Markets and ETF Investors Plow Forward in May

Markets scraped forward while stock ETFs continued to haul in new money.

Markets scraped forward in May, albeit more slowly than in recent months. The Morningstar Global Markets Index--a broad gauge of global equities--added 1.47% last month, bumping its year-to-date return to 11.02%. Bonds continued to inch upward, as interest rates settled. The Morningstar U.S. Core Bond Index climbed 0.27%, marking back-to-back monthly gains after three down months in a row.

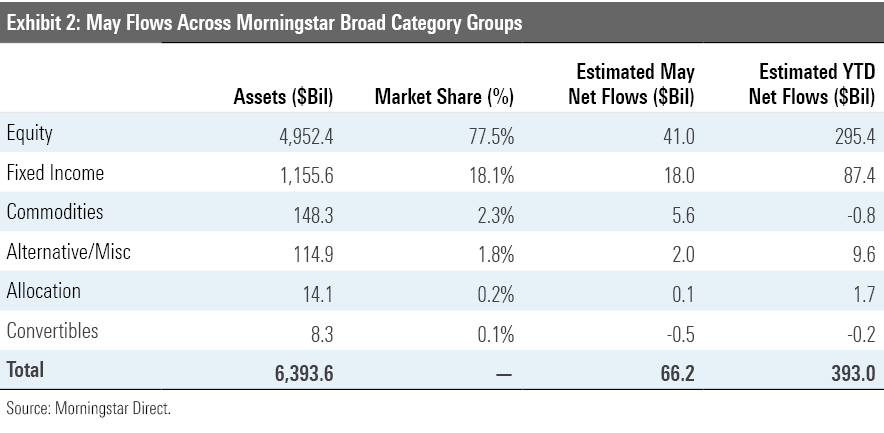

A richly valued market hasn’t dampened investors’ appetite for stock exchange-traded funds. After pulling in $41 billion of inflows in May, stock ETFs have now racked up $295.4 billion of net inflows in 2021, well past their 2020 total. Bond ETFs notched another solid month of inflows, but the $18 billion they collected in May leaves them in the back seat after leading the way through much of 2020.

Here, we’ll take a closer look at how major asset classes performed last month, where investors put their money, and which corners of the market looked rich and undervalued at month’s end--all through the lens of ETFs.

