Are Thematic Funds Worthy of the Hype or a Risky Distraction?

Here are four key takeaways from our latest look at thematic funds.

The global menu of thematic funds has expanded in number and breadth.

Thematic funds have been one of the big winners to emerge from the coronavirus pandemic, with many posting eye-catching returns over the period. These funds attempt to harness secular growth themes ranging from artificial intelligence to cannabis. The result has been a steady supply of new funds and greater complexity from asset managers, as well as increased demand for greater clarity among investors.

We detail these findings in our latest Global Thematic Funds Landscape report, which dives into the ever-expanding menu of thematic funds. Here are four key takeaways from the report. Morningstar Direct clients can access the full report here.

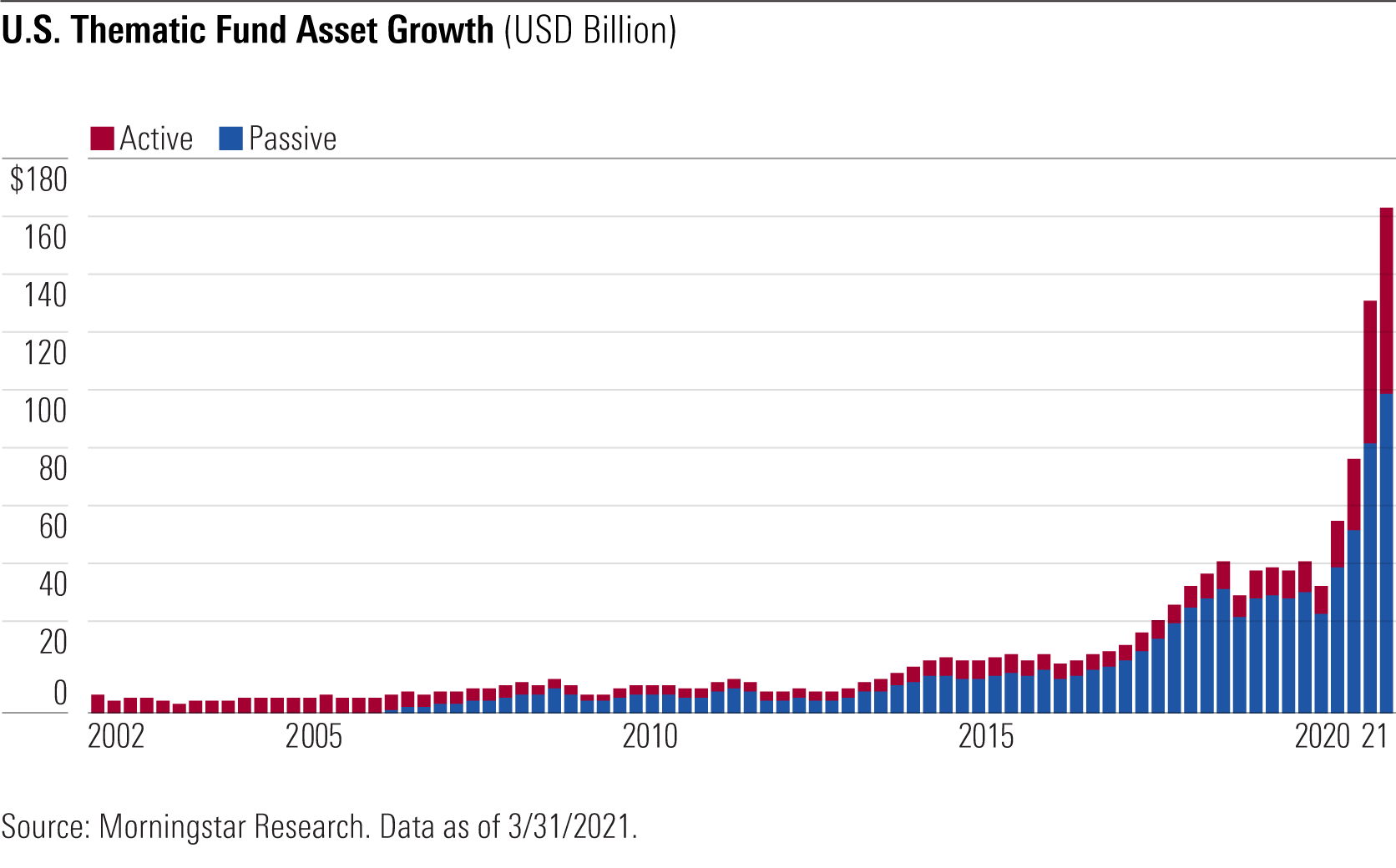

1) Thematic Funds' Strong Performance During the Pandemic Has Piqued Investors' Interest The growth of U.S. thematic funds in 2020 was nothing short of remarkable. Strong performance, persistently high inflows, and a bevy of new launches combined to push the assets in these funds to heights never seen before.

