Our Ultimate Stock-Pickers' Top 10 Buys and Sells

Funds see value in a diverse range of sectors.

For the past decade, our primary goal with Ultimate Stock-Pickers has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers: 22 managers oversee mutual funds covered by Morningstar's manager research group and four Stock-Pickers run the investment portfolios of large insurance companies. As holdings data becomes available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through our early read on our Ultimate Stock-Pickers' purchasing activity during the first quarter of 2020. The piece itself was an early read on individual purchases—focused on high-conviction and new-money buys—that were made during the period, based on the holdings of almost all our top managers. Now that all but two Ultimate Stock-Pickers have reported their holdings for the period, we think it is appropriate to examine our managers' high-conviction purchases and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers made their buying and selling decisions, we urge investors to analyze securities at current valuation levels before making any investment decisions and provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help investors along the way.

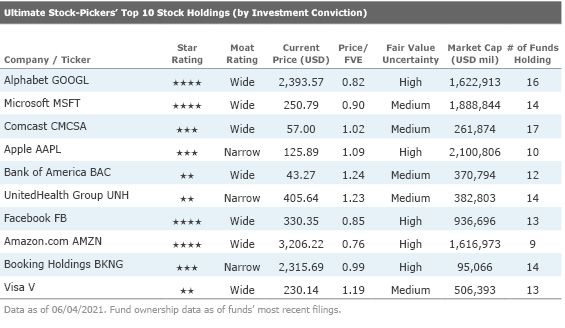

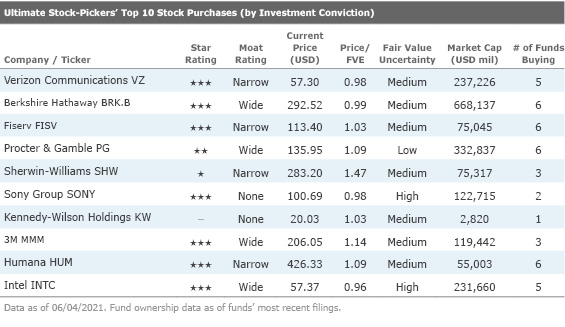

Our Ultimate Stock-Pickers continued their long-standing trend of buying and holding high-quality companies that Morningstar believes have developed sustainable competitive advantages. Morningstar's analysis shows that all the top 10 high-conviction holdings have either a narrow or wide economic moat and that seven of the top 10 conviction holdings have a wide economic moat. Additionally, eight of the 10 companies composing the top 10 high-conviction purchases and five of the companies on the top 10 high-conviction sales lists have been granted either a narrow or wide economic moat by Morningstar analysts.

Morningstar Direct and Office clients can find the full report here.

From a sector allocation perspective, our Ultimate Stock-Pickers are taking about as active of a stance as they were last quarter. The Ultimate Stock-Pickers remain meaningfully underweight in the technology and utilities sectors relative to the S&P 500. There has been a shift toward the financial services sector, with our managers overtaking the S&P 500 in this arena. The Ultimate Stock-Pickers also remain meaningfully overweight in the industrials and basic materials sectors.

As many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the composition of our top 10 conviction stock holdings was the same as the prior quarter, with only Facebook FB overtaking Amazon AMZN to move to number seven on our top 10 conviction stock holdings list. Google’s holding company, Alphabet GOOGL, maintained its number one spot on the list. Our Ultimate Stock-Pickers indicate a preference for communication services with three communications companies on our top 10 list. Managers also continue to hold companies from the financial services, technology, and consumer cyclical sectors with conviction, each contributing two stocks to our list. Our current fair value estimates suggest that four of the top 10 companies on the conviction holdings list—Alphabet, Microsoft MSFT, Facebook, and Amazon—are undervalued. Our research indicates that wide-moat rated Bank of America BAC and Visa V along with narrow-moat rated UnitedHealth are overvalued at the time of writing. As wide-moat Comcast CMCSA continues to maintain its presence on our top 10 convictions holdings list, we believe it is worthwhile to discuss the company's performance and take a closer look at Morningstar analyst Michael Hodel’s outlook on the company.