Stocks Carry the Load

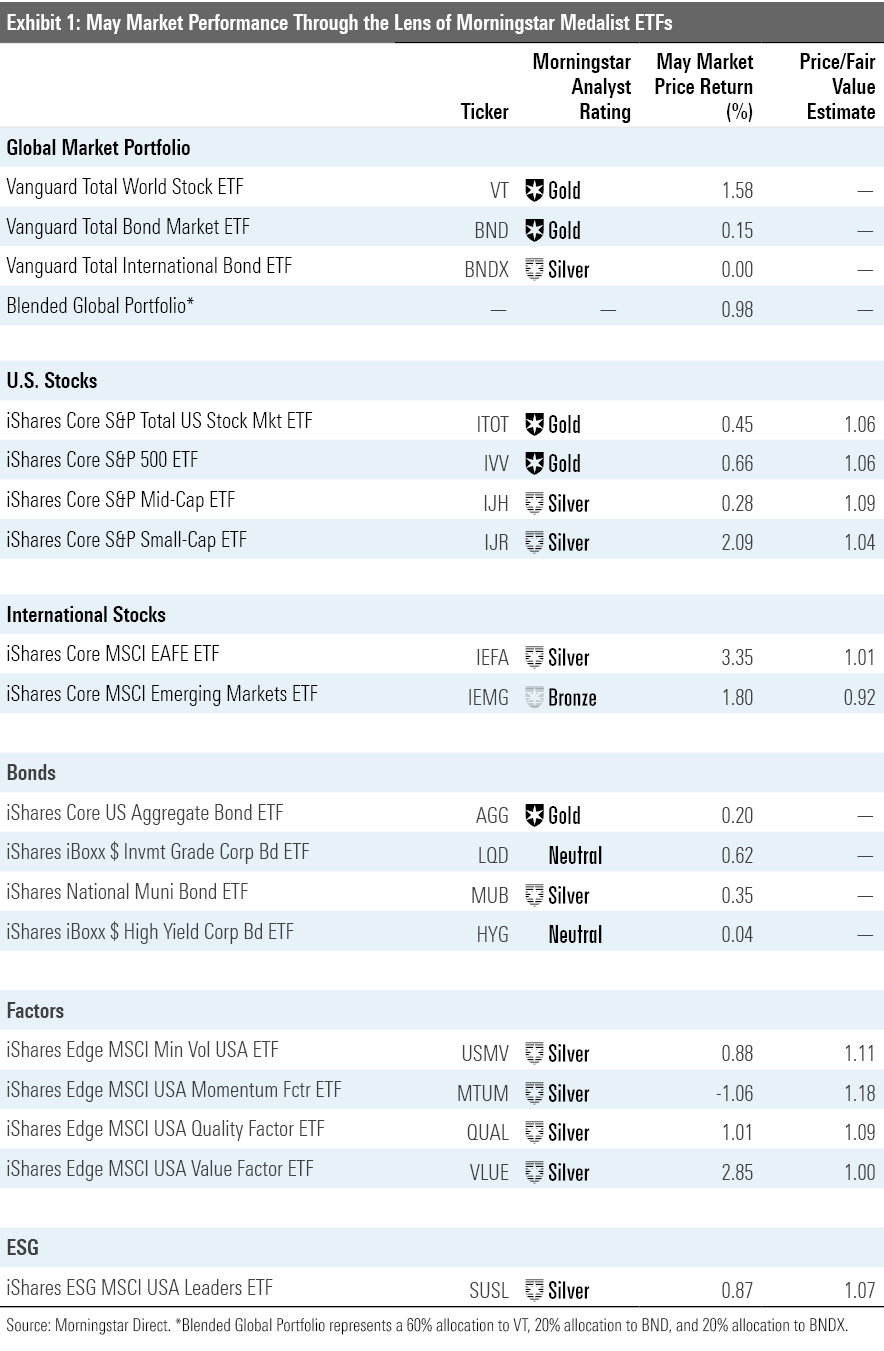

Exhibit 1 features May returns for a sample of ETFs with Morningstar Analyst Ratings that serve as proxies for major asset classes. Investors in a blended global portfolio saw a 0.98% return last month. The stock sleeve of the portfolio continued to shoulder the burden. Vanguard Total World Stock ETF's VT 1.58% gain was its lowest since January, but it outpaced meager returns from the portfolio’s fixed-income constituents.

International stocks set the pace in May, as iShares MSCI ACWI ex U.S. ETF ACWX climbed 2.98%--a strong month that looks even stronger next to iShares Core S&P Total U.S. Stock Market ETF's ITOT 0.45% return. International stock funds have trailed their U.S. counterparts for most of 2021, but solid contributions from developed markets like Canada, France, Switzerland, and the United Kingdom helped reverse that trend in May.

Stateside, cheaper stocks returned to what value investors hope is the comeback trail after a detour in April. Vanguard Value ETF VTV posted a 2.88% gain, while Vanguard Growth ETF VUG slid 1.46%. For the year to date, these Gold-rated value and growth index funds have climbed 18.2% and 6.97%, respectively. The prospects--and more recently, reality--of a post-pandemic economy have particularly benefited value stocks. Firms found in value-leaning sectors like energy, utilities, and real estate tend to be more economically sensitive than their faster-growing peers.

IShares MSCI USA Momentum Factor ETF's MTUM recent shakeup points to value stocks’ recent roll. This fund selects the MSCI USA Index’s hottest stocks based on trailing seven- and 12-month risk-adjusted performance. It materially altered its composition when it rebalanced in May, cutting its technology allocation by more than half (to 17% of the portfolio from 41%) while raising its stake in the value-friendly financials sector (to 32% from 2%). After its growth-oriented portfolio led it to trail iShares MSCI USA Value Factor ETF VLUE by 18.23 percentage points for the year to date, MTUM borrowed a few tricks from its cheap single-factor counterpart.