All told, more than $81 billion flowed into U.S. thematic funds in the year to the end of March 2021. The first quarter of 2021 was the strongest on record, with more than $35 billion entering these niche strategies. The impact on asset growth was considerable. Collectively, as shown below, thematic funds’ assets under management more than tripled to more than $160 billion by the end of March 2021 from about $49 billion at the end of December 2019.

2) Investors Are Betting on Thematic Funds Investors in thematic funds are making a trifecta bet (a term from the racetrack). Specifically, they are implicitly betting that they are:

- Picking a winning theme--one that is real and durable.

- Selecting a fund that is well-placed to harness that theme--that owns stocks that are positioned to capitalize on it in a meaningful way.

- Making their wager when valuations show that the market hasn't already priced in the theme's potential.

The odds of winning these bets are low, but the payouts can be meaningful.

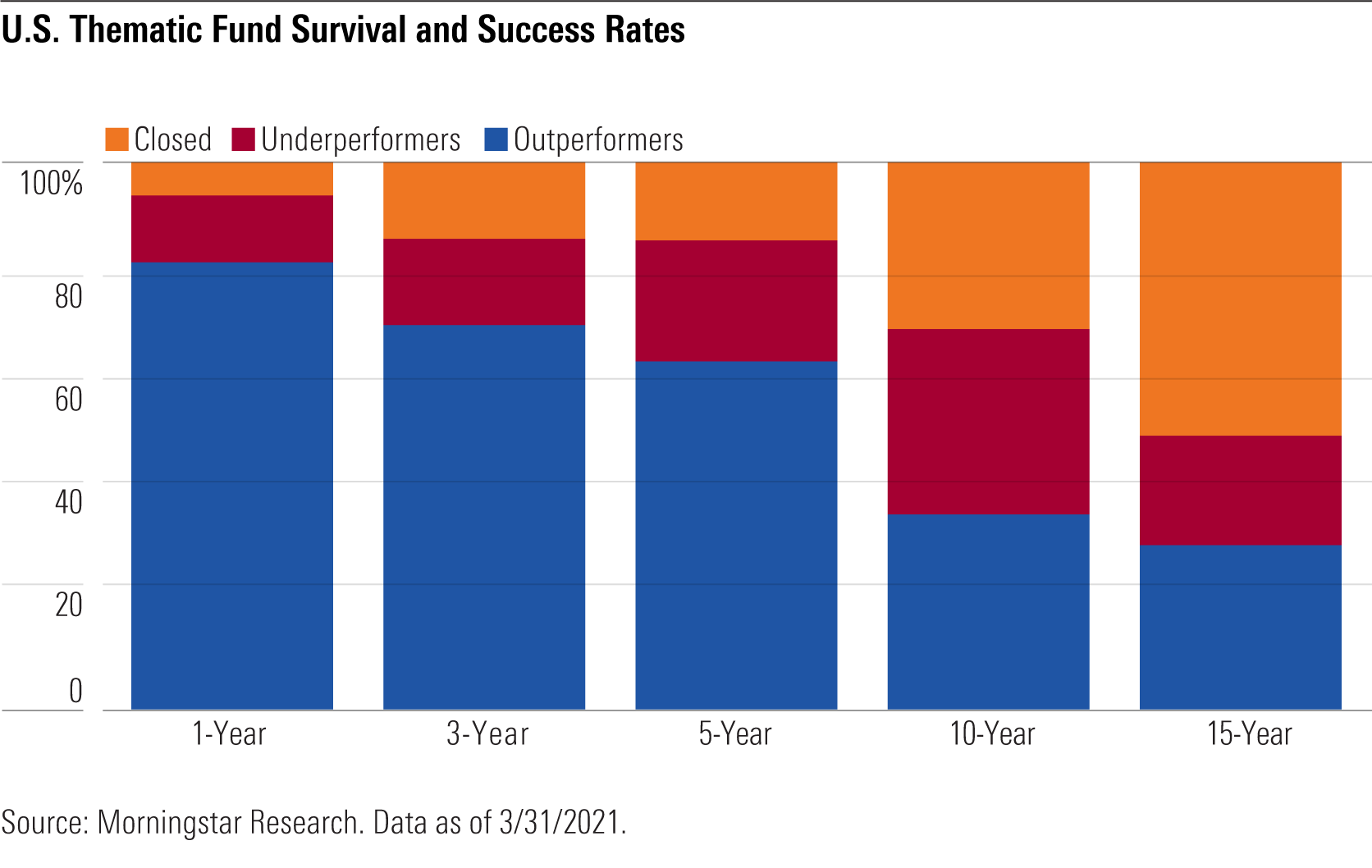

Still, the long-term performance figures for thematic funds are not flattering. They suggest that investors' odds of selecting a fund that will survive and outperform over the long run are slim. Over the 10 years through March 2021, 30% of U.S. thematic funds shuttered, while 36% went on to outperform the Morningstar Global Markets Index. The chart below details the odds facing investors in selecting a thematic fund that will survive and outperform global equities over longer periods.

3) There May or May Not Be a Place for Thematic Funds in a Portfolio Because of their narrow exposure and higher risk profile, thematic funds are best used to complement rather than replace existing core holdings. Some may be used as part of a core allocation, as they are broadly diversified and retain some of the characteristics of a broad global benchmark. Narrower exposures might be considered as single-stock substitutes for those investors looking to express a view on a particular theme but lacking the time, tools, and inclination to conduct due diligence on individual companies. The best themes are expected to play out over many years. This means that they are most suitably deployed over longer investment horizons.

Most thematic funds will be used with the hope of boosting returns over the investment period, but some can be specifically used to reduce portfolio risk. For example, alternative energy funds can be substituted for core energy holdings to reduce carbon risk. They fit especially well with "ex-energy" exposures.

Even if we set aside the claims of prospective outperformance from asset managers, if a thematic fund has drivers of risk and return that are distinct from other portfolio holdings, adding it around the margins of a core portfolio might yield diversification benefits. Ultimately, the risk and return drivers should be well-understood before any attempt is made to blend them into a broader portfolio. Equally, portfolio overlap and potential style drift should be monitored carefully through time.