Wide-moat Comcast was held by 17 funds at the time of this article’s writing. This medium uncertainty stock currently trades at par with Morningstar analyst Michael Hodel’s fair value estimate of $56. Hodel asserts that the company possesses a wide moat, a result of its prowess in the cable-provided Internet space.

To underscore the longevity of this prowess, it is helpful to think about what a new entrant must do to breach Comcast’s wide economic moat. Hodel believes that while technological developments have made it possible to build more efficient and reliable networks than legacy providers possess, deploying these technologies still requires heavy construction spending while also overcoming the regulatory hurdles that municipalities often impose. Assuming successful network construction, entrants then face steep customer acquisition costs and startup losses as they attempt to gain share, typically with a modestly differentiated product in a rapidly maturing market. The most poignant example is of Alphabet and how the company curtailed its Google Fiber plans in 2016 after six years of effort ended with likely less than 1% of the U.S. connected, despite the firm’s deep pockets.

Another advantage enjoyed by Comcast is the ability to leverage existing architecture and technology to steadily add network capacity at modest incremental cost. For example, the firm deployed DOCSIS 3.1 technology across its network in 2017 and 2018, enabling gigabit speeds without significantly increasing capital spending as a percentage of sales. More than 85% of Comcast’s customers receive 100 megabits/second speeds, a superpremium offering only a few years ago. This is juxtaposed with phone companies that remain incapable of increasing network speeds broadly across their networks without heavy investment to bring fiber closer to customers.

The structural advantage listed above has enabled Comcast to steadily grow its market share over the past decade. With Verizon VZ mostly focusing on its wireless business and AT&T’s T efforts in fiber expansion yet to bear fruit, Comcast has been able to increase its share of total customer telecom spending in a given neighborhood. Hodel expects the company to be able to further outspend rivals on network maintenance and upgrades while gaining operating cost efficiencies.

Whereas returns on capital are stellar in Comcast’s core cable business, Hodel does not view the returns from Comcast’s business services segment as such. Hodel estimates the cable business currently produces about a 10% return with all intangibles included in the capital base and about 40% without. Given that regulators are unlikely to allow Comcast to make another significant cable acquisition, we expect returns will trend upward as the business grows.

With an eye on the future, Hodel believes Comcast’s competitive advantages will hold steady over the next several years. The changes roiling television viewing habits present the biggest threat to the company, in our view, but we expect it will be able to manage well regardless of how the industry evolves.

As we previously mentioned, our Ultimate Stock-Pickers' top 10 conviction stock purchases list is primarily composed of names that have been given moats by Morningstar equity analysts. We found that our Ultimate Stock-Pickers made three purchases in the technology sector. Since Intel INTC has recently made news for its IDM 2.0 strategy, we think it’s pertinent to take a deeper dive into the company that was purchased by five of our fund managers.

Wide-moat rated Intel currently trades at a 4% discount to Morningstar analyst Abhinav Davuluri’s fair value estimate of $65. In summary, Intel is the leader in the integrated design and manufacturing of microprocessors found in PCs and servers. With the rise in interconnectivity of devices, Intel strives to provide the most powerful and energy-efficient silicon solution to any product "smart and connected." The data centers used to facilitate the information stored, analyzed, and accessed by various front-end devices are mostly run with Intel server chips.

According to Davuluri, Intel has historically differentiated itself via the execution of Moore's law, which predicts transistor density on integrated circuits will double about every two years, meaning subsequent chips have substantial power, cost, and size improvements. This scaling advantage was perpetuated through a higher-than-peer-average R&D and capital expenditure budget that allows it to control the entire design and manufacturing process in an industry where the majority of competition focuses on only one phase. However, the firm has had issues with its 10-nanometer process in recent years and has announced its 7-nm process will be delayed until 2023, thus opening the door for competitors such as AMD AMD to gain share. These delays have also disrupted the firm’s “tick-tock” strategy, in which the firm advanced its technology node every two years to reduce feature sizes (the tick), while it launched a new architecture for its microprocessors during the years in between (the tock). However, more recently Intel has sought to reimagine parts of its business in a strategy known as IDM 2.0.

