Morningstar Awards for Investing Excellence--Outstanding Portfolio Manager Nominees

Four portfolio managers earn accolades for industry achievements.

Today, Morningstar named four nominees for the 2021 Morningstar Awards for Investing Excellence--Outstanding Portfolio Manager: J.P. Morgan's Jeffrey Geller, BlackRock's Rick Rieder, Baird's Mary Ellen Stanek, and Fidelity's Joel Tillinghast. The winner, alongside the recipients of the Exemplary Stewardship and Rising Talent awards, will be announced in late June.

The candidates have delivered exceptional long-term performance while demonstrating shareholder alignment, courage in their convictions, and clear investment skill. Morningstar analysts pick nominees from investment strategies that earn Morningstar Analyst Ratings of Silver or Gold for at least one vehicle or share class. These nominees have navigated various market cycles over their tenures and remain among the best in their respective asset classes. They also invest significant sums alongside their strategies' investors.

Here's more detail about each nominee.

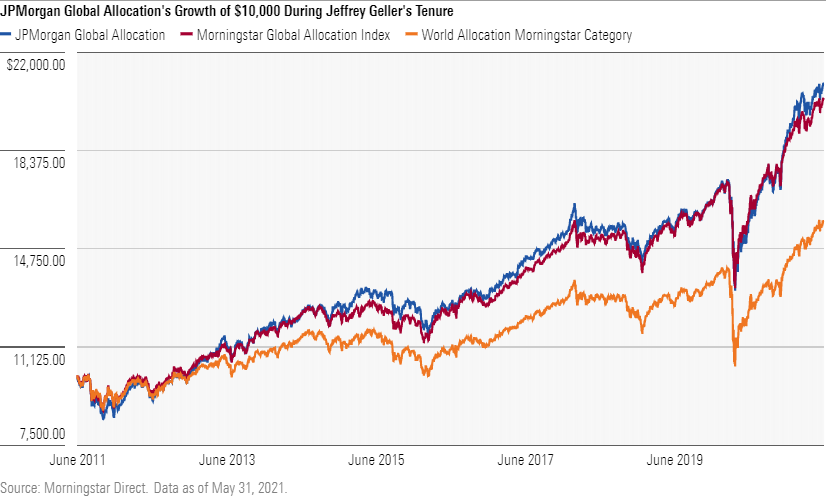

Jeffrey Geller, J.P. Morgan Asset Management

In his 44 years in the industry and 16 years at J.P. Morgan Asset Management, Geller has demonstrated tactical acumen and standout leadership. His rigorous, high-conviction process and topnotch resources propelled JPMorgan Global Allocation GAOSX, the firm's purest play on its tactical allocation views, to top-quintile returns in the world allocation Morningstar Category over his 10-year tenure through May 2021.

The approach doesn't have dedicated strategic allocations besides keeping at least 40% in non-U.S. securities, so it relies heavily on Geller's tactical moves. They've paid off: The fund has beaten its typical rival in every rolling three-year period on his watch.

Geller's contributions extend beyond this strategy. As J.P. Morgan's CIO of multi-asset solutions in the United States, he helps oversee the highly collaborative, nearly $300 billion global asset-allocation behemoth. In this role, Geller determines the firm's outlook with a group of senior firm leaders. This outlook influences the allocation and portfolio manager decisions of every portfolio in J.P. Morgan's multi-asset group, including the Gold-rated JPMorgan SmartRetirement Blend target-date series. Overall, the tactical signals have added 0.6 percentage points each year on average since Geller took over as CIO in 2006, though performance varies fund to fund. Geller also helped grow J.P Morgan's multi-asset investment team to more than 85 people, making it one of the most well-staffed asset-allocation teams investing today.

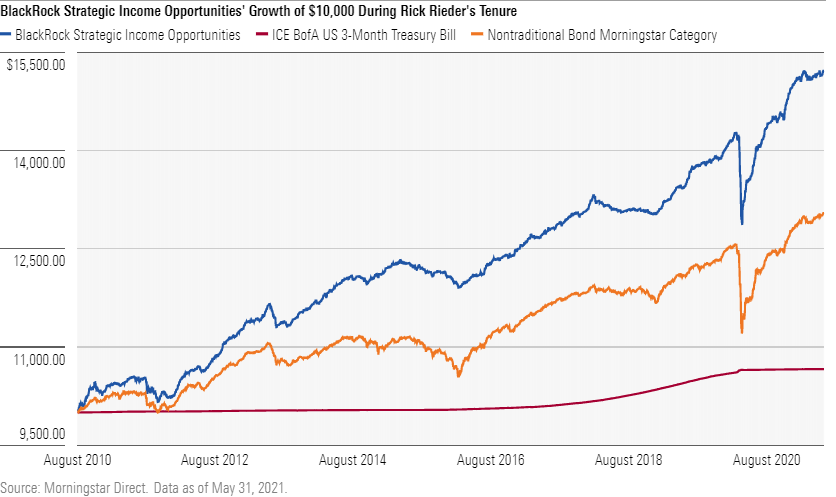

Rick Rieder, BlackRock

Rieder has built one of the strongest fixed-income platforms in the industry. He joined BlackRock in 2009 and became the firm's CIO of global fixed income in 2010. Over the years, Rieder has taken the helm of many strategies, including BlackRock Strategic Income Opportunities BSIIX and BlackRock Strategic Global Bond MAWIX in 2010 and 2015, respectively, and has provided stable leadership. He and his team focus on diversification and risk management using an exhaustive process of deep market and sector research. Rieder's process draws on a very large and experienced pool of investment professionals across BlackRock's fixed-income group. The managers have portfolio construction latitude on these strategies, but the team's disciplined and thoughtful risk management has kept volatility at bay. Rieder's long-term focus, rigorous research, and risk awareness have yielded top-decile risk-adjusted category results (as measured by their Sharpe ratios) over his tenure on both strategies.