Small-cap U.S. stocks broadly fared better than their larger brethren in May. During the month, iShares Core S&P Small-Cap ETF IJR added 2.09%, which bested iShares Core S&P 500 ETF's IVV modest 0.66% gain. Over the 12 months through May, IJR has led the S&P 500 tracker by 32.46 percentage points. Small stocks tend to be more volatile than their better-established peers, and they have flourished in the rebound following the coronavirus-driven drawdown last year. Whether they can sustain their run primarily hinges on the direction of the market writ large.

The broad U.S. market’s sound recent performance has precipitated rich valuations. ITOT traded 6% above its fair value at the end of May, as measured by the fund’s Morningstar price/fair value estimate. While this looks frothy, ITOT’s price/fair value estimate actually compressed in May; it traded at an 8% premium in April. The iShares proxies for the broad large-, mid-, and small-cap markets saw their ratios shrink, too, despite positive returns all around. So, Morningstar analysts have broadly increased their fair value estimates for U.S. stocks, indicating that stocks may prove more worthy of their steep valuations than previously anticipated.

Investors Gravitate Toward Value

Investors have continued to funnel into stock ETFs, unfazed by lofty valuations. The $41 billion that stock ETFs added last month represented about two thirds of all ETF flows in May. Stock ETFs’ $295.4 billion in year-to-date flows accounted for 75% of all inflows to ETFs for the year to date.

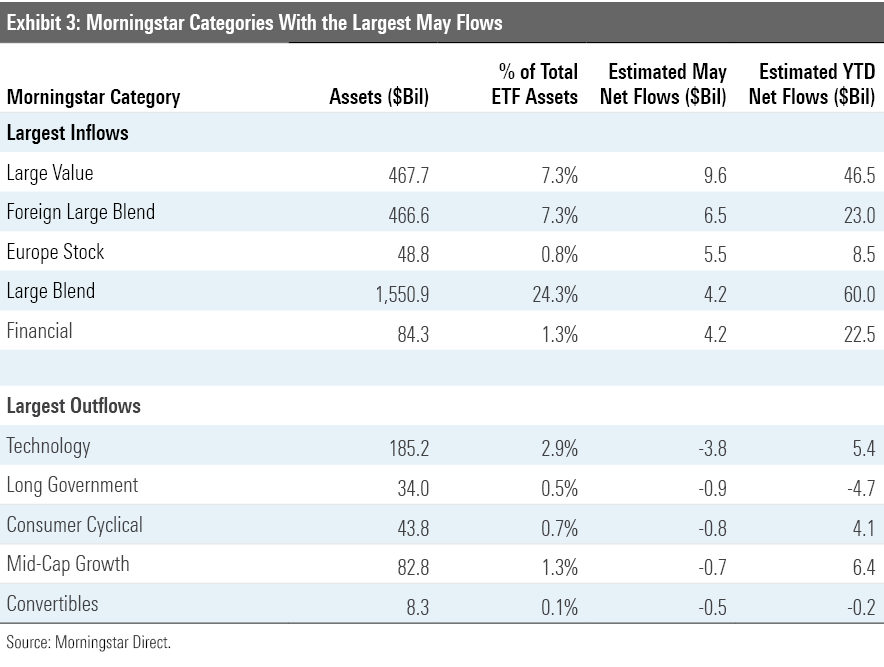

Investors have not shied away from stock ETFs, but they have been selective, seeming to file into the market’s cheaper corridors. Value funds, which weave portfolios of cheap stocks by design, have attracted more attention than their growth counterparts. After another lopsided month, U.S. small-, mid-, and large-value funds have hauled in $59 billion in flows for the year to date. U.S. growth funds collectively absorbed $3 billion over that span. The currents of ETF flows indicate that investors are reticent to pay up for the market’s most richly valued stocks.