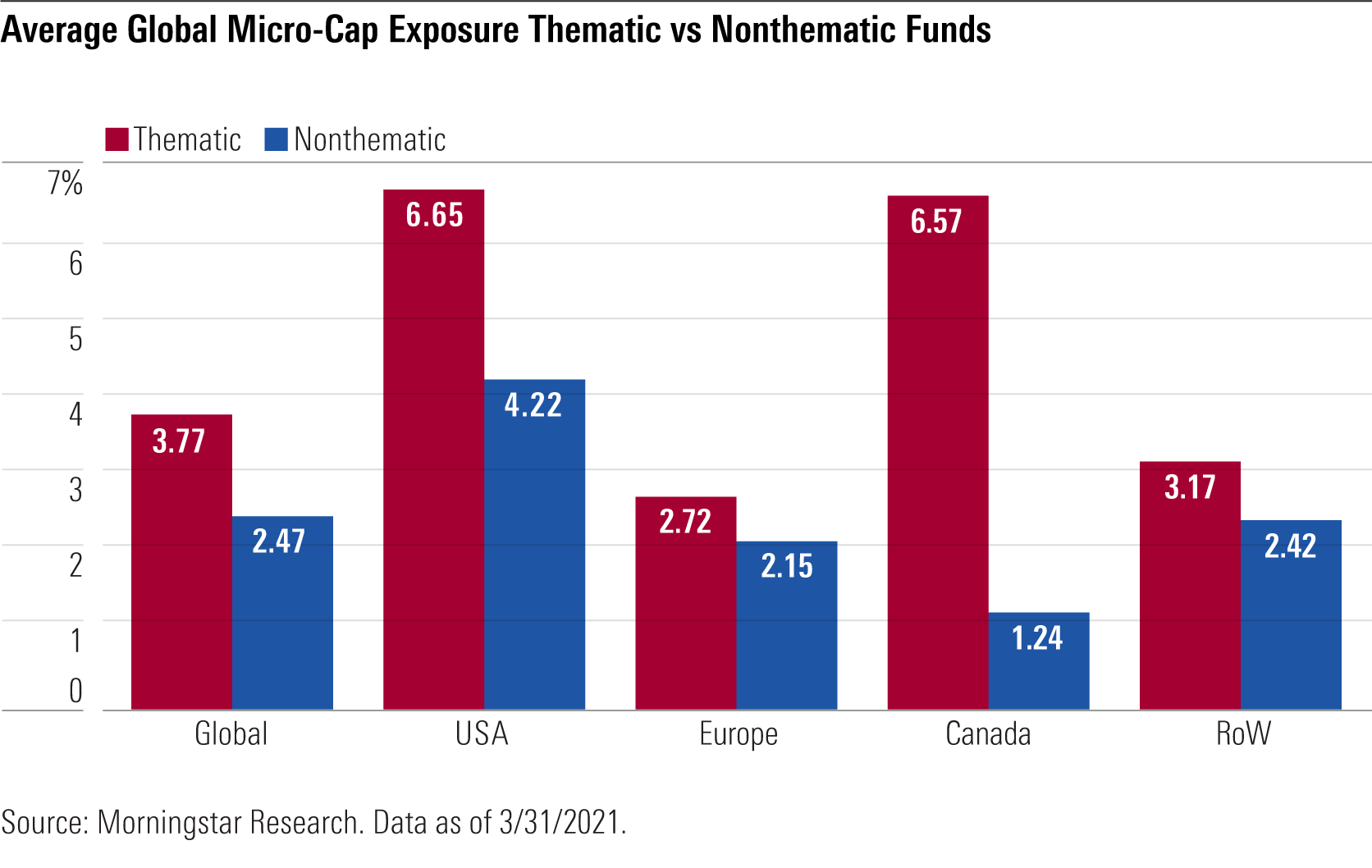

4) Thematic Funds' Liquidity Might Be a Concern In their search of companies with the highest exposure to emerging themes and those with the highest growth potential, thematic funds often invest in the smaller, less liquid stocks. The chart below shows that thematic funds have a higher average exposure to micro-cap stocks than their nonthematic counterparts. Micro-cap stocks can offer large upside potential, but a lack of liquidity means trading in and out at short notice can be costly.

