise value/sales multiple of 11 times.

- Growth Forecast: In our base case, we forecast revenue will grow at a compound annual growth rate of 25% with an average a gross margin of 75% through fiscal 2026.

- Morningstar Economic Moat Rating: We assign Splunk a narrow economic moat based upon switching costs and network effects associated with its broad suite of products. Splunk's platform can ingest, index, and analyze vast quantities of data that support businesses' abilities to maintain and monitor mission-critical functions in a variety of cases within security, IT operations, and observability.

What Disruptive Technology Stocks Are Overvalued?

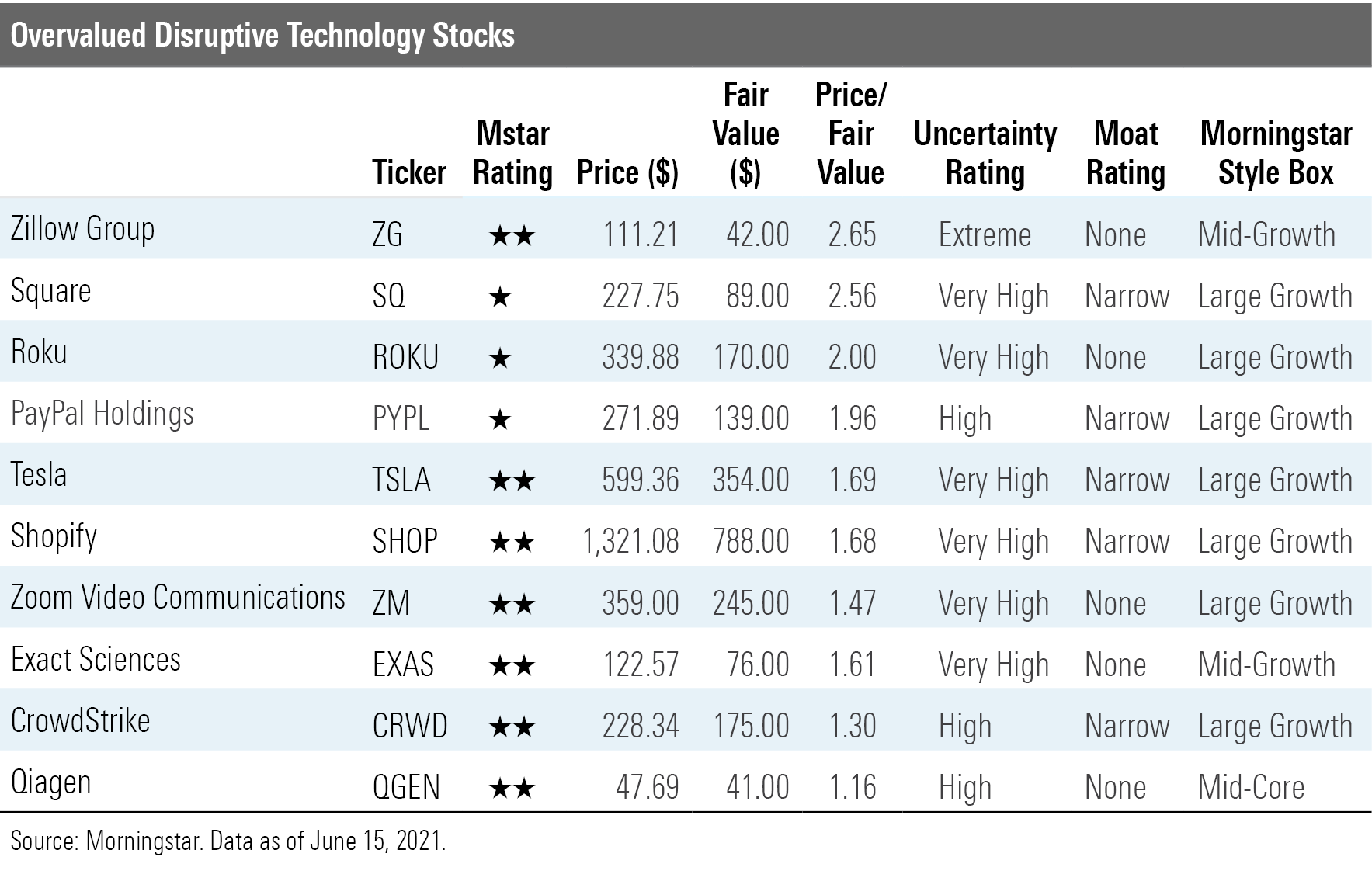

For some of these disruptive technology companies, we think the market has overextrapolated growth and profitability too far into the future. The exhibit below shows those that we view as being the most overvalued today.

Of this sample, we note Zillow Group ZG. While the stock is exposed to both the big data and analytics and financial-services innovation themes, we think it is one of the most overvalued stocks under our coverage.

While we forecast strong revenue growth rates through 2029, this growth is inflated as much of it comes from purchasing and selling homes, where we expect gross profit to be razor thin. We project that the legacy Internet, media, and technology segment will continue to grow in the mid-single-digit range but will see revenue growth decelerate considerably from the rapid expansion of the past few years.

Further, we expect companywide operating margins to deteriorate before improving moderately by the end of our forecast period. We expect Zillow to post negative operating income through 2025, after which the operating margin will eventually rise to around 6% by 2029. We do not assign an economic moat to Zillow. Specifically, we are concerned about the sudden pivot to the volatile iBuying business through Zillow Offers and away from its core advertising business model based on its estate listings platform.

Investment Outlook on Disruptive Technology Stocks

We currently view the broad U.S. market as being slightly overvalued overall, but nowhere near as overvalued as during the height of the late-1990s technology bubble. During the tech bubble, the greatest excesses were concentrated in Internet stocks, but the overvaluation had also spread into the wider market as well.

Today, though many of the stocks categorized as disruptive technology are significantly overvalued, we still see many that are undervalued to fairly valued. At this point, we do not believe that speculative excesses in disruptive technologies have spread into the broader market. In fact, since early February, many of the indicators of speculative excess in the markets (such as SPACs and crypto currencies) have declined as investors have rotated away from overvalued growth stocks and into value stocks.

Based on the inherent nature of investing in disruptive technologies, investors will need a healthy dose of fortitude to weather the heightened volatility among these stocks. Yet, whether they gain exposure by investing in individual stocks or a well-managed fund, investing in disruptive technology will add additional diversification and likely lead to enhanced returns for a properly constructed portfolio.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/237L6UCCT5DIJOTXSUHF5NKFYM.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/R7HDJUUCAVCXZH56GSOH6M55CU.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)