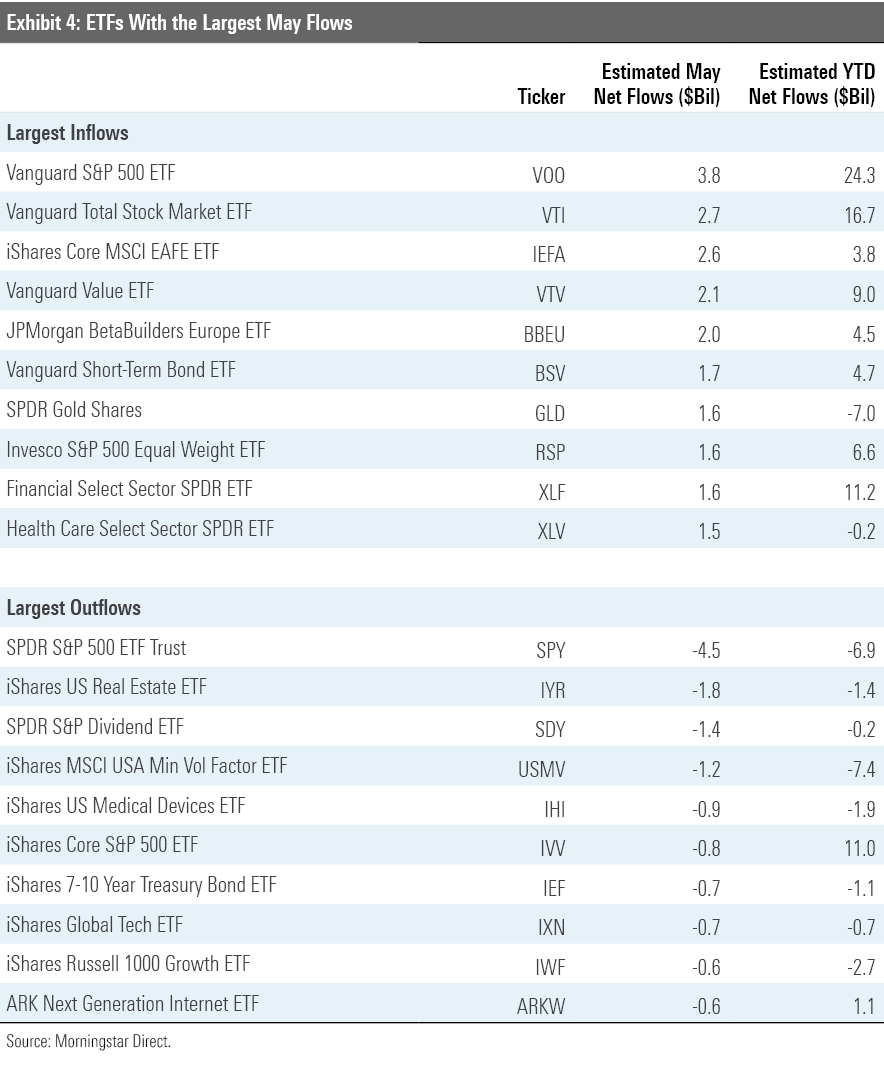

Some investors have turned overseas in search of undervalued firms. ETFs in the foreign large blend Morningstar Category collected $6.5 billion last month and $23 billion for the year to date, which ranks third among all categories behind U.S. large blend ($60 billion) and U.S. large value ($47.5 billion). IShares Core MSCI EAFE ETF IEFA and JPMorgan BetaBuilders Europe ETF BBEU led the way, jointly drawing in $4.6 billion in flows. Both funds traded at 1% premiums to their fair value estimates at May's end. This would be a take-it-or-leave it valuation under most circumstances but registers as mildly attractive when ITOT trades 6% above its fair value estimate. Investors willing to turn over every stone for cheap stocks may eye emerging markets--iShares Core MSCI Emerging Markets ETF IEMG was priced at an 8% discount at May's end--but the space entails a unique array of risks to consider.

Two S&P 500 trackers claimed last month's steepest inflows and outflows among all ETFs. Vanguard S&P 500 ETF VOO added $3.8 billion of new money, while SPDR S&P 500 ETF Trust SPY bled $4.5 billion. This juxtaposition reflects the very different clientele and use cases served by this pair. It's unclear what the contrasting flows say about investors' overall optimism, but IVV investors--who tend to fall somewhere in the middle--did yank $789 million out of the fund last month.

Bond ETFs pulled in $18 billion in May, as interest rates held steady. Higher rates depress bond prices and diminish the appeal of long-term bond funds, so the plateau that started to form in April could have aided flows. Not all sections of the bond market were safe--long-term government ETFs suffered the second-worst collective outflows of any category in April--but those with short to intermediate time horizons mostly fared well.

