Some High-Yield Managers Are Making Bolder Bets

The lowest-rated bonds appear to be trading in more dangerous territory lately.

Not all junk-bond investing is created equal. BB rated debt sits at the top of the below-investment-grade credit-quality rating spectrum and carries the lowest relative credit risk. As you move down the credit-rating rungs, the default rate at each sequential rung increases exponentially. According to data from S&P Global Ratings' "2020 Annual Global Corporate Default And Rating Transition Study," the global corporate annual default rate for issuers rated BB was 0.93% last year, compared with 3.5% for issuers rated B and a whopping 47.5% for issuers rated CCC, CC, and C. This phenomenon contributes to the persistent compensation (yield) differences offered at each rating tier, which is particularly acute during times of credit market stress.

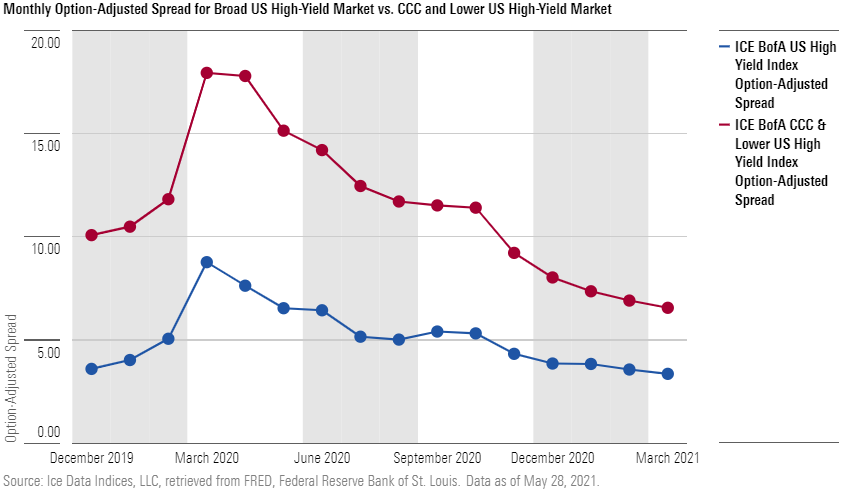

Credit spreads--the additional yield provided for taking credit risk beyond that of U.S. Treasury bonds--jumped during 2020's first-quarter volatility. The chart below reflects the ICE BofA U.S. High Yield Index's option-adjusted spread, which measures its spread over a spot U.S. Treasury curve. It jumped to 8.8 percentage points as of March 2020 from 3.6 percentage points as of December 2019. Over the same stretch, the ICE BofA CCC & Lower U.S. High Yield Index's option-adjusted spread spiked even higher, soaring to 17.9 percentage points from 10.1. With the ensuing rebound, credit spreads have narrowed further than where they rested prior to the broad market sell-off in 2020's first quarter. The broader high-yield benchmark's option-adjusted spread tightened to 3.4 percentage points as of March 2021, while the riskier bogy has come down well below 2019 levels to 6.6 percentage points.

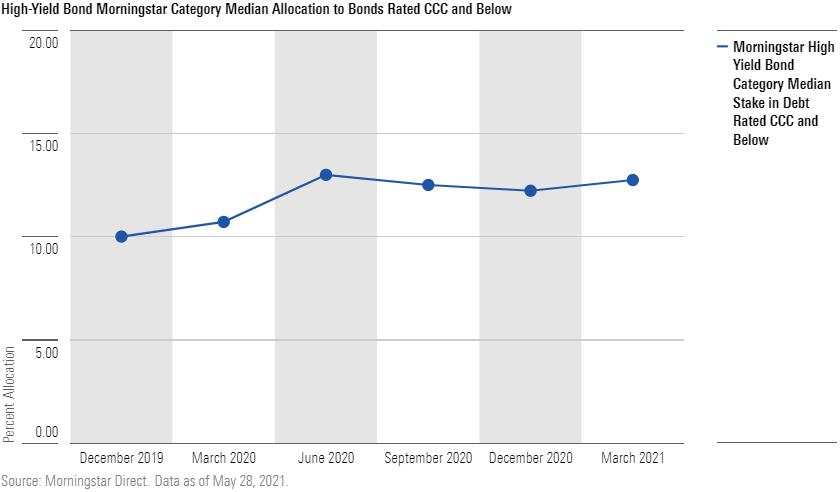

Despite the additional credit risk in CCC debt and tighter credit spreads compared with a year ago, high-yield bond managers are not shying away from these riskier segments of the market. The chart below highlights the high-yield bond Morningstar Category's median allocation to debt rated CCC and below between December 2019 and March 2021. It rose to 12.8% from 10.0% during the period, most noticeably as managers scooped up battered names during and right after the March 2020 sell-off.

These figures reflect the general trend, but if we drill more deeply, we see that some active fund managers are making much bolder bets. For example, Neuberger Berman High Income Bond NHILX, which has a Morningstar Analyst Rating of Neutral, boosted its allocation rated CCC and below to 22% of assets as of March 2021 compared with 10% of assets as of December 2019, as the strategy's managers found opportunity in shorter-duration CCC midstream debt and some longer-dated names that the team still liked despite slipping into lower-rated territory. Similarly, Silver-rated T. Rowe Price High Yield PRHIX increased its allocation rated CCC and below to 19% of assets as of March 2021 compared with 13% of assets at the end of 2019 because the strategy's managers scooped up names they deemed capable of surviving an unsettled market environment.

Not all active fund managers are leaning into risk as heavily. Gold-rated Vanguard High-Yield Corporate VWEAX modestly increased its stake in debt rated CCC and below to 6% of assets as of March 2021, less than 100 basis points above the December 2019 level. This stake rests slightly above the strategy's historical average of roughly 5%--which does sit on the lower end of the category in general--though its manager has proved adept at tactically capturing gains through small increases down the credit-quality spectrum.

Volatile performance is par for the course with high-yield bond investing, but it's still worth examining an individual fund's credit risk before diving in, as you may be in for a bumpier ride. Indeed, Vanguard High-Yield Corporate has consistently lost less than most of its rivals during credit or broad-based downturns over the past decade. For a more aggressive approach, like that of T. Rowe Price High Yield, understanding the roots of that volatility is a key element in getting comfortable owning it.

/s3.amazonaws.com/arc-authors/morningstar/27c1489e-bff3-4eff-a3de-cf100c9e63d2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/27c1489e-bff3-4eff-a3de-cf100c9e63d2.jpg)