Morningstar Awards for Investing Excellence--Rising Talent Nominees

Three managers to keep an eye on.

Today, Morningstar named three nominees for the 2021 Morningstar Awards for Investing Excellence--Rising Talent: Diamond Hill’s John McClain, Pimco’s Sonali Pier, and T. Rowe Price’s Justin White. The winner, alongside the recipients of the Outstanding Portfolio Manager and Exemplary Stewardship awards, will be announced in late June.

Morningstar presents the Rising Talent Award to an up-and-coming manager in Morningstar’s coverage universe. To qualify for this award, managers must have less than seven years’ tenure managing portfolios and have contributed to exceptional results over that span. They also must run investment strategies with Morningstar Analyst Ratings of Bronze or higher for at least one vehicle and/or share class, or be featured in Morningstar Prospects, a publication highlighting investments that Morningstar analysts are following closely but do not yet cover.

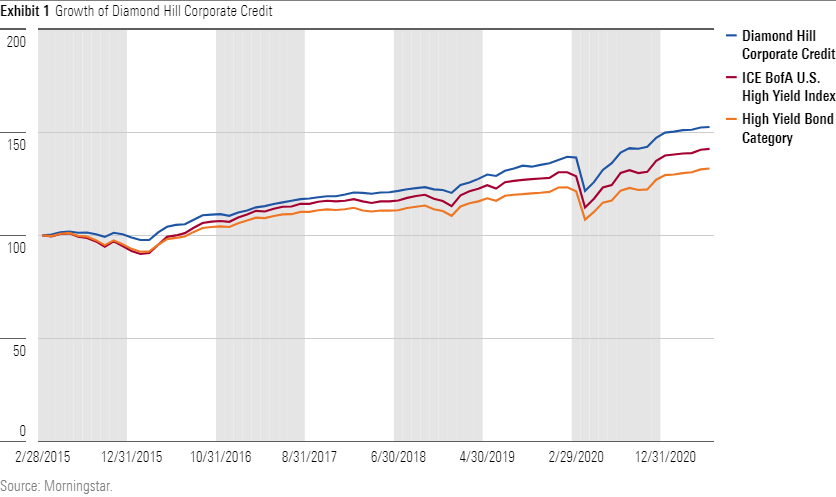

John McClain, Diamond Hill

McClain has demonstrated a strong ability to execute the approaches of two high-conviction strategies with different mandates and risk profiles. He joined Diamond Hill in 2014 and became a comanager on Diamond Hill High Yield DHHAX when it launched later that year. In February 2015, he became a comanager at Silver-rated Diamond Hill Corporate Credit DSIAX, which uses a disciplined, value-driven, and contrarian approach to build a benchmark-agnostic portfolio. Sharp attention to risk and solid credit selection have helped Diamond Hill Corporate Credit consistently outperform in downturns, including in late 2018 and early 2020. McClain’s expertise in the energy sector also resulted in Diamond Hill Corporate Credit’s strong showing during the energy-led sell-off from June 2015 to February 2016, thanks to solid relative results from firms like McDermott International MCDBF and Diamondback Energy FANG. McClain’s strong credit selection and portfolio management skills for both strategies have resulted in top-decile performance among high-yield Morningstar Category peers over his tenure through May 2021 on a total return and risk-adjusted return basis.