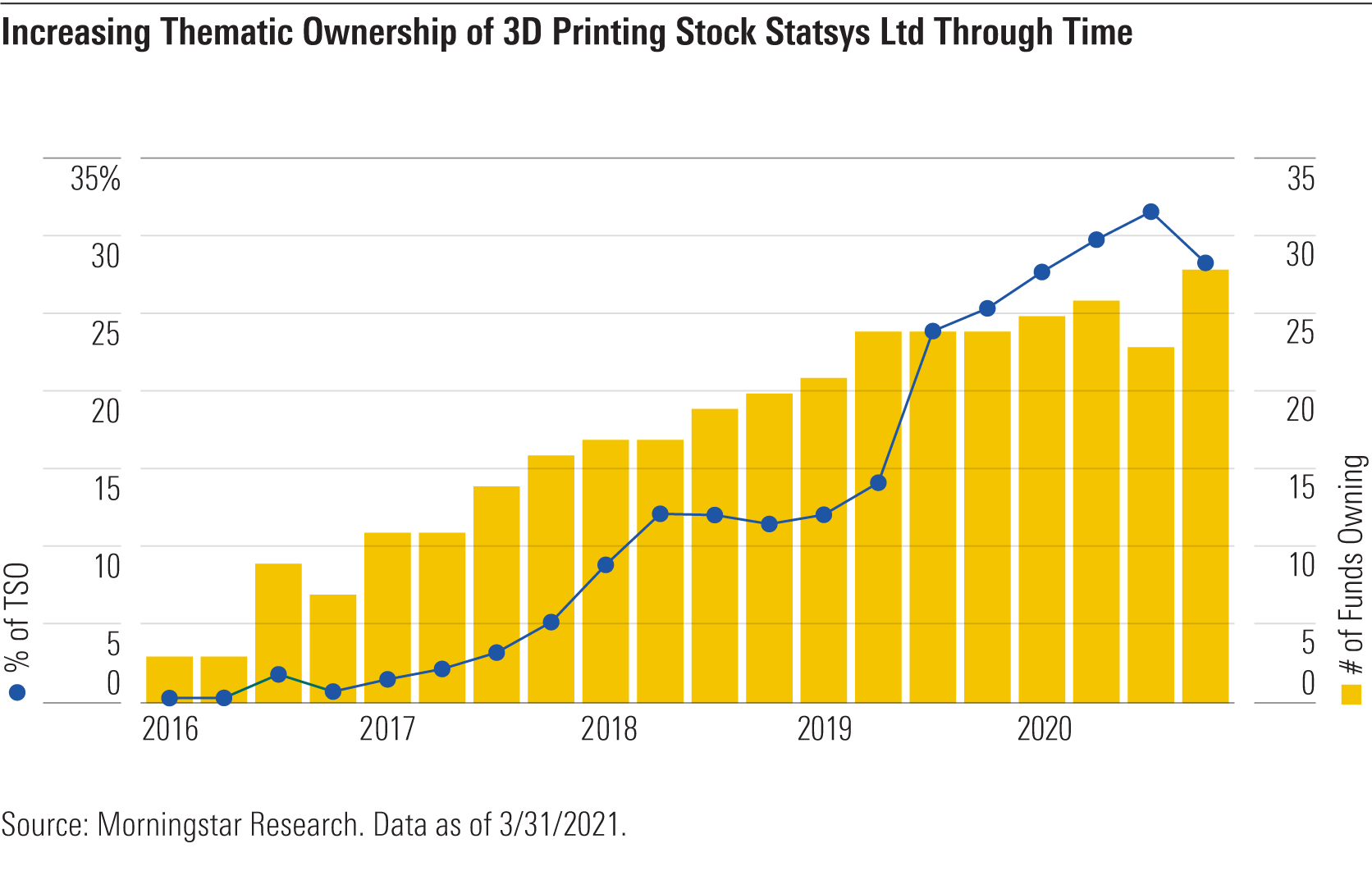

The surge in popularity of thematic funds--and thematic exchange-traded funds, which tend to have narrow exposures and (when passively managed) are compelled to buy and sell in line with index rules--has raised questions surrounding stocks' liquidity. As thematic funds have grown, the concentration of their holdings also spiked. These funds tend to gravitate toward similar names.