Widespread investor concern over inflation reared its head in May. ETFs in the inflation-protected bond category collected $3.2 billion last month, and commodities ETFs absorbed $5.6 billion, their best monthly haul of the year. Much of the commodities movement was toward gold; SPDR Gold Shares GLD led the way with $1.6 billion in flows. Gold is traditionally viewed as a sound instrument to protect against inflation, but, like any investment, it’s an imperfect solution.

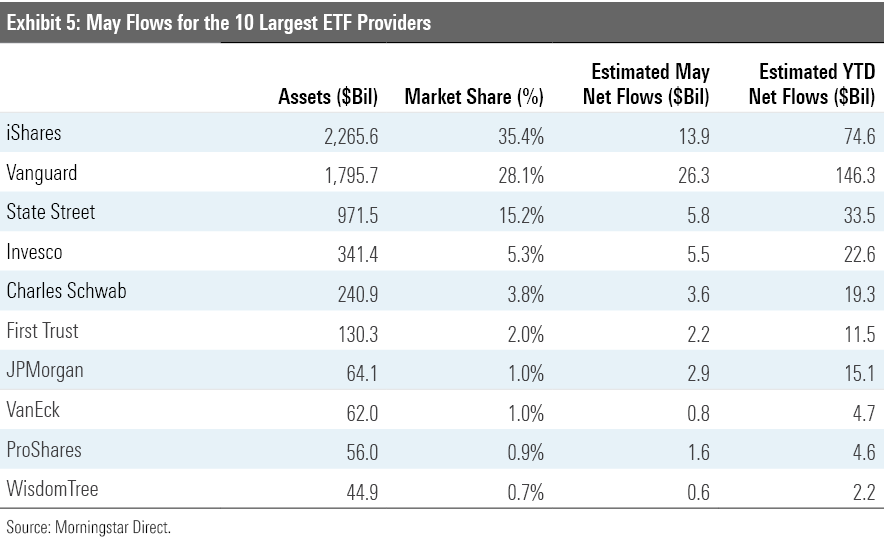

WisdomTree Joins the Top 10; ARK Leaves

Vanguard extended its streak atop the ETF provider flows league table to six months in May, as the firm’s ETFs raked in $26.3 billion. At the end of May, Vanguard ETFs’ $146.3 billion year-to-date haul was more than double its nearest competitor, iShares. Some of Vanguard's recent ETF flows have resulted from conversions of assets in their funds' Admiral share classes to ETF shares, which are now cheaper than the Admiral shares of the same funds after a wave of recent repricing. The firm has since either directly converted some of its investors' existing Admiral share-class allocations to the ETF share class or otherwise nudged them to do it on their own. That said, the majority of its new inflows have come from new investments, not conversions. Most of these conversions have now run their course, and their impact on the firm's ETF flows has diminished.

WisdomTree reclaimed its spot among the industry’s top 10 in May. It collected $585 million last month and has garnered over $2.2 billion in flows for the year to date. WisdomTree Emerging Markets ex-State-Owned Enterprises ETF XSOE has been the firm’s crown jewel, pulling in $1.3 billion for the year to date. This fund targets emerging-markets stocks but excludes all state-owned enterprises, allowing it to sidestep some of the unique governance risks that can plague emerging-markets strategies.

ARK fell off the industry leaderboard after the firm’s ETFs collectively leaked $1.9 billion in May. As investors have favored more attractively valued funds, it’s no surprise that these richly valued strategies have seen waning interest. ARK Innovation ETF ARKK, the firm’s flagship, traded at a 15% premium to its fair value at May’s end. Recent performance could have spurred exits as well. After ARKK led the mid-growth category with a 152.5% return in 2020, it lost 22.4% for the year to date through May--last among its category peers.