In addition to his role as BlackRock's CIO of global fixed income, Rieder serves as the head of the firm's fundamental fixed-income business and global allocation investment team. He is also a member of BlackRock's global operating committee and chairman of the firmwide BlackRock investment council.

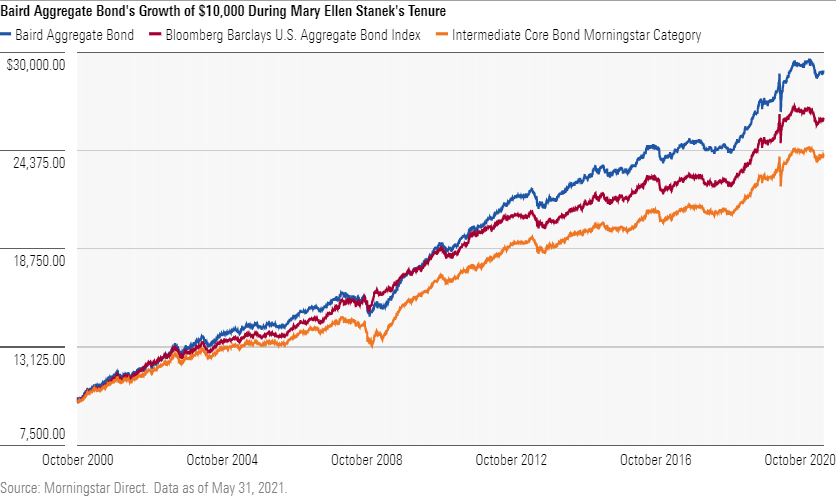

Mary Ellen Stanek, Baird Asset Management

In her more than 21 years at Baird Asset Management, Stanek has stayed true to her disciplined and risk-aware approach, thoughtfully navigating various market environments. Stanek leads four Baird strategies, including Baird Core Plus Bond BCOIX and Baird Aggregate Bond BAGIX, which had top-decile category returns over Stanek's tenure through May 2021, and even more impressive relative risk-adjusted results.

The stability of Stanek's nimble, nine-person portfolio management team speaks to its strength. Her commitment to employee development and the firm's employee-ownership structure foster a tight-knit team culture with little turnover. Stanek has also been proactive in expanding the team's roster and resources as many of the key players on this investment team are later in their careers.

Stanek has exemplified an investors-first mentality. Long before it was the industry norm, Stanek and her team launched these strategies with some of the lowest fees available for actively managed strategies. The low fees ensure the managers don't have to take on more risk to clear their price hurdles and beat their respective benchmarks.

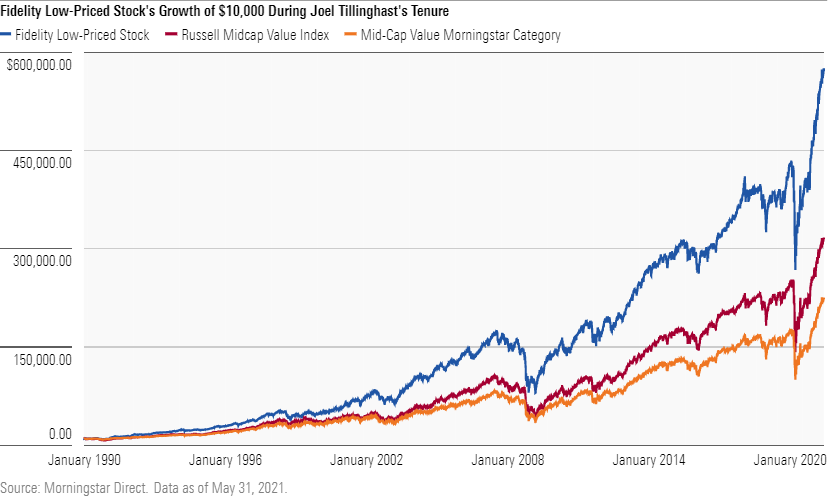

Joel Tillinghast, Fidelity

Since taking the helm in late 1989 through May 2021, Tillinghast shaped Fidelity Low-Priced Stock's FLPSX long-term track record to be among the industry's best. He looks for resilient companies with staying power, doesn't chase fads, avoids firms that lack enduring competitive advantages or load up on debt, and scrutinizes executives' integrity and prowess. Though this patient and risk-conscious approach can lag during bull markets, the fund's steady gains, subdued volatility, and impressive downside protection have kept its risk-adjusted results consistently strong, especially during stressed market environments such 2020's pandemic-induced bear market.

As assets under management have grown, Tillinghast has kept the sprawling 800-stock strategy from becoming bland or too much like the benchmark. He has long distinguished the portfolio through its exposure to international markets; its 41% non-U.S. stake as of January 2021 was well above the typical mid-value peer's 6%. A preference for consumer cyclical names and a typically lighter financials stake also help the portfolio stand out from its bogy.

Tillinghast has help. He has access to Fidelity's deep, 100-plus global analyst team and the strategy's five listed comanagers together run around 5% of assets. Those managers have discretion over their respective slices, but they also have Tillinghast's constant guidance. He owns this impressive record.

/s3.amazonaws.com/arc-authors/morningstar/73478172-d83e-49a0-8810-5eb20b6f672a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/73478172-d83e-49a0-8810-5eb20b6f672a.jpg)