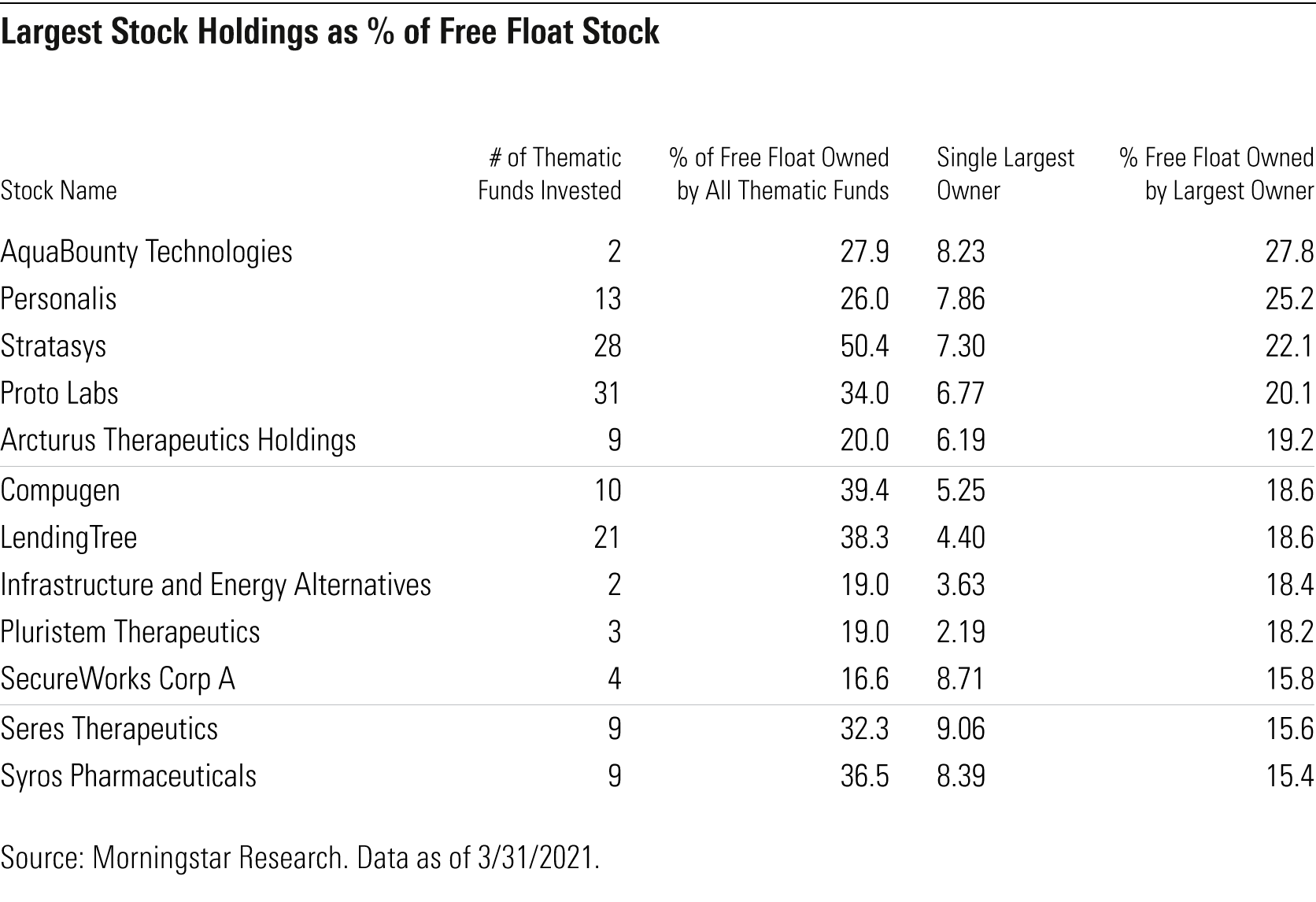

For example, 28 thematic funds globally combine to own one fourth of the total shares outstanding of 3D printing firm Stratasys SSYS. This is shown in the chart below.

The stratospheric growth of the ARK Financial range of actively managed ETFs has seen the firm build huge stakes in smaller companies. In the case of Stratasys, the ARK Innovation ETF ARKK alone holds 22% of the stock's available free float. The table below shows the extent to which ARK funds own some portfolio companies.

Although ARK funds dominate the largest owners table in this image, they are not the only ones with concentrated holdings. Alternative energy funds' recent growth spurt has also seen them build large stakes in smaller firms. For example, Invesco WilderHill Clean Energy ETF PBW recently held 18% of the free float of the micro-cap Infrastructure and Energy Alternatives IEA.

In fact, the runaway success of some alternative energy ETFs caused their own growing pains in late 2020. The combined assets of iShares Europe- and U.S.-domiciled alternative energy ETFs iShares Global Clean Energy ETF ICLN and iShares Global Clean Energy ETF USD Dist INRG catapulted to USD $10.7 billion by the end of first-quarter 2021 from $0.8 billion at the beginning of 2020. With so much money gushing into such a narrow portfolio of small- and mid-cap stocks and amid questions about liquidity, the S&P Global Clean Energy Index has been forcibly broadened. Any additional trading costs associated with this switch were absorbed by fund investors.

In the case of ETFs, should the liquidity dry up in a portfolio stock, the increased trading costs will be passed on to the ETF investor through larger spreads, and tracking error versus the underlying benchmark will increase. In a similar circumstance, active managers can choose which holdings to sell first. This in itself may result in suboptimal outcomes, but consequences may be greater if, faced with prolonged selling, the fund is forced to divest to meet redemptions. Recall, for instance, the fate of star manager Neil Woodford in the United Kingdom.

Like all investors, thematic investors are prone to what George Soros calls “reflexivity trades”--that is, they invest in themes because they have been performing well and scramble to divest when the tide turns. This strategy will have paid off for many investors in 2020, as thematic funds climbed to new heights, but some of the same individuals will likely get burnt when the fortunes of the more popular themes inevitably wane and investors swarm for the exits.

When evaluating the liquidity of a thematic fund, investors should look directly at fund holdings (and, in the case of passive funds, the index methodology). Metrics like market capitalization of the stocks and average daily traded volume can be used to estimate how difficult it would be to sell holdings at short notice. A fund with large exposure to small- and micro-cap stocks is worth further scrutiny.

Kenneth Lamont and Dan Sotiroff also contributed to this article.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)