Opportunity in Emerging Markets

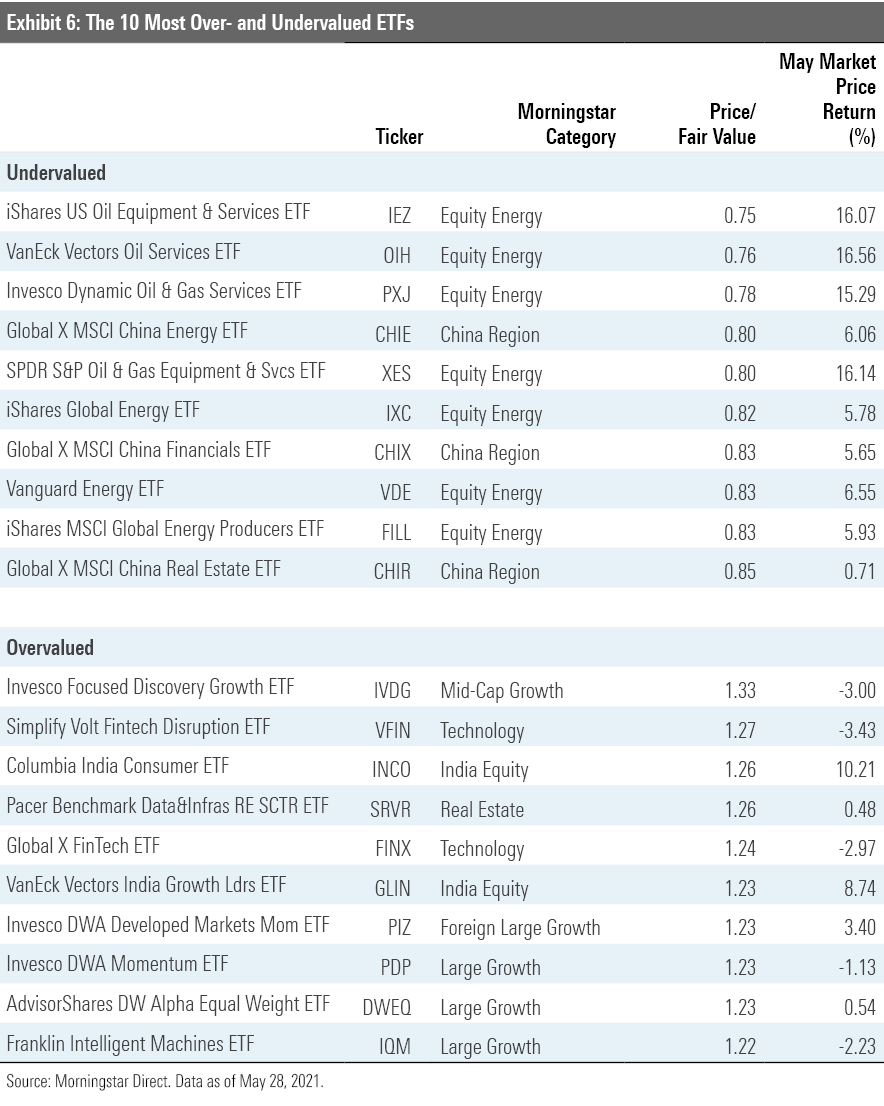

The fair value estimate for ETFs rolls up our equity analysts' fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing this value by the ETFs' market prices yields the price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

Exhibit 6 features the 10 ETFs that were trading at the largest discounts and premiums to their fair value estimates as of the end of May. Seven of the 10 trading at the largest discounts weave energy-focused portfolios. The energy sector took a nosedive when the coronavirus pandemic took hold last spring, as demand declined and supply continued to flood the market. As producers ran out of places to store their output, prices collapsed, as did the share prices of firms operating in the sector.

The market is a discounting mechanism, however, and the prospect of reopening the global economy has widely lifted oil and prices and energy ETFs. May was the second month this year in which iShares U.S. Oil Equipment & Services ETF IEZ added more than 15%, bringing its year-to-date return to 33.1%. That this fund remains among the most undervalued ETFs on the market even after its torrential start to the year highlights two points: 1) Energy funds were incomprehensibly cheap at the market’s nadir last March; and 2) finding compelling valuations in today’s stock market is no easy feat.

A pair of thematic funds rank among the top of May’s most overvalued ETFs: Simplify Volt Fintech Disruption ETF VFIN (1.27 price/fair value estimate) and Global X FinTech ETF FINX (1.24 price/fair value estimate). The funds have pursued their shared financial technology theme with mixed results in 2021. FINX has lost 3.32% for the year through May, while VFIN sank 18.33% over the first quarter. These funds’ portfolios--and performance--look quite different from one another, highlighting the importance of looking under the hood of all options when considering a thematic approach.