In March 2021, Intel announced its long-awaited manufacturing plans, with new CEO Pat Gelsinger updating the firm’s 7-nm progress and use of third-party foundries. Additionally, Intel will more meaningfully offer foundry services to fabless chip designers, with the firm announcing a $20 billion investment to build two new fabs in Arizona. Davuluri points out that the company has undertaken this mission of providing foundry services before but has not been successful at doing so. In response to this concern, Gelsinger highlighted Intel will be creating a dedicated foundry business unit with segregated capacity that won’t compete with Intel’s own products and will be located in the U.S. and Europe.

Davuluri notes that Intel’s focus on building its fabs in the U.S. and Europe (for both internal and foundry services) should foster government subsidies to support the investments. As the semiconductor industry grapples with the lingering impacts of COVID-19 on the supply chain and current chip shortage, additional fungible chip capacity will be greatly appreciated by customers and governments alike.

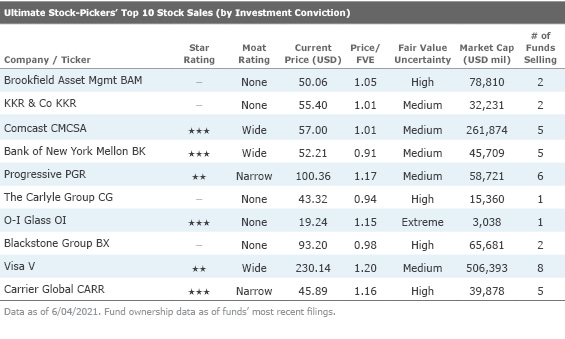

The Ultimate Stock-Pickers’ top 10 conviction sales list contains some new names compared with the previous quarter. Two of the conviction sales are also conviction holdings—wide-moat Visa and Comcast appear on both lists. Much of the selling activity came from the financial services sector, which contributed seven names to the conviction sales list. Seven of the 10 names on this list are overvalued according to Morningstar estimates. As our Ultimate Stock-Pickers sold out of their financial services sector positions the most, we find it pertinent to discuss a financial services stock. One name that eight managers have sold is wide-moat rated Visa, which trades at a 20% premium to Morningstar analyst Brett Horn’s fair value estimate of $194.

Visa is the largest payment processor in the world. In fiscal-year 2020, it processed almost $9 trillion in purchase transactions. Visa operates in over 200 countries and processes transactions in over 160 currencies. Despite the ongoing evolution in the payments industry, Horn thinks a wide moat surrounds the business and that Visa’s position in the global electronic payment infrastructure is essentially unassailable. Visa’s growth has historically been aided by the shift toward electronic payments. Digital payments, on a global basis, surpassed cash payments just a couple of years ago, suggesting this trend still has a lot of room to run. Visa’s position as the leading network makes it something of a tollbooth business, and the company is relatively agnostic to the smaller shifts within electronic payments, since it earns fees regardless of whether payment is credit, debit, or mobile.

Visa’s wide economic moat is a product of the network effect the firm enjoys. The more consumers that are plugged into a payment network, the more attractive that payment network becomes for merchants, which makes the network more convenient for consumers, and so on. While the network effect is the initial and primary driver of economic moats in this industry, the highly scalable nature of payment processing leads to sizable cost advantages for large payment networks, which further cements their competitive positions.

Horn believes that the firm will continue to enjoy double-digit growth as it has in recent years. This growth has been spurred on by the shift toward electronic payments that Horn expects to continue to drive growth. Given the scalable nature of the business, this strong growth should allow margins and returns to improve, but we view this more as the company reaping the benefits of its wide moat as opposed to a shift in its competitive position.

When thinking about what it’d take to displace Visa, Horn asserts that displacing the company in a tangible manner would require a complete overhaul of the current global electronic payment infrastructure. While the possibility of it happening is non-zero, Horn does not see any credible threats on the horizon. With regard to blockchain, it is currently incapable of handling the volume Visa processes. Alternatively, some companies have tried to build payment platforms that bypass networks such as Visa with little success.

Disclosure: Malik Ahmed Khan, Justin Pan, and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4ef98a5a-6be5-4127-a335-3568837ad0cd.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)