Morningstar Awards for Investing Excellence: Exemplary Steward Nominees

These three firms have long track records of putting investors' interests first.

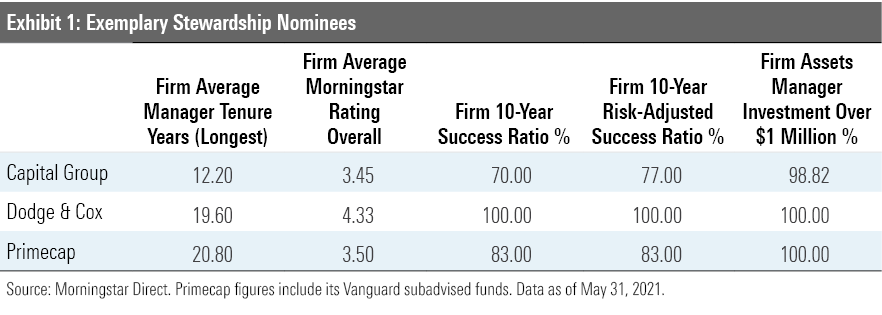

Today, we share the 2021 nominees for the Morningstar Awards for Investing Excellence: Exemplary Stewardship. The winner, alongside the recipients of the Outstanding Portfolio Manager and Rising Talent awards, will be announced in late June.

Exemplary stewards have long track records of putting investors’ interests first. Eligible candidates must have earned a Morningstar Parent Pillar rating of High, signaling Morningstar analysts’ highest conviction in their stewardship of investor capital. Few U.S. investment firms qualify for this elite cohort. Each has built and nurtured investment and commercial cultures that stand above the competition. From that group, Morningstar has nominated three firms for its Exemplary Stewardship award.

In 2019, The Vanguard Group received Morningstar’s inaugural award for Exemplary Stewardship; in 2020, Morningstar recognized T. Rowe Price. Considering the long-term nature of Morningstar’s assessment of investment firms and the desire to highlight more good works, we determined to choose a different firm from both 2019’s and 2020’s winners, though both Vanguard and T. Rowe Price continue to receive High Parent Pillar ratings. Two of this year’s nominees were also nominated in 2019 and 2020, while one is a first-time nominee in 2021.

Capital Group (American Funds)

One of the two firms nominated for Morningstar’s Exemplary Steward award in 2019 and 2020, Capital Group boasts a long history of doing right by investors. The firm offers a sensible strategy lineup and has nurtured an investment culture that helps it attract, develop, and retain talented investors for long careers both as analysts and as portfolio managers. In large part a function of its scale--the firm had roughly $2.4 trillion in assets under management as of December 2020--Capital Group’s American Funds generally sport comparatively low expense ratios. The firm has also been an industry leader through its clean F3 shares, which promote transparency around mutual fund pricing in the United States.

Capital Group’s signature multimanager approach to equity investing, in place since 1958, underpins a lot of the firm’s success. It combines multiple high-conviction portfolios run in a variety of styles on each strategy, allowing Capital Group to grow prudently and maintain a relatively compact set of offerings. This system has translated into performance characterized by more-limited volatility and downside than many competitors’; at the same time, the firm’s plethora of talented investors has also led to superior investment results over very long stretches. The multimanager approach also helps with succession planning and portfolio-manager transitions, which has helped the firm provide continuity for its investors. Long a strong equity investor, Capital Group has invested heavily in its fixed-income efforts since the 2008 credit crisis revealed vulnerabilities at the firm; this attention and the firm’s ability to attract strong investors has resulted in improvements to its fixed-income offerings that have made Capital Group a formidable contender for investors’ fixed-income portfolio allocations, in addition to its long-standing place as a go-to stock shop. Drawing upon these strengths, the firm’s target-date series and other multi-asset options are topnotch.

Dodge & Cox

Dodge & Cox is the second Exemplary Steward nominee that was also considered in 2019 and 2020. The firm stands out for its singular approach to investing; specifically, its value-oriented, often contrarian, investment style that considers a company’s entire capital structure has helped define the seven stock and bond mutual funds it has launched. The firm boasts a pristine reputation that helps it attract talent and has produced stable investment teams that build portfolios through teamwork and consensus. Overall, its strategies have delivered impressive long-term performance.

Of late, Dodge & Cox has been able to show off other attributes. In May 2021, it launched its first stock fund focused on emerging markets. The investment committees on its international-stock and global-stock funds have invested in emerging markets for years; adding an emerging-markets stock fund is thus in the firm’s wheelhouse. This one, however, will add a quantitative component to help the investment team differentiate the portfolio by presenting overlooked firms. As has been its practice, Dodge & Cox is pricing this new fund in the bottom quartile of its peer group. Another of its hallmarks has been the firm’s well-telegraphed and seamless transitions from one generation of leadership to the next. For example, the firm announced in January 2021 that chairman and CIO Charles Pohl will retire in June 2022, after adding associate CIO David Hoeft to support Pohl in January 2019. Hoeft’s work as an understudy, plus the year he has remaining to work with Pohl, should help him take up CIO duties without a hitch. Dodge & Cox’s past success in leadership transition and its transparency inspire confidence in the firm for the long haul.

Primecap

Primecap is an investment boutique focused on U.S. equities. Although the firm can be contrarian in its investment decisions, it generally practices a growth-oriented investment philosophy. As a testament to this focus and part of its charm, the firm offers just three funds under the Primecap Odyssey brand, but it has been a key subadvisor for Vanguard since November 1984, just 14 months after Primecap’s founding. In fact, Vanguard remains its largest client. Vanguard’s Primecap offerings are unsurprisingly cheap, but the Primecap Odyssey bunch is also very competitively priced. Although at times the firm’s high-conviction portfolios can endure rough stretches of performance, Primecap’s strategies enjoy excellent long-term results overall.

Similar to fellow nominees, Primecap uses a team approach to portfolio management, which helps with succession planning and portfolio-manager transitions. Its portfolio managers are also deliberate and engaged in the long-term strategy and management of the firm, and they have made some uncommon but pleasing choices. For example, they have determined to maintain a certain smallness to the firm; although Primecap manages more than $150 billion as of March 2021, it limits its number of clients in addition to keeping a small, focused strategy lineup. It has also proved capacity-conscious in closing one of its Odyssey strategies to new investors. In recruiting investment talent to the firm, three Primecap principals and portfolio managers do the recruiting themselves and often hire standout, culturally aligned MBA graduates even when there is no immediate need and even when they had not explicitly considered an investment career.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NOBU6DPVYRBQPCDFK3WJ45RH3Q.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)