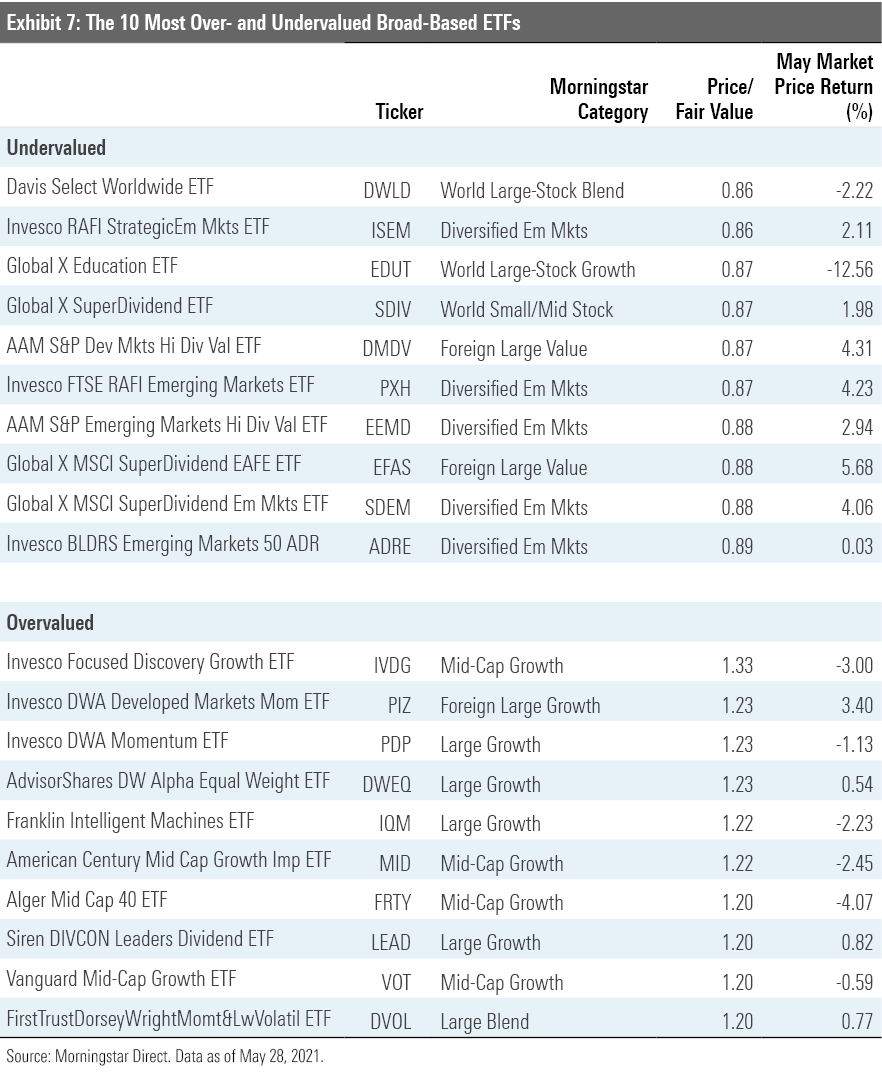

Exhibit 7 features the 10 broad-based ETFs (those belonging to one of the mainline Morningstar Style Box or other broader geographic categories) that were trading at the largest discounts and premiums to their fair value estimates as of month-end.

If there’s any value in today’s market, it is likely overseas. Foreign stock ETFs dominated the ranks of the cheapest broad-based ETFs at the end of May. This month’s list features five ETFs that zero in on emerging markets stocks that are trading cheap relative to their dividends or fundamental measures of their value more broadly. While these funds currently register as cheap, the more important question is whether they are cheap enough to offer adequate returns for the level of risk involved. For example, Global X MSCI SuperDividend Emerging Markets ETF's SDEM risk/reward profile should give investors pause. The fund’s standard deviation of returns (a measure of risk) has consistently exceeded the MSCI Emerging Markets Index category benchmark. Also, its upside-capture ratio relative to that same bogy has been 91%, while its downside-capture ratio has been 139%. So, the stocks featured in some of these funds’ portfolios may be cheap for very good reason and not nearly cheap enough to compensate investors for the gut rot they might cause.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)