2 High-Yield Bond Funds Secure Silver Ratings in May

We share some highlights from this month.

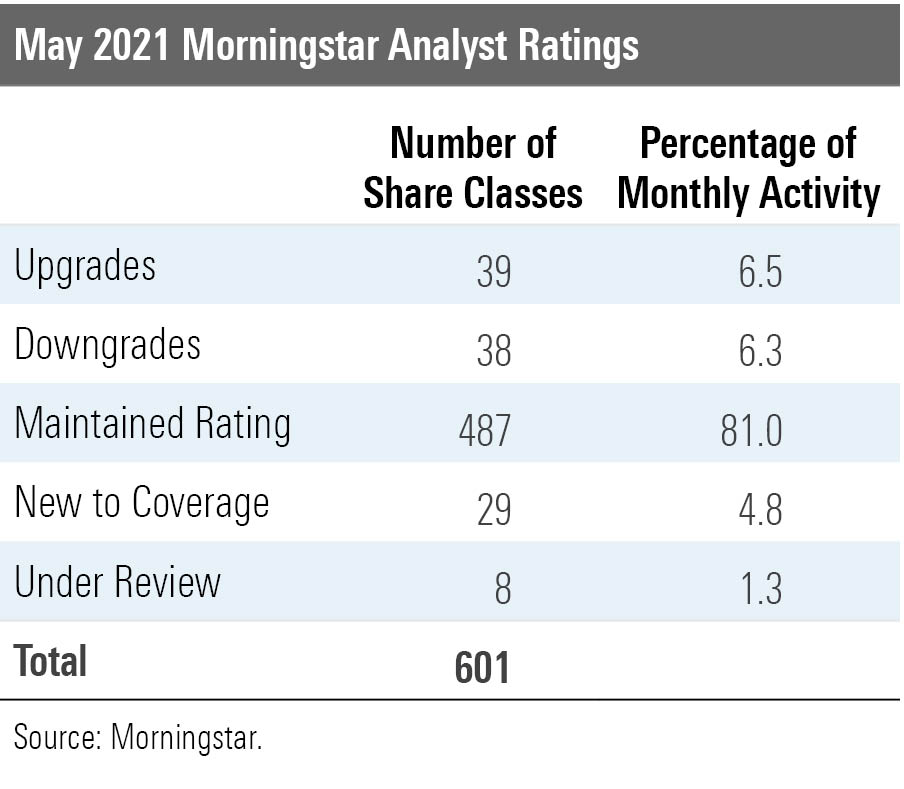

Morningstar updated the Analyst Ratings for 601 fund share classes, exchange-traded funds, and separately managed accounts/collective investment trusts in May 2021. Of these, 487 maintained their previous rating, 38 were downgrades, 39 upgrades, 29 were new to coverage, and eight were placed under review because of material changes, such as manager departures.

Sifting out multiple share classes and vehicles, Morningstar rated 148 unique strategies in May 2021. Of these, seven received an Analyst Rating for the first time, with the rest having at least one investment vehicle type that a Morningstar analyst previously covered. Below are some highlights of the upgrades, downgrades, and new to coverage.

Upgrades

The liquidity-constrained Artisan High Income APDFX recently earned a Process Pillar upgrade to High from Above Average by closing to most new investors, which brought its Morningstar Analyst Rating to Silver for all share classes. Manager Bryan Krug balances the risk of his bold, concentrated, and idiosyncratic approach with impressive bond-picking and thoughtful portfolio construction. He prefers asset-light companies with lower credit ratings but substantial cash flow. The portfolio typically holds one third of assets in its largest 10 issuers. Krug has deftly managed the strategy through volatile times; it has been one of the best-performing high-yield bond funds since its 2014 inception.

Fidelity Advisor Growth Opportunities FAGOX earned a Process rating upgrade to Above Average from Average, which brought its Analyst Rating to Silver for its cheapest share classes. Kyle Weaver, the strategy's manager since 2015, has skillfully balanced risk and reward in potential opportunities that are typically off the beaten large-growth path, such as small and nascent firms. Weaver diversifies the portfolio across three types of companies: those with abundant current free cash flow; those growing at strong, sustainable rates; and those that are currently unprofitable but have potentially explosive future revenue and profit opportunities. Successful picks from the latter bucket have distinguished the fund, and since Weaver's 2015 start, performance ranks near the top of the large-growth Morningstar Category.

New to Coverage

Brandywine Global's pending acquisition of Diamond Hill High Yield DHHYX creates concerns, but they were not enough to keep the fund from debuting with a Silver rating for its cheapest share classes and Bronze and Neutral ratings for its more expensive ones. Managers Bill Zox and John McClain, who have run this strategy since its January 2015 inception, have a tested approach in place. They focus on relatively small issues and tend to make sizable bets on their best ideas but offset some concentration risk by treading lightly in the market's lowest-quality names. They combine an intrinsic-value-driven and contrarian approach to build a high current income portfolio and try to beat the ICE BofA U.S. High Yield Index by 150 basis points.

Downgrades

High active share dropped iShares MSCI USA ESG Select ETF's SUSA Process rating to Above Average from High, bringing down its Analyst Rating to Bronze from Silver. The fund tracks the MSCI USA Extended ESG Select Index, which targets a 1.8% tracking error against the MSCI USA Index. The index removes companies involved in significant controversies and controversial businesses from its parent benchmark. While the fund's realized tracking error has been close to its 1.8% target, its active share relative to the parent index has historically been around 50%. There are many large names that are absent or underweight, which has weighed on recent performance. Its top holdings also can look quite different from the parent index, as the portfolio optimizer has no active weight constraints, which can significantly overweight smaller stocks with strong environmental, social, and governance metrics.

The surprise resignation of its entire management team in April 2021 dropped Royce Opportunity's RYPNX People rating to Below Average from Above Average and brought its Analyst Rating to Neutral from Bronze for its cheapest share classes. Four veterans took over, but there is not a lot of evidence this group can steer the process as well as Bill Hench's team had. One of the newly minted managers, Boniface Zaino, had been semiretired, and it is not clear how long he will remain. However, he is the original strategy architect and will still look for cheap, out-of-favor stocks that show signs of improvement.

/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c52d2eba-3a3c-478f-b3bd-c3ca80a5100f.jpg)