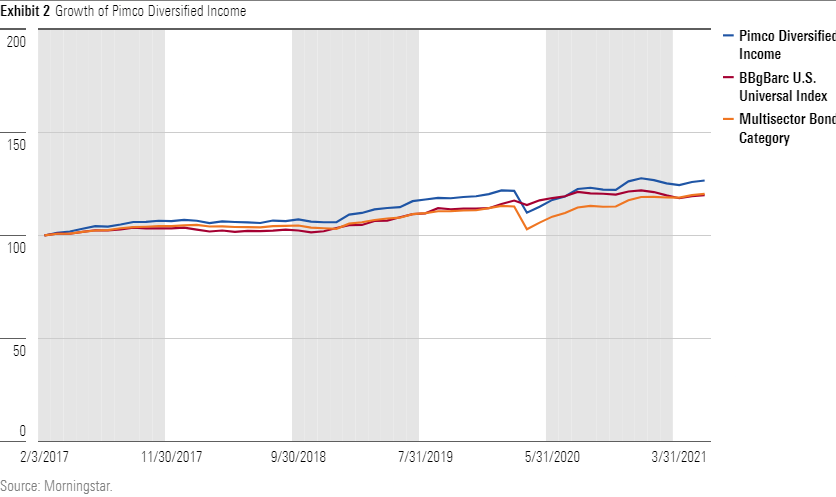

Sonali Pier, Pimco

Pier’s cautious contrarianism and rising influence at one of the industries’ premier and most internally competitive fixed-income asset-management firms stands out. She became one of the named managers on Gold-rated Pimco Diversified Income PDIIX in February 2017 after working at Pimco for four years. She is distinguished by her willingness to take less risk even if that positioning goes against conventional wisdom. This is crucial for high-beta strategies such as Pimco Diversified Income, where the penalty for getting things wrong can be much more severe than the reward for getting things right. This approach has been successful; over her tenure from February 2017 through May 2021, both the annualized and risk-adjusted returns landed in the top quintile relative to multisector bond category peers. She is highly regarded by her colleagues at Pimco, as she serves as a rotating member of the investment committee and has key responsibilities in executing Pimco’s investment forum process.

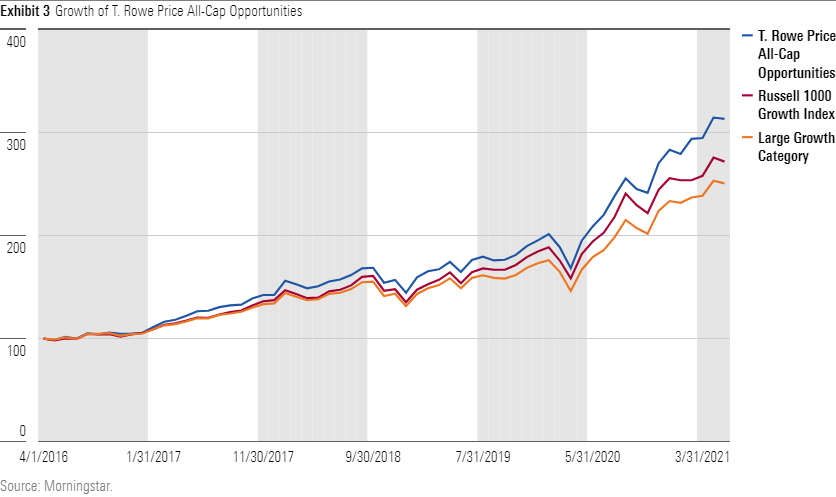

Justin White, T. Rowe Price

White is an independent thinker whose portfolio often reaches beyond pure growth plays. He has been Silver-rated T. Rowe Price All Cap Opportunities’ PRWAX sole manager since April 2016 and has posted strong results, a period when it has been difficult for large-growth managers to beat the benchmark. During his five-year tenure through May 2021, the fund beat the Russell 1000 Growth Index by more than 3 percentage points annualized and outperformed 90% of its large-growth category peers on a total and risk-adjusted return basis. For context, less than a third of the category’s funds beat the Russell 1000 Growth Index during this stretch. Furthermore, the fund is more of an all-cap opportunistic offering, with its average market cap in the category’s lowest third, and it has less of a growth tilt relative to the category benchmark. His ability to outperform by such a wide margin in a period where mega-caps and growth ruled is impressive and speaks to his stock-picking abilities.

Morningstar analysts Benjamin Joseph, Eric Jacobson, and Katie Reichart contributed to this